This article was co-authored by Samantha Gorelick, CFP®. Samantha Gorelick is a Lead Financial Planner at Brunch & Budget, a financial planning and coaching organization. Samantha has over 6 years of experience in the financial services industry, and has held the Certified Financial Planner™ designation since 2017. Samantha specializes in personal finance, working with clients to understand their money personality while teaching them how to build their credit, manage cash flow, and accomplish their goals.

This article has been viewed 67,721 times.

Establishing money management skills is a necessary undertaking, whether you are single or married with children. The sooner you learn how this is done, the sooner the skill becomes second nature. In fact, the sooner successful management skills are developed, the less likely you will have to backtrack and fix the financial burdens incurred during any prior bad management. Learning how to develop money management skills can be as simple as developing discipline and following some necessary steps. Its success is dependent on your desire to be financially responsible.

Steps

-

1Share the burden if you are married. Even if you have been assigned the responsibility of paying bills, include your spouse in the process. For example, discuss all purchases with each other and always establish a budget that you agree on. By doing this, your spouse will be respectful towards the money management decisions you have established and will make sure to abide by them. The goal is to have both you and your partner working together within the boundaries of whatever budgetary requirements you have established together. Additionally, you won't feel alone mulling over the finances.

-

2Remain transparent when developing financial management skills. This can be as simple as having an open book policy with your spouse so that he or she has access to bank accounts and any billing books you have established. Of course only one person should actually pay the bills and work the books, but having good transparency helps avoid any feelings of resentment by your spouse.Advertisement

-

3Establish a budget when managing your finances. This is a very necessary step and a helpful tool for any person, family, and business. A budget reigns your spending in, and it ensures that you are not spending recklessly. Everything should be budgeted, including your mortgage, loans, utilities, and groceries.[1]

- Use an app to track your spending, create a spreadsheet, or use a notebook.[2]

-

4Assign all your finances and don't leave a penny unassigned. Monies that do not have a goal will be vulnerable to reckless spending and waste, even if this means including a dining fund so that you can have dinners out. By doing this, you are controlling every penny. You should always have a savings account, and then you can add a vacation fund, and emergency fund. You can include a car fund that you put money into to pay for registrations and oil changes, and so on. The goal is to take your income and divide what you have into those funds as soon as possible. The amounts that each fund gets are up to you and your financial responsibilities.

-

5Include an allowance for you and your spouse. Allowances are not just for kids. You and your spouse deserve to make personal purchases that are not dictated, so assign a weekly allowance that fits your budget. It can be as little as $5.00 a week and you and your spouse can spend on what you want. This does not include needs, such as gas, work clothes and shoes, but it would include video games, fancy purses, and anything else that is not considered a need.

-

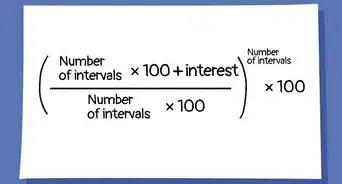

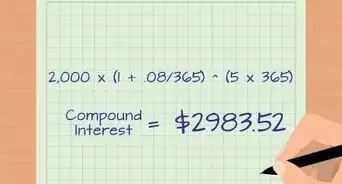

6Understand how credit cards work and how they can be beneficial when managing your income successfully. Credit cards don't have to drive you into debt. They can be useful if used to make monthly purchases, including groceries, gas, and so on, and then paying them off at the end of the month to avoid interest and finance fees. Building points for money back rewards is also a good incentive. Just remember to make sure monthly credit card purchases are within the monthly budget you have established and that you can pay the whole amount off at the end of the month and in cash. If you cannot do this, then do not get a credit card.

Community Q&A

-

QuestionHow can I start a business?

Tom De BackerTop AnswererFirst, you need an idea. It doesn't have to be a new idea; you can just do what people have been doing since forever--open a barbershop, for example, or sell secondhand DVDs online. Next, you need some idea of the financial side of things, what will be your income and what your expenses. If you're buying DVDs at $5 each, but the market pays an average of $3 each, you're losing money. Start small. Get an official registration and a professional bank account, but don't rent offices for 40 people if it's just you the first three years. After that, it's marketing, sales and customer service.

Tom De BackerTop AnswererFirst, you need an idea. It doesn't have to be a new idea; you can just do what people have been doing since forever--open a barbershop, for example, or sell secondhand DVDs online. Next, you need some idea of the financial side of things, what will be your income and what your expenses. If you're buying DVDs at $5 each, but the market pays an average of $3 each, you're losing money. Start small. Get an official registration and a professional bank account, but don't rent offices for 40 people if it's just you the first three years. After that, it's marketing, sales and customer service. -

QuestionWell educating myself on math help me budget it better?

Community AnswerIf you still have the same amount of income and expenses, then knowing math may make you more keenly aware of the precise amounts, but budgeting is typically just basic addition and subtraction. Your best bet for budgeting better is to cut out unnecessary expenses and exercise impulse control on purchases, using a calculator as needed.

Community AnswerIf you still have the same amount of income and expenses, then knowing math may make you more keenly aware of the precise amounts, but budgeting is typically just basic addition and subtraction. Your best bet for budgeting better is to cut out unnecessary expenses and exercise impulse control on purchases, using a calculator as needed.

References

- ↑ Samantha Gorelick, CFP®. Financial Planner. Expert Interview. 6 May 2020.

- ↑ Samantha Gorelick, CFP®. Financial Planner. Expert Interview. 6 May 2020.

- ↑ Samantha Gorelick, CFP®. Financial Planner. Expert Interview. 6 May 2020.

- ↑ Samantha Gorelick, CFP®. Financial Planner. Expert Interview. 6 May 2020.