This article was co-authored by Gina D'Amore. Gina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

There are 7 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 12,319 times.

Wiring money is a way to transfer money from one person to another or from one account to another. You can either use your bank's transfer service or a non-bank transfer service like Western Union. Sending money by wire transfer is fast, but can be expensive. To transfer money to a bank account, use your own bank's transfer service. If you want to send cash to a bank account, go through a non-bank transfer service. While domestic transfers can sometimes get processed within a few hours, plan ahead for international transfers. They can take up to 5 days to go through.

Steps

Transferring from Bank to Bank

-

1Log in to your bank account to send money online. Each bank is different, but you might see an option like "send money to another account," "make a payment," or even "transfer money." Follow the instructions provided on screen.[1]

- Some banks also have apps that help you transfer money from one account to another.

- Visit a branch of your bank or call customer service to get help wiring money. Keep in mind that your bank might charge an extra fee for requesting a transfer in person rather than online.[2]

-

2Provide the routing number for the receiving bank. The person receiving your wire transfer should provide you with the routing number for their bank, also known as an ABA number. The routing number can be found at the bottom left side of a check. It is the first 9 numbers.[3]

- You can also find a bank's routing number on the bank's website or from your online banking.

Advertisement -

3Give the name, address, and phone number of the receiving bank. This is to ensure that the money is going to the correct location. The bank information should match with the routing number. Otherwise, the transfer might not go through.[4]

- You can double-check that a bank's information matches the routing number you were given on the ABA website at https://routingnumber.aba.com/default1.aspx

-

4Ask for the recipient's bank account number. The bank account number is the second set of numbers on the bottom left side of a check. It is 12 digits long.[5]

-

5Provide the recipient's name and address as listed on the account. Provide the recipient's full legal name, as well as the address they have on file with the bank. This information must match the information the bank has on file.[6]

- If the information doesn't match, ask the recipient to double-check if they opened the account under a different name or at a different address.

-

6Specify what the funds are for in the description. You can provide a description of the wire transfer. Provide your name, so that the receiver knows who the money is coming from, as well as what the money is for.[7]

- For example, "Jane Doe rent money" would indicate that the money is coming from Jane Doe and is to be used for rent.

-

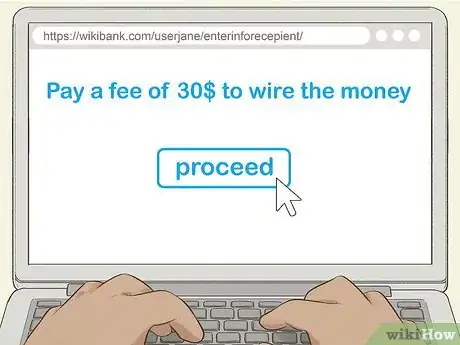

7Pay a fee to wire the money. For a domestic transfer, expect to pay anywhere from $15-35 to wire money. Usually, the fee is around $30. The fee comes out of your bank account when you transfer the money.[8]

- The recipient of the wire transfer might also have to pay a fee to get the money. Fees for receiving a wire transfer are usually $15-20.

- Some banks reduce fees for recurring wire transfers.

-

8Transfer money between two bank accounts in your name by linking them online. If you have 2 or more bank accounts at different banks, log in to one of the accounts and click on "External Transfers" or "External Accounts." There will be a link that allows you to add an external account. Prove that you own both accounts by providing your routing number, account number, username, and password for the second account. Once you have verified that both accounts belong to you, you can transfer funds between the accounts for free.[9]

- Sometimes the first bank will deposit and withdraw a small amount of money into the account at the second bank. The first bank will ask you to log in and check the exact amount to prove that you own and can access both accounts.

- If you have 2 accounts at the same bank, look for a link that says "internal transfers."

Using a Non-Bank Transfer Service

-

1Visit a non-bank wire transfer service's website to send money electronically. You can send funds using a credit card, debit card, or bank account online. Different fees may apply depending on which method you choose.[10]

- Usually, it is cheaper to transfer from a bank account than a card.

- The most well-known wire transfer services in the U.S. are Western Union and TransferWise.

-

2Go to a physical location to transfer cash to a bank account. You don't need to provide your own bank account number or credit card if you are sending cash. However, you will need to provide a photo ID to send the money.[11]

- In some cases it is faster to transfer cash than it is to transfer money from an account.

-

3Ask the receiver for their bank account information. You will need their bank's routing number and their personal account number to send a domestic wire. For an international wire, you'll need a SWIFT code rather than a routing number. Also provide the receiver's full legal name.[12]

- The receiver can also choose to pick up the money in cash. In this case, you won't need to provide a bank account number, just the receiver's name.

- The receiver will have to show a photo ID matching the name the sender provided.

-

4Pay a fee to send the money. The fee will depend on the service provider, whether you are sending money domestically or internationally, and if you are paying cash or with a card. Expect to pay anywhere from $5-40.[13]

- In general, transfer services usually have better rates than banks.

Sending International Wire Transfers

-

1Use an international bank's SWIFT code. A SWIFT (Society for Worldwide Interbank Financial Telecommunication) code works as an international routing number. It identifies the bank you are sending money to. Ask the receiver to provide the SWIFT code for the bank.[14]

- If you have the name and address of the bank, you can look up the SWIFT code.

- You may also have to provide the bank's name and address to confirm the SWIFT code.

-

2Provide the receiver's full name and account number. The receiver's name should match the name on the account. The receiver should also provide you with an account number.[15]

- If you are wiring to a business account, provide the name and address of the business.

-

3Send the transfer in the recipient's currency. Sending in the recipient's currency is a courtesy that allows them to collect the transfer without converting it. You can select this option when transferring money online, or ask the customer service representative working with you to send in the receiver's currency.[16]

- You may have to pay a conversion fee.

- Banks often skew the conversion fee in their favor, to make a profit from converting.[17]

-

4Pay the fee for international wire transfers. International wire transfers are more expensive than domestic transfers because they require more verification. Expect to pay $25-65, usually around $40.[18]

- The receiver may need to pay a fee to collect the transfer, usually around $15-20.

-

5Expect the transfer to take 1-5 business days. Some wire transfers go through within one day, but international transfers usually take longer. If the transfer hasn't arrived within 5 business days, contact your bank.[19]

- If you need to track the transfer, you may have to pay a tracer fee.

Warnings

- Make sure you are transferring money to a trustworthy person or business. Scammers often use wire transfers because you can't get your money back once you have sent it.⧼thumbs_response⧽

- Double-check the amount of money you are sending, especially if there are conversions involved.⧼thumbs_response⧽

References

- ↑ https://www.moneyadviceservice.org.uk/en/articles/making-phone-or-online-transfers

- ↑ https://www.finder.com/bank-fees-wire-transfers

- ↑ https://wallethacks.com/how-to-find-your-banks-routing-number/

- ↑ https://www.finder.com/bank-fees-wire-transfers

- ↑ https://wallethacks.com/how-to-find-your-banks-routing-number/

- ↑ https://www.finder.com/bank-fees-wire-transfers

- ↑ https://www.finder.com/bank-fees-wire-transfers

- ↑ https://www.finder.com/bank-fees-wire-transfers

- ↑ https://www.nerdwallet.com/blog/banking/how-to-transfer-money-from-one-bank-to-another/

- ↑ https://www.nerdwallet.com/blog/banking/what-is-a-wire-transfer/

- ↑ https://www.nerdwallet.com/blog/banking/what-is-a-wire-transfer/

- ↑ https://www.nerdwallet.com/blog/banking/what-is-a-wire-transfer/

- ↑ https://www.nerdwallet.com/blog/banking/what-is-a-wire-transfer/

- ↑ https://www.finder.com/bank-fees-wire-transfers

- ↑ https://www.finder.com/bank-fees-wire-transfers

- ↑ https://www.finder.com/bank-fees-wire-transfers

- ↑ https://www.thesimpledollar.com/banking/international-wire-transfer/

- ↑ https://www.finder.com/bank-fees-wire-transfers

- ↑ https://www.nerdwallet.com/blog/banking/best-ways-to-wire-money-internationally/