X

wikiHow is a “wiki,” similar to Wikipedia, which means that many of our articles are co-written by multiple authors. To create this article, 21 people, some anonymous, worked to edit and improve it over time.

This article has been viewed 244,220 times.

Learn more...

A great starting point for anyone looking to buy property in Canada. Although this article is geared towards British buyers, it has general information of utility for all readers interested in purchasing Canadian property as an outsider.

Steps

-

1Consider the reasons for choosing Canada. Increasing numbers of British people are choosing Canada as the location for their second home, attracted by its spectacular scenery, laid-back lifestyle, political and social stability. Easier travel and increasing coverage by low-cost airlines are also considerations, as is the fact that Canada’s international homes market is still young and developers seeking to attract British buyers therefore have to provide good value.

- The Canadian residential property market has performed well in recent years, and is only suffering from the global recession by the economy’s association with world markets. Residential property is generally cheaper than in the UK, which, along with historically healthy capital appreciation, makes it an attractive investment for British second home purchasers or those looking to emigrate permanently.

- Canada is said to have weathered the global recession better than almost any other developed economy in the world, the government having put aside money when times were good and there was a budget surplus for 12 years. The problems currently being seen by Canadian companies are almost exclusively as a result of their exposure to global markets. This give property in Canada a real chance of surviving the recession well, despite fact that prices are currently on the slide.[1]

-

2Look for the popular locations. Down the years, intrepid Britons have immigrated to every part of Canada. For those contemplating the purchase of a holiday home, however, travel time and cost will probably govern the choice of location. These will vary considerably depending on whereabouts in the UK you live. Owing to the comparative ease of travel, British second home purchasers have traditionally favoured eastern Canada. However, the recent introduction of low-cost transatlantic services has led to increased interest in western areas.[2] Purpose-built resorts are also proving popular. We hope this guide provides a place to start. There are many resources to help with further research, including television and radio programs, magazines, the Internet and property exhibitions, as well as estate agents in both the UK and Canada.

- Eastern Canada - Homes in eastern Canada are generally cheaper than comparable ones in the west. Traditionally, Montreal has had the lowest residential property prices of Canada’s major urban areas. However, they are now increasing rapidly, so this may be a good place to consider investing. The area has much to offer. Beautiful countryside and excellent sporting facilities, including skiing, are within easy reach. The US is 40 minutes to the south. Boston and New York are six hours’ drive away, or an hour by air. There are several daily flights to London, in a flight time of approximately seven hours. Because of its strong rental market, Toronto is also growing in popularity. Rental yields in both Toronto and Montreal have held up well despite the credit crunch.

- Vancouver - British Columbia, Canada’s westernmost province, is also one of its most beautiful, with glorious mountains, lakes, rivers and beaches. It has Canada’s most temperate climate and some of its friendliest people. Vancouver, the largest city, is the most expensive area of Canada for residential property. The city, with the neighbouring ski resort of Whistler, is to host the 2010 Winter Olympics, a fact that has to lead to further price increases. Transport links with the UK are improving. There are direct daily services from London to Vancouver (flight time approximately 9.5 hours).

- The Rocky Mountains - Many people visit the Rocky Mountains on holiday and fall in love with this spectacular area. However, property tends to be expensive and, as much of it is situated within national parks, out of bounds to most purchasers. An area worth considering is Canmore in Alberta. Given that it is next to the Banff and Kananaskis national parks, only an hour’s drive from Calgary’s international airport (flight time to London approximately nine hours) and in a temperate climate zone, it is no surprise that Canmore has doubled its population since it hosted the Winter Olympics in 1988. Prices are relatively low, but increasing. Prices are also rising in Calgary, a young city with a strong first-time buyer market.

- Resorts - Canada is the world’s tenth most popular tourist destination but still offers great potential for growth. Recognizing this, the government has invested huge sums in tourism, particularly in the east, which until recently was largely neglected as a holiday destination. Consequently, resort developments are now big business. More and more Britons are seeing the advantages of buying resort properties. Many of them are skiers frustrated by the costs and crowds of European skiing. However, most resorts, even those offering winter sports, are now year-round, with family-oriented attractions. These factors help to extend the rental season and attract a wider range of purchasers. As a bonus, build quality is generally high, maintenance is arranged by a management company and capital appreciation tends to be excellent, particularly in eastern Canada.

Advertisement -

3Buy a property. Know the rules and regulations. Regulations on property purchase vary throughout Canada, so it is important to find out about them when you are researching an area. In British Columbia, New Brunswick, Newfoundland, Nova Scotia, Ontario and Quebec, for example, there are no restrictions on foreign ownership, provided you spend less than six months per year in Canada. However, in Banff, which is located within a national park, only businesses and employees of the park can own property, and even they can do so only through renewable 42-year leaseholds.

- Each province has a different limit on the amount and kind of land that can be owned. Unless buying a new property from a developer, potential purchasers are required to register with an estate agent (realtor).

-

4Familiarize yourself with the purchase process. The purchase process in Canada is different from that in the UK and elsewhere, and the practice of gazumping is unknown. As the majority of Canadian realtors cooperate in multiple listings, one realtor can usually access information on all available properties in an area. Once you have chosen a property, you should appoint an independent realtor (or buyer’s agent) to represent your interests. In the majority of real estate transactions, the seller pays both the realtors involved. Your agent will draft an Offer to Purchase, which will then be submitted with a deposit, which is refundable should the sale fall through. Once the offer is signed by both vendor and purchaser and any conditions (for example, mortgage approval) are met, the sale can proceed.[3]

-

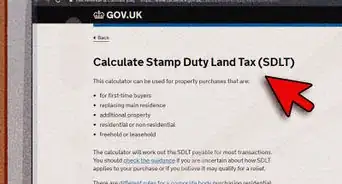

5Prepare to meet the costs. Transactions costs in Canada, while varying from province to province, usually comprise between 4.7 and 11 per cent of the property price, making it one of the cheaper places to buy from a fees perspective. A Goods and Services Tax (GST) of 7 per cent and a Provincial Sales Tax (PST) of up to 10 per cent are usually included in the asking price of new homes. Alberta is the only province that does not levy PST.[4]

- In New Brunswick, Newfoundland and Labrador and Nova Scotia, GST is combined with an 8 per cent provincial retail sales tax to form Harmonized Sales Tax (HST) of 15 per cent.

- Subject to certain conditions, GST and HST can be reduced or avoided (see Taxation section). Buying costs vary between provinces, but purchasers should allow up to £2,000 for legal fees, a survey and insurance. Purchase tax of between 0.5 per cent and 2 per cent of the price is also payable.

-

6Finance your purchase. When working out how to finance your purchase, consider all the options. Paying cash, if you can afford to do so, is often recommended, but you may not want to tie up a relatively large sum in this way. The other options are remortgaging your UK home or arranging a mortgage on your Canadian property through a Canadian or UK lender. Remortgaging offers the easiest solution. Releasing equity in a UK home means that the second home can be purchased for cash, without the need for another mortgage. However, this may only be feasible for those who own their first home outright.

- Several UK mortgage providers will lend funds of up to 80 per cent of the purchase price for second home purchase over, typically, a 15-year term.

-

7Understand the taxation system. Canada’s tax system - Both the federal and provincial governments impose income taxes, which together make up more than 40 per cent of total tax revenue. Taxes are progressive, the wealthy paying a higher percentage of their income than the less well off. Canada has no Inheritance Tax as such. Inheritance is treated as the disposal of an asset and is therefore subject to Capital Gains Tax, currently 25 per cent.

- A number of other federal, provincial and local taxes are payable by individuals, including sales taxes (see Costs section of Buying a Property) and property taxes. Residential properties are subject to annual local taxes of between 0.5 per cent and 2 per cent of their value.

- Taxation of non-residents - Non-residents pay federal and provincial income tax on Canadian-sourced income. As the UK has a comprehensive double taxation treaty with Canada, taxes paid in Canada may reduce UK liability. GST and HST are charged on new homes purchased for private use. However, in some circumstances – for example, if the owner of a resort property commits it to a rental pool and uses it for 10 per cent of the year or less – a home is classified as commercial property and not subject to tax. Rental income is taxed at 25 per cent, but expenses can be offset against tax.[5]

- A non-resident selling a property in Canada must pay Capital Gains Tax of 25 per cent, levied on a percentage of the profit.[6]

-

8Sort out your passports, visas and residency.

- Passports and visas - To enter Canada as a visitor, a UK national must be in possession of a standard 10-year passport. Visas are not generally necessary, though there are some exceptions. Non-residents can spend up to six months per year in Canada.

- Residency - Permanent resident status gives a non-Canadian the right to live in Canada. Certain residency obligations must be met in order to maintain it. Those desiring permanent residence must apply for landed immigrant status. As this is a complicated process, it is wise to consult a lawyer specializing in immigration.

-

9Understand the available communications.

- Telephone - An excellent service is provided throughout Canada, using modern technology, through a number of national and provincial phone companies. As in the UK, coin-operated telephones are available in many public places, and payphones accepting major credit cards are increasingly common. Nearly all the phone companies produce pre-paid phone cards for domestic and international use. These are sold in a variety of outlets, including petrol stations, pharmacies and post offices. Some companies also produce affinity cards, whereby the cost of a call is debited from the caller’s credit or debit card account.

- Internet - Most major cities and even some smaller towns now have Internet cafe's. Many large hotels, public libraries and other establishments also offer Internet access.

Advertisement

Community Q&A

-

QuestionIf I purchase property in Canada, can I gain legal residence there?

Community AnswerNo. Owning property in Canada does not grant you any immigration privileges. and if you want to live in Canada,, you’ll still need to qualify under Canada’s immigration laws.

Community AnswerNo. Owning property in Canada does not grant you any immigration privileges. and if you want to live in Canada,, you’ll still need to qualify under Canada’s immigration laws. -

QuestionHow do I buy property in Canada from USA?

Community AnswerEasy, with a realtor or directly from the seller.

Community AnswerEasy, with a realtor or directly from the seller. -

QuestionDo I have to use a Realtor if I am a U.S. citizen and want to purchase property in Canada?

Community AnswerNo, you can buy directly from the seller -- but it is a good idea to have a U.S. lawyer involved.

Community AnswerNo, you can buy directly from the seller -- but it is a good idea to have a U.S. lawyer involved.

Advertisement

Warnings

- This is intended as a guide only. You should always seek professional advice when undertaking any type of property transaction.⧼thumbs_response⧽

- You are required to have a sponsor which is approved by the Canadian Government prior to complete this process successfully as housing vendors are unauthorized to give foreigners a unit or house without proof of a sponsor approved by the Canadian Government.⧼thumbs_response⧽

- Buying a home or property abroad is a major decision and one that should not be taken lightly. Before committing yourself, it is vital to ensure you have researched all aspects thoroughly and are in possession of all the relevant facts. Individual circumstances will vary widely, so it is essential to obtain professional advice and guidance tailored to your particular situation, especially in areas such as property purchase, potential rental returns, taxation and mortgages.⧼thumbs_response⧽

- You should save up as this can be very expensive.⧼thumbs_response⧽

Advertisement

References

- ↑ http://www.bankpedia.org/index.php/en/104-english/h/23921-how-the-canadian-economy-avoided-the-global-crisis-encyclopedia

- ↑ https://www.livingin-canada.com/house-prices-canada.html

- ↑ https://www.cmhc-schl.gc.ca/en/data-and-research/publications-and-reports/buying-your-first-home-in-canada-what-newcomers-need-to-know

- ↑ https://www.taxandtradelaw.com/introductiontopst.html

- ↑ https://www.canada.ca/en/revenue-agency/services/tax/international-non-residents/individuals-leaving-entering-canada-non-residents/non-residents-canada.html#txblgtns

- ↑ https://www.canada.ca/content/dam/cra-arc/formspubs/pub/ic72-17r6/ic72-17r6-11e.pdf

About This Article

Advertisement