This article was co-authored by Derick Vogel. Derick Vogel is a Credit Expert and CEO of Credit Absolute, a credit counseling and educational company based in Scottsdale, Arizona. Derick has over 10 years of financial experience and specializes in consulting mortgages, loans, specializes in business credit, debt collections, financial budgeting, and student loan debt relief. He is a member of the National Association of Credit Services Organizations (NASCO) and is an Arizona Association of Mortgage Professional. He holds credit certificates from Dispute Suite in credit repair best practices and in Credit Repair Organizations Act (CROA) competency.

This article has been viewed 40,918 times.

Working your way through a person’s financial accounts after they’ve passed away can be stressful. However, by following a series of basic steps, you can simplify at least one aspect of this process: cancelling credit cards. Start by collecting multiple copies of the deceased’s death certificate and any credit card statements. Then, reach out to the 3 major credit bureaus and ask that they put a freeze on the deceased’s credit. Finally, contact the credit card companies and go through the official process of closing the accounts.

Steps

Getting Ready to Notify

-

1Take action as soon as possible. The banks will not automatically reach out when a cardholder becomes deceased. If you wait to cancel the cards, it’s possible that the account will be charged late fees or interest in the interim. Keeping the cards active can also make them vulnerable to fraud and identity theft.

-

2Request multiple copies of the death certificate. You’ll likely need to send at least 1 copy to each of the credit card companies formally used by the deceased. The credit bureaus will also request official copies as well before releasing credit report copies. You can get extra copies of the death certificate by talking to the funeral director.[1]Advertisement

-

3Gather all cards from everyone, including authorized users. Use the account information included on the card’s statement or reach out to the card company to get a list of all possible cardholders or users. Then, contact these people directly and ask them to give you the card. You can also request that they just destroy the card, if you trust them to do so.[2]

- If you know that other people have the card numbers on file, ask them to shred those documents and to not charge the account in the future.

-

4Know that the account can stay active for joint users. If the account is in your name as well as the deceased, then the credit card will not need to be cancelled. You can simply take over the payment and maintenance of the card. This also means that you’ll be held liable for any debts on the card.

- In contrast, if you are just an authorized user, then the account will need to be cancelled.

-

5Don’t use the cards for any reason if you aren’t a joint user. The minute that a person dies, their credit becomes invalid for use. If you continue to charge items on the card, then you are technically committing credit card fraud and could face legal charges. Don’t even put ‘necessary’ items, such as funeral expenses, on these cards. Instead, talk with a lawyer or funeral advisor regarding how to pay for these costs without credit.

Contacting the Credit Bureaus

-

1Ask that the credit companies flag the deceased’s credit account. Reach out to the 3 big credit bureaus (TransUnion, Experian, and Equifax) both by phone and by mail. Ask them to flag the deceased’s credit account as “Deceased. Do Not Issue Credit.” This will help to prevent identity fraud or others using the deceased’s credit to open cards or make purchases.[3]

-

2Request a copy of the deceased person’s credit report. Contact all credit reporting agencies via email or the phone. Ask for their policies regarding releasing credit reports. They will most likely ask you to fax over proof of your position as financial executor or executrix of the deceased’s accounts. Be aware that, depending on the agency, it may takes weeks to receive these report copies.[4]

-

3Read over the credit report making note of any open accounts. After you’ve received the reports, look over each of them. Disregard any accounts that show as closed or paid off. Instead, highlight or circle those accounts that still show as active and carry balances. These are the credit card companies that you’ll need to contact.[5]

-

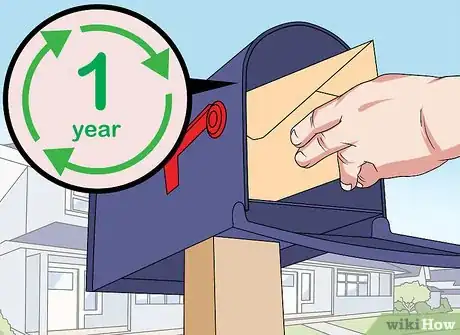

4Monitor all the deceased’s financial mail for 1 year. It’s not enough to simply cancel all active credit accounts. To fully prevent identify fraud, request that the postal service forward all of the deceased’s mail to you. Then, look for financial notices in particular and watch for anything indicating that additional credit accounts have been opened.

Reaching Out to Credit Card Companies

-

1Call each credit card company directly. Using the customer service numbers listed on each credit statement, reach out to each company by phone. Ask to be connected directly with a representative who can handle deceased accounts. Then, ask them to close the account in question. You should also ask them where you’ll need to send a copy of the death certificate.[6]

- When you are talking with the card representative, ask them to pull up the account on their computer. If they see any recurring charges, you should ask that these be stopped and cancelled as well.

- This is also the time to request that any late fees or charges be refunded. Most companies will be happy to do this after documentation is provided.

-

2Follow up with an official letter to each card company. Send a registered and certified letter requesting cancellation to the official card company’s address. You’ll find this address listed on the credit card statement. Your letter should include the following: the credit card account number, the deceased’s name, address, Social Security number and date of birth.[7]

- Make sure to also include your name and full contact information, so that the company will know who to reach out to when the cancellation is complete.

-

3Pay any cards off. Check to see which credit cards still have balances. Then, request that the card companies in question send you proof of a claim to the estate. Once you have these documents, go through and use the estate assets to pay off each debt in order from the oldest to the newest.[8]

- Never use your personal funds to pay off estate debts, unless you were listed as financially responsible for that particular credit card account.

Community Q&A

-

QuestionIf a credit card is in your spouse's name only is the surviving spouse responsible for the debt?

CageyCatTop AnswererIf you did not have to file the estate with the local court (and there's no administrator of the estate), you are typically not responsible for the credit card debts of the deceased spouse. Call the creditor and discuss it with them.

CageyCatTop AnswererIf you did not have to file the estate with the local court (and there's no administrator of the estate), you are typically not responsible for the credit card debts of the deceased spouse. Call the creditor and discuss it with them.

Warnings

- Don’t allow creditors to pressure you into paying them early or out of order. Make sure that you have all proof of estate claims before making any credit payments.⧼thumbs_response⧽

Expert Interview

Thanks for reading our article! If you'd like to learn more about canceling credit cards, check out our in-depth interview with Derick Vogel.

References

- ↑ https://consumerist.com/2016/03/31/the-grim-but-necessary-art-of-closing-accounts-for-dead-family-members-loved-ones/

- ↑ https://www.discover.com/credit-cards/help-center/faqs/deceased.html

- ↑ https://www.bankrate.com/finance/debt/request-credit-freeze-for-deceased.aspx

- ↑ https://www.credit.com/blog/debt-after-death/

- ↑ https://www.credit.com/blog/debt-after-death/

- ↑ https://www.discover.com/credit-cards/help-center/faqs/deceased.html

- ↑ https://www.credit.com/blog/debt-after-death/

- ↑ https://pocketsense.com/cancel-credit-cards-after-someone-deceased-7797.html