This article was co-authored by Gina D'Amore. Gina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

This article has been viewed 177,364 times.

It's the responsibility of the employer to accurately calculate payroll for his or her employees. Errors can result in employees having too much or too little of their pay withheld for taxes, Social Security, Medicare and other deductions, which causes an inconvenience for them at tax time. Miscalculations can also result in the company coming under review and possibly facing penalties by government agencies, such as the Internal Revenue Service.

Steps

Filling out the Forms

-

1Have employees complete federal and state employee withholding forms. When starting a new job, all employees must complete a federal Employee Withholding Allowance Certificate, also known as a W-4 form.[1] The name and structure of the state form will vary from state to state.

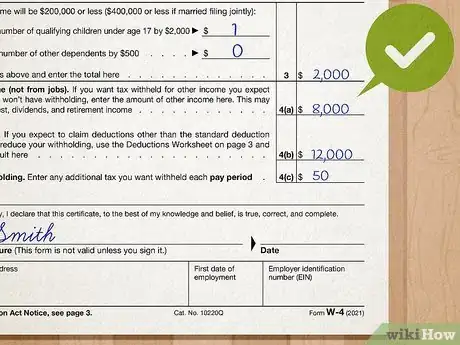

- Information provided on Employee Withholding Allowance Certificates lets a company know how much federal and state income tax to withhold from each employee's pay based on filing status and the number of exemptions he or she claims. Keep in mind, the more exemptions claimed, the less that the employee has withheld from his or her paycheck. However, that employee might owe money when it comes time to pay taxes.

- Keep in mind that you might be doing business in a state with no state income tax, in which case there is no form for state withholding. Since the state isn't asking people to pay taxes, there's no reason that your employees will need to fill out a withholding form.[2]

-

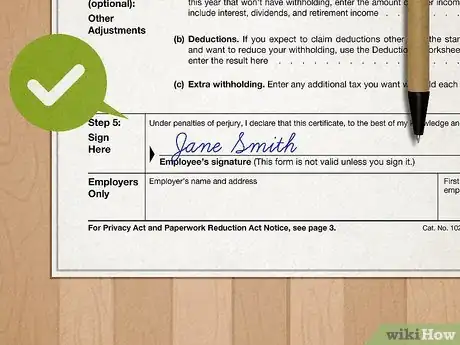

2Verify that the forms are signed. Remember, those federal and state documents are not valid if they're not signed.Advertisement

-

3Double-check the math on the forms. Although the math on those forms can be very easy (it's typically as simple as adding a few 1's), it's best to double-check it just to be certain that the employee added the numbers correctly.

Calculating Net Pay

-

1Determine the employee's gross pay. Before you can begin to calculate payroll, you must know what the employee's gross income is. This is determined by multiplying the number of hours worked in a pay period by the hourly rate. For example, if an employee works 40 hours in a pay period and earns $15 an hour, you would multiply 40 times $15 to get a gross pay of $600.

- Don't forget to factor in any overtime, commissions, or bonuses awarded during the pay period.

- Pay periods may be weekly, bi-weekly, or monthly. If the period is bi-weekly, for instance, then a full-time employee should work about 80 hours.

- An employee with a fixed salary will earn the same amount no matter how many hours they work.

-

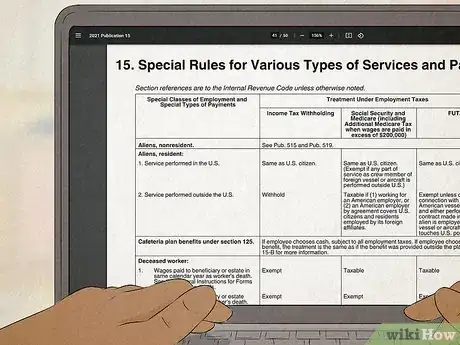

2Obtain federal and state income tax tables. Federal Income Tax tables break down the amount of federal income tax an individual owes based on pay, exemptions, and filing status. The Internal Revenue Service posts current tax tables online.[3] You may find state income tax tables online by visiting your state comptroller’s office website.

-

3Apply federal and state income taxes. You'll use the tax tables that you've retrieved to apply the correct amount of federal and state income tax to withhold.

- For federal taxes, you'll look up the withholding amount based on the employee's gross pay, filing status, and the number of exemptions claimed. Then, you'll deduct that amount from the gross pay.

- For states taxes, consult your state's department of revenue website for instructions about how much to withhold.

-

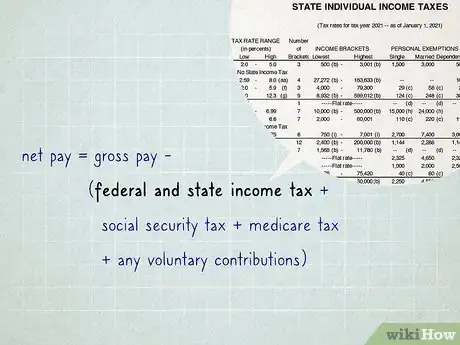

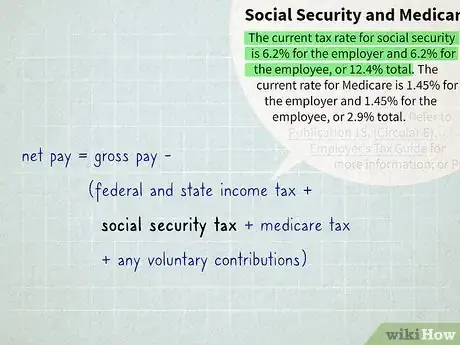

4Apply Social Security tax rates. Calculating the amount of Social Security tax to pay is easy as it is a fixed percentage of an employee’s gross pay. Employers must bear in mind that they too are responsible for paying social security taxes. The current tax rate for Social Security is 6.2% for the employee.[4]

-

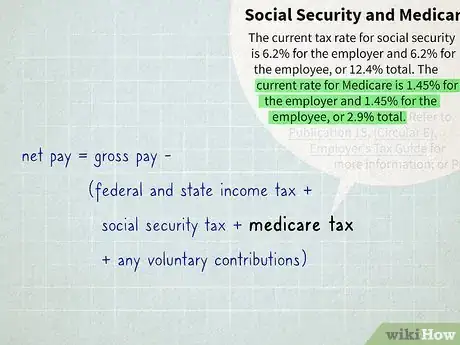

5Deduct Medicare taxes. Like the Social Security tax, Medicare taxes are also a fixed percentage of a person’s earnings. In addition, employers are also responsible for paying Medicare taxes. Employees are currently taxed at 1.45% for Medicare.[5]

-

6Subtract other deductions. Employees may have voluntary contributions or mandatory deductions that need to be reduced from their gross pay.

- Examples of voluntary contributions include 401(k) contributions, deferred compensation programs, long-term disability, and flexible spending accounts.

- Examples of mandatory deductions include child support and alimony.

-

7Finalize net pay. The amount remaining after these deductions are subtracted will be net pay. Go back over your calculations and make sure that you haven't make any mistakes.

References

About This Article

If you want to calculate your payroll, start by working out your employee's gross pay by multiplying the number of hours they worked by their hourly pay rate. Next, retrieve federal and state income tax tables, which you'll find on the IRS website and the website of your state comptroller's office. Use the tables to withhold the correct amounts of federal and state income taxes from the paycheck. To finish, subtract Social Security tax, which is currently 6.2 percent of gross pay, and Medicare tax, which is 1.45 percent, before confirming the remaining amount as net pay. To learn more from our Financial Advisor co-author, like how to have an employee fill out withholding forms, keep reading the article!