This article was co-authored by wikiHow staff writer, Jennifer Mueller, JD. Jennifer Mueller is a wikiHow Content Creator. She specializes in reviewing, fact-checking, and evaluating wikiHow's content to ensure thoroughness and accuracy. Jennifer holds a JD from Indiana University Maurer School of Law in 2006.

There are 14 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 97% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 168,126 times.

Learn more...

Homes in Spain are reasonably priced, and the Spanish government encourages foreigners to purchase property there. In Spain there are no restrictions on the foreign purchase of real estate, whether commercial, residential, or undeveloped land. If you want to buy property in Spain, whether as an investment, a vacation home, or a permanent residence, be prepared to do some research to find the right property. If you plan to live in Spain, you may have to get a residence visa.[1]

Steps

Finding the Right Property

-

1Examine your reason for buying property in Spain. Where in Spain you want to buy property depends on whether you want the property as an investment, as a vacation home, or to live in permanently.[2]

- If you're buying as an investment, look in vacation hot spots on the coasts or in large cities such as Barcelona and Madrid. These properties are likely to go up in value and will provide good rental income.

- For a vacation home, concentrate on apartments and villas in developments. The property management company will care for the exterior and landscaping, and plenty of neighbors means leaving the home vacant for months won't be as big of a concern.

- For a more permanent home, you'll want to focus on your quality of life. Look at the local infrastructure, facilities, and accessibility. If you want to be around other expats, focus on towns and cities that have thriving expat communities.

-

2Calculate your budget. Before you start looking at properties in Spain, you need to fully understand the costs of owning property in Spain so you can budget accordingly. You will have expenses beyond the price of the house.[3]

- You'll pay a stamp tax of around 1 percent of the purchase price of your new home, as well as fees to brokers, attorneys, and others. Assume you'll pay between 10 and 15 percent more than the list price of the house, once you factor in taxes and fees.

- Don't forget the costs associated with moving your furniture and belongings to Spain, or purchasing new items for your Spanish home.

- If you're buying a new home, you also must pay a 10 percent VAT tax (4.5 percent in the Canaries) on the property when you close on the sale of the house.

Advertisement -

3Evaluate different regions of Spain. Spain is a large country, with diverse regions that all have different things to offer for a property owner. Climate, activities, and the size of the local expat community are some factors you'll want to consider.[4]

- You'll find thriving expat communities, beautiful beaches, and a mild climate along the beaches of the east coast. This includes the regions of Catalonia, Valencia, and Murcia, where prices generally are medium to high – although you can find some lower priced options in Murcia and the south coast of Valencia.

- Southern regions and islands are more expensive, but many of these locations have high tourist appeal, so they might work for you if you plan on renting out your Spanish property when you're not using it.

- The least expensive property in Spain tends to be in the northern interior, where the climate is hotter and drier on the interior and cooler on the northwest coast. Winters can be less mild than in the southeast, but the area has a lower cost of living and a more rural feel.

-

4Look at different types of Spanish property. Just as in any other country, you can buy properties in Spain that are in different states of readiness. Which you choose depends on your needs as well as your budget. There are different costs associated with different types of property.[5]

- New construction (obra nueva) is the most expensive type of property you can buy in Spain. However, the biggest advantage is that you know exactly what you're getting, and won't incur any remodeling expenses.

- You also can be resale property, which essentially is an existing house that has already been sold at least once. These properties are generally safer investments, provided you understand how much you'll have to spend on repairs or remodeling.

- Off-plan (sobre plano) property has been approved for construction by local authorities, but construction is not yet completed. You may get a lower price for these properties than you would for new construction, but you run the risk that the house will never be finished.

-

5Research your favorite areas. Before you buy property in Spain, hit the internet to learn more about areas that have captured your interest. The information you need depends on your reasons for buying property in Spain.[6]

- For example, if you're buying the property as an investment, you want to check out the property values in the area. If property values have been declining significantly in recent years, the area might not be a good investment.

- If you're looking to rent out the property when you're not there, you want to look for a well-connected area with lots of attractions and things to do. Avoid properties that are too rural or isolated, as you may have a hard time keeping them rented on a regular basis.

- If you want to move to Spain and live in the property permanently, research what it's like to live in that area on a daily basis. Find out about any risks, and compare the cost of living and tax rates to surrounding areas.

-

6Visit the area where you plan to buy. Spending some time on your own exploring the area around property you want to buy is crucial. Go there not as a tourist on vacation, but with an eye toward what it would be like to live there full-time.[7]

- While it's important to find out what activities and entertainment are available, if you plan to live there permanently, these things shouldn't be your priority. Renting a property in the area for a few months will give you a better idea of what it's like to live there.

- If you want to buy property in Spain for investment purposes, you still need to look at what daily life is like in the area. You'll need to be able to tell prospective renters what the property offers for them.

-

7Hire a property broker. Once you start to get serious about buying a property in a particular area, a property broker can help you find the right property for your needs. There are several different types of brokers from which you can choose.[8]

- Corredores are local brokers in rural Spain. They charge small commissions, typically around 1 percent from the buyer and the seller. If you're fluent in Spanish and looking for a rural property, a corredor may be your best bet.

- You also could talk to a buyer's agent, who charges an upfront fee, or foreign-based agents who also sell Spanish property. If you go with a foreign-based agent, make sure they have an active local office.

- In Spain, brokers' commissions are typically paid by the seller, so interview several brokers before you hire one, and keep in mind that they may not always have your best interests at heart.

-

8Talk to an attorney. Especially if you're not fluent in Spanish, a local attorney who also is fluent in your native language will be your best choice to guide you through the process of buying property and make sure you don't run afoul of any Spanish laws.[9]

- For example, suppose you want to be a vacation home and rent it out short-term to other vacationers when you're not using it. Some areas in Spain don't allow short-term rentals, and fines can be as high as 30,000 euros for violating local laws.

- Whether you hire a lawyer in Spain or in your home country, make sure they specialize or have extensive experience in Spanish real property law (urbanismo). They will be able to tell you about any laws that might cause concern.

- Interview several attorneys and check their credentials. If you're hiring a Spanish lawyer, ask for their registration number and look it up with their local bar association (Colegio de Abogados).

Purchasing the Property

-

1Get your Foreigner's Identity Number. If you want to conduct any business or financial transactions in Spain, including purchasing a house or opening a bank account, you'll need a Número de Identificación de Extranjero (NIE).[10]

- EU citizens will automatically get one when they register, while others must first register and get a residence permit (assuming you want to stay in the country for more than three months).

- You may be able to apply for an NIE at the Spanish embassy in your home country. Doing it this way can take several weeks, so make sure you plan ahead.

-

2Set up your accounts. You'll need insurance and a Spanish bank account if you want to buy property in Spain. Most sellers will only accept checks drawn on Spanish banks and payable in euros.[11]

- If you're receiving a pension, make sure you can get that pension paid into a Spanish bank.

- You may be getting your mortgage through a Spanish bank. In that case, it's usually easiest to set up your bank account at the same bank.

- If you're using a Spanish mortgage lender, they'll help you get property insurance. Otherwise you'll have to arrange for this yourself.

-

3Hire a translator. Even if you consider yourself fluent in Spanish, legal documents can be especially difficult. Having these documents translated into your native language so you understand the deal.[12]

- Check the website of the Spanish Ministry of Foreign Affairs to find a list of accredited translators.

- Ideally, you want a translator who has experience with legal documents, especially real property documents.

-

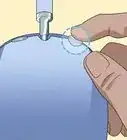

4Get a full survey done. Even if the property has been surveyed fairly recently, you still want to have a fully survey done before you buy the property so you know exactly what you're getting for your money.[13]

- A survey is separate from an inspection. An inspection shows you existing defects or improvements that can be made to the house and other structures. A survey simply tells you where the boundaries of your property are, as well as the locations of any underground cables or pipes.

-

5Negotiate a contract. Your broker and attorney (if you've hired one) will negotiate with the seller in an attempt to lower the price as much as possible. Other factors up for negotiation include who pays taxes, what structures or fixtures are included in the final price, and who pays for any repairs.[14]

- The contract also will include deadlines for various steps of the process to be completed. There will be deadlines for you and the seller. For example, if you've not yet secured financing, the contract may specify a date by which you must have a mortgage for the property.

- The details included in the contract depend to some extent on the type of property you're buying. For example, if you're buying an off-plan contract, you'll be signing a payment construction contract. This contract binds the seller to complete the house under a certain schedule.

-

6Apply for a mortgage. Unless you're buying the property for cash, you'll need to finance your purchase. You can do so by taking out a home equity loan on existing property you own, setting up a mortgage in your home country, or arranging for a mortgage with a Spanish lender.[15]

- The cheapest and easiest solution typically is to take out a second mortgage, or home equity line of credit, on your first home. This enables you to buy your property in Spain with cash, and you'll continue dealing with the same mortgage lender.

- You also might seek a mortgage from a local bank that has offices in Spain. This can be particularly helpful if you plan on spending most of your time in your home country.

- You also can take out a mortgage in Spain, which can simplify repayment because you don't have to worry about exchange rates or paying extra fees for international transactions.

-

7Close on the property. Once you've negotiated a sales contract and have your financing in place, you'll conclude your purchase. If you're able to do this in person, it typically will occur at a notary's office near the property.[16]

- When you close on the property, you'll have to make your initial deposit, typically of around 10 percent of the total purchase price of the home.

- If you're not able to appear in person, you can arrange to have someone represent you as a representante verbal (verbal representative). You can later ratify the representation at a Spanish consulate office in your home country, or at the notary's office next time you visit Spain.[17]

-

8Register the property. In Spain, the buyer is responsible for registering the transfer of ownership with the local registry office. If you used a notary for closing, they may provide this service for a fee.[18]

- If you're paying the notary to register the property, make sure you understand exactly what they're going to do. They may simply notify the registry office that a transfer was made, but not complete the full registration.

- The cost of registration and notary services together typically ranges from 0.5 percent to 1 percent of the sale price of your property.[19]

-

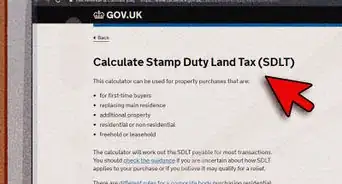

9Compute property taxes. There are several types of real and personal taxes you must pay if you are living in Spain for any length of time, or if you own property there. The amount of taxes depends on the cost of your property and the area where it's located.[20]

- You must pay property ownership tax yearly. The tax is set locally, and ranges from 0.4 percent to 1.1 percent of your property's valor catastral, or the administrative value of the property. That amount is typically lower than market value.

- For a small country home, your taxes may be as little as 100 euros per year. However, a luxury villa in a waterfront tourist development could set you back as much as 3,000 euros a year in taxes.

- If you own more than 700,000 euros in worldwide assets, you may end up paying the wealth tax for any property value beyond that amount. The rate ranges from 0.2 percent to 2.5 percent, depending on the value of your assets.

- You also must pay personal income tax based on the valor catastral of your property. If you plan to rent out your property, you'll also pay around 25 percent of the gross income you earn from renters.

Getting a Residence Visa

-

1Find out if you need a visa. How long you plan to stay will in many cases determine whether you need a visa. Generally, if you want to stay in Spain for more than 90 days you will need a visa.[21]

- If you are a citizen of the European Union (EU), the European Economic Area (EEA), or Switzerland, you do not need a visa to live or work in Spain, regardless of how long you plan to stay. The EEA is the EU plus Iceland, Liechtenstein, and Norway.

- If you are a citizen of Croatia, you may need a visa if you plan to work in Spain, but you won't need one simply to live in Spain.

-

2Choose the right type of visa. You will need a different type of visa depending on whether you plan to work in Spain and how long you plan to live there. If you want to retire to Spain and live in the property you've bought, you'll need a different type of visa.

- A resident visa to retire in Spain allows you to live in Spain without working. To qualify for one, you'll need a valid passport, proof that you have adequate financial resources, and a medical certificate from your doctor. The fee is between $38 and $160, depending on your home country. US citizens will pay $160.

- If you want to work, you must first get hired by a Spanish company. The company will contact the Spanish Immigration Office to get a letter of approval. To apply, you'll need that letter, a valid passport, a Police Records Certificate from your home country's law enforcement, and a medical certificate. You'll pay between $38 and $190 depending on your home country.

- You also may be eligible for a fast-track visa, available for investors and self-employed people. If the property you bought in Spain is worth more than $500,000, this would potentially qualify you for the fast-track visa.

- If you're unsure what visa you should get, talk to someone in the Spanish consulate or to an attorney who specializes in Spanish immigration law.

-

3Complete a visa application. You must complete and submit your visa application in person, either at an immigration office in Spain or at one of the consular offices abroad. You can download the application for free from the website of any Spanish consulate.

- When you submit your application, you will need the original and one copy, along with any original documents and copies that are required with your application.

- You may be required to have original documents translated into Spanish.

- You also must pay your application fee. The entire fee will be refunded if your application is denied.

-

4Apply for permanent residence. If you want to make Spain your home, you can apply for permanent residency after you've lived there continuously for five years. With permanent residency, you can stay in Spain indefinitely and enjoy the same benefits as Spanish citizens.[22]

- Go to the Civil Registry nearest you to get more information and assistance on applying for permanent residence.

- If you decide you want to be a full citizen of Spain, you can apply for Spanish nationality after having lived there continuously for 10 years.

Community Q&A

-

QuestionWhat is a minimum down payment on a property?

Community AnswerAccording to a Law Firm and our Bank in Spain, it will cost a non-Spain resident 40 percent as a down payment along with 10 percent taxes and 4 percent fee for doing the loan (like closing costs in the U.S). So a total of 54 percent of the home you are buying if you are a non-resident.

Community AnswerAccording to a Law Firm and our Bank in Spain, it will cost a non-Spain resident 40 percent as a down payment along with 10 percent taxes and 4 percent fee for doing the loan (like closing costs in the U.S). So a total of 54 percent of the home you are buying if you are a non-resident. -

QuestionIs Wealth tax applicable in Spain?

Community AnswerYes. If your cumulative wealth and income taxes exceed 60 percent of your total taxable income, you will be assessed a 20 percent wealth tax.

Community AnswerYes. If your cumulative wealth and income taxes exceed 60 percent of your total taxable income, you will be assessed a 20 percent wealth tax. -

QuestionAre the apartments in Spain leaseholds, like in the U.K.?

Community AnswerBoth leasehold and freehold apartments are available in Spain. Depending on your needs, a leasehold could be cheaper and easier for you than buying freehold property.

Community AnswerBoth leasehold and freehold apartments are available in Spain. Depending on your needs, a leasehold could be cheaper and easier for you than buying freehold property.

References

- ↑ http://www.expatica.com/es/housing/Buying-a-property-in-Spain_103805.html

- ↑ http://www.spanishpropertyinsight.com/buying-property-in-spain/defining-your-spanish-property-needs/

- ↑ http://www.spanishpropertyinsight.com/buying-property-in-spain/costs/

- ↑ http://www.spanishpropertyinsight.com/buying-property-in-spain/overview-of-spanish-regions/

- ↑ http://www.spanishpropertyinsight.com/buying-property-in-spain/overview-types-of-property-in-spain/

- ↑ http://www.spanishpropertyinsight.com/buying-property-in-spain/background-research-before-you-buy-property-in-spain/

- ↑ http://www.spanishpropertyinsight.com/buying-property-in-spain/background-research-before-you-buy-property-in-spain/

- ↑ https://www.spanishpropertyinsight.com/guide/buying-property-in-spain-part-iv-estate-agents/

- ↑ https://www.gov.uk/how-to-buy-property-in-spain

- ↑ http://www.expatica.com/es/visas-and-permits/Moving-to-Spain-Guide-to-Spanish-visas-and-permits_102354.html

- ↑ https://www.spanishpropertyinsight.com/buying-property-in-spain/costs/

- ↑ https://www.gov.uk/how-to-buy-property-in-spain

- ↑ http://www.dummies.com/personal-finance/real-estate/buying-a-property-in-spain-for-dummies-cheat-sheet/

- ↑ http://www.expatica.com/es/housing/Buying-a-property-in-Spain_103805.html

- ↑ http://www.which.co.uk/money/mortgages-and-property/guides/buying-overseas-property/mortgages-for-overseas-property/

- ↑ https://www.gov.uk/how-to-buy-property-in-spain

- ↑ https://www.justlanded.com/english/Spain/Spain-Guide/Property/Buying-property

- ↑ http://www.expatica.com/es/housing/Buying-a-property-in-Spain_103805.html

- ↑ http://www.spanishpropertyinsight.com/buying-property-in-spain/costs/

- ↑ http://www.spanishpropertyinsight.com/buying-property-in-spain/costs/

- ↑ http://www.expatica.com/es/visas-and-permits/Moving-to-Spain-Guide-to-Spanish-visas-and-permits_102354.html

- ↑ http://www.expatica.com/es/visas-and-permits/How-to-get-Spanish-citizenship_107634.html

About This Article

If you want to buy a property in Spain, search for properties in the north of the country if you're on a tight budget, since they're usually cheaper. If your main concern is avoiding extreme heat, check out properties listed in eastern Spain, where the weather is cooler. You can also travel to Spain on vacation and visit different areas to get an idea of where you'd like to live. If you find a property and you're serious about buying it, you'll need to hire a property broker to manage the transaction for you or a lawyer to review legal documents. For tips on which region of Spain may be best suited to your needs and how to get a residence visa, keep reading!