This article was co-authored by Jill Newman, CPA. Jill Newman is a Certified Public Accountant (CPA) in Ohio with over 20 years of accounting experience. She has experience working as an accountant in public accounting firms, nonprofits, and educational institutions, and has also honed her communication skills via an MA in English, writing jobs, and as a teacher. She received her CPA from the Accountancy Board of Ohio in 1994 and has a BS in Business Administration/Accounting.

This article has been viewed 136,385 times.

The annual interest rate on credit cards can be notoriously high. While most consumers would prefer to reduce, or even eliminate, credit card debt, it remains a familiar item in family budgets. Here's how to calculate credit card interest with Excel so you can estimate your cost savings by reducing or eliminating your credit card debt or switching to a card with a lower interest rate. Tips for saving money on credit card interest are also included.

Steps

Gathering Data and Setting up Excel

-

1Gather the details of all credit card accounts. Pull out your most recent statements. At the top or bottom look for the current balance, minimum payment percentage, and annual interest rate for each card.

-

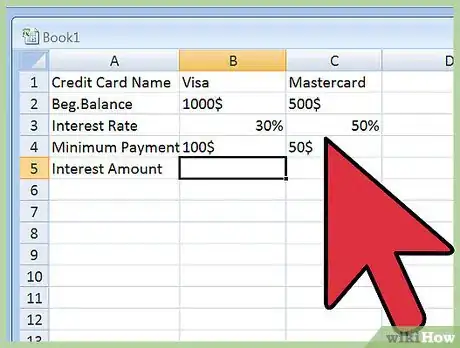

2Launch Microsoft Excel and open a new workbook. Label cell rows A1 through A6 as follows: Credit Card Name, Beginning Balance, Interest Rate, Minimum Payment, Interest Amount, and New Balance.[1]

- There column at the end of the spreadsheet labeled New Balance should be equal to the Beginning Balance minus the Minimum Payment plus the Interest Amount.

- You will also need 12 rows for each credit card so that you can see how paying the minimum amount will extend your debt and accumulate a great deal of interest over time.

Advertisement -

3Enter the information from your credit card statements. Use one column for each credit card. So the information for the first credit card will be entered into column B, rows 1–5. The next credit card will be entered into column C, rows 1–5, and so on.[2]

- If you are unable to locate the minimum payment percentage on your statement, divide the minimum payment amount by the ending balance for that statement to arrive at a percentage. You need to calculate the percentage because the dollar amount will change each month.

- Assume a Visa card with a $1,000 beginning balance, 18% annual interest rate and a minimum payment of 3% of the total.

- In this scenario, you would enter $30 as the minimum payment, or the formula "=1000*.03."

Calculating Credit Card Interest

-

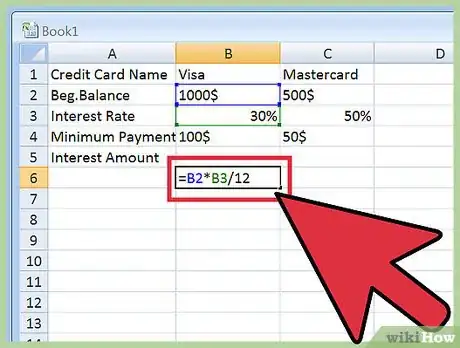

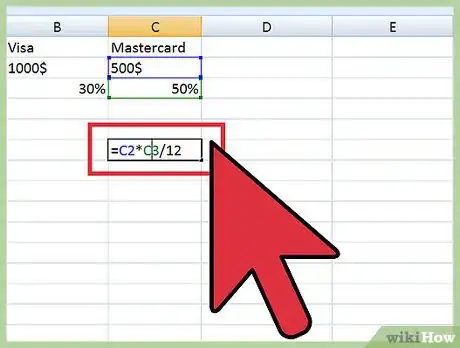

1Calculate the monthly interest amount. For each cell in Row 6 where you have an account enter the following formula: "=[Letter]2*[Letter]3/12" in the cell and hit the Enter key. For example, if you were going to enter the formula in B6, you would enter: "=B2*B3/12" and press the Enter key. Copy the formula in cell B6 and paste it into all other cells in Row 6 that have columns for accounts. Excel will automatically adjust the formula for any cells you copy/paste the formula into.[3]

- You will have previously entered all the credit card information in columns C, D, E, etc., depending on how many credit cards you have. The copied formula will calculate the new data from each column automatically.

- The annual interest rate is divided by 12 to arrive at a monthly interest charge. For this example of a $1,000 balance at 18% annual interest, the formula will return a monthly interest charge of $15.

-

2Compare interest to principal payments. Once you have entered your data and the formulas have been calculated, you will see how much you are paying in interest on each card and how much your minimum payment of principal is each month. It's important to note the proportion of your payment that is allocated to interest and the amount that is being used to reduce your principal. You want your monthly payments to reduce your principal amount as much as possible, which you can do with a lower interest rate.[4]

- To pay down your credit cards as quickly as possible, transfer your balances to cards with a lower interest rate or a zero percent introductory rate. See elsewhere in this article for ways to do this.

-

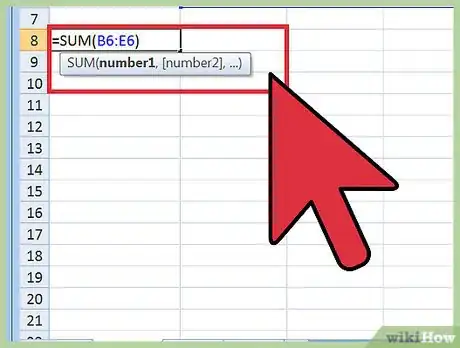

3Total the sum of all monthly interest charges. Create a formula using the "SUM" function. The syntax is "=SUM(B6:E6)" where E6 represents the last cell in row 6 that has a number. This is how much you are paying in interest each month for all your credit cards.

- Keep in mind that the interest fee will change every month as you make payments on the balance.

Saving Money on Credit Card Interest

-

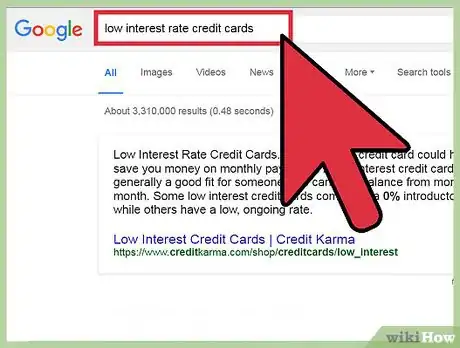

1Find lower interest and no fee credit cards. Do an Internet search on "low interest rate credit cards" or "zero percent introductory rate credit cards" or "no annual fee credit cards." Once approved, it is easy to make a balance transfer from your current high interest cards.[5] [6]

- If you keep your credit score high (over 690) by paying all your bills on time, you will get a lower interest rate.

- Check the interest rates on cards with your bank or credit union if you have been a good customer.

-

2Pay more than the minimum amount. Most credit card statements will include a section that shows how much you will pay in total if you only make the minimum payments versus paying more than the minimum each month. You will pay your cards off quicker and it will improve your credit score if you can add at least $10 to the minimum amount owed each month. Once you pay a card off, add that former payment amount to another card's payment to quickly pay down another high interest card.

- Be sure you make minimum payments on all credit cards to protect your credit score, but add extra payments to the highest interest cards.

-

3Take advantage of zero percent offers. If you have a credit score of at least 690 you will probably receive offers in the mail for zero interest credit cards for a year or more. Once approved, transfer your high interest cards to a zero interest card. Try to pay them off before the end of the zero interest time period.

Warnings

- The interest rate advertised by your credit card company may already be adjusted for the monthly interest rate, as this figure appears to be lower. Make sure you are using the actual annual interest rate in your calculations.⧼thumbs_response⧽

References

- ↑ http://sce2.umkc.edu/BIT//cs100/coursecontent/excel/html/creditcardpaymentschedule.html

- ↑ http://sce2.umkc.edu/BIT//cs100/coursecontent/excel/html/creditcardpaymentschedule.html

- ↑ http://sce2.umkc.edu/BIT//cs100/coursecontent/excel/html/creditcardpaymentschedule.html

- ↑ http://www.csgnetwork.com/creditcardmincalc.html

- ↑ https://get.com/creditcards/11-low-interest-credit-cards-offering-introductory-rates/

- ↑ http://www.lowcards.com/low-interest-credit-cards

- http://www.csgnetwork.com/creditcardmincalc.html