This article was co-authored by Carla Toebe. Carla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

There are 10 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 87,015 times.

Townhouses are good choices for people who don’t want a condo but can’t afford a single-family house. Buying a townhouse is not radically different from buying other types of homes. However, you should think carefully about whether you want to buy a home that shares walls with your neighbors.

Steps

Finding Townhouses

-

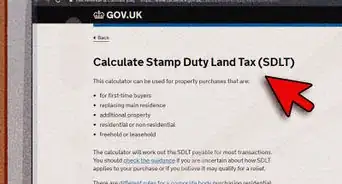

1Decide how much house you can afford. Take out all of your family’s bills and add up how much you spend each month on food, insurance, school, transportation, etc. Then calculate all sources of income. You need to buy a home within your budget.[1]

- Use online calculators to estimate your monthly mortgage payment. For example, a $160,000 loan at 4% interest will cost about $764 each month.

- Your mortgage shouldn’t be more than 31% of your monthly income, and your total debt to income ratio shouldn’t exceed 43%.

-

2Look at online listings. You can find townhouse listings on websites such as Trulia, Zillow, and Realtor.com. Search by location and price. Each listing should have pictures, so you can get some feel for the property.[2]

- You can also set up alerts at some of these websites. You’ll enter your criteria, and then receive an email whenever a townhouse that matches that criteria comes onto the market.

Advertisement -

3Hire a real estate agent, if you need help. A qualified real estate agent will know the market inside and out. They may also know about townhouses for sale that haven’t been listed yet. You can buy a townhouse without an agent, but you should hire one if you can’t find acceptable properties or are overwhelmed by the process.

- You can find an agent in your telephone book or online.

- Also ask friends or family if they would recommend any agent they have used in the past.[3]

-

4Consider the disadvantages of owning a townhouse. You may absolutely want a townhouse, but at least consider common disadvantages so that you will make an informed choice. Consider the following:

- Townhouses share one or more walls with neighbors. If these neighbors are noisy, then you could be in for an uncomfortable stay in your new home.

- Many townhouses are governed by homeowner associations (HOAs), which might place restrictions on what you can do. For example, an HOA can prohibit you from having a pet or remodeling your townhouse. HOAs also charge annual fees.[4]

- You may be responsible for the upkeep of any personal, non-communal outdoor areas. If you don’t want any maintenance responsibilities, then you should consider a condo.

-

5Visit properties. Once you’ve identified properties, contact the seller’s agent and schedule a showing. You can also stop by if there are any open houses. While walking through the townhouse, pay attention to the following:

- Check if you can hear any noise coming through the walls. If the townhouse has been properly insulated, then noise should be minimal.

- Also take a peek at the yard. You’ll probably be responsible for upkeep.[5]

- Consider whether you are happy with the property as is or if you want to renovate.

-

6Ask the owner questions. Figure out why the owner is selling. Are they retiring and needing to downsize? If so, they might not be in a hurry to sell. However, they might have gotten a new job in a different city and need to move. If so, they might be desperate to sell, which means you can be more aggressive when it comes to price.

- Check how much the owner regularly pays for utilities.[6] This amount will impact whether you can afford the property.

- Ask whether there are any restrictions on renovating.

Making an Offer

-

1Improve your credit, if necessary. You’ll need a good credit score to qualify for a conventional mortgage—usually around 620. To get the best interest rates, you’ll need a score around 740 or better.

- Check your credit score and get copies of your credit report. Go through your credit report to see if there are any errors. For example, someone else’s debts might be listed on your report because they have a similar name or Social Security number. Dispute any wrong information.

- The best way to improve your credit is to pay down debt. Consider whether you need to delay buying your townhouse until you improve your credit score.[7]

-

2Get pre-approved for a mortgage. You’ll be in a stronger bargaining position if a lender pre-approves you for a mortgage. The process is easy. Gather financial documents, such as your paystubs, bank statements, and tax returns. You can complete an application either online or by visiting the lender.[8]

- Work only with lenders who have experience underwriting loans for townhouses. Some lenders don’t know how to classify townhouses and consider them condos.[9] However, the difference between a townhouse and a condo is that a condo has no land attached to it, whereas a townhouse includes the land under and around it as specific in the lot map. A townhouse includes the land in its value, but a condo has no land as part of its value.

- If you’re approved, you’ll receive an approval letter which is good for only 90 days. Plan your house hunting accordingly.

-

3Analyze the market. In a hot market, sellers can usually get their asking price (or more) because there are multiple bidders on the same house. However, in a cold market, buyers have more power. Look at how long the townhouse has been on the market.

- Also check how much comparable homes have sold for. If you have a real estate agent, they can do a Comparative Market Analysis. However, you can also check websites such as Zillow and Trulia yourself to see what similar townhouses have fetched.[10]

-

4Set an opening bid. Bid appropriately, based on the market. If it’s cold, then come in a little under the asking price, e.g., 5% below. If you think the home is wildly overpriced, then make an appropriate bid based on your market research and be prepared to justify your offer.

- In a hot market, make your first offer your best one. You probably won’t have a chance to negotiate.

- Don’t forget you’ll need to give the seller earnest money, which is around 1-2% of the purchase price. This money shows that you are serious about buying the house.[11]

-

5Draft a purchase offer. Agents typically have forms they use. If you don’t have an agent, you might be able to find a form online or by contacting your state’s Department of Real Estate. In some states, only a lawyer can draft a purchase offer.

- A purchase offer is legally binding if accepted, so be sure it includes all necessary information. Even if you don’t have a lawyer draft it, ask one to review it.[12]

- If you need to sell your home to buy the townhouse, include a contingency to that effect.

-

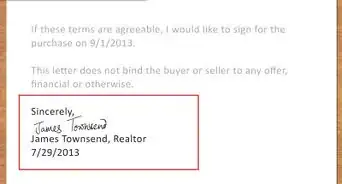

6Write a letter of interest. A letter of interest can give you an edge in a hot housing market. You should describe your family and why you love the townhouse. Try to find a connection with the seller, e.g., you both attended the same college or you both have children.

-

7Submit your offer. You should give the seller’s agent your purchase offer, your earnest money, and any letter of interest. If your bid is lower than the asking price, you can include a list of comps you used to calculate what is a fair market price.[13]

Negotiating and Closing the Deal

-

1Go back and forth with the seller. If the seller rejects your offer, they’ll tell you why. Ideally, they will only disagree on price, which is easy to negotiate. However, they might also disagree on other things, such as contingencies. Talk to your agent about how to proceed.

- You can expect sellers to claim that there is another buyer interested in the property. Trust your research. If the home has been on the market 120 days, it’s unlikely a second buyer suddenly appeared at the same time you did.

- If you increase your bid, don’t go too high. You still need to be able to afford your house.

-

2Apply for your mortgage. You’ve been pre-approved, but you still need to apply for a mortgage. Complete the application and submit all required supporting documentation. Mortgage rates are determined when you apply (not during the pre-approval process). Don’t be afraid to shop around for the best rates.[14]

-

3Have the home inspected and appraised. Check your purchase offer to see who will pay for them. You will need to pay for the inspection and appraisal fees at the time of service. If you plan to do the inspection yourself or do not want an inspection, then you may not have to worry about this cost. However, getting an inspection is a good idea in case there are any major issues with the home.

- The appraiser will take photos and send those to the underwriter along with their report. The underwriter is in charge of approving the loan, so any issues may delay approval. In some cases, a rehab loan may be required to move forward.

- If the inspection uncovers problems, then discuss with the seller how to handle them. You can ask the seller to repair the problem before closing, or you can ask for a credit that will be applied against the purchase price. Depending on your contract, you might also be able to walk away from the purchase.

- Your lender will be interested in the appraisal, since they won’t lend you more than the townhouse is worth. You can contest the appraisal if you think it is low.

-

4Purchase insurance. Your lender will probably require that you have homeowners insurance before they will give you the loan. You’ll need to pay your first year’s premium at closing. You can shop around for the best deal.

-

5Get certified or cashier’s checks. At the closing, you’ll need to pay for your down payment, closing costs, and possibly the first payment on your mortgage. You may also need to pay your lawyer. You’ll need a certified or cashier’s check to cover the closing costs and your down payment.[15]

-

6Attend your closing. You’ll end up signing dozens of documents at your closing.[16] Your lawyer or real estate broker should attend along with you in case there are any problems. Pay attention to the following:

- You will receive a closing disclosure. This document should itemize how closing costs have been divided between you and the seller. Although you should have received this document a few days in advance, double check the information.

- Carefully review the terms of your mortgage. Again, there shouldn’t be any surprises. Stop the closing if the mortgage details are not what the lender has previously told you.

- At the end of the process, you should get the keys to your new home!

Expert Q&A

-

QuestionWhat are you buying in a townhouse, just the house and not the property?

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

VP, CAPITALPlus Mortgage You do own the property when you buy a townhouse, but typically that property is managed for you by the association. When you do not own the property, it is considered a condominium.

You do own the property when you buy a townhouse, but typically that property is managed for you by the association. When you do not own the property, it is considered a condominium. -

QuestionWhich is a better investment, a townhouse or a condo?

Carla ToebeCarla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

Carla ToebeCarla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

Real Estate Broker A townhouse may typically appreciate more in value over time because a townhouse owner owns the land, whereas with a condo, the land is shared and only the walls are owned. Additionally it is easier to get FHA approved for a townhouse community, but with a condo community, FHA funding may be restricted to a portion of the community. A townhouse community association may factor similar upkeep and maintenance to keep the shared community land from deteriorating and preserving its value but with a condo community all the land is shared and generally all the land is perpetually cared for by the condo owner dues. Condo owner dues may be higher to factor in the upkeep where the owners are not caring for their own back yards if they have yard space it belongs to the community. Insurance will usually be less for a condo because the community may cover the roof and exterior walls and only the inside walls are owned by the homeowner, whereas with a townhouse, the owner will have ownership of their roofing portion and siding portion. Many times an association may factor into their budget replacement costs to keep the community value high.

A townhouse may typically appreciate more in value over time because a townhouse owner owns the land, whereas with a condo, the land is shared and only the walls are owned. Additionally it is easier to get FHA approved for a townhouse community, but with a condo community, FHA funding may be restricted to a portion of the community. A townhouse community association may factor similar upkeep and maintenance to keep the shared community land from deteriorating and preserving its value but with a condo community all the land is shared and generally all the land is perpetually cared for by the condo owner dues. Condo owner dues may be higher to factor in the upkeep where the owners are not caring for their own back yards if they have yard space it belongs to the community. Insurance will usually be less for a condo because the community may cover the roof and exterior walls and only the inside walls are owned by the homeowner, whereas with a townhouse, the owner will have ownership of their roofing portion and siding portion. Many times an association may factor into their budget replacement costs to keep the community value high.

References

- ↑ https://www.nytimes.com/guides/realestate/how-to-buy-a-house

- ↑ https://www.nytimes.com/guides/realestate/how-to-buy-a-house

- ↑ https://www.nytimes.com/guides/realestate/how-to-buy-a-house

- ↑ http://finance.zacks.com/disadvantages-investing-townhouses-2937.html

- ↑ https://www.nytimes.com/guides/realestate/how-to-buy-a-house

- ↑ https://www.nytimes.com/guides/realestate/how-to-buy-a-house

- ↑ https://www.nytimes.com/guides/realestate/how-to-buy-a-house

- ↑ https://www.nytimes.com/guides/realestate/how-to-buy-a-house

- ↑ https://smartasset.com/mortgage/advantages-disadvantages-of-buying-a-townhouse

- ↑ https://www.nytimes.com/guides/realestate/how-to-buy-a-house

- ↑ https://www.realtor.com/advice/finance/understanding-the-earnest-money-deposit-2/

- ↑ https://www.zillow.com/home-buying-guide/real-estate-contract/

- ↑ https://www.zillow.com/home-buying-guide/real-estate-contract/

- ↑ https://www.nytimes.com/guides/realestate/how-to-buy-a-house

- ↑ https://www.zillow.com/home-buying-guide/real-estate-closing/

- ↑ https://www.zillow.com/home-buying-guide/real-estate-closing/

About This Article

To buy a townhouse, check out online listings and visit the properties you're interested in until you settle on the space you want. Next, consider getting pre-approved for a loan before you place your opening bid, which will put you in a better position to negotiate. Then, bid on the property based on the current market price and draft a purchase offer. Once the seller approves your bid, have the home inspected and appraised, apply for your mortgage, and attend your closing so you can sign the final documents! For tips on improving your credit before you apply for a loan or place a bid, read on!