wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, volunteer authors worked to edit and improve it over time.

This article has been viewed 71,380 times.

Learn more...

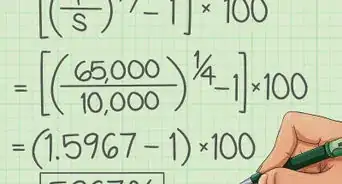

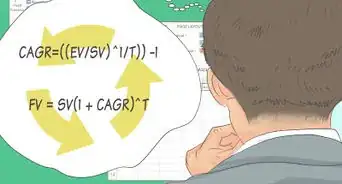

With this article, you can learn how to calculate CAGR, the Compound Annual Growth Rate, in Excel. The Compound Annual Growth Rate is the year-over-year growth rate of an investment over a specified period of time. It is calculated by taking the nth root of the total percentage growth rate, where n is the number of years in the period being considered. The formula for CAGR is [(Ending Value/Beginning Value)^(1/(# of years))]-1.

CAGR isn't the actual return in reality. It's an imaginary number that describes the rate at which an investment would have grown if it grew at a steady rate. You can think of CAGR as a way to smooth out the returns.

Steps

-

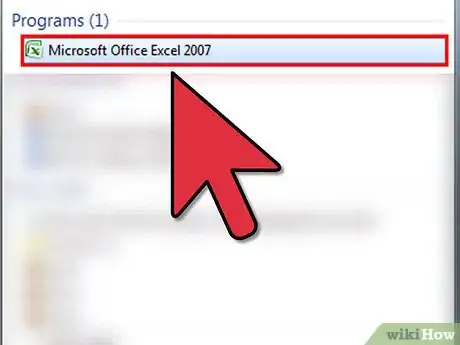

1Open Microsoft Excel. Either click on the green X icon on the dock or opening it from the Applications folder in Microsoft Office.

-

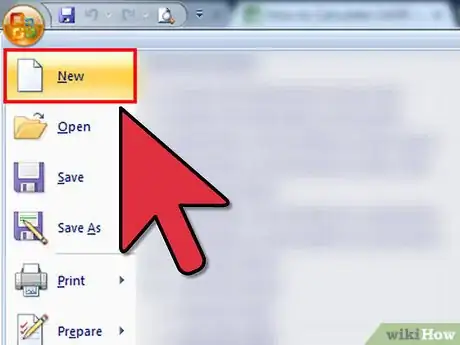

2Open a New Workbook.Advertisement

-

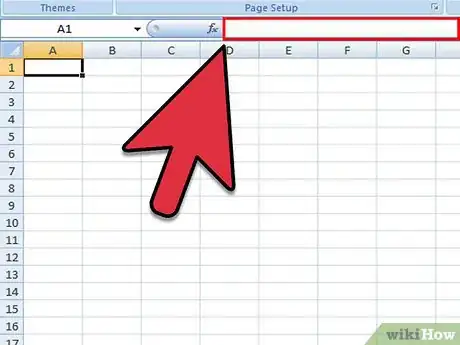

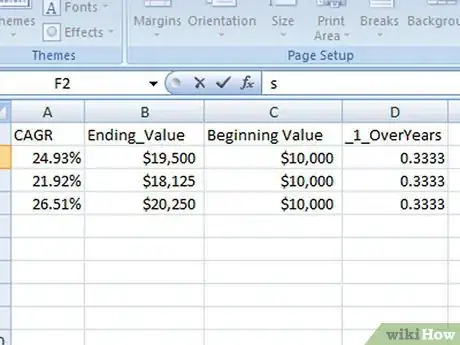

3Enter the Headings/Defined Variables:

- Enter to cell A1 the label, CAGR

- Enter to cell B1 the label, Ending_Value

- Enter to cell C1 the label, Beginning_Value

- Enter to cell D1 the label, _1_OverYears

- Enter to cell E1 the label, Years

- Enter to cell F1 the label, _1

-

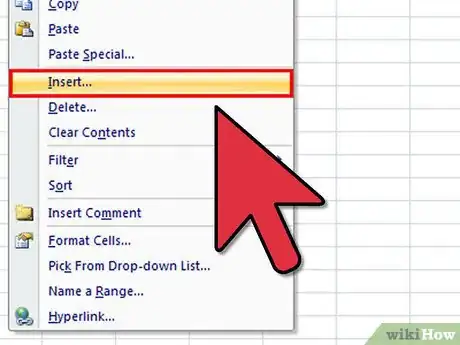

4Highlight columns B:F and select Insert from the top menu. Click Names > Create and choose Top Row

-

5Enter the formulas and values:

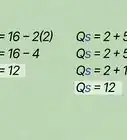

- Enter to cell A2 an = and then the formula ((Ending_Value/Beginning_Value)^(_1_OverYears))-_1

- Enter to cell B2 the Ending Value of the investment, e.g. 23,512

- Enter to cell C2 the Beginning Value of the investment, e.g. 14,500

- Enter to cell E3 the number of Years the investment was outstanding up to the Ending Value, e.g. 3

- Enter to cell D3 an = and then the formula, 1/Years.

- Enter to cell F3 the value, 1

-

6Format your cells:

- Highlight columns A:F and select Format from the top menu. Click Column and then AutoFit Selection, and Alignment Center.

- Highlight column A and choose Format, then Cells. Under the Number menu, and Percentage category, choose 2 decimal places.

- Highlight columns B:C and choose Format, then Cells. Under the number Number in the Custom category, enter $#,##0

- Highlight column D and choose Format, then Cells. Under the Number menu in the Number category, enter .0000

-

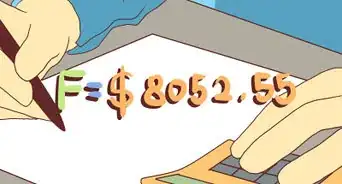

7Review the value in cell A2. For the example numbers given, you should see a CAGR result of 24.93% Thus, your CAGR for your three-year investment is equal to 24.93%, representing the smoothed annualized gain you earned over your investment time horizon.

-

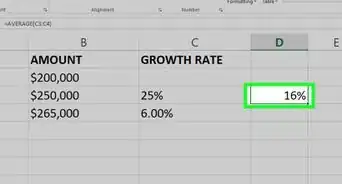

8Then you would construct a Table of similar investments: