This article was co-authored by Alex Kwan. Alex Kwan is a Certified Public Accountant (CPA) and the CEO of Flex Tax and Consulting Group in the San Francisco Bay Area. He has also served as a Vice President for one of the top five Private Equity Firms. With over a decade of experience practicing public accounting, he specializes in client-centered accounting and consulting, R&D tax services, and the small business sector.

There are 7 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 518,809 times.

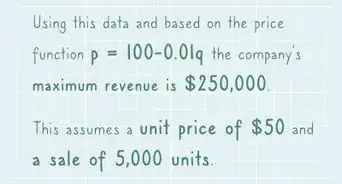

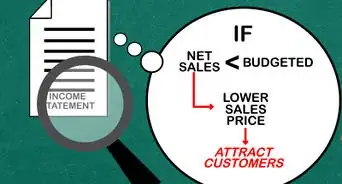

According to basic economic principles, if a company lowers the price of the products it sells, it will sell a greater number of products. However, it will also make less money for each additional product it sells. This "extra money" — the revenue generated from selling one additional product — is marginal revenue.

Steps

Calculating Marginal Revenue

-

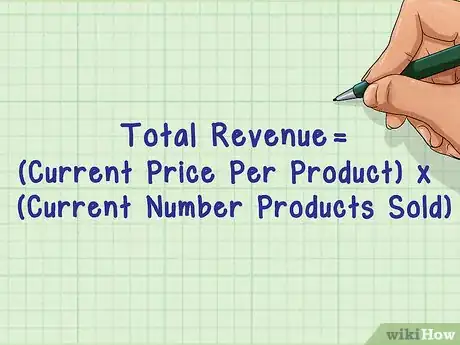

1Find the total revenue by using this equation:

-

2Consider lower Alternate Price and determine Alternate Number Products Sold at this price. This step requires specific market analysis.Advertisement

-

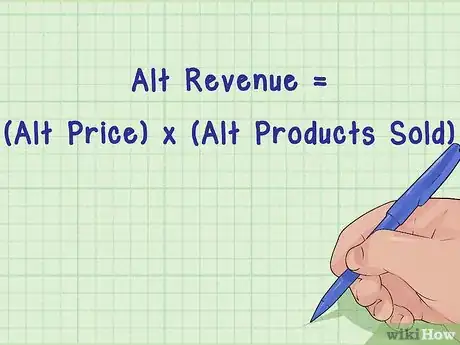

3Find the alt revenue by using this equation:

-

4Calculate the marginal cost by using this equation:

- .

- In other words, marginal revenue is the change in revenue per additional product sold.

-

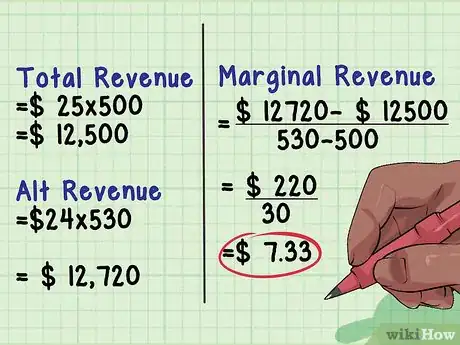

5Look at this example: A company sells 500 T-shirts for $25 each.

- The company determines it will sell 530 T-shirts if it drops the price to $24.

- \text{Marginal Revenue} =

Analyzing Marginal Revenue

-

1Start with accurate data. You'll generally need access to a company's internal inventory figures or sales reports to determine the number of products sold. Finding the alternate price to sell one more unit is much more difficult, and requires skill market analysis.

- Remember, marginal revenue is only useful when analyzing a single product. Some reports may only list data for groups of products.

-

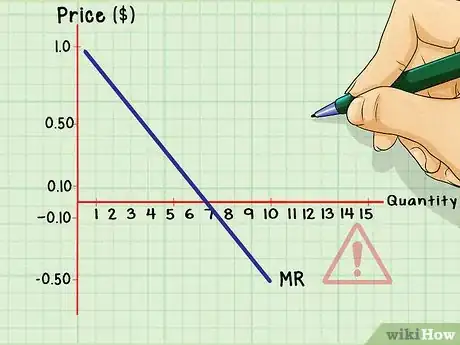

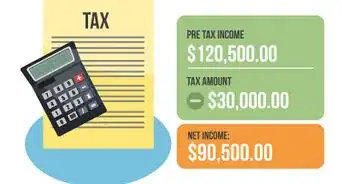

2Avoid negative marginal revenue. A negative marginal revenue means the company would lose revenue if it lowered the price. In this case, selling more products would not make up for the lowered revenue per product.

-

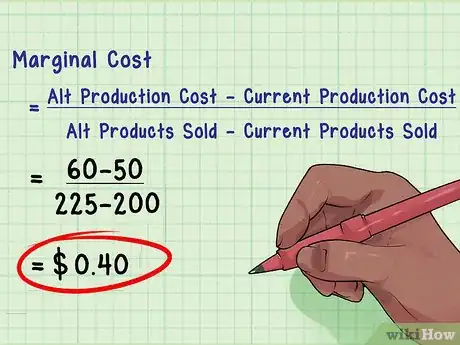

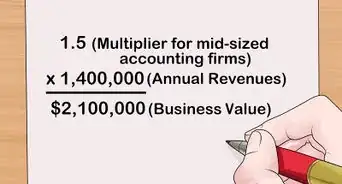

3Compare to marginal cost to determine profitability. Companies that optimize the price/sales balance are said to have a level of output where the marginal revenue equals the marginal cost. Marginal cost is the cost to the company of producing one more unit of product.[1] [2]

- .

- For example, it costs Kim's Soda $50 to produce 200 cans of soda. Kim's could spend $60 instead to produce 225 cans. . Kim's soda should only enact this plan if marginal revenue is equal to or greater than $0.40.

Understanding Different Market Structures

-

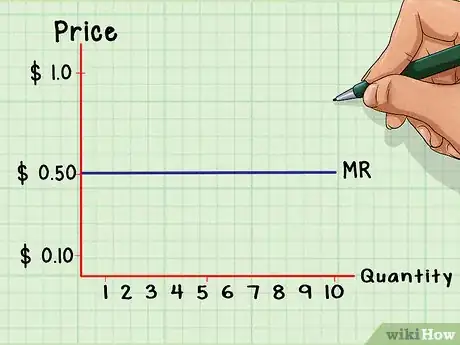

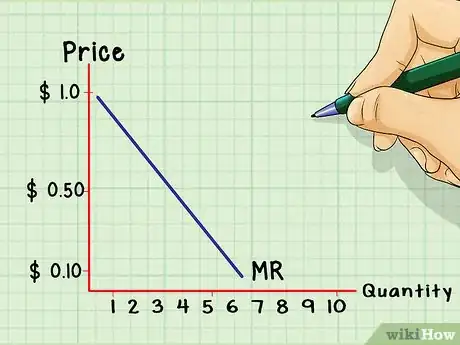

1Understand marginal revenue under perfect competition. In the examples above, we've been dealing with a simplified market model that considers only one company without competition (a monopoly).[3] More commonly, companies are under pressure to keep prices low due to competition. Under perfect competition, marginal revenue doesn't change as a result of the number of products sold, because prices are fixed.

- For instance, let's say that Kim's, the soda company from the examples above, is now in competition with hundreds of other soda firms. The price per can is set at $0.50 — any lower and Kim's will lose money, and any higher and customers will choose other products. Marginal revenue is always $0.50, since Kim's cannot sell cans for any other price.

-

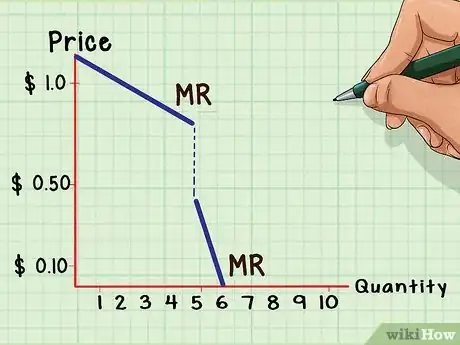

2Know the behavior of marginal revenue under monopolistic competition. In real life, the small, competing firms that make up highly competitive markets aren't perfect. They don't instantly react to each others' price changes, they don't have perfect knowledge of their competition, and they don't always set their prices for maximum profitability. This sort of market system is called "monopolistic competition." Marginal revenue will typically decrease with each additional product sold, but not as steeply as it would in a monopoly.

- For example, Kim's drops the price of its soda from $1 to $0.85. It may still receive additional revenue, but in a monopolistic market, customers will still buy their competitors' soda for a higher price.

-

3Know the behavior of marginal revenue under an oligopoly. In an oligopoly, a few large firms that are in competition with each other control the market. Marginal revenue usually has a downward trend with each additional unit sold, as it would in a monopoly. However, in real life, firms in an oligopoly are often reluctant to lower prices because it can result in a price-dropping war, reducing profits for all.[4] Often, firms in an oligopoly will only lower their prices to force a small competitor out of business, then raise prices together to increase profitability for all.[5] If firms in an oligopoly have agreed to set prices like this, sales levels depend on marketing and other considerations, not on price.

- Kim's has become a major soda player and now shares the market with Linda's and Andy's, two other soda firms. The three firms agree to sell their sodas at the same price, so marginal revenue for each additional soda will remain unchanged regardless of the price level they chose. If Jeff starts a small firm to undercut their inflated price, the three large firms may drop their prices so low that Jeff is forced out of business. The firms accept the reduced marginal revenue temporarily because they can raise the prices again once Jeff's is gone.

Expert Q&A

-

QuestionWhat's the difference between marginal cost and marginal revenue?

Alex KwanAlex Kwan is a Certified Public Accountant (CPA) and the CEO of Flex Tax and Consulting Group in the San Francisco Bay Area. He has also served as a Vice President for one of the top five Private Equity Firms. With over a decade of experience practicing public accounting, he specializes in client-centered accounting and consulting, R&D tax services, and the small business sector.

Alex KwanAlex Kwan is a Certified Public Accountant (CPA) and the CEO of Flex Tax and Consulting Group in the San Francisco Bay Area. He has also served as a Vice President for one of the top five Private Equity Firms. With over a decade of experience practicing public accounting, he specializes in client-centered accounting and consulting, R&D tax services, and the small business sector.

Certified Public Accountant Marginal cost is the additional costs incurred when you produce one additional unit of your product. Marginal revenue is the additional revenue you'll receive when you produce that additional unit. So, you should only make additional units when you know that your marginal revenue is more than your marginal cost.

Marginal cost is the additional costs incurred when you produce one additional unit of your product. Marginal revenue is the additional revenue you'll receive when you produce that additional unit. So, you should only make additional units when you know that your marginal revenue is more than your marginal cost.

References

- ↑ Alex Kwan. Certified Public Accountant. Expert Interview. 1 June 2021.

- ↑ http://www.amosweb.com/cgi-bin/awb_nav.pl?s=gls&c=dsp&k=marginal%20cost

- ↑ http://economics.fundamentalfinance.com/micro_revenue.php

- ↑ http://www.amosweb.com/cgi-bin/awb_nav.pl?s=wpd&c=dsp&k=oligopoly

- ↑ http://www.economics.utoronto.ca/jfloyd/modules/olig.html

- https://www.inkling.com/read/managerial-economics/chapter-2/marginal-revenue-and-marginal

- http://www.slideshare.net/mfladlien/why-marginal-revenue-equals-marginal-cost-determines-profit

About This Article

To calculate marginal revenue, start by multiplying the current price per product by the current number of products sold to find the total revenue. Next, calculate the alternate revenue by multiplying the alternate price by the alternate number of products sold. Then, subtract the original revenue from the alternate revenue. Finally, divide that number by the sum of the alternate products sold minus the current products sold to get the marginal revenue To learn more, including how to use marginal revenue to determine a product’s profitability, scroll down.

-Step-04.webp)