This article was co-authored by Brian Stormont, CFP®. Brian Stormont is a Partner and Certified Financial Planner (CFP®) with Insight Wealth Strategies. With over ten years of experience, Brian specializes in retirement planning, investment planning, estate planning, and income taxes. He holds a BS in Finance and Marketing from the University of Denver. Brian also holds his Certified Fund Specialist (CFS), Series 7, Series 66, and Certified Financial Planner (CFP®) licenses.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 100% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 82,587 times.

Do you want to do a better job of saving money while enjoying a bit of entertainment, too? This article features a simple way to save, enjoy and not have to worry all the time about money. Read on to find help in being financially disciplined.

Steps

Getting the Basics Down

-

1Organize all your financial documents. Create a file folder or a cabinet or box with sections for all your expenses, insurance, assets, income and liabilities. You could label the folders this way:

- House/apartment

- Income

- Insurance

- Medical

- Vehicle

- Utilities

- Taxes

-

2In each folder put everything associated with the category. For example, under "house/apartment" you would keep mortgage or lease/rent documents. Under "utilities" you'd file gas/electricity, water, sewage, tv/internet, and phone bills. Note everything you spend on entertainment, groceries, and gas.Advertisement

-

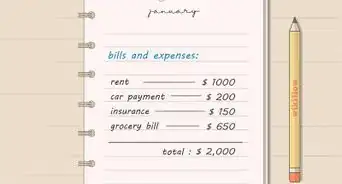

3Determine how much you spend in each category. Some expenses are unavoidable, such as mortgage/rent and utilities. However, you could reduce your monthly expenses in other categories by first determining how much you spend there and how much is absolutely necessary.[1]

-

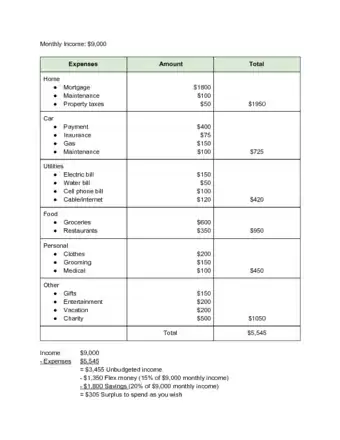

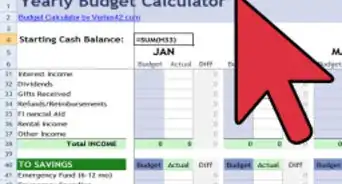

4Create a balance sheet with all your income in one column and all your expenses in another. Do this for at least three months to determine a pattern. By doing this you get an idea of how often you eat out and how much you spend on movies or other entertainment. You'll begin to see where you might be able to reduce costs.[2]

-

5Set goals. Write down everything you want to accomplish. Include estimates of how much your goals will cost and how long before you achieve them. For example:

- "Buy a house: $200,000 with a 5% down payment. Save $10,000 by June 2020."

- This will give you an idea of how much you need to save to reach your goals.

-

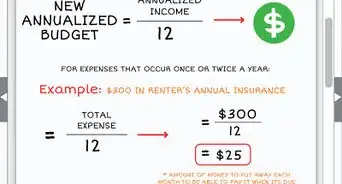

6Once you've identified your goals, determine which are short-range goals (within five years), and determine how much you will need to put aside every month to reach them. Let’s say you want to buy a $30,000 car. You can take out a loan for $30,000 that you will need to pay back in three years. You will have monthly costs (not taking interest into account) of approximately $833.

-

7Save as much as possible for a down payment. This will reduce the amount of the loan and the interest you'll pay on it. Be realistic in setting money aside, because you'll have to continue meeting your living expenses.

-

8Ask your payroll department to deposit a certain amount from your paychecks into whatever retirement account your employer offers. By paying yourself first in this way, you can save money for retirement without even seeing it (and being tempted to spend it). Spend only a part of what's left in each paycheck. Try to save as much of what remains as you can. You may find it hard to maximize your savings, but as you near retirement, you will be very glad you did.

-

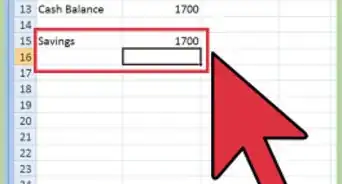

9Deposit some money into a savings account for emergency purposes. Try to maintain an emergency fund consisting of roughly six months' worth of normal expenses. This will help cover costs should you lose your job or become temporarily incapacitated.[3]

-

10Find ways to reduce costs. Using a budget will help.[4] Here are some examples:

- Watch matinee movies instead of higher-priced evening showings.

- Eat out once or twice a month rather than once or twice a week.

- Make your own coffee and take it to work or school rather than stopping by a coffee stand on your way.

- Leave your credit cards home when going shopping. If you're determined to use a card, pick one with a generous rewards program.

- Don’t go grocery shopping when you're hungry. You may buy more than you need at such times.

Using the Envelopes System

-

1Budget each paycheck. Take note of how you spend your money. Keep a list of every outlay. When you stay accountable this way, you'll tend to be a little more careful. Allocate an amount each payday for food, utilities, entertainment, and whatever other necessities you're committed to.

- This completely depends on the size of your paycheck and how much you tend to spend on groceries, clothing and the like.

- Sometimes you'll have to cut down on some things to make it work and to make sure you aren't stretching yourself too tightly.

-

2Label some envelopes. Create an envelope for each of the above categories. Once you've budgeted your paycheck, you'll fill those envelopes with the amount of cash allotted to each category. For example, if you've allotted $100 for food, you'll put $100 in your food envelope.

-

3Don't resupply the envelopes until the next paycheck. This means that once you've spent the money in an envelope, that's all you can spend in that category until the next paycheck. So if you blow all your fun money at once, don't take a trip to the ATM to replenish. Take your envelopes seriously.

- Don't be stupid. If you're low on groceries, and you've run through all your food money, you might have to borrow from another envelope. Pay it back the next payday. You may need to adjust your budget if you keep running short.

-

4Allow time to get it right. You aren't going to get the system 100% right the first time. That's okay. It'll take a few months to get accustomed to budgeting and to figure out how much you need for essentials like food and electricity before you can spend more on clothes and fun things.

-

5Try to avoid using plastic. There will be times when you're going to need to use a debit or credit card. Using plastic, however, is so easy that you may not even feel like you're spending money. That's not good if you're trying to be disciplined with your finances.

Community Q&A

-

QuestionI owe $10,000 in credit card payments. How should I pay it back if I can only afford minimum monthly payment times three?

DonaganTop AnswererPay as much as you can. It's very important to get completely out of debt (except for a mortgage) as soon as possible.

DonaganTop AnswererPay as much as you can. It's very important to get completely out of debt (except for a mortgage) as soon as possible.

References

- ↑ Brian Stormont, CFP®. Certified Financial Planner. Expert Interview. 21 July 2020.

- ↑ Brian Stormont, CFP®. Certified Financial Planner. Expert Interview. 21 July 2020.

- ↑ Brian Stormont, CFP®. Certified Financial Planner. Expert Interview. 21 July 2020.

- ↑ Brian Stormont, CFP®. Certified Financial Planner. Expert Interview. 21 July 2020.