X

This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

This article has been viewed 119,515 times.

An Automated Teller Machine (ATM) card is a great convenience as you can use it to get cash from just about any place in the world. If you just signed up for a new bank account and received your ATM card in the mail, you may use it at any ATM. Here is how to use it to withdraw cash.

Steps

Part 1

Part 1 of 4:

Choosing an ATM and Logging In

-

1Check to see which ATMs belong to your bank's network. This way you will avoid having to pay processing fees. Many banks belong to a large network so you can check on their website to find out which ATMs will not incur a processing fee.

-

2Walk up or drive up to the ATM. If you have children in your car it is much easier to use a drive-through ATM. If you are walking up to a drive-through, watch out for cars.Advertisement

-

3Insert your ATM or debit card face up into the ATM. Look for a diagram on the ATM to show you how to insert your card. The machine will not accept your card or will send it back out if you insert it the wrong way. Then you will know the correct direction to insert it.

-

4Select your language. In the U.S., you will usually be offered a choice of English or Spanish.

-

5Enter your Personal Identification Number (PIN). This is the number you would have given your bank when you opened your checking account. If you forgot it, you will have to call your bank. Then touch or press Enter or Go.

Advertisement

Part 2

Part 2 of 4:

Obtaining Cash

-

1Touch or press Withdraw from the main menu. The ATM will ask you if you want to withdraw from your checking or savings account if you have both. Some ATMs will offer preset amounts called "Fast Cash" where you can select $20, $40, $60, etc.

-

2Enter the amount of money you wish to withdraw. For example, if you want to withdraw $20 you would type 20.00 and press or touch ENTER or Confirm. Remember that most ATMs only give cash in increments of $20, so don't request $25, $65, etc.

-

3Wait while the machine processes your transaction. The cash will come out of a slot usually located in the lower left hand corner of the ATM. If you do not have enough money in your checking account there will be a message stating this on the screen.

-

4Press or touch Yes to accept the processing fee if this ATM is not in your bank's network. This could range from $1 to $5.

Advertisement

Part 3

Part 3 of 4:

Getting a Receipt and Recordkeeping

-

1Press or touch Yes or No for a receipt or no receipt. It is always a good idea to request a receipt and put it in your wallet until you have the chance to record the transaction in your checkbook.

-

2Take your cash and receipt. Always count your cash to make sure you received the correct amount. If it is incorrect you will have to go into the bank during regular business hours to correct the problem.

-

3Decide whether you would like to make another transaction. This is a good opportunity to check balances, make transfers between checking and savings accounts or to make a deposit if your ATM offers these features. Touch or press Yes or No when the screen asks if you want to make another transaction.

-

4Take your card and walk or drive away with your cash. Remember to record the amount you withdrew into your checkbook or however you keep track of your checking account balances. You can then toss out the receipt unless you need it for tax purposes.

Advertisement

Part 4

Part 4 of 4:

Avoiding ATM Fraud and Scams

-

1Make sure no one is looking over your shoulder when you are typing your PIN. Be particularly careful in airports and bus and train stations. Politely ask the person to stand back farther, or you could find another ATM.

-

2Cover the keypad or touch screen with your whole hand when you are typing in your PIN. This way hidden cameras installed by thieves will not be able to read the numbers you type in. Beware of card slots that look like they have been tacked onto the ATM.[1]

-

3Use ATMs that have video surveillance and avoid those in dark, isolated areas. Try not to use them late at night and limit your visits to as few times per week as possible. ATMs found in gas stations, grocery and convenience stores and kiosks have been found to have had fraudulent card reading devices more often than those located outside of banks.

-

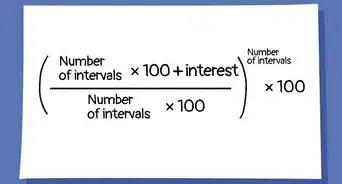

4Check your bank balances frequently. This is the best way to guard against theft and fraud. Notify your bank immediately if you notice any withdraws that you did not make. You will not be liable beyond the first $50 if you report the fraud within 2 days and no more than $500 if you report ATM fraud within 60 days.[2]

Advertisement

Things You'll Need

- ATM

- ATM/Debit Card

References

About This Article

Advertisement