This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

There are 9 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 117,805 times.

Although an annuity is meant to provide steady income, particularly when you retire, there are circumstances under which you might decide to sell your annuity.[1] For example, you might decide to sell your annuity in order to buy a home, invest in a business, or to cover the costs of an emergency. Perhaps you've done the math and discovered that your annuity isn't the best most profitable option for you, and you'd like to reinvest. To find the right buyer for your annuity, look for buyers who can give you the terms you desire. If time permits, get competing offers rather than going for the first buyer you find.

Steps

Evaluating Your Annuity

-

1Determine whether or not your annuity is transferable. If your annuity is not transferable, then you cannot sell it under any circumstances. Check your contract to see if it is transferable. If you are trying to get immediate funds, list your nontransferable annuity as an asset or form of income and apply for a bank loan.

-

2Determine if your annuity is a structured settlement. Check your contract or consult your accountant to learn about the laws in your state. Most states have laws that protect people trying to sell their structured annuity. If your state has a Structured Settlement Protection Act, your transaction will have to be approved by a state court. The Periodic Payment Settlement Act protects those who received a cash sum as a result of personal injury and wrongful death lawsuits, from spending the awarded money too quickly, which may then force them to turn to public assistance to meet their needs.[2]

- Don’t try to sell a structured annuity by yourself, especially if you are living in a state that does not have a structured annuity protection law. Talk to a trusted broker and attorney before you proceed.

Advertisement -

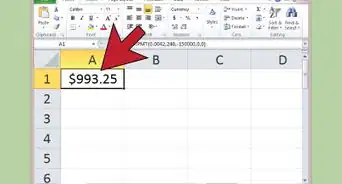

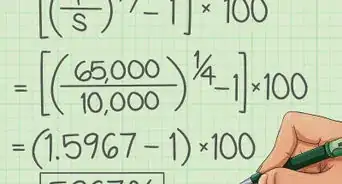

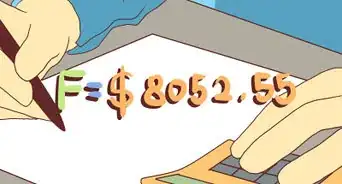

3Evaluate your annuity. Before you shop around for annuity buyers, find out what the resale value of your annuity is. Hire an accountant if you are unclear on the details of your investment and its relative worth. Keep in mind that selling your annuity always result in your receiving a lower amount of money from your annuity. You will get a lump-sum payment that is adjusted with a discount rate, meaning that you'll get about 8 to 14 percent less than you would if you waited for the payments.[3]

-

4Understand the tax implications of selling your annuity. All annuities offer tax-deferral from the time of your initial investment. Your distributions, however, are taxable. This means that your annuity grows tax-free in the accumulation phase, but is taxed as distributions are made to you. These payments are taxed as ordinary income.[4]

- Gains made by selling your annuity before it matures are taxable as ordinary income. However, losses on the sale are not tax-deductible as investment losses.[5]

- If you withdraw from an annuity before age 59.5, you are also charged a 10% tax penalty. However, exceptions are made in various cases, such as the death or disability of the annuity holder.

- You can also trade your annuity for another qualified annuity contract without paying taxes on the first annuity. These "1035" exchanges can be tricky, so check with a tax accountant or investment adviser before proceeding.[6]

Finding a Buyer

-

1Search for potential annuity buyers. Your best source for locating a potential buyers is the insurance agent that first sold you the annuity. They understand the market well and will likely have contacts for this sort of transaction. Additionally, they may also charge you a reduced commission for finding a buyer, as you already paid them a commission when you purchased the annuity.[7] Alternately, you can search for an annuity buyer online. Before working with any of these companies, make sure that they:

- Have positive, independent reviews of their services.

- Have excellent customer service.

- Can make a competitive offer for your annuity.

- Are licensed to conduct business and follow all appropriate regulations.

- Communicate timelines and figures in a transparent way.

- Recommend that you first consult with a financial professional before selling.[8]

- Try checking with the Better Business Bureau (BBB) to identify whether or not the company is reputable. Companies with poor ratings from the BBB should be avoided.[9]

- Some reputable buyers of annuities include JG Wentworth, Catalina Structured Funding, Peachtree Financial, and Stone Street Capital. These companies can be contacted by phone or through their respective websites.

-

2Hire a broker. If you are having trouble finding potential buyers, or if you can't find the price you think is reasonable, hire a broker. You’ll have to pay a brokerage fee, but you may stand to gain from the expertise of the broker's negotiations. Choose your broker carefully. Check their certifications to ensure that they are licensed to negotiate the sort of sale you want to make.

- Ask the broker you want to hire for a quote. If they quote you a percentage, calculate it before you agree.

- Look up the name of a broker you haven't worked with before. Any violations or complaints they have might be online.[10]

-

3Get offers for your annuity. Try to obtain offers from at least five companies before you choose. When you find companies online, use their quote form to get a free quote from them. A quote is not necessarily the amount you would receive, and it may not include the fee that may be deducted when a settlement is reached.

- When you fill out the free quote form, give them only the standard information. Your name, email address and the name of your annuity should be the only information they ask for.

- Do not give your social security number, bank information, or pay any fees to obtain a free quote.

- Give yourself as much time as you can to make the sale. A rushed sale is less likely to get you a good deal.

-

4Pick the best offer. Getting an offer of about 80% of the value of your annuity would be considered a good deal.[11] Do not take a deal in which your buyer expects you to pay fees out of pocket before a settlement is agreed upon. Once you have finalized your agreement, all agreed upon court costs, legal fees and commissions should be deducted from the final settlement.

-

5Gather your paperwork. To sell your annuity, you will need copies of your original annuity application and your annuity policy. If you are already collecting on your annuity, you will need your most recent disbursement check and tax return. If you have a settlement agreement, you will need a copy of that. Bring your valid government issued id, such as a passport or driver's license, and a written declaration that you are selling your annuity of your own free will.

- Gather any other documentation your buyer requires, such as a copy of a court judgment for a structured annuity, or copies of any release agreements.

Deciding What Kind of Sale to Make

-

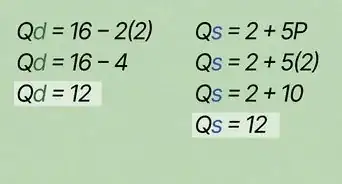

1Decide what type of funding you are trying to get from your sale. Investigate the various ways annuity buyouts are made. Remember that no matter what kind of deal you make, the buyer will get the better deal in the long term. You will likely be offered anywhere from 60% to 85% of the value of your annuity. With this in mind, consider alternatives to selling your annuity.

- If you are just selling your annuity to free up some cash, taking out a loan might better serve your purposes.

-

2Consider selling as a straight purchase. If you sell as a straight purchase, the buyer will give you one lump-sum payment for your annuity. You will not go on to collect future payments. Choose to sell as a straight purchase if you are trying to get the largest immediate sum possible, or if you have determined that your annuity is not serving its purpose.

- If you sell an annuity contract, you will have to pay ordinary income tax on your annuity's earnings.[12]

-

3Consider selling as a partial purchase. In this case, the buyer purchases your immediate annuity payments for a set period. At the end of that time, you once again collect your annuity payments as scheduled. Consider this option if you have a temporary shortage of cash, but would like to continue investing in your retirement.

-

4Consider selling as a reverse purchase. Sell several years of your annuity. For example, if you are now receiving $1,000 per month for the next 15 years, sell your payments from years 5 through 10 only. You will get a lump sum for those years, but still receive your current payments up through year 4. You will then receive no monthly payments in years 5 through 10, but they will resume in years 11 through 15.

- Know that this will result in a lower overall payout from your annuity. You will get the money for the sold years up front, but it will be lower than the total value of the payments from those years.

- You also need to be sure of the value of the future payments before any deals are made.

- This might be a good option if you need money now, but know you will be able to support yourself during an upcoming time period.

-

5Consider selling as split purchases. If your buyer makes a split purchase, they will receive part of your monthly payment. If you only need $500 a month and your annuity payment is $1,000, sell half your annuity; you will get an immediate lump sum for the half you don't need, and continue to receive monthly payments of $500.

- Even though you've only sold half the annuity, you will still pay ordinary income taxes on the deferred earnings and any gains made on the sale.[13]

References

- ↑ http://www.sec.gov/answers/annuity.htm

- ↑ http://www.annuity.org/structured-settlements/periodic-payment-settlement-act/

- ↑ https://www.stackingbenjamins.com/ups-downs-selling-annuities/

- ↑ http://www.investopedia.com/exam-guide/finra-series-6/taxation-issues/tax-treatment-variable-annuity-contracts.asp

- ↑ http://www.annuity.org/cash-value/tax-implications/

- ↑ http://www.investopedia.com/exam-guide/finra-series-6/taxation-issues/tax-treatment-variable-annuity-contracts.asp

- ↑ http://www.investopedia.com/ask/answers/082715/what-are-best-ways-sell-annuity.asp

- ↑ https://www.annuity.org/selling-payments/buyers/

- ↑ https://www.annuity.org/selling-payments/buyers/