This article was co-authored by Jennifer Mueller, JD and by wikiHow staff writer, Amy Bobinger. Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow's legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.

There are 13 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 4,809 times.

Whether you're already enjoying a sunny retirement in Florida or you're just starting out on your own, it's inevitable that you'll think about your will sooner or later. In fact, it's very responsible to make a plan for what will happen to your assets when you can't use them anymore! As long as you're at least 18 years old (or an emancipated minor) and of sound mind, you can write your own will. We'll help walk you through the process of what to include so you can feel as confident as possible about writing your will.

Steps

Preparing Your Will

-

1Write the will yourself if you have a simple estate. If you don't have many assets, dividing up your estate may be fairly easy. In that case, you may want to make your own will without the added cost of an attorney. There are a number of online will-making services that will walk you through the process.[1] And if you prefer, you can simply write the will yourself by hand.

-

2Have a probate lawyer draft your will if it's more complex. Dividing your estate can be complicated, especially if you have a lot of assets. It requires you to navigate issues like inheritance taxes, insurance, investment accounts, and creditors. While you can do this on your own, it can be really helpful to consult an experienced attorney for the process.[4]

- Using an attorney can sometimes save your estate a lot of money. If you make your own will and there are any mistakes, your executor may have to spend a lot of time sorting that out. That expense will be deducted from your estate.

- Probate lawyers specialize in estates and trusts, so they'll be the most knowledgeable about how you should divide your assets.[5]

- Your probate lawyer might charge an hourly fee, a flat rate, or a percentage of your estate's value.

Advertisement -

3Inventory all of your assets and debts. Your assets include any bank accounts, investments, property, and real estate that you own. You might also write down individual items, like heirlooms or sentimental items that you wish to leave to specific people.

- It can also be helpful to write out how you want certain debts to be paid. For instance, you might designate your savings account to be used to pay any outstanding income taxes before the remainder is divided between your beneficiaries.

- Certain assets, like life insurance policies and retirement accounts, don't need to be included in your will. That's because you already designated a beneficiary when you set up those accounts.[6]

-

4Be sure to record your will on paper. In Florida, an oral will won't be recognized. That means you can't just tell someone what you want to happen to your property after you pass.[7] Also, you can't record yourself on video making an oral will. This is called a nuncupative will, which isn't binding in Florida.

- A handwritten will still needs to be witnessed and notarized in order to be considered valid. If you simply write a will and sign it by yourself, it's considered a "holographic" will, and it's not legally binding in Florida.

Writing the Will

-

1Open the will with your name and intention. Start by writing your full, legal name. Then, specify that you are writing your last will and testament. Also, include that you are of sound mind and are not writing the will under duress—legal requirements for writing a will in Florida.[8]

- For instance, you might say, "I, Brian Jones, being of sound mind and not under duress, declare that this is my Last Will and Testament."

- Being "of sound mind" means that you are rational and you have the capacity to understand what you're doing.

-

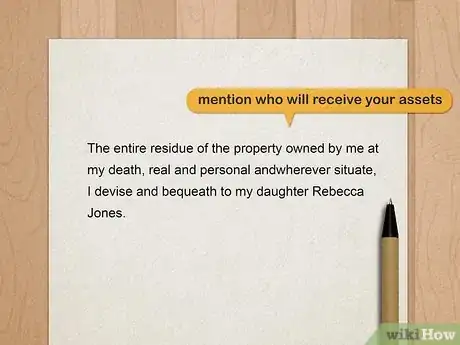

2Specify who you want to receive your assets. Your beneficiaries are the people you name to receive your estate. These might include your spouse, children, grandchildren, friends, or even charities you support. In general, you can divide up your assets however you like. However, there are a few exceptions.[9]

- For instance, you can't entirely disinherit your spouse. They're entitled to at least half of your estate.

- Also, you can't will property that you own jointly with someone else, because if you pass away, that property automatically goes to the joint owner.

-

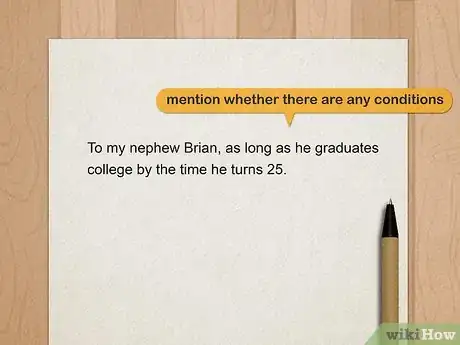

3Include whether there are any conditions on the assets you leave. In some cases, you may be able to state that a certain beneficiary should only be included in the will if a specific event happens. There are some restrictions, though—you can't legally include conditions that require someone to marry, divorce, convert to a different religion, or use the gift for anything illegal.[10]

- For instance, you might say, "To my nephew Brian, as long as he graduates college by the time he turns 25."

-

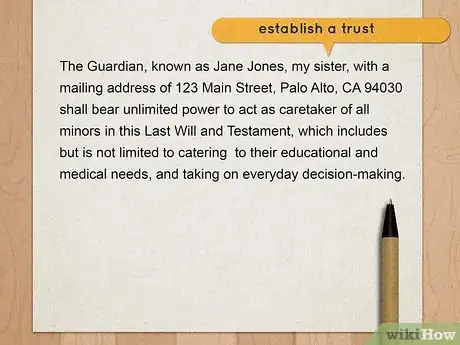

4Name a guardian for your minor children or pets. If you have children who are under the age of 18, you may want to designate a person to care for them. By including this in your will, you'll ensure that your wishes will be followed.[11]

- If you simply ask someone to act as a guardian for your children or pets, this may not be sufficient to hold up if there's a question about guardianship after you pass.

- Don't leave any assets to your pets—animals can't legally own property. However, you can leave assets to the guardian of your pet.[12]

-

5Add a statement if you're disinheriting any adult children. Don't just leave them out—you'll need to note that you are intentionally excluding them from your will. Otherwise, they might be able to contest the will after you pass. It's best to talk to an attorney about this to ensure you word your intentions appropriately.[13]

- Some people believe that you must name all of your descendants in your will, so if they want to disinherit a child, they'll sometimes leave them $1. This actually can add a lot of work for your executor—and that can end up being expensive for your overall estate.[14]

-

6Name your executor. The executor of your will is the person who will manage your estate after you pass away. This is a big decision—your executor is responsible for dividing up your assets as directed in your will, and it can sometimes be a complicated process. You can choose an individual you trust, if you like, or you can choose a bank or a trust company if you prefer.[15]

Signing and Notarizing the Will

-

1Sign the will in the presence of 2 witnesses. Wait until you've completely finished writing your will before you sign it. Then, you'll need to have at least two witnesses sign the will and acknowledge that they either saw you sign it or that you signed it previously. At this point, your will is considered valid.[18]

- Your witnesses have to sign the will in front of you and each other.

- Under Florida law, your witnesses can be interested parties, or people who are named as beneficiaries in your will.[19]

-

2Bring the will to an officer of the court to be notarized. You'll need to formally acknowledge that this is your will, that you're under sound mind, and that you didn't write the will because anyone forced or pressured you to. You can do this by going before a judge, justice, court clerk, or notary. Your witnesses will need to accompany you, as well.[20]

- After you do this, you'll receive a certificate declaring that your will is self-proving.

- You do not have to have your will notarized for it to be legal. However, it can make it easier to enforce after you pass away.[21]

-

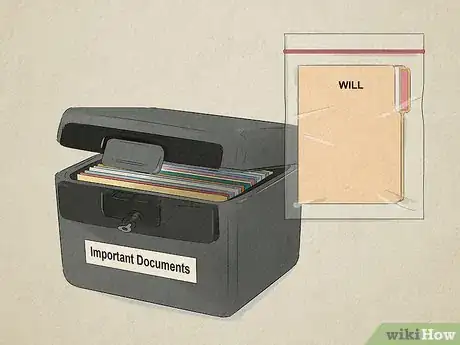

3Store the will somewhere safe. Your will won't be considered final until after you pass away. That means that if it gets stolen or destroyed, the courts won't have a copy of it on file, so it won't be able to be executed. Be sure to keep your will in a secure place, like a safe or bank deposit box. You can also leave it with someone you trust, like your attorney.[22]

Making Changes

-

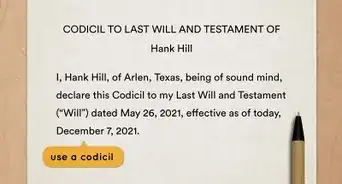

1Make minor changes by adding a codicil. If you just want to amend or add a few small details, there's no need to write a whole new will. Instead, just add a codicil, which is a document that you keep with the will itself. If you have a codicil, it will be treated just as formally as your will.[23]

- For instance, if you have a portion of your assets being split among your 3 grandchildren and one of your children has a new baby, you might add a codicil specifying that same portion should be divided between your 4 grandchildren.

- Be sure to date the codicil—the most recent version of your will, including any amendments, is the one that will be enforced.

-

2Write a new will if you need to make major changes. If you want to make more complicated changes—reallocating major parts of your estate or changing how much each of your beneficiaries receives—it's best to create a whole new will. That way, you'll avoid any confusion when your executor tries to reconcile the original will with complex codicils.[24]

- Be sure to sign the new will in front of witnesses, as well.

- If there's a significant change in the amount of your assets, you get married or divorced, or one of your heirs dies, it's a good idea to draft a new will.

- You can change your will as often as you want as long as you're of sound mind.[25]

-

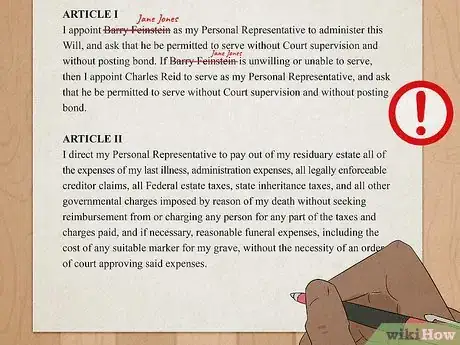

3Do not write on the will itself. It might seem simple to just cross something out or write in a small detail. However, you can actually invalidate your will by writing on it after it's been signed and witnessed.[26]

- Similarly, don't destroy your will—that will completely invalidate it.

References

- ↑ https://www.seniorsmatter.com/how-to-make-an-online-will-in-florida/2575258/

- ↑ http://www.leg.state.fl.us/statutes/index.cfm?App_mode=Display_Statute&Search_String=&URL=0700-0799/0732/Sections/0732.502.html

- ↑ https://money.usnews.com/money/retirement/aging/articles/the-best-online-will-making-programs

- ↑ https://www.floridabar.org/public/consumer/pamphlet011/

- ↑ https://www.findlaw.com/estate/probate/what-is-a-probate-lawyer.html

- ↑ https://www.findlaw.com/estate/wills/what-not-to-include-when-making-a-will.html

- ↑ https://www.floridabar.org/public/consumer/pamphlet011/

- ↑ http://www.leg.state.fl.us/statutes/index.cfm?App_mode=Display_Statute&Search_String=&URL=0700-0799/0732/Sections/0732.501.html

- ↑ https://www.floridabar.org/public/consumer/pamphlet011/

- ↑ https://www.findlaw.com/estate/wills/what-not-to-include-when-making-a-will.html

- ↑ https://www.floridabar.org/public/consumer/pamphlet011/

- ↑ https://www.findlaw.com/estate/wills/what-not-to-include-when-making-a-will.html

- ↑ https://www.seniorsmatter.com/how-to-make-an-online-will-in-florida/2575258/

- ↑ https://www.floridabar.org/public/consumer/pamphlet011/

- ↑ https://www.floridabar.org/public/consumer/pamphlet011/

- ↑ http://www.leg.state.fl.us/statutes/index.cfm?App_mode=Display_Statute&Search_String=&URL=0700-0799/0732/Sections/0732.502.html

- ↑ http://www.leg.state.fl.us/statutes/index.cfm?App_mode=Display_Statute&Search_String=&URL=0700-0799/0732/Sections/0732.524.html

- ↑ http://www.leg.state.fl.us/statutes/index.cfm?App_mode=Display_Statute&URL=0700-0799/0732/Sections/0732.502.html

- ↑ http://www.leg.state.fl.us/statutes/index.cfm?App_mode=Display_Statute&Search_String=&URL=0700-0799/0732/Sections/0732.504.html

- ↑ http://www.leg.state.fl.us/statutes/index.cfm?App_mode=Display_Statute&Search_String=&URL=0700-0799/0732/Sections/0732.503.html

- ↑ https://www.floridabar.org/public/consumer/pamphlet011/

- ↑ https://www.floridabar.org/public/consumer/pamphlet011/

- ↑ https://www.floridabar.org/public/consumer/pamphlet011/

- ↑ https://www.floridabar.org/public/consumer/pamphlet011/

- ↑ https://www.floridabar.org/public/consumer/pamphlet011/

- ↑ https://www.floridabar.org/public/consumer/pamphlet011/

- ↑ http://www.leg.state.fl.us/statutes/index.cfm?App_mode=Display_Statute&Search_String=&URL=0700-0799/0732/Sections/0732.501.html