This article was co-authored by Andrew Lokenauth. Andrew Lokenauth is a Finance Executive who has over 15 years of experience working on Wall St. and in Tech & Start-ups. Andrew helps management teams translate their financials into actionable business decisions. He has held positions at Goldman Sachs, Citi, and JPMorgan Asset Management. He is the founder of Fluent in Finance, a firm that provides resources to help others learn to build wealth, understand the importance of investing, create a healthy budget, strategize debt pay-off, develop a retirement roadmap, and create a personalized investing plan. His insights have been quoted in Forbes, TIME, Business Insider, Nasdaq, Yahoo Finance, BankRate, and U.S. News. Andrew has a Bachelor of Business Administration Degree (BBA), Accounting and Finance from Pace University.

There are 9 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 18,148 times.

Despite the somewhat unsavory reputation of offshore banking, there are legitimate reasons to do it, including asset protection, currency diversification, higher interest rates, and greater banking privacy.[1] It might seem difficult and daunting to open an offshore bank account. However, it just takes some planning and paperwork. With a little research into the jurisdiction and bank that will best fit your financial needs, and the submission of a few documents, you can open an offshore banking account quickly and easily.

Steps

Choosing an Offshore Bank

-

1Decide if offshore banking is right for you. Weigh the pros and cons of having an offshore bank account for your particular financial situation. The fees associated with offshore banking could outweigh the benefits for you if you don’t have many assets.

- Having an offshore account can be a good way of legally protecting your assets in foreign banks that are often more solvent and safe than American banks. These banks are full-reserve, which means that they don’t lend your money to borrowers but instead generate profits by charging fees for account maintenance and transactions.[2]

- The set-up fee for opening an offshore account ranges between $350 and $1250 depending on which bank and jurisdiction you choose. Monthly maintenance fees run from about $20 to $100. Wire transfer fees are usually between $25 and $75 per transaction.

- Offshore banks also require minimum initial deposits, which can be as low as a few hundred dollars, or as high as six figures.

-

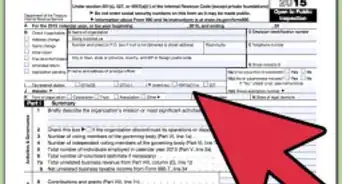

2Consult a tax professional. Make sure that you are compliant with all domestic and foreign tax regulations when you open your offshore account and use international wire transfers. Tax codes can be confusing, so seek out a tax advisor to ensure you’re following all regulations and that you are (legally) minimizing the amount of taxes you have to pay.[3]

- To find a good tax advisor, look for an enrolled agent through the National Association of Enrolled Agents if you’re an American. Enrolled agents have to pass a test, meet annual requirements for continuing education, and be licensed to represent clients in front of the IRS.[4]

Advertisement -

3Choose a jurisdiction that is economically and politically stable. Your offshore account will be based in a foreign country, so ensure that the country’s government and economy are sound, that levels of corruption are low, and that the country practices conservative banking practices.[5]

- For example, Liechtenstein is a sound choice of offshore jurisdiction. The country has the highest GDP per capita in the world and the lowest level of external debt. Its government is also stable. Hong Kong is another sound choice, because its banking system is liquid, well-capitalized, and very sound.

- Venezuela is an example of a bad choice of offshore jurisdiction in the current climate. There is rampant political corruption and crime, and the country’s economy is in dire crisis.[6]

-

4Pick a jurisdiction that meets your offshore banking needs. Different countries offer different advantages depending on the amount of wealth you have and the features you’re looking for in offshore banking. Some jurisdictions have lower minimum initial deposit fees to open accounts. Some have better customer service.[7]

- For instance, in Puerto Rico, you can open an account with as little as $500. In Liechtenstein, the minimum initial deposit requirements start at $250,000, so if you’re not a high-wealth individual this jurisdiction won’t be a good fit for you.

- The United Arab Emirates has a central bank backed by abundant wealth and its banks operate under much more conservative standards than Western ones. However, you need to go in person to open an account and customer service once you’re back home might not be very efficient.[8]

-

5Select a bank with a good reputation that is financially sound. Once you’ve chosen a jurisdiction, choose a bank in that country that is well reputed. Look in the monthly magazine Global Finance for rankings of safe banks worldwide.

- Make sure that the bank is liquid and solvent enough to withstand a financial shock. This means that the bank keeps enough of depositors’ funds available in cash on hand and deposits in the central bank to cover any run on the bank, financial shock, or drop in market value. The more money the bank has in reserve, the healthier and safer it is.[9]

-

6Consult with a trusted financial advisor to help evaluate your bank. It can be hard to determine by yourself if a bank is solvent and meets your needs. Choose an independent financial advisor who is not affiliated with any particular financial services or products.

- Speak to one or two of the advisor’s existing clients before committing to their services and be wary of an advisor who won’t provide references. Ask for a free in-person consultation with the advisor to make sure that you feel comfortable with them.[10]

-

7Visit the bank in person if you can. This is increasingly a requirement for opening a bank account anywhere, since banks want to make sure they know who their customers are. Even if you don’t officially have to put in a personal appearance, it’s a good idea to go and get a better sense of how the bank operates.

- Visiting in person also makes you look like a more trustworthy customer to the bank.[11]

Opening the Account

-

1Prepare basic documentation verifying personal information. Just as a domestic bank does when you set up an account there, an offshore bank will ask you to submit personal information such as your name, date of birth, address, citizenship, and occupation. Mail documents that verify this information. The bank will provide you a list of acceptable documents to submit as proof.

- In most cases, expect to submit a copy of your passport, driver’s license, or other government-issued identifying documents as proof of your identity.

- Use a current utility bill or perhaps a copy of a mortgage or lease to verify your physical address for tax purposes.[12]

-

2Get these documents authenticated. Many banks will require assurances of the authenticity of these documents. For some offshore banks, a notarized copy of the documents will be sufficient. Some offshore banks require an apostille stamp, which is a certification mark used internationally to verify the authenticity of foreign documents.[13]

- You can find a notary near you by searching online or contacting your local bank, city hall, or court.

- The process for obtaining an apostille stamp varies by country and state. In the United States, you typically send a form explaining the nature of the document that needs authenticating and how and where it will be used, along with the original document, and a fee to the secretary of state in your state for processing. In a few days, your document will be returned in the mail with the stamp.[14]

-

3Submit financial references from your current bank. To discourage illegal activities such as money laundering and tax fraud, many offshore banks require more documents in addition to those verifying your personal information to make sure that you are a legitimate customer. Provide financial reference documents from your current bank attesting to your average account balances and your ‘satisfactory relationship’ with the bank.

- Usually bank statements from the past 6-12 months will suffice.[15]

-

4Provide proof of the source of your funds. Many offshore banking centers are under governmental pressure to crack down on fraudulent financial activity, so they want proof that the sources of your money aren’t illegal. Submit documentation verifying the source of your money, whether it is your job, investments, business, or real estate.

- If your money comes from your job, submit a wage slip from your employer.

- Provide information about any investment income and where your investments are held.

- If your money comes from a business or real estate transaction, provide the sales contracts or other relevant material.

- If your money comes from an insurance payout, provide a letter from your insurance company.

- If your money is inherited, provide a letter from the executor of the estate.[16]

-

5Choose a currency for your account. Domestic banks only offer accounts in the domestic currency, whereas offshore bank accounts offer you the choice of which currency to hold your funds in. Research the currency that best fits your needs.

- Be aware that holding funds in certain currencies can make you liable for foreign taxes. You might also need to exchange currencies in order to make any deposits or withdrawals. It can be expensive to exchange currencies depending on the going exchange rate and any fees the bank charges.[17]

- Holding funds in foreign currencies can be valuable if your domestic currency is unstable or depreciating in value.[18]

- An example of a good foreign currency for people with funds in US dollars is the Hong Kong dollar. The Hong Kong dollar is ‘pegged’ against the American dollar, which means that you can convert your funds from US dollars into Hong Kong dollars and back again with minimal cost. In the event of a major depreciation of the US dollar, the Hong Kong government could de-peg their dollar, thus preserving the purchasing power of your savings.[19]

Depositing and Withdrawing Money

-

1Fund your account through a wire transfer. There are fees attached to wire transfers, unfortunately, but this is really the only viable option for putting money into your account. The fees vary from bank to bank, so try to find one that gives you a good deal.[20]

- Checks aren’t usually an option because domestic checks are rarely accepted in foreign countries.[21]

- It’s impractical to deposit cash in person regularly.[22] Moreover, most offshore banks don’t encourage you to fund the account with cash, and some actively disallow it. Depositing cash also raises suspicions that you’re laundering money.[23]

- You can make an international wire transfer online easily. Follow your bank’s directions.

-

2Make withdrawals using an ATM card. Lots of offshore banks will issue you a debit/ATM card. Use this card the way you use your normal debit card and access your money worldwide. Be aware though that there will likely be fees associated with using the debit card, and they might be steep.

- Try withdrawing larger amounts of cash at one time if you can to minimize the number of withdrawals you have to make and therefore the number of fees you have to pay.

- Some offshore banks will offer checks. However, it can be problematic to use checks to withdraw funds from your account because checks do not preserve your confidentiality, since they have your information written on them. Checks drawn on foreign accounts are also not accepted everywhere.[24]

-

3Use a domestic account in partnership with your offshore account. To avoid the fees associated with using an offshore account debit card, set up a domestic account as well as an offshore account. Send electronic wire transfers from your offshore account to your domestic account, where you can withdraw the funds more easily with fewer fees.

- Sending wire transfers between your accounts offers more privacy and security than making withdrawals via an ATM or check. It also lets you capitalize on the conveniences of local banking services.[25]

Expert Interview

Thanks for reading our article! If you'd like to learn more about opening an offshore bank account, check out our in-depth interview with Andrew Lokenauth.

References

- ↑ https://internationalman.com/articles/offshore-banking/

- ↑ https://medium.com/@icoservices/6-things-you-should-know-before-opening-an-offshore-bank-account-eaba6ad10af3

- ↑ https://www.investopedia.com/articles/pf/11/opening-an-offshore-bank-account.asp

- ↑ https://www.kiplinger.com/article/taxes/T056-C001-S001-how-to-find-a-good-tax-adviser.html

- ↑ https://www.sovereignman.com/offshore-bank-account/

- ↑ https://www.sovereignman.com/offshore-bank-account/

- ↑ https://www.sovereignman.com/offshore-bank-account/

- ↑ https://www.sovereignman.com/offshore-bank-account/

- ↑ https://www.sovereignman.com/offshore-bank-account/

- ↑ https://www.expertsforexpats.com/expat-financial-advice/choosing-a-financial-adviser/

- ↑ https://internationalliving.com/5-ways-easily-open-offshore-bank-account/

- ↑ https://www.investopedia.com/articles/pf/11/opening-an-offshore-bank-account.asp

- ↑ https://www.investopedia.com/articles/pf/11/opening-an-offshore-bank-account.asp

- ↑ https://thelawdictionary.org/article/how-to-obtain-an-apostille-stamp-in-the-usa/

- ↑ https://www.investopedia.com/articles/pf/11/opening-an-offshore-bank-account.asp

- ↑ https://www.investopedia.com/articles/pf/11/opening-an-offshore-bank-account.asp

- ↑ https://www.investopedia.com/articles/pf/11/opening-an-offshore-bank-account.asp

- ↑ https://www.investopedia.com/articles/pf/11/opening-an-offshore-bank-account.asp

- ↑ https://www.sovereignman.com/offshore-bank-account/#is-the-bank-liquid

- ↑ https://www.investopedia.com/articles/pf/11/opening-an-offshore-bank-account.asp

- ↑ https://www.investopedia.com/articles/pf/11/opening-an-offshore-bank-account.asp

- ↑ https://www.investopedia.com/articles/pf/11/opening-an-offshore-bank-account.asp

- ↑ https://internationalliving.com/5-ways-easily-open-offshore-bank-account/

- ↑ https://www.investopedia.com/articles/pf/11/opening-an-offshore-bank-account.asp

- ↑ https://www.investopedia.com/articles/pf/11/opening-an-offshore-bank-account.asp