This article was co-authored by Andrew Lokenauth. Andrew Lokenauth is a Finance Executive who has over 15 years of experience working on Wall St. and in Tech & Start-ups. Andrew helps management teams translate their financials into actionable business decisions. He has held positions at Goldman Sachs, Citi, and JPMorgan Asset Management. He is the founder of Fluent in Finance, a firm that provides resources to help others learn to build wealth, understand the importance of investing, create a healthy budget, strategize debt pay-off, develop a retirement roadmap, and create a personalized investing plan. His insights have been quoted in Forbes, TIME, Business Insider, Nasdaq, Yahoo Finance, BankRate, and U.S. News. Andrew has a Bachelor of Business Administration Degree (BBA), Accounting and Finance from Pace University.

There are 15 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 26,810 times.

The stock market is constantly changing. It may seem difficult to keep track of the various movements in the market, but fortunately, there are a number of tools, websites, and other resources that can give you the trends and data. If you’re interested in larger market trends, stock indexes and financial sites will do the work for you. Keep an eye on individual stocks to know when to buy and sell. If the information seems overwhelming, don't worry. You can easily track your portfolio online or offline.

Steps

Finding Resources About Stocks

-

1Read financial news daily to learn trends and predictions. Financial news sites will often identify the major trends, falls, and predictions for you. Many will also provide the major stock indexes as well as information on each individual stock. There are many different places you can stay up-to-date with the market. Some popular ones include:[1]

- Wall Street Journal: https://www.wsj.com/

- Bloomberg: https://www.bloomberg.com/

- MarketWatch: https://www.marketwatch.com/

- Yahoo Finance: https://finance.yahoo.com/

-

2Open an online brokerage account to manage your portfolio. If you like to do your own trading, an online brokerage account will help you map the trends in your portfolio. Online accounts can keep track of how well your stock is doing and provide updated information about a stock’s highs, lows, risk, and prices.[2]

- Online brokerage firms include Ameritrade, E-trade, and Ally. These might charge a fee for every trade.

- These accounts will also give the history of individual stocks. You can look up the daily highs and lows for a stock, as well as its historical performance.

- Some websites may even give a rating to each stock to let you know how risky it is.

Advertisement -

3Talk to a stock broker if you want personalized information. A stock broker will be able to teach you about the current market, stock history, and industry standards. If you’re new to stock trading, a stock broker will also be able to help you develop a portfolio that will help you reach your financial goals.[3]

- You can find brokers at investment firms. Stock brokers charge a commission. Some may require you to invest a certain level of money with them to open an account.

- Tell the broker what your financial plans are, such as saving for retirement or buying a home. They’ll build a portfolio aimed towards your specific financial needs.

Identifying Market Trends

-

1Pay attention to major stock exchanges. A stock exchange is a market where you can buy and sell stocks. There are multiple exchanges both in the US and around the world. When studying the stock market, you should make sure that you are aware of the trends in each exchange. While some companies trade among various exchanges, others may only trade on one.[4]

- The New York Stock Exchange (NYSE) is the largest exchange in the world. Stocks on the NYSE are generally considered to be more stable and less risky.

- The NASDAQ is the second largest. Technology companies tend to trade more on the NASDAQ than the NYSE.

- The London Stock Exchange (LSE) is the main hub for the UK market. It is also traded electronically.

- You may also want to pay attention to other international exchanges, such as the Tokyo Stock Exchange or EuroNext.

-

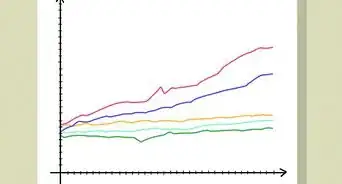

2Read the major stock indexes regularly. Stock indexes are companies that compile all of the changes in individual stock exchanges. This data is put into graphs that show whether the market rose, fell, or stayed stable that day. Stock indexes are a great way to see how well general markets are doing at a specific time. These indexes are all available online.[5]

- The 2 most important indexes in the United States are the Dow Jones Industrial Average (DJIA) and the Standard and Poor’s 500 (S&P 500).

- Some stock indexes are focused on particular regions. The Nikkei 225, for example, represents the Tokyo Stock Exchange. Others, such as the S&P Global 100, compare multiple regions.

- Stock indexes represent how well the market is doing in real time. For example, the Financial Times Stock Exchange (FTSE), which represents the LSE, is updated every 15 seconds.

-

3Look at the change and percentage change for markets each day. Stocks can rise and fall rapidly, so it is best to look at how much the price has changed since the exchange opened that day. Stock indexes and trading websites will list the change and percentage change for each stock. Positive changes are marked in green while negative changes are marked in red.[6]

- The change may be +.50 if the stock rose 50 cents in value or -.50 if it fell 50 cents in value.

- The percentage change is what percentage of its opening value it lost or gained.

- Changes are noted both for individual stocks as well as markets and indexes.

-

4Read the news for outside factors that can influence the market. Interest rates, political unrest, natural disasters, and company buyouts can all have an effect on the stock market. Read newspapers, financial websites, and political blogs every day to stay aware of any event that might influence the market.[7]

- If there is an earthquake in San Francisco, the markets might drop in response, as investors might think that it will slow or stop economic growth.

- Watch out for economic changes, such as interest rates or changes in the value of currencies.

- If two companies merge, then the stock of the acquiring company usually drops while the stock of the bought or acquired company usually rises.

- Stay aware of international markets. The European and Asian markets tend to close by the time the American market opens.

Evaluating Individual Stocks

-

1Read the annual report to learn if the company is stable and profitable. The annual report often contains an income statement, a balance sheet, and a cash flow statement. You can find the annual report by contacting the investor relations department at the company or by visiting the investment page on their website.[8]

- The income statement tells you how much the company made. Generally, profitable companies tend to do better on the stock market, although profitability is not the only factor.

- The balance sheet compares the assets and liabilities of the company. Look for a company that has more assets than liabilities.

- The cash flow shows where they made and lost money. Each company and industry will have different types of expenditures.

-

2Research 52-week high/lows to identify average prices in the market. It is generally recommended to sell high and buy low, but it can be hard to understand what the high and low points are for a certain stock. Daily highs and lows can fluctuate significantly. You will get a better idea of the stock’s value from the 52-week high/low.[9]

- For example, let’s say Ulta (ULTA) has a 52-week high of $314.86 and a 52-week low of $187.96.

- If ULTA goes above the 52-week high, it might be a good time to sell. Similarly, if it goes below its 52-week low, you might want to buy.

- So, you might want to buy ULTA stock when it is below $187.96 USD and sell it when it is near or above $314.86 USD.

- Any online stock broker will tell you the 52-week high/low on the page for the stock, but you can also just search for it online.

-

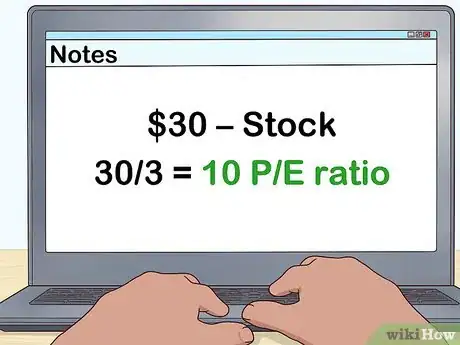

3Check the price/earnings ratio (P/E) if the stock pays dividends.Dividends are quarterly or yearly payments that a company may choose to pay its shareholders. Not all companies offer dividends on their stock, but those that do will have a P/E ratio. This ratio divides the price of the stock to the yearly earnings of the dividends.[10]

- For example, consider a stock that costs $30. Each year, shareholders might earn $3 per share. In this case, 30 is divided by 3. The P/E ratio is 10.

- A P/E ratio in the teens is considered “average.” A high P/E is considered expensive while a low P/E is considered cheap.

- Companies that offer dividends include Wal-Mart, McDonald's, AT&T, Coca-Cola, and Verizon.

-

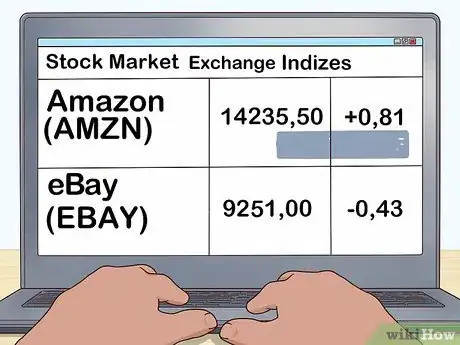

4Compare the stock with stocks from similar companies. Look for another stock from the same industry with a similar size to the company you are studying. You can even compare the stock to its direct competitors. This can help you determine if the stock is a good choice compared to its competitors.[11]

- For example, do not compare Amazon (AMZN), an e-commerce company, with Antero Resources Corporation (AR), which is in the energy section.

- Instead, compare Amazon with eBay (EBAY) or Apple (AAPL), which are both competitors of Amazon.[12]

- Plug the companies into a stock comparison tool to quickly compare them. Popular stock comparison tools include NASDAQ, Google Finance, and MarketBeat.

Keeping Track of Your Stocks

-

1Use an online investment portfolio. There are many programs available that can help your portfolio. If you use an online broker, it may keep track of your portfolio for you. If you use a personal broker or if you have different types of investments, however, you may want to use a separate portfolio tool, such as:[13]

- Morningstar

- Personal Capital

- Google Finance

- SigFig

-

2Set up daily stock alerts to be delivered to your email. Many websites, online brokerage accounts, and electronic market exchanges will send you alerts when the stock reaches a certain price. In most cases, you will need to set up an account, provide your email, and state when you want an alert.[14]

- Both NASDAQ and the LSE offer email alerts through their web pages. You can also use a company like Stock Monitor or Zignals.

- You can set alerts to know when a stock reaches a certain price or if there is a significant move in the stock’s daily price action.

-

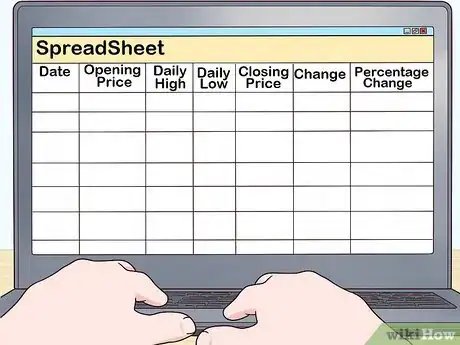

3Create a spreadsheet with all of your stocks. If you prefer to track your own stocks, you can always make a spreadsheet on your computer or even by hand. Create columns for date, the opening price, the daily high, the daily low, the closing price, the change, and the percentage change. Put the day’s date under the date column. For each day, fill in the columns according to the stock’s data.[15]

- The opening price is the price at the beginning of the day and the closing price is the price at the end of the day.

- The daily high is the highest price that day and the daily low is the lowest.

- Each individual stock should have its own spreadsheet. You can also create a spreadsheet to record the overall value of your portfolio.

Expert Q&A

-

QuestionShould I keep my 401k in the stock market?

Andrew LokenauthAndrew Lokenauth is a Finance Executive who has over 15 years of experience working on Wall St. and in Tech & Start-ups. Andrew helps management teams translate their financials into actionable business decisions. He has held positions at Goldman Sachs, Citi, and JPMorgan Asset Management. He is the founder of Fluent in Finance, a firm that provides resources to help others learn to build wealth, understand the importance of investing, create a healthy budget, strategize debt pay-off, develop a retirement roadmap, and create a personalized investing plan. His insights have been quoted in Forbes, TIME, Business Insider, Nasdaq, Yahoo Finance, BankRate, and U.S. News. Andrew has a Bachelor of Business Administration Degree (BBA), Accounting and Finance from Pace University.

Andrew LokenauthAndrew Lokenauth is a Finance Executive who has over 15 years of experience working on Wall St. and in Tech & Start-ups. Andrew helps management teams translate their financials into actionable business decisions. He has held positions at Goldman Sachs, Citi, and JPMorgan Asset Management. He is the founder of Fluent in Finance, a firm that provides resources to help others learn to build wealth, understand the importance of investing, create a healthy budget, strategize debt pay-off, develop a retirement roadmap, and create a personalized investing plan. His insights have been quoted in Forbes, TIME, Business Insider, Nasdaq, Yahoo Finance, BankRate, and U.S. News. Andrew has a Bachelor of Business Administration Degree (BBA), Accounting and Finance from Pace University.

Finance Executive Well, it depends on your age and your time horizon when you need this money. If you're in retirement, the best way to protect your money is to convert from stocks to either cash or bonds. If the stock market were to crash and you have cash, you maintain your purchasing power. If you're young, and you have a very long time horizon—20 to 40 years, give or take—, it makes sense to stay in stocks.

Well, it depends on your age and your time horizon when you need this money. If you're in retirement, the best way to protect your money is to convert from stocks to either cash or bonds. If the stock market were to crash and you have cash, you maintain your purchasing power. If you're young, and you have a very long time horizon—20 to 40 years, give or take—, it makes sense to stay in stocks.

Expert Interview

Thanks for reading our article! If you'd like to learn more about stock trading, check out our in-depth interview with Andrew Lokenauth.

References

- ↑ https://www.stocktrader.com/learn-stock-trading/

- ↑ https://finance.zacks.com/online-investing-vs-personal-broker-6720.html

- ↑ https://www.forbes.com/sites/samanthasharf/2016/01/20/how-to-find-the-right-broker-and-start-investing-now

- ↑ https://www.investopedia.com/articles/basics/04/092404.asp

- ↑ https://www.investopedia.com/articles/analyst/102501.asp

- ↑ https://www.investopedia.com/terms/p/percentage-change.asp

- ↑ https://www.forbes.com/2007/08/29/market-timing-djia-pf-education-in_gc_0829investopedia_inl.html#4ea6d85b7580

- ↑ https://www.thestreet.com/story/10362279/1/getting-started-fundamental-analysis.html

- ↑ https://www.investopedia.com/terms/1/52weekhighlow.asp

- ↑ http://guides.wsj.com/personal-finance/investing/how-to-evaluate-a-stock/

- ↑ https://www.thestreet.com/story/10362279/1/getting-started-fundamental-analysis.html

- ↑ https://www.investopedia.com/ask/answers/120314/who-are-amazons-amzn-main-competitors.asp

- ↑ https://www.forbes.com/sites/robertberger/2014/04/16/the-best-online-tools-to-track-your-investments/#17de386185ba

- ↑ https://www.investopedia.com/articles/investing/031115/5-top-portfolio-management-apps.asp

- ↑ http://education.howthemarketworks.com/beginners/using-excel-track-stock-portfolio/

-Step-3.webp)