This article was co-authored by Carla Toebe. Carla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, several readers have written to tell us that this article was helpful to them, earning it our reader-approved status.

This article has been viewed 366,213 times.

Private mortgage insurance (PMI) is insurance that protects a lender in the event that a borrower defaults on a conventional home loan. Mortgage insurance is usually required when the down payment on a home is less than 20 percent of the loan amount. Monthly mortgage insurance payments are usually added into the buyer's monthly payments.

Steps

Calculating Mortgage Insurance

-

1Find the purchase price. Even if you are just beginning to look for a home, you probably already have a good idea about the price of the home you can afford to purchase. The purchase price of the home will help you determine your loan-to-value ratio.

-

2Determine the loan-to-value (LTV) ratio. The loan-to-value ratio is a simple way for lenders and insurance agents to calculate how much you've paid and how much you owe. The LTV ratio is calculated by taking the amount of money you borrowed on the loan and dividing it by the value of your property. The higher the LTV, the more your mortgage insurance will cost.[1]

- For the purposes of this article, let's assume a loan amount of $225,000. Say you're buying a house that costs $250,000 and you've put 10% down on the house, or $25,000. Because you've only paid 10%, and 90% is still outstanding, your loan is $225,000 and your loan-to-value ratio is 90 percent.

Advertisement -

3Determine the terms of the loan. The type and length of your loan can also play a factor in the mortgage insurance amount. Shorter loans require lower rates of the mortgage insurance. However, a 30 year loan is the most popular time period. Similarly, fixed loans cost less than adjustable-rate loans.

- If you have a Federal Housing Association (FHA) loan, you will have a type of insurance called Mortgage Insurance Premium (MIP) instead of PMI. This is still a type of mortgage insurance, but the structure of the loan is slightly different. Be sure to read the terms of the loan carefully to understand how MIP might be calculated for you.[2]

-

4Determine the mortgage insurance rate. PMI fees vary, depending on the size of the down payment and the loan, from around 0.3 percent to 1.15 percent of the original loan amount per year.[3]

- The easiest way to determine the rate is to use a table on a lender's website. If you are already working with a lender, you can use the one on your lender's website. If you do not yet have a lender, you can still find a calculator online to estimate the rate. One such calculator can be found at mgic.com/ratefinder.

-

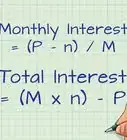

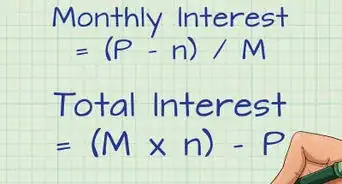

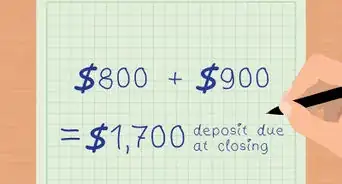

5Do the math. The good news is that calculating mortgage insurance is easy. After you know the numbers, all you need to do is multiply and divide to determine the amount of mortgage insurance.

- First, determine the annual mortgage insurance amount. Do this by multiplying the loan amount by the mortgage insurance rate. Here, if the remaining value of your loan was $225,000 and the mortgage insurance rate was .0052 (or .52%) then: $225,000 x .0052 = $1170. Your annual mortgage insurance payment would be $1170.

- To determine the monthly payment amount, divide the annual payment by 12: $1170 / 12 = $97.50/month.

- You can add your monthly mortgage insurance amount to your principal, interest, taxes, and insurance payment to determine your total monthly house payment.

-

1Understand that your mortgage insurance will "fall off" if you build up enough equity in your home. You don't need mortgage insurance indefinitely. Once you've built up 20% equity in your home (i.e. your LTV is 80%) you can request to cancel your mortgage insurance.

- Keep in mind that lenders won't automatically cancel your mortgage insurance until your equity reaches about 22% based on the original appraisal of the home.[4]

- Don't wait for the lender to cancel the insurance for you. Do it yourself once you reach a 20% equity stake in your home. The lender will need an appraiser or real estate agent to give them a valuation before the insurance can be canceled.

- If you have an FHA loan, you need to have paid 22% of the mortgage before you can cancel the insurance. You also need to have made five years of monthly payments before it can be removed.

-

2Know that your credit score will also affect your mortgage insurance. Just like your credit score affects your ability to get approval for loans, it also may affect your ability to get good rates on mortgage insurance rates. Those with lower credit scores may not get rates as favorable as those with high credit scores.

-

3Understand that some lenders may waive MI altogether if the buyer agrees to a higher interest rate. Some lenders will allow you to purchase a mortgage without insurance if you agree to pay more interest on the life of the loan. Anywhere from .75 to 1 basis points more is normal, depending on the down payment.[5]

- This is a tradeoff. Most people will pay more money in the long run, since the interest rate hike applies for the whole mortgage. Again, the mortgage insurance only lasts until the buyer has pumped enough equity into the home. You'll most likely end up paying more if you make this tradeoff.

- At the same time, this tradeoff does come with one perk. The payments you make on your interest are tax deductible, whereas the payments you make on insurance premiums are not, unless you took out your mortgage after Jan 1, 2007 and your Annual Gross Income (AGI) does not exceed $109,000. If you fit this category, you can reduce your AGI by 12 times your monthly PMI payment. So in these parameters, it is deductible.

-

4Know the difference between prepaid insurance and monthly insurance. Figure out if your lender is asking you to pay one sum, up-front, or will stagger your insurance in monthly premiums.

- Paying your premiums monthly has the benefit of a smaller initial cost as well, and they are harder to forget.[6]

- Remember, you should request to cancel your mortgage insurance after you've reached a 20 or 22% equity stake in your home. You may forget to do so if you make an up-front payment.

Expert Q&A

Did you know you can get expert answers for this article?

Unlock expert answers by supporting wikiHow

-

QuestionMy house appraisal value was 410000, but the purchase price is 400000, so to cancel the insurance, which value will be used?

Carla ToebeCarla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

Carla ToebeCarla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

Real Estate Broker

-

QuestionHow do I calculate title insurance?

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Business Advisor

-

QuestionWhen you have reduced the original loan amount by 20%, you can drop the PMI?

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Business Advisor

References

- ↑ https://www.bankofamerica.com/home-loans/mortgage/budgeting-for-home/mortgage-down-payment-amount.go

- ↑ https://www.fha.com/fha_requirements_mortgage_insurance

- ↑ http://homeguides.sfgate.com/calculate-mortgage-insurance-premium-9455.html

- ↑ http://www.zillow.com/mortgage-rates/buying-a-home/mortgage-insurance-and-pmi/

- ↑ http://www.realtor.com/home-finance/insurance/private-mortgage-insurance.aspx

- ↑ http://www.inman.com/2012/10/25/3-things-you-should-know-about-mortgage-insurance/

About This Article

To calculate mortgage insurance (PMI), identify the purchase price of the home and the loan-to-value ratio by taking the amount of money you borrowed on the loan and dividing it by the value of your property. Next, determine the mortgage insurance rate by using a table on a lender's website. Then, multiply the loan amount by the mortgage insurance rate to calculate PMI. To determine the monthly payment amount, divide the annual payment by 12. For information about the difference between prepaid insurance and monthly insurance, read on!

-Step-18.webp)