This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

There are 8 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 20,166 times.

An extended absence, such as a summer vacation or a year-long business trip to another country, requires making sure that bills will be taken care of in advance. Bills in need of attention may include mortgage or rental payments, household utilities, health insurance, tax payments and/or storage costs. Making such arrangements includes setting up automatic payments through the company or through the bank, paying bills in advance, or asking friends or relatives for assistance. You can even use all of these different payment methods for maximum flexibility.

Steps

Preparing All of Your Bills

-

1Make a list of all of your bills. Review your checkbook and your online bank accounts as far back as 1 year to create a thorough list of all possible expenses.

- Include all expenses related to your home. These include expenses like mortgage or rent, property insurance, utilities and lawn care.

- Account for miscellaneous expenses. For example, you might choose to avoid reconnection fees by keeping your Internet and phone service activated.

-

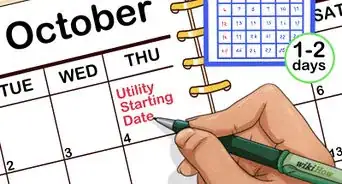

2Mark on a calendar when they must be paid by. You can also simply write the due date on your list, but marking it on a calendar will give you a visual of when each bill must be paid by. You can also make notes about how the bill will be taken care of directly on the calendar.[1]

- If you will be away for several months, marking the bill on the calendar will also help you identify how many months in advance you need to pay or how many signed checks you will need to give to a friend.

Advertisement -

3Contact each company. If you aren’t sure how you will manage to take care of a particular bill, contact the company associated with the bill and explain that you will be away for awhile, and need to know how you can pay them the money you owe.

- The company will likely already have a convenient method in place, or can make different suggestions about how to pay the bill.

-

4Suspend service when possible. Some companies will allow you to suspend your service if you will be away for many months (e.g. phone companies and internet companies). This will save you money and from having to figure out how to set up bill pay for those accounts while you are away.[2]

- You may be able to set it up online, but you can also call these companies to ask if they offer such a service. If so, you will need to provide the date that you are the leaving and the date when you want the service to be turned back on.

- The company may or may not ask you to pay a reduced fee for your services while you are away. In most cases, you can pay this fee up front or set it up so the amount is debited directly from your account each month. Although you will have to manage to pay the bill, you will still be saving money.

Paying Each Bill Via the Internet

-

1Review which accounts offer online payment. In this day and age, most of the bills you pay can probably be taken care of without trying to set up automatic bill pay or asking someone else to take care of it while you are away. All you will need is a good internet connection and a computer or smart phone to pay your bill.[3]

- Even if you can’t pay the bill on the company website, the company may have a telephone number you can call to make a payment. If you will be in a foreign country, consider using an internet phone service such as Skype to make your call. This can save you a lot of money if you don’t already have an international calling plan.

- If you plan to make the calls over an internet phone service, look to see if the company has a 1-800 number you can call. Internet phone services will usually allow you to make these calls for free.

-

2Contact the companies that offer it to set up online payments. If you don’t already have it set up for certain accounts, call the company and tell them that you would like to be able to make online payments.[4]

- If they don’t offer the service, ask whether you might be able to make payments over the phone.

-

3Mark due dates on your calendar. Since you will be paying each bill yourself as you would when you were at home, you’ll need to make sure you are keeping up with your payments. Write the due date of the bill on the calendar, and how much you have to pay.

- If you have to call to make the payment, it might be a good idea to make a note of this on the calendar so you don’t forget.

-

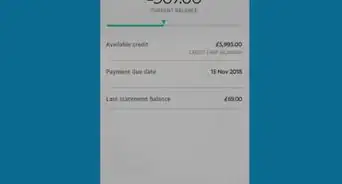

4Check your email regularly. Many companies will send an automated email a few weeks before your bill is due, so it’s a good idea to check your email regularly just in case you have forgotten about a particular bill.[5]

- Usually, they will also email you if something unusual occurs. For example, if your credit card company notices unusual activity on your account, they may send you an email to confirm that you made the charges.

-

5Pay bills over the internet. On the day that the bill is due, or a few days before, log into your online account and follow the step-by-step instructions on how to pay your bill. Some companies will offer to store your payment information so you don’t have to get out your debit/credit card each time you pay the bill.[6]

- Avoid paying bills in a place such as an internet cafe. These connections are not always secure, and you run the risk of getting your computer hacked. If you can’t find a place where the connection will be secure, then it is best to just call and pay your bill over the phone.

Setting Up Automatic Bill Pay for Each Company

-

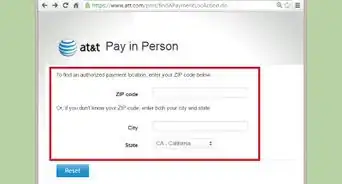

1Call the company. If your company has an online account feature, it may be easy to set up automatic debit transfers on the website, but if it is not clear to you, a simple phone call will help you figure it out.

- You may be able to set up the automatic bill pay over the phone, or they may be able to walk you through an online set up.

-

2Set up automatic payments. Make sure that you do this for each company that you have to pay a bill too. It may be tedious and time consuming, but it will save you a lot of time later on, and will give you peace of mind.[7]

- On your list of bills, be sure to make a note of when you set up bill pay for that bill, how you set it up, and who you spoke to on the phone (if anyone).

- A week or so before your trip, take an hour or two to double check each account to make sure that the bill pay is set up correctly.

-

3Talk to your landlord. If you are renting your home, you may be able to pay several months of your rent in advance so that you don’t have to worry about it getting paid on time while you are away. Many landlords are open to this, so get in touch with them.[8]

- If your landlord doesn’t like this idea, then you might consider giving post-dated checks for your rent to a friend or family member who can then make the payments for you.

- Your landlord might also be willing to come check on your apartment every once in a while to make sure that everything is in good running order. You could also ask a friend or neighbor to keep an eye on your home while you are away if you want.

-

4Ask other service providers if you can pay in advance. For the bills you have that remain the same each month, you can talk with them about paying the bill in advance, if you have the cash available to you.[9]

- If you can afford to pay the bill far in advance, and the company allows it, you will have the peace of mind that the bill is taken care of.

Setting Up Automatic Bill Pay Through Your Bank

-

1Contact your bank. If don’t use online banking or aren’t sure how to set up the automatic bill pay feature through online banking, then the easiest thing to do is just head to your local branch.

- Doing this in person will make sure that it is set up correctly, and will also give you a chance to ask any questions about how the service works.

-

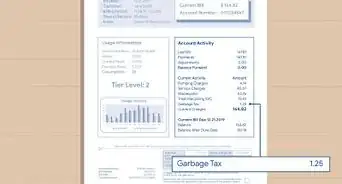

2Bring a list of all your bills with you. Your bank will be able to tell you exactly what information you need to provide them, but at minimum you will need the name of the company, how much the bill will be (if you know), when it is due, and any account numbers related to the bill.

- Having this list written up in advance will help you make sure that you’ve covered every single bill.

-

3Specify whether the bank should mail a check or make a direct transfer. If your bill must be paid using a check, your bank may be able to send a check directly to the company on your behalf. If the company offers online bill pay, then the bank can make a direct debit transfer to the company.[10]

- Some banks may offer bill pay through direct debit, but not via paper checks. Other banks may offer to send checks, but not have a direct debit scheme. Be sure to clarify this with your bank.

-

4Be clear about due dates. When you are setting up your automatic bill pay, make sure that you know the due date of the bill, and try to have it paid a few days in advance if it is possible. This will eliminate the risk of late payments.[11]

- In some cases, such as with credit cards, paying a bill even a day late can be very harmful to your financial health.

Asking a Trusted/Friend Family Member

-

1Determine the best person for the job. If you go this route, you will need to choose a friend or family member that you trust completely. This person will have access to your money as well as a lot of your personal information, so choose wisely.[12]

- Think about how responsible the person is as well. You may have a friend that you trust with your life, but who tends to be very forgetful. This isn’t the kind of person you want keeping up with your bills. If you have a close relationship with a parent this can often be a good choice as they are likely to be more concerned with your financial health than a friend.

-

2Give them a list of all of your bills. Write down each bill, when the due date for the bill is, how much the bill is (or how to find out how much the bill will be), how it should be payed (e.g. online, using a check, in person, etc.), and the contact information of the company.

- In this case, it is better to provide too much information than not enough. They may not ever need the contact information of the company the bill belongs to, but it is better to have it.

-

3Share the dates your bills are due. On your list, make it very clear when the bill is due. You could even consider providing them with a calendar that marks the due date of each bill. The most important part of paying bills is paying them on time, so make sure it is very clear.[13]

- If your friend/family member doesn’t get the bill paid on time it won’t hurt them, but it could harm your credit score. You may also then have to sort out a way to get any late fees taken care of.

-

4Ask them to check your mail regularly. In some cases, you may receive your bill each month via the mail. If so, your friend/family member will need to check the mail to retrieve the bill.[14]

- Even if you don’t have any bills that you receive via mail it is still a good idea to have your mail checked while you are away. This way, your mailbox won’t get over-full, and the person checking the mail can alert you if you receive any important letters or unexpected bills.

- Alternatively, you can also sign up for a mail forwarding service through the post office. This will make it easy for your friend to keep an eye on the mail because it can be forwarded directly to them.

-

5Give them access to your online accounts. Use caution when sharing your online account information with anyone. There are other options available, so this is usually not even necessary. However, if you think sharing your online account information is the best option for your situation, then make sure that you choose someone who is trustworthy. If you have accounts (e.g. credit cards or student loans) that you pay online, provide your friend with a list of each website, when the bill is due and how much it will be (if you know), along with the user name and password for the site.

- If you really trust your friend/family member, you could provide them with access to your email in case they manage to lock themselves out of the account. For many online accounts, it will be possible to reset the password if they have access to your email account.

-

6Provide them with signed checks. If any of your bills must be paid by check, you can give them one check for each bill that will need to be paid. It may be a good idea to provide your friend with one or two extra checks in case they make a mistake, or something happens to the first check.

- At a minimum, be sure to sign the check. To make it easier for your friend/family member, you could also write out the name of the company/person receiving the money, as well as a memo for what bill the check is related to.

-

7Supply them with stamped and addressed envelopes. In some cases, your friend may need to mail a check along with a payment voucher. Don’t expect your friend to foot the bill for postage. In addition to the stamp, you can also write the name and address of the recipient on the envelope so they don’t have to worry about it.[15]

- You can even take this a step further by providing everything your friend/family will need to mail inside the envelope. For example, if you have a payment slip that has to be included, fill it out with as much information as you can and insert it in the envelope along with a signed check.

- If you will be away for many months you can even write the month that the envelope is for somewhere inconspicuous on the envelope. For example, if your friend will need to send off a check each month from January to July then provide them with 7 stamped and addressed envelopes. On each envelope, write the month that it is for.

Warnings

- Some banks do not offer automatic bill pay. If you are considering this method, then check with your bank well in advance. You don’t want to plan to use automatic bill pay only to find out one or two days before your trip that it isn’t available at your bank.⧼thumbs_response⧽

- Make sure that the account you will be paying your bills from will have enough money in it to cover all of your expenses while you are away. If you receive a paycheck, ask your employer to use direct deposit so that the money will go directly into the account.[16]⧼thumbs_response⧽

References

- ↑ http://www.thinkglink.com/2004/08/03/paying-bills-while-on-vacation/

- ↑ http://www.centurylink.com/help/index.php?assetid=284

- ↑ http://www.transitionsabroad.com/listings/living/articles/how-to-manage-finances-at-home-while-living-abroad.shtml

- ↑ https://www.baylorhealth.com/mybaylor/BillingFinance/PayYourHospitalBill/Pages/OnlineBillPay.aspx

- ↑ http://www.transitionsabroad.com/listings/living/articles/how-to-manage-finances-at-home-while-living-abroad.shtml

- ↑ https://www.t-mobile.com/support/account/pay-your-bill#subhead3

- ↑ http://www.soundmoneymatters.com/paying-bills-on-vacation/

- ↑ http://www.soundmoneymatters.com/paying-bills-on-vacation/

- ↑ http://www.soundmoneymatters.com/paying-bills-on-vacation/

- ↑ http://www.quickanddirtytips.com/money-finance/saving-spending/how-to-save-money-using-online-bill-pay

- ↑ http://www.thinkglink.com/2004/08/03/paying-bills-while-on-vacation/

- ↑ http://www.transitionsabroad.com/listings/living/articles/how-to-manage-finances-at-home-while-living-abroad.shtml

- ↑ http://www.thinkglink.com/2004/08/03/paying-bills-while-on-vacation/

- ↑ http://www.liferemotely.com/work-while-traveling/staying-connected/70-managing-incoming-postal-mail-while-traveling

- ↑ http://www.soundmoneymatters.com/paying-bills-on-vacation/

- ↑ http://www.soundmoneymatters.com/paying-bills-on-vacation/