This article was co-authored by Andrew Lokenauth. Andrew Lokenauth is a Finance Executive who has over 15 years of experience working on Wall St. and in Tech & Start-ups. Andrew helps management teams translate their financials into actionable business decisions. He has held positions at Goldman Sachs, Citi, and JPMorgan Asset Management. He is the founder of Fluent in Finance, a firm that provides resources to help others learn to build wealth, understand the importance of investing, create a healthy budget, strategize debt pay-off, develop a retirement roadmap, and create a personalized investing plan. His insights have been quoted in Forbes, TIME, Business Insider, Nasdaq, Yahoo Finance, BankRate, and U.S. News. Andrew has a Bachelor of Business Administration Degree (BBA), Accounting and Finance from Pace University.

This article has been viewed 524,215 times.

Banks in the Cayman Islands offer a range of accounts to suit your needs. You can contact a Cayman bank via the internet to arrange a confidential consultation to discuss your needs, whether you would like an offshore bank account, investment fund account, or the highly prestigious private bank account, Cayman banking can provide an account ideally suited to your business and private needs.

Steps

Understand the General Information and Requirements

-

1Understand tax laws in your country. Know the penalties and jail terms for avoiding local tax obligations through the use of offshore banking. If you are taxed on worldwide income, it is illegal to not report proceeds earned in an offshore bank/investment account, even though there may be no added tax from that country.

- If your intention in setting up an offshore account in the Cayman Islands is to skirt tax laws, you cannot do so lawfully. If you are caught skirting tax laws by depositing money into an offshore account, you may face a variety of civil and criminal penalties, including forfeiture of money and possible imprisonment.[1]

- You should hire a tax professional to ensure all your bank accounts are compliant with foreign and domestic tax regulations.

-

2Understand the differences between an offshore account and an investment account. Having a bank account and an investment account are two different things, each having distinct tax implications.[2]

- Offshore bank accounts are administered by banks and offer traditional services associated with holding a bank account: spending, receiving, and transferring funds, along with earning some forms of interest. If you just want to hold money in an offshore account, a bank account is probably your way to go.

- Offshore investment accounts are administered by investors and can hold money in different currencies, as well as stocks, bonds, and mutual funds. They provide greater flexibility than bank accounts, but may come with higher fees. If you want to hold assets in addition to cash overseas, an investment account may be your best bet.

Advertisement -

3Realize that you don't need to go to the Cayman Islands to open the account. Accounts can be opened by mail, precluding the need for you to visit Cayman in order to open an account. Additionally a number of services such as internet banking, mail retaining, credit cards and investment options can be set up on these accounts.[3]

-

4Find a Cayman Islands bank with competitive rates. You can use the internet or write to your local British embassy for a list of Cayman Islands Banks. Use search terms like "Cayman Private bank account" if you want to deposit more than $300,000 or "Cayman bank account," "Cayman banking," "Cayman banks" for Cayman Islands banks that accept less for opening accounts. Cayman private banks are more about investment and portfolio management than normal banking.

- Ask each bank you talk to what kind of fees are associated with setting up a bank account. Use these fees to shop around for competitive pricing. These fees may not be insignificant. It may cost somewhere in the area of $500 to $1,000 to set up an offshore account.

-

5Ask banks if they require an "apostilles" stamp. An apostilles stamp is a special kind of certification that you may need to provide as part of an international treaty. If you are required to show an apostilles stamp, you will need to visit your governmental office to obtain a state or national version of that stamp before continuing the application process.[4]

-

6Ask for a list of requirements needed to set up an account. Requirements are usually set in place in order to avoid money laundering, fraud, or other legal or other illegal activities associated with the international transfer of money. These requirements may include:

- Financial statements from your current bank to prove a satisfactory relationship.

- Wage slip from current job.

- Proof of identity.

- Copy of your passport. (May be distinct from proof of identity.)

- Proof of residence.

- Description of the expected uses of the money.

-

7Note that some, not all, offshore bank accounts may require far fewer proofs and far less information. Banks that do not ask questions or require many documents exist for a reason: many people choose to consistently use them. If your intention in setting up a bank account in the Cayman Islands is to remain clean and lawful, you may find it in your interest to steer clear of these institutions....

-

8Prepare for other requirements sets up by banking institutions that act as safety measures. Because of increased publicity and scrutiny over the years, offshore banks are starting to ask more questions and see more proof. For the following contingencies, be prepared to supply additional information:

- You may need to provide sales contracts if the money you're depositing is from a real estate transaction or significant business venture.

- You may need to provide a letter from your insurance company if the money you're depositing is from an insurance contract.

- You may need to provide a letter from an executor of the estate if the money you're depositing is from an inheritance.

Use Your Offshore Bank Account

-

1Choose what currency you want your money to be held in, if possible. One perk of having an offshore bank account is being able to choose what currency your money is held in. This, however, has its major advantages and disadvantages.[5]

- The advantage of holding your money in a foreign currency is the ability to hedge against depreciation or an unstable currency. If your currency is unstable and/or steadily losing value, this perk might be a significant advantage.

- The disadvantage of holding your money in a foreign currency is that you may be subject to foreign tax laws and you will experience fees to exchange currencies.

-

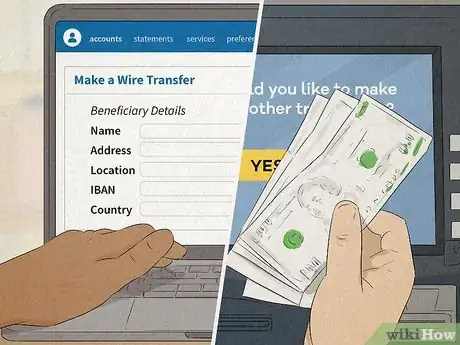

2Learn how to deposit funds into your account. Most modern offshore bank accounts effect transfers by electronic wire transfer. Many offshore banks do not accept foreign checks, and carrying money around may be impractical and/or dangerous.[6]

- Shop around for competitive rates, as banks will typically charge a wire transfer fee when you deposit money. If you can find a bank that does not charge wire transfer fees, you might consider banking with that institution.

-

3Learn how to withdraw funds from your account. Although most banks will issue a debit card associated with your account, you may need to pay fees in order to withdraw funds from your bank account.[7]

- Offshore banks generally do not issue checks for withdrawal purposes, for privacy reasons. Additionally, checks drawn on foreign accounts are often not accepted by other banking institutions.

- For this reason, consider holding money in two accounts: one offshore account, and one domestic account. You'll be able to wire transfer funds from the offshore account over to the domestic account, where you won't have to deal with unknown hassles.

Expert Q&A

-

QuestionHow do you open an offshore bank account in Panama?

Andrew LokenauthAndrew Lokenauth is a Finance Executive who has over 15 years of experience working on Wall St. and in Tech & Start-ups. Andrew helps management teams translate their financials into actionable business decisions. He has held positions at Goldman Sachs, Citi, and JPMorgan Asset Management. He is the founder of Fluent in Finance, a firm that provides resources to help others learn to build wealth, understand the importance of investing, create a healthy budget, strategize debt pay-off, develop a retirement roadmap, and create a personalized investing plan. His insights have been quoted in Forbes, TIME, Business Insider, Nasdaq, Yahoo Finance, BankRate, and U.S. News. Andrew has a Bachelor of Business Administration Degree (BBA), Accounting and Finance from Pace University.

Andrew LokenauthAndrew Lokenauth is a Finance Executive who has over 15 years of experience working on Wall St. and in Tech & Start-ups. Andrew helps management teams translate their financials into actionable business decisions. He has held positions at Goldman Sachs, Citi, and JPMorgan Asset Management. He is the founder of Fluent in Finance, a firm that provides resources to help others learn to build wealth, understand the importance of investing, create a healthy budget, strategize debt pay-off, develop a retirement roadmap, and create a personalized investing plan. His insights have been quoted in Forbes, TIME, Business Insider, Nasdaq, Yahoo Finance, BankRate, and U.S. News. Andrew has a Bachelor of Business Administration Degree (BBA), Accounting and Finance from Pace University.

Finance Executive Contact local bank in the country for more specific information! They can advise on the next best steps to take in alignment with Panama's banking laws and regulations.

Contact local bank in the country for more specific information! They can advise on the next best steps to take in alignment with Panama's banking laws and regulations. -

QuestionCan I keep jewelry in my account?

Community AnswerTo keep items there, ask the bank for a locker which you can rent yearly for free, or a fee according to the bank rules.

Community AnswerTo keep items there, ask the bank for a locker which you can rent yearly for free, or a fee according to the bank rules. -

QuestionHow do I get a savings account that pays good interest?

Community AnswerI've found that Credit Unions tend to have better interest rates for savings accounts.

Community AnswerI've found that Credit Unions tend to have better interest rates for savings accounts.

Warnings

- Expect to be asked where your money came from.⧼thumbs_response⧽

Expert Interview

Thanks for reading our article! If you'd like to learn more about opening a bank account in the Cayman islands, check out our in-depth interview with Andrew Lokenauth.

References

- ↑ http://www.irs.gov/Individuals/International-Taxpayers/Offshore-Voluntary-Disclosure-Program-Frequently-Asked-Questions-and-Answers

- ↑ https://www.investopedia.com/investing/pros-cons-foreign-market-investing/

- ↑ https://www.investopedia.com/articles/pf/11/opening-an-offshore-bank-account.asp

- ↑ https://travel.state.gov/content/travel/en/legal/travel-legal-considerations/internl-judicial-asst/authentications-and-apostilles/apostille-requirements.html

- ↑ https://www.aesinternational.com/blog/the-7-benefits-of-offshore-banking

- ↑ https://www.investopedia.com/articles/pf/11/opening-an-offshore-bank-account.asp

- ↑ https://www.investopedia.com/articles/pf/11/opening-an-offshore-bank-account.asp

About This Article

Before you open a bank account in the Cayman Islands, make sure you understand that it’s illegal to open offshore bank accounts in order to skirt tax laws in your own country. In order to open an account, look for a bank with competitive rates on fees for services like deposits and withdrawals. Then, be prepared to provide documentation, such as a copy of your passport, proof of residence, and statements from your current bank. You may also need to submit a sales contract or a letter from an insurance company, depending on the source of your funds. For more advice, including how to decide what currency you want your money to be held in, keep reading!