This article was co-authored by Gina D'Amore. Gina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

There are 10 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 98,866 times.

Writing a check to two people is a common way to gift money to a newly married couple, or to pay individuals who share a common asset, such as a house or business. There are different ways to write such a check, though, and these different ways determine how the check can be deposited or cashed by its payees. Something as little as a single word can change the check’s validity and endorsement requirements, so you should learn about the process before you pay.

Steps

Preparing to Pay

-

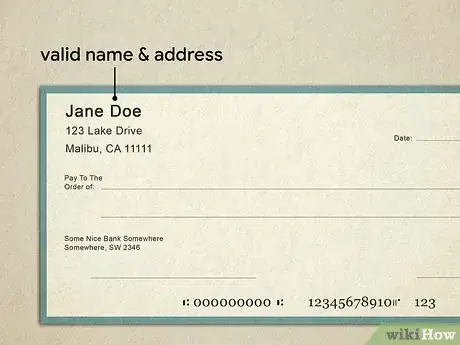

1Make sure you have a valid check with your current address. If your check is out of date or invalid in some way, your payees won’t be able to deposit or cash the check, even if you’ve filled it out correctly.

- Some banks will accept a current address hand-written onto a check with an old address, but contact your bank first to make sure this is acceptable.[1]

-

2Check that you have the funds to cover the check. If you have an online banking portal, log in to make sure you have the necessary funds in your account before you write and hand over the check. If you don’t have online access to your account information, stop by the bank or an ATM and check your balance that way.

- Failing to verify funds before writing a check has serious consequences. First of all, your payees won’t get the money you intended for them. Second, your bank and the payees’ bank will charge you an insufficient funds fee for bouncing the check. Such fees can be high, so it’s always worth it to double-check your account before committing yourself.[2]

Advertisement -

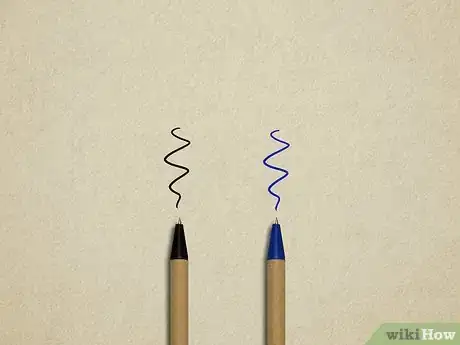

3Get a blue or black pen. Not only is colored ink harder to read, but it can also nullify the check or trigger unwanted safety measures like fraud alerts.[3]

- Some ball point pens deliver ink in such a way that it smudges easily, which can obscure important information on the check and, if it smudges to the point of illegibility, even cause the check to get rejected. You can avoid unwanted smudging by making sure that you select a pen and ink that doesn’t bleed easily.

- Never use a pencil to write a check. It can be easily altered to reflect an amount or payee which is different from your original intention.[4]

-

4Make sure you have all the correct information. Check the spelling of your payees’ names and make sure you know the proper amount to assign to the check.

- While most financial institutions will accept and cash checks if a payee’s name is misspelled, you shouldn’t bank on this likelihood.[5] Avoid any potential delays or confusion by double-checking your payees’ information beforehand.

Writing the Check

-

1Date the check. In the date field on the check, write today’s date. This is important because it dictates how long the payee will have to deposit or cash the check.

- Most banks will refuse to cash or deposit a check that is more than six months old, so make sure your payees know to use the check as soon as possible.[6]

-

2Decide whether you want one or both parties to endorse the check. This determines whether you’ll separate the names using “and” or “or” on the “Payable To” line.

- Use “and” if you want both individuals to sign the check. Alternately, use a plus sign or comma in place of “and.” Choosing this option means that neither party can do anything with the check unless they have express consent and cooperation from the other payee, so it’s a good idea to use this option if you aren’t very familiar with the payees’ relationship or whether or not they have a joint account.[7]

- Use “or” if you want only one of the parties to endorse the check. This means that either payee can cash or deposit the check with only their own endorsement. This is a good option if you know your payees very well and can be sure neither party would use the check without the other’s knowledge. In this case, it makes the process more convenient for the payees, since either of them can deposit or cash the check at any time.[8]

- Be aware that, even if you decide to use “or” to link the payees’ names, the bank might use their discretion to require both parties to sign in any case. This policy varies from bank to bank and is designed to protect both bank and customer from fraudulent activity.[9]

-

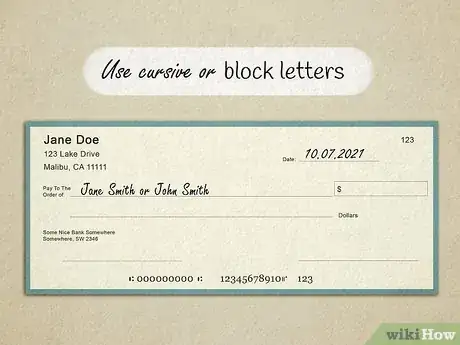

3Write the names of both payees on the “Payable To” line. Separate the two names with either “and” or “or," depending on what you decided regarding how many payees should have to endorse the check.

- For example, if paying two individuals with different last names, write “John Doe and/or Jane Smith.”[10]

- Find out if the two payees have the same surname. If so, you won’t need to repeat the last name on the “Payable To” line. For example, if paying a married couple, address the couple as “Mr. and Mrs. John Doe” instead of “Jane Doe and John Doe.” If the couple is married but keeping distinct last names, or if the two payees are linked by business purposes, you will need to enter both their full names.

-

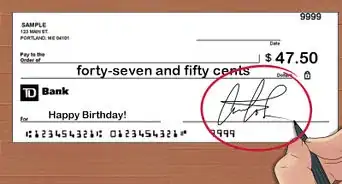

4Use cursive or block letters to print legibly. While it used to be customary to write checks in cursive, modern practice permits either cursive or block letters.[11] The most important thing is legibility: use whichever writing form that you do best.

-

5Fill out all other required fields on the check. This includes the numerical dollar amount, written dollar amount, and your own signature.[12]

-

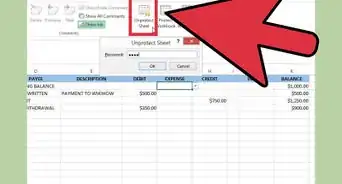

6Record the check in your personal register. Write down the number of the check you’ve just written, as well as its amount and the payees in your paper register or online service such as QuickBooks. This will allow you to keep track of your expenditures and balance your checkbook even if the payee hasn’t cashed or deposited the check yet.[13]

- If you write a lot of checks, you should keep a memo or other notation system which describes the purpose or purchase of each check.

Expert Q&A

-

QuestionCan I order checks from my bank over the phone?

Gina D'AmoreGina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

Gina D'AmoreGina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

Financial Accountant Sure, but you will need to prove your information and the checks will go directly to the address on your account. This is a way to prevent fraud. Let's say someone had all your information and was trying to order checks from your bank. The other person will not be able to change the address, and you would be the one to receive them.

Sure, but you will need to prove your information and the checks will go directly to the address on your account. This is a way to prevent fraud. Let's say someone had all your information and was trying to order checks from your bank. The other person will not be able to change the address, and you would be the one to receive them. -

QuestionWhat if both payees have long names? Can I use both the first and second line?

DonaganTop AnswererNo. You'll have to write very small on the top line.

DonaganTop AnswererNo. You'll have to write very small on the top line. -

QuestionCan I use & sign in place of and?

DonaganTop AnswererYou could, but "and" would be better for the sake of clarity.

DonaganTop AnswererYou could, but "and" would be better for the sake of clarity.

Expert Interview

Thanks for reading our article! If you'd like to learn more about writing checks, check out our in-depth interview with Gina D'Amore.

References

- ↑ http://money.stackexchange.com/questions/5450/how-to-correct-a-mistake-made-when-writing-a-check

- ↑ https://wallethub.com/edu/bounced-check/13879/

- ↑ http://www.investopedia.com/articles/personal-finance/061314/dont-sign-legal-pitfalls-signatures.asp

- ↑ http://www.mycreditunionnewsletter.com/dcu/show-me/august12/page4.php

- ↑ http://steadfastfinances.com/blog/2012/06/21/things-that-wont-stop-a-bank-from-cashing-a-check/

- ↑ https://www.tdbank.com/tdhelps/default.aspx/if-i-write-a-check-to-someone-how-long-do-they-have-to-cash-it-before-it-expires/v/39020541/

- ↑ https://www.thebalance.com/endorse-checks-payable-to-multiple-people-315299

- ↑ https://www.thebalance.com/endorse-checks-payable-to-multiple-people-315299

- ↑ https://www.thebalance.com/endorse-checks-payable-to-multiple-people-315299

- ↑ http://www.mybanktracker.com/news/2013/05/15/simon-says-deposit-check-written-payees/

- ↑ http://www.mycreditunionnewsletter.com/dcu/show-me/august12/page4.php

- ↑ http://money.usnews.com/money/blogs/my-money/2015/06/11/why-no-one-knows-how-to-write-a-check-anymore

- ↑ https://www.thebalance.com/use-check-registers-315289