This article was co-authored by Ryan Baril. Ryan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

There are 7 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 123,800 times.

The repayment of mortgages can be a daunting proposition. Imagining twenty or thirty years of payments on anything makes many borrowers wish there were a better way. Luckily, with mortgage accelerator programs, you can pay off your loan more quickly without placing a massive financial strain on yourself. Unlike plans that simply tack on an additional payment each year, this plan pays off your loan using money you already have. Following the plan is as easy as taking the steps below.

Steps

Deciding to Use a Mortgage Acceleration Program

-

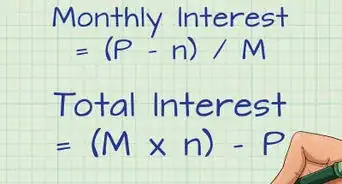

1Determine if a mortgage accelerator program can help you. Mortgage accelerator programs exist so that borrowers can pay off their mortgages in a shorter period of time than their mortgage originally planned for. This can save you tens of thousands of dollars on interest because total interest paid is directly tied to how long it takes you to pay off the loan. This can be helpful if you want to get your mortgage out of the way to focus on other financial goals or if you simply want to save money in the long run.

- For example, imagine you have a 30-year, $100,000 loan that charges 6 percent interest. With a $600 monthly payment, your loan will be paid in full in 30 years and you will have paid over $115,000 in interest. If you paid just $100 more per month, $700, you would pay off your loan in 21 years and pay less than $76,000 in interest. This is a savings of $39,000 in interest, even though you've payed back the same amount of principal.[1]

-

2Choose a mortgage accelerator program type. There are basically two types of mortgage acceleration plans. One simply accelerates your payments by switching your 12 yearly monthly payments for 26 bi-weekly payments (for half your regular monthly payment amount). This does pay off your mortgage faster (down to about 22 years from 30), but is essentially the same as writing an additional monthly check at the end of the year and can cut more into your monthly income. The other type, the type discussed in this article, involves moving around your expenses in a home equity line of credit (HELOC) and credit card so that you can use your existing income to pay down your loan principal.[2]Advertisement

-

3Never pay for a mortgage accelerator program. There are many plans and programs out there that charge for arranging this type of mortgage acceleration. In some cases, this can be very expensive. Know that you can plan and budget out your own mortgage acceleration plan without paying for these scams.[3]

- For example, one of these plans might cost you an initial $300 fee and then $65 per year for the life of your loan. These fees are unnecessary, as you are paying for something you can do yourself.[4]

-

4Decide whether or not acceleration is your best option. Mortgage acceleration will invariably reduce the amount of money you are able to spend each month. While this will help you get out of debt faster, it may interfere with your other financial goals. If you're also in another type of debt, like credit card debt, paying that off should be your priority before taking on a mortgage acceleration plan. Alternately, you may have a large savings goal, like saving for your child's education. Consider your priorities before deciding on this type of plan.[5]

Implementing the Program

-

1Find your positive cash flow. This is the most important step. Take all your monthly bills including your mortgage, credit cards, utilities, memberships, gas, shopping money, grocery money, etc. etc. and add them all together. Take your monthly paycheck and subtract the total monthly expenses from it. Whatever you have left over is your amount of Monthly Positive Cash Flow. The more positive cash flow you have, the more interest you will save, and the faster you will payoff your mortgage.

- In our example, we have a $200,000 mortgage and we make $5,000 per month. Our monthly mortgage payment is $1,000. Additional payments and expenses, like utilities, car payments, and food, cost another $2,000 per month. This means that we have a total of $3,000 in expenses each month. So, our positive cash flow is $5,000 monthly income minus $3,000 in monthly expenses, or $2,000.

- This plan will not work if you don't have any positive monthly cash flows.

-

2Deposit your paycheck into your mortgage. Yes, you read it correctly. Let's say you get paid your paycheck of $5,000 on January 1. Take that entire $5,000 and deposit it into your mortgage. If you didn't already know, interest accrues daily on your mortgage in the United States. Deposit the entire $5,000 into your mortgage and your new balance (in our example) will be $195,000. For the entire month, interest will accrue based on a $195,000 balance instead of $200,000. You are already saving money! Wait, how do we pay our bills?

-

3Get a good credit card. Credit cards can be the death of you BUT, if used correctly, they can be a cornerstone of this whole system. The one thing credit cards do well is they will give you "free" money for up to 45 days. If you have a $100 balance and you pay it off every month, you won't accrue any interest. We are going to pay as many bills as possible on our credit card. Utilities, gas, shopping, tickets to the movies...everything.

- This means putting your full $2,000 in additional monthly expenses on the credit card.

- Get a credit card that accrues good airline miles or cash-back points. You are racking up big balances but you are paying them off in full every month. This will help you enjoy additional benefits at no extra cost.

-

4Get a Home Equity Line of Credit. The other cornerstone behind the system is the Home Equity Line of Credit, aka a HELOC. The HELOC is a useful type of mortgage that you can get that acts like a credit card using your home as collateral. Always always get a HELOC with a ZERO balance. You will use the HELOC to payoff the credit card balance of $2,000 in FULL every month and you will also use the HELOC to pay your mortgage payment (let's say your mortgage payment is $1,000).

- If any lender says that you must take a draw at closing, they are wrong. They only say that because most loan officers only get paid based on the draw amount and not the balance of the HELOC. Move on until you find one that does not require a draw at closing.

- Find a HELOC that has a debit card. Some of the bigger banks will offer a debit card in lieu of HELOC checks. It will be easier to payoff your credit card and your mortgage utilizing these debit card that are tied to your HELOC. Some of the major banks are Wells Fargo and CitiMortgage.

- While direct lenders, such as major commercial banks, may have good deals, consider looking into mortgage brokers, too. Mortgage brokers can give you quotes from a bunch different lenders so you can compare.[6]

-

5Look at your current balances. Consider the current balances of your mortgage, HELOC, and credit card. This will help you understand how you are saving money with the mortgage accelerator program. To recap the example:

- You put your entire $5,000 paycheck into your mortgage of $200,000.

- Your new mortgage balance is now $195,000.

- You put all your $2,000 of monthly "spendings" on a credit card.

- You have a $1,000 mortgage payment for a total of $3,000/month in payments.

- You use your HELOC to pay the credit card bill and the mortgage payment.

- Your new TOTAL mortgage balances are:

- 1st Lien of $195,000

- 2nd Lien HELOC of $3,000

- Total = $198,000

-

6Pay off the HELOC. In February, you get your paycheck again, but this time, put your positive cash flows entirely into your HELOC. This keeps the balance of your 1st mortgage at $195,000 which is already saving you interest. With our balance of $3,000 in the HELOC and our positive cash flow of $2,000, the HELOC will be paid back to $0 in, technically, a month and half. Realistically, though, this will take two months of payments ($2,000 in month 1 and $1,000 in month 2).

- Specifically, your payments for the month of February (from your $5,000 paycheck) will be as follows: $1,000 regular mortgage payment, $2,000 in regular expenses, and $2,000 remaining positive cash flow put towards paying off the HELOC.

- In March, you would pay the regular $1,000 mortgage payment, pay your standard $2,000 monthly expenses, finish paying the HELOC with $1,000, and then have an additional $1,000 in positive cash flow left over.

-

7Repeat as desired. With your HELOC payed off, you can continue the process of putting your paycheck into your mortgage (that is, restart the process you've just completed). Put your entire paycheck into mortgage again and repeat the process from there. Every time you do, you will reduce your loan principal more quickly and accelerate your repayment.

- In order to do this, you can keep your HELOC open even after it has been paid off. In this way, your HELOC functions mostly like a credit card, allowing you to take out money as needed (up to a certain limit, of course).[7]

- In theory, you can borrow as much as 80 to 90 percent of your home equity value from your HELOC. That is, imagine that for the example $200,000 mortgage, you have a full home value of $250,000, meaning that you originally made a down payment for $50,000. If you haven't paid into your mortgage yet, this $50,000 is your equity in the home. Therefore, you could borrow 80 to 90 percent of that value on your HELOC, or about $40,000 to $45,000.[8]

- Make sure to not repeat the process until your HELOC has been completely paid off from the previous cycle.

Considering Other Options

-

1Think about simply staying on schedule. As previously mentioned, there are some advantages to simply staying on track with your mortgage payments. While you'll still be paying the full amount of interest and for the full duration of your loan, you will be able to meet other financial goals more easily. Instead of accelerating your mortgage, you can use your positive cash flows to pay off other debts, invest in your child's education, or save for retirement. Reflect on your goals and decide whether an accelerated mortgage plan is best for you.[9]

-

2Pay more each month. Instead of taking on an extreme program, simply pay more every month on your mortgage. This number can be whatever you feel comfortable with. Even an extra $50 per month can have a drastic effect on the length of your loan and your total interest paid. Prune other expenses in your life, like parts of your tv or cell phone bills, to free up this money.

- Be sure to mark the extra payment as “apply to principle,” or it could just be applied to your interest.

- To keep yourself on track, consider setting up automatic billing from your checking account. This feature will automatically deduct the amount of your payment (your mortgage bill plus whatever you are choosing to pay on top of that) from your checking account. This will make sure that you stay on track, even if things are tight in some months.[10]

-

3Refinance to a shorter-term loan. If you're really serious about paying down your loan faster and have some positive cash flow to burn, you can refinance your loan to a shorter-term loan with the bank. For example, you can shorten your 30-year loan to a fifteen, ten, or even five-year loan. Of course, the shorter the loan, the higher your monthly payments will be. On the other hand, a shorter loan will also charge you less interest overall. Talk to a loan representative at your mortgage lender to learn about your options.[11]

- Refinancing your loan may incur new origination charges and closing fees.

- Additionally, your lower interest payments will likely mean that you cannot deduct as much mortgage interest from your income taxes each year.[12]

-

4Pay in lump sums if and when you receive them. Another option, which is in line with any type of repayment plan, is simply putting any lump-sum payout you get into paying down your loan. This means taking any payments you receive in excess of your regular income and putting them directly into your mortgage. For example, rather than spending your tax refund on a vacation, pay that money directly into your mortgage. This is understandably unpleasant for most people, but will ensure that your mortgage is paid off in a shorter time period.

References

- ↑ http://www.nbcnews.com/id/15145783/ns/business-answer_desk/t/whats-mortgage-accelerator/#.VsOLbJOAOko

- ↑ http://www1.cbn.com/should-i-use-mortgage-accelerator

- ↑ http://www1.cbn.com/should-i-use-mortgage-accelerator

- ↑ http://www.nbcnews.com/id/15145783/ns/business-answer_desk/t/whats-mortgage-accelerator/#.VsOLbJOAOko

- ↑ http://www.nodebtplan.net/2009/04/01/avoid-mortgage-accelerator-programs-like-the-plague/

- ↑ http://www.investopedia.com/articles/personal-finance/090915/mortgage-broker-vs-direct-lenders-which-best.asp

- ↑ http://homeownership.org/news/happens-heloc-loan-zero-balance/

- ↑ http://www.bankrate.com/finance/home-equity/how-much-equity-can-you-cash-out-of-home.aspx

- ↑ http://www.nodebtplan.net/2009/04/01/avoid-mortgage-accelerator-programs-like-the-plague/

-Step-18.webp)