This article was co-authored by Dave Labowitz and by wikiHow staff writer, Jennifer Mueller, JD. Dave Labowitz is a Business Coach who helps pre-entrepreneurs, solopreneurs/entrepreneurs, and team leaders start, scale, and lead their businesses and teams. Before beginning his coaching career, Dave was a startup executive who spent over a decade building high-growth companies. Dave’s “path less traveled” life includes adventures such as dropping out of high school, co-authoring a book in the Smithsonian Institute, and getting his MBA at Pepperdine’s Graziadio Business School.

There are 9 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. This article has 21 testimonials from our readers, earning it our reader-approved status.

This article has been viewed 730,162 times.

Cost analysis is one of four types of economic evaluation (the other three being cost-benefit analysis, cost-effectiveness analysis, and cost-utility analysis). Conducting a cost analysis, as the name implies, focuses on the costs of implementing a program without regard to the ultimate outcome. A cost analysis is an important first step before you engage in other types of economic evaluation to determine the suitability or feasibility of a potential project.[1]

Steps

Defining Your Purpose and Scope

-

1Differentiate the programs you offer. How you delineate your programs will determine how you allocate costs for the purpose of cost analysis. If your organization runs very distinct programs, divisions may be obvious. For overlapping programs or programs that share resources, determine how to separate them.[2]

- Programs that overlap to a significant degree may be lumped together, rather than evaluated separately. Go with what makes the most sense for the operations of your organization, avoiding duplication of efforts wherever possible.

- To determine whether programs should be separated, look at the services offered by each program, the resources needed to provide those services, and who those services are provided to. If two programs are the same in 2 out of 3 of those dimensions, they probably should be treated as one for the purposes of cost analysis.

-

2Set the time period you want to evaluate. How you categorize and calculate costs depends on whether you're analyzing those costs over the long term (say, months or years) or over the short term (a few weeks, or maybe even a single application).[3]

- For example, if you're trying to decide whether to charge for a specific service, you would first determine how much that service costs you to provide. You would then do a longer term cost analysis to determine whether your organization can sustain a loss for providing that service.

- It's generally best to choose a time period for which you can acquire accurate revenue data, rather than estimates. This will help if you plan to use your cost analysis as a basis for further economic evaluation.[4]

Advertisement -

3Figure out why you need a cost analysis. The scope of your cost analysis will depend on its purpose, so before you can consider how broad you want your analysis to be, you need to know what you want ultimate questions you want the analysis to answer.

- If you are conducting a cost analysis merely to set a budget or plan strategically for the future, you would typically conduct a cost analysis that extended organization-wide.

- On the other hand, a narrower or more specific purpose, such as determining whether to bill for a particular service (and how much), might require a narrower cost analysis that only addressed the costs of that particular service.

-

4Identify the perspective for your cost analysis. In addition to figuring out why you need a cost analysis, you also need to know whose cost you're going to analyze. This will determine what data you collect and how you classify it.[5]

- For example, you may be interested in the cost to your clients of offering a particular service. You would look at costs from their perspective, taking into account the amount you bill (or plan to bill) for the service, transportation to your location, and other costs.

- If you're simply looking at the cost of the program to your organization, you'll look at your organizational expenses generally. You might also look at opportunity costs, such as whether offering one program means you will be unable to offer other programs.

Categorizing Costs

-

1Review previous cost analysis reports, if available. If your organization has done cost analyses in the past, use the same or similar methods to categorize costs. Maintaining continuity in this way means the reports can be compared, making them more useful over time.[6]

- You might also look at cost analyses conducted by similar organizations implementing similar programs or providing similar services.

-

2List all direct costs of the program you're evaluating. Direct costs include salaries and benefits for team members, supplies and materials, and any necessary furniture or fixtures. Depending on the type of program or service offered, you may also have contract, licensing, or insurance costs.[7] Perform a cost-benefit analysis of the program before making a decision.

- Direct costs are specific to the program or service you're evaluating in your cost analysis – they are not shared with any other programs.

- Overhead costs, such as utilities or rent, may be a direct cost if the program or service has its own location.

-

3Include indirect costs. Indirect costs include general administration or management salaries and benefits, facilities, equipment, and anything else shared across multiple programs or services. What you categorize as an indirect cost will depend on how you have separated the programs or services offered by your organization.[8]

- Ultimately, when you calculate the costs of an individual program or service, you'll need to allocate these indirect costs

-

4Organize costs to reflect the purpose of your analysis. Ultimately, you want your cost analysis report to be useful to your organization. Rather than relying on broad financial categories, use categories that accurately reflect the way your analysis will be used.[9]

- Standard categories may include personnel costs, operational costs, and start-up costs. Within each category, identify which costs are direct and which are indirect.

Calculating Costs

-

1Gather financial records and information. For each type of cost you plan to include in your cost analysis, make a note of where you plan to get the figures to calculate that type of cost. If you need to estimate a cost, list where you'll get the information to make a reliable estimate.[10]

- Use actual cost information as much as possible. It will increase the utility and reliability of your ultimate cost analysis. [11]

- For estimates, seek out reliable sources that can be applied as narrowly as possible. For example, if you need to estimate pay, use average rates for employees locally, not nationally.

-

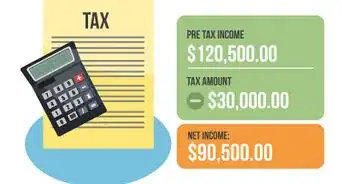

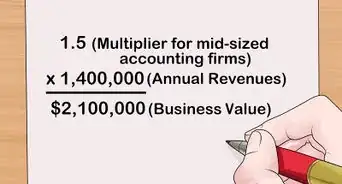

2Total direct costs for the program. Using the information in the records you've gathered, add up the salaries, supplies, materials, and other costs that apply only to the program you're evaluating. Extend these costs out over the time period for your cost analysis.[12]

- If you're doing a longer term cost analysis, compute direct costs first on a weekly or monthly basis, and then extend them out.

- When computing personnel costs, be sure to include the cost (or value) of any benefits offered to employees working on the program.

-

3Allocate indirect costs to the program you're analyzing. To allocate indirect costs, determine how each cost can be divided amongst the different programs. Then calculate the proportion of that cost the program uses.[13]

- For example, suppose you're allocating the salary of the director of human resources. Since they are responsible for personnel, it makes sense to divide their salary by the number of people on staff. If you have 10 employees total, 2 of whom are dedicated to the program or service you're evaluating, you can allocate 20 percent of the director's salary to the program for the purposes of your cost analysis.

-

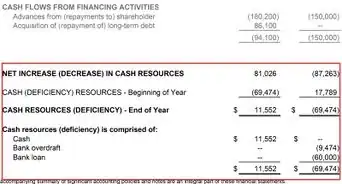

4Calculate depreciation of assets. If your organization's capital assets, including furniture, equipment, or fixtures, must be used to implement the program or provide the service you're evaluating, depreciation of those assets should be included in your total costs for the program or service.

- Calculating depreciation can be a complicated endeavor. If you don't have experience doing it, consider hiring an accountant.[14]

-

5Factor in hidden costs. Depending on your organization and the program you're evaluating, there may be additional costs that wouldn't appear on any budget sheet or financial record. Including estimates of these costs in your analysis will give your evaluation more credibility.[15]

- For example, if you're doing the cost analysis of a program for a non-profit, hidden costs might include the estimated value of volunteer hours, donated materials, or donated space.

- Hidden costs might also include opportunity costs. For example, launching one program may affect your organization's ability to offer other programs.

-

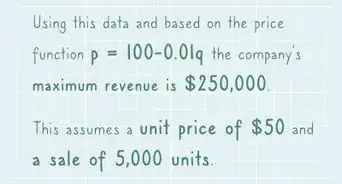

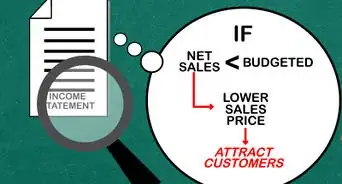

6Make conclusions based on your findings. Return to your purpose for doing the cost analysis and determine what action should be taken. You might also include projections or estimates of future costs for the program or service.[16]

- At a minimum, your cost analysis should provide your organization with the true cost of running a program or providing a particular service.

- Your cost analysis may also raise additional questions, indicating further analysis is necessary before an ultimate decision can be made.

Community Q&A

-

QuestionHow do I do a cost analysis network project?

Community AnswerObtain complete cost estimates. Obtain complete benefit estimates. Choose an appropriate Cost Benefit Analysis (CBA) algorithm to analyze the cost and benefit streams. Compute estimated costs and benefits schedule over time to determine the payback period. Make recommendations, and set next steps as required.

Community AnswerObtain complete cost estimates. Obtain complete benefit estimates. Choose an appropriate Cost Benefit Analysis (CBA) algorithm to analyze the cost and benefit streams. Compute estimated costs and benefits schedule over time to determine the payback period. Make recommendations, and set next steps as required. -

QuestionHow can I do a cost and benefit analysis for an attendance monitoring system?

Community AnswerList setup and running costs: analysis, implementation, capital investment, time, consumables, etc. List benefits: time saved, improved attendance, improved results. Put a monetary value to each cost and benefit. Capital and running costs. Labor costs need to include the person's pay rate, taxes and overheads in employing them. Costing intangible benefits is much harder and will depend on the system you are working in. For a school, increased attendance increases pass rates that may carry direct funding or may need to have a perceived value attached. In business, improving attendance may negate the need to pay for cover or may increase productivity and profitability.

Community AnswerList setup and running costs: analysis, implementation, capital investment, time, consumables, etc. List benefits: time saved, improved attendance, improved results. Put a monetary value to each cost and benefit. Capital and running costs. Labor costs need to include the person's pay rate, taxes and overheads in employing them. Costing intangible benefits is much harder and will depend on the system you are working in. For a school, increased attendance increases pass rates that may carry direct funding or may need to have a perceived value attached. In business, improving attendance may negate the need to pay for cover or may increase productivity and profitability. -

QuestionHow do I perform a cost and return analysis?

Community AnswerList alternatives. List your stakeholders. Measure all cost/benefit elements. Predict the outcome of cost and benefits over relevant time period. Convert all costs and benefits into a common currency. Calculate the net present value of your project options.

Community AnswerList alternatives. List your stakeholders. Measure all cost/benefit elements. Predict the outcome of cost and benefits over relevant time period. Convert all costs and benefits into a common currency. Calculate the net present value of your project options.

References

- ↑ https://www.cdc.gov/dhdsp/pubs/docs/CB_January_2013.pdf

- ↑ https://www.bridgespan.org/insights/library/pay-what-it-takes/nonprofit-cost-analysis-introduction

- ↑ https://www.universalclass.com/articles/business/basic-methods-and-calculations-of-financial-and-cost-analysis.htm

- ↑ https://www.bridgespan.org/insights/library/pay-what-it-takes/nonprofit-cost-analysis-introduction

- ↑ https://www.cdc.gov/dhdsp/pubs/docs/CB_January_2013.pdf

- ↑ https://www.cdc.gov/dhdsp/pubs/docs/CB_January_2013.pdf

- ↑ https://www.bridgespan.org/insights/library/pay-what-it-takes/nonprofit-cost-analysis-introduction/step-3-allocate-indirect-costs

- ↑ https://www.bridgespan.org/insights/library/pay-what-it-takes/nonprofit-cost-analysis-introduction/step-4-allocate-indirect-costs

- ↑ https://www.cdc.gov/dhdsp/pubs/docs/CB_January_2013.pdf

- ↑ https://www.bridgespan.org/insights/library/pay-what-it-takes/nonprofit-cost-analysis-introduction/step-2-gather-financial-data

- ↑ https://www.cdc.gov/dhdsp/pubs/docs/CB_January_2013.pdf

- ↑ https://www.usaid.gov/sites/default/files/documents/1868/300mad.pdf

- ↑ https://www.bridgespan.org/insights/library/pay-what-it-takes/nonprofit-cost-analysis-introduction

- ↑ https://www.investopedia.com/ask/answers/021815/what-are-different-ways-calculate-depreciation.asp

- ↑ https://www.cdc.gov/dhdsp/pubs/docs/CB_January_2013.pdf

- ↑ https://www.bridgespan.org/insights/library/pay-what-it-takes/nonprofit-cost-analysis-introduction/step-6-apply-this-knowledge

About This Article

To do a cost analysis, start by calculating the direct costs for your program, which include things like salaries, supplies, and materials. If you're doing a long-term cost analysis, break the costs up into weeks or months. Next, calculate the indirect costs, which are costs that are shared across multiple programs or services. You'll also want to include the depreciation of your company's assets that will be used, as well as any hidden costs that may appear. To learn how to calculate direct and indirect costs, keep reading!

-Step-04.webp)