This article was co-authored by Darron Kendrick, CPA, MA. Darron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

This article has been viewed 61,378 times.

When you have an annuity, you invest money for a specific period of time and are guaranteed that the money will be returned with interest. You are essentially loaning money to an insurance company, which invests that money and later pays it back with interest over a specific period. Many people deposit money into retirement accounts during their working career. That retirement money can be transferred to an annuity account for purposes of receiving income during retirement. It is easy to calculate this future annuity income by using a bit of algebra.

Steps

Gathering Your Variables

-

1Identify the terms of your annuity. Ask your financial advisor or annuity administrator for the terms of your annuity. In order to calculate your annuity payments, you will need the annuity's principal amount, annual interest rate, payment frequency, and number of payments.

- Most of this article calculates annuity payments for the most common type of annuities: ordinary annuities that make payments at the end of end of the period. Those with annuities that pay at the beginning of the period will have to use the Excel function to calculate their payments.

- In addition, these calculations assume that the annuity makes payments consistently throughout the term. These calculations will not work for annuities that change interest rates or payment size throughout their lives.[1]

-

2Identify the principal amount and duration of the annuity. The principal is the present value, or current worth, of the annuity. If you purchased the annuity, this is the lump sum payment that you made to receive the annuity payments over a period of time. The duration is the number of years that the annuity will make payments.

- For example, imagine that you paid $150,000 for an annuity. This would be your principal amount.

- The duration is how long the annuity pays out payments. For example, this could be 20 years.

Advertisement -

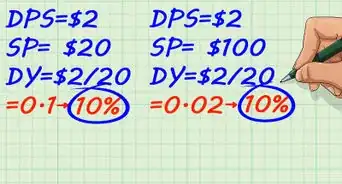

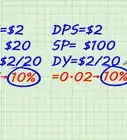

3Find the period interest rate. The period interest rate is the annual percentage rate divided by the number of payments made each year. So, if the payments are made monthly, you would divide by 12, quarterly by 4, semiannually by 2, and if there are annual payments, you would not divide the annual interest rate at all.[2]

- For example, you would calculate your monthly interest rate by dividing your annual interest rate, r, by 12. So, for the example, imagine that your annual interest rate is 5 percent. This would be expressed as a decimal for the calculation by dividing by 100 to get 0.05 (5/100).

- To get the monthly interest rate, divide this number by 12. So, this would be 0.05/12, which is 0.004167. For ease of calculation, we will round this number to 0.0042. This is the R value that will be later used in the calculation.

-

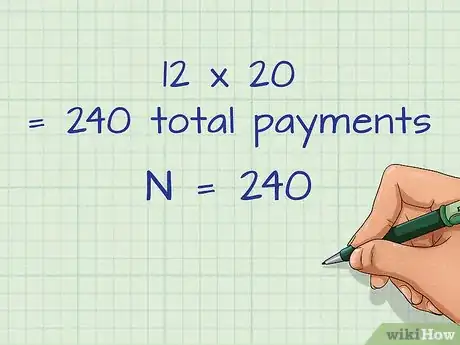

4Calculate the number of payments. The total number of payments is calculated by multiplying the payment frequency times the duration of the annuity. So, if your annuity makes monthly payments for 20 years, you will have 240 total payments (12 monthly payments per year*20 years).[3]

- For the purposes of this article, the duration is represented by the variable t, the payment frequency by n, and the total number of payments by N. So, for the example, N=240.

Calculating Annuity Payments

-

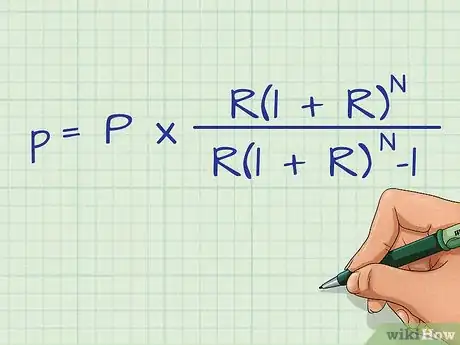

1Know the correct formula for finding annuity payments. Use the following formula to calculate your monthly, annual and lifetime annuity income: In the formula, the variables stand for the following amounts:[4]

- p is the annuity payment.

- P is the principal.

- R is the period interest rate.

- N is the total number of payments.

-

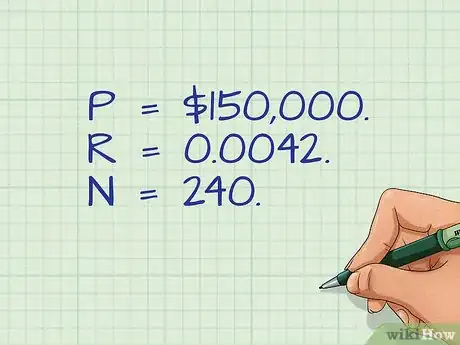

2Make sure your variables are in the correct form. In particular, make sure that your interest rate is the correct period interest rate, whether that is the annual rate, monthly rate, or another type. In addition, make sure that your total number of payments, N, is calculated correctly from the payment frequency and duration.[5] For the example, the variables should be input as follows:

- P is $150,000.

- R is 0.0042.

- N is 240.

-

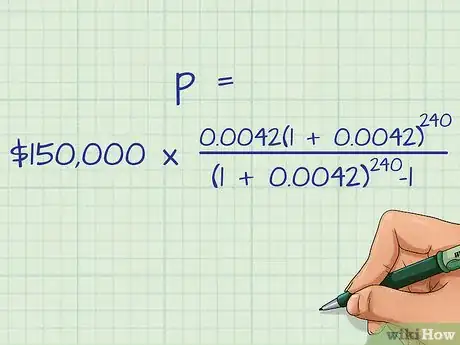

3Input your variables. Place your variables in the correct spots in the formula. Check over it where you're done to make sure everything is in the right place.

- The completed equation for the example looks like this:

-

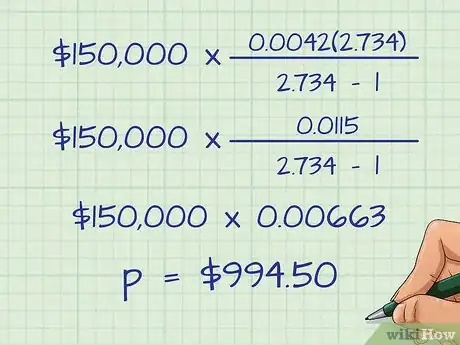

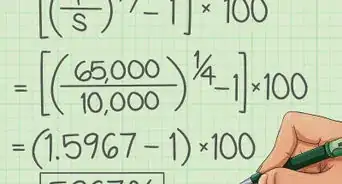

4Solve the equation. Go through your equation, solving each part in the correct sequence for the order of operations. This means starting with the addition within the parentheses.

- After the addition in parentheses, the example is:

- Next, solve the exponents. This involves raising the lower numbers (1.0042 in the example) to the power of the higher numbers (240). This is done on a calculator by entering the lower number, pressing the exponent button (usually ), and then entering the higher number and pressing enter.

- The result of the exponent calculation yields 2.734337. For convenience, we will round this number to 2.734. So, the example equation now looks like so:

- Multiply the top of the equation. Multiply the two numbers, 0.0042 and 2.734, together. This gives:

- This result, 0.115, is also a rounded figure.

- Subtract in the denominator. Complete the figure (2.734-1). This gives:

- Divide the fraction. Divide 0.0115 by 1.734 to get 0.00663206. For convenience, round this number to 0.00663.

- The equation is now

- Solve the final multiplication. Multiply the last two numbers to get the monthly annuity payment, which is $994.50. Keep in mind that this number is the result of rounded calculations and may be off by several dollars. Keeping more decimals in your calculations will give you a more accurate calculation.

- In other words, for an annuity costing $150,000 that makes monthly payments based on an annual rate of five percent, you can expect monthly payments of $994.50.

-

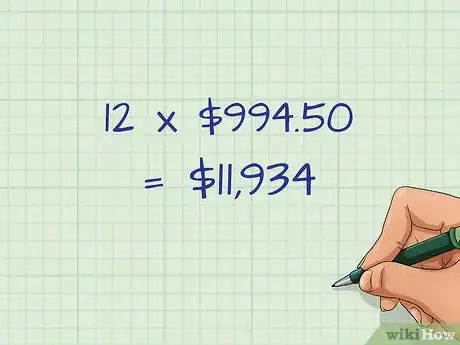

5Calculate the annual annuity income payments. You can now use your monthly payment to calculate how much you receive from the annuity each year. This is done by multiplying p (monthly payment) by 12, which would be 12*$994.50, or $11,934 in the example.

Calculating Annuity Payment Using Excel

-

1Open a new Excel worksheet. Open the program and start a blank worksheet to begin. You can also use another spreadsheet program, like Google Sheets or Numbers, but the specific formula names and inputs might be slightly different.

- You should use this method to calculate payments if your annuity is one that makes payments at the beginning of each period (for example the first of the month).

-

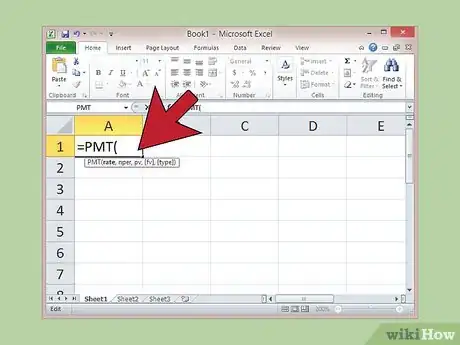

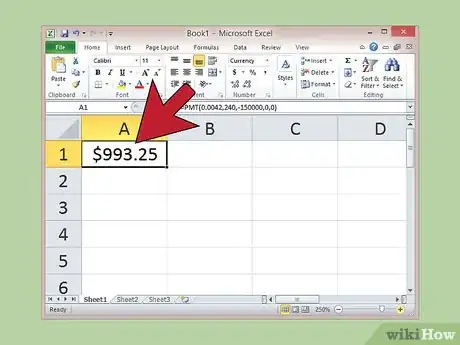

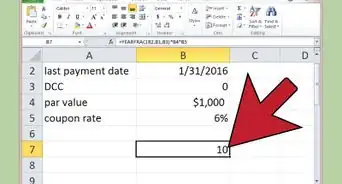

2Use the PMT function. The PMT is one of several formulas you could use to calculate annuity payments, but is the easiest to use. Start by typing "=PMT(" into an empty cell of your choosing. You will then be prompted by the program to input your variables as follows: =PMT(rate, nper, pv, [fv],[type]). The inputs mean the following:

- rate is your period interest rate. This is like the monthly interest rate, R, from the calculating by hand method.

- nper is the number of payments made over the life of the annuity. This is like the total number of payments, N, from the calculating by hand method.

- pv is the principal of the annuity. This is like the variable P from the calculating by hand method.

- Don't worry about the last two prompts, just put a 0 (zero) into each place.[6]

-

3Solve the function. Input your annuity information into the function. For example, imagine an annuity that has a principal value of $150,000, a monthly interest rate of 0.42 percent (from an annual rate of 5 percent), and a number of payments totaling 240 (20 years of monthly payments). For this example, the completed function would look like this: =PMT(0.0042,240,-150000,0,0).

- Make the value for pv a negative number. This represents a payment that you made so it should be negative.[7]

- Remember that the monthly interest rate should be input as a decimal. To get this number, divide the stated monthly interest rate by 100, for example 0.42/100 is 0.0042.

- Remember to close the parentheses at the end.

- Don't place a comma in your pv value. The program will misread this.

- The example calculation returns a monthly payment of $993.25.

- Note that this number is slightly different than the result calculated by hand in the other method, despite using the same annuity terms for each calculation. This is due to the rounding of figures in the by hand method; the Excel function makes calculations using more decimal places.

- The actual payment made by the annuity may differ slightly from both of these calculations, depending on the accuracy of the calculation used by the payer.

-

4Adjust the payment type, if necessary. The [type] prompt at the end of the function if asking for the type of annuity payment. For ordinary annuities, the payment is made at the end of the period (end of the month in this case). This is represented by placing a 0 in the function. However, you can also compute your payment amounts if the payments are made at the beginning of a period by changing the value in the [type] input to 1.[8]

- So for the example, this would be: =PMT(0.0042, 240,-150000,0,1)

- This gives a slightly lower payment amount in the example ($989.10).

Expert Q&A

-

QuestionWhat is the annuity formula?

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Financial Advisor There is no one general formula to apply to an annuity contract and calculate the monthly payment. However, annuities are based on the concept of the time value of money. The present value of an ordinary annuity demonstrates the concept.

There is no one general formula to apply to an annuity contract and calculate the monthly payment. However, annuities are based on the concept of the time value of money. The present value of an ordinary annuity demonstrates the concept. -

QuestionHow much does a $100,000 annuity pay per month?

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Financial Advisor The amount of an annuity's payout is based on many variables, such as when the initial payments are made, the interest rate in the contract, the projected life span of the annuitant, and the term of the annuity.

The amount of an annuity's payout is based on many variables, such as when the initial payments are made, the interest rate in the contract, the projected life span of the annuitant, and the term of the annuity. -

QuestionHow do you figure out annuity payments?

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Financial Advisor There are many variables to consider when considering an annuity. However, the most basic approach is to use the formula for an ordinary annuity which is a concept utilizing the time value of money. One must know the term or time period, the annual interest rate, the initial deposit, and the amount of the payment to be made (or be able to solve for these).

There are many variables to consider when considering an annuity. However, the most basic approach is to use the formula for an ordinary annuity which is a concept utilizing the time value of money. One must know the term or time period, the annual interest rate, the initial deposit, and the amount of the payment to be made (or be able to solve for these).

References

- ↑ http://www.financeformulas.net/Annuity_Payment_Formula.html

- ↑ http://www.financeformulas.net/Annuity_Payment_Formula.html

- ↑ http://www.financeformulas.net/Annuity_Payment_Formula.html

- ↑ https://www.mathsisfun.com/money/annuities.html

- ↑ http://www.financeformulas.net/Annuity_Payment_Formula.html

- ↑ https://support.office.com/en-us/article/PMT-function-0214da64-9a63-4996-bc20-214433fa6441

- ↑ https://support.office.com/en-us/article/PMT-function-0214da64-9a63-4996-bc20-214433fa6441

- ↑ https://support.office.com/en-us/article/PMT-function-0214da64-9a63-4996-bc20-214433fa6441