This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

There are 13 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 28,417 times.

If you suspect someone of benefit fraud, you should try to confirm your suspicions. There are many benefit programs, each with its own eligibility criteria. What looks like fraud to you may, in fact, be a legitimate use of benefits. If you are reasonably confident that a person has committed fraud, however, you can report them to the appropriate government authority for investigation.

Steps

Preparing to Report the Fraud

-

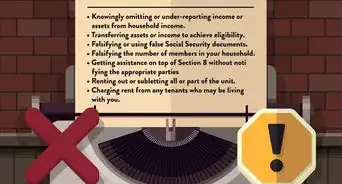

1Identify fraud. Fraud can take many forms. In general, there are two main types of fraud. A person commits fraud when they either lie or fail to report relevant information on their benefits application.[1] Examples include stating that you are single when you are married and not reporting savings or earnings.[2] [3]

- A person also commits fraud when they misuse benefits. Many benefit programs limit how their beneficiaries can spend their benefits. If a person spends their benefits on unauthorized goods or services, they have also committed fraud.

- Beneficiaries must also report a change in circumstance. For example, if you applied for benefits when you were unemployed, you must report when you find a job. Furthermore, if a beneficiary dies, then his or her death should be reported so that benefits are stopped.

-

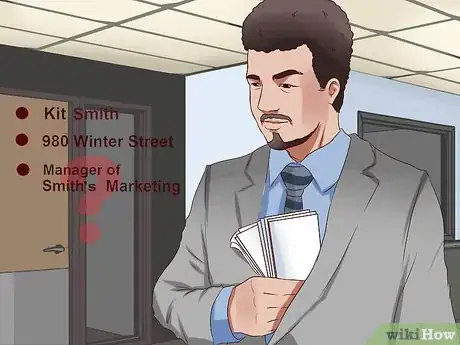

2Gather information. To successfully report benefit fraud, you will need sufficient information so that the authorities can perform an investigation. You should try to gather as much of the following as possible:[4]

- the name and address of the person committing the fraud

- the name and address of the person’s partner (if any)

- a description of the person

- the benefit fraud they are committing

- why you suspect the fraud

- information about the person’s job and vehicle, if applicable

Advertisement -

3Confirm the fraud. By reporting someone for benefit fraud, you potentially threaten an important source of income for people who may have few options for supporting themselves. Although you do not need to be absolutely certain that benefit fraud has been committed, you should try to confirm the fraud before reporting it.

- For example, if you think someone is on benefits and is working because they leave their home every day, you might want to ask where they are going. They may be leaving every day to interview for jobs or to volunteer.

- If you think a beneficiary has died because you haven’t seen him in a long time, then you should check newspaper obituaries and the internet. The person may only be sick and confined to bed.

-

4

Reporting Benefit Fraud in the U.K.

-

1Understand the penalties for fraud. If a beneficiary commits fraud, then many of those benefits can be stopped or reduced. For example, Pension Credit, Universal Credit, Income Support, and Carer’s Allowance can be reduced or stopped if fraud is found.[9]

- Some benefit programs cannot be reduced or stopped. These include Child Benefit, Guardian’s Allowance, State Pension, and Disability Living Allowance.[10]

-

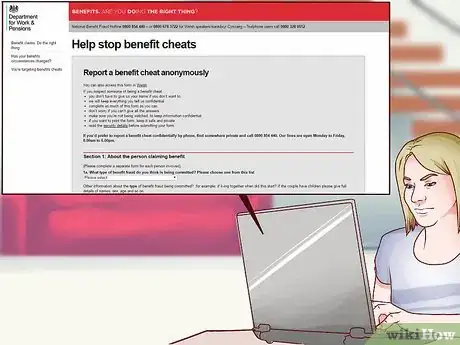

2Report the fraud online. You can report benefit fraud to the Department of Work and Pensions by visiting the Targeting Benefit Thieves website at https://secure.dwp.gov.uk/benefitfraud/. You can access the form in English or Welsh.

- Answer as many questions as possible. Skip questions if you don’t know the answer.

- Print off the form and keep a copy for your records in a safe and private place.

- If you want to remain confidential, be sure that no one is watching you as you complete the form.[11]

-

3Report the fraud by post. If you do not want to report the suspected fraud online, then you may also write a letter containing the requested information. Mail the letter to NBFH, PO Box 224, Preston, PR1 1GP.[12]

- You should keep a copy of your letter for your records.

-

4Report by telephone. If you choose not to report online or by post, then you can also report over the telephone. Call 0800 854 440. If reporting by text phone, then text 0800 328 0512. Someone is available to take your call Monday through Friday, 8:00 am to 6:00 pm.[13]

- To report by Welsh telephone, call 0800 678 3722.

-

5Provide additional documents if requested. After you report the fraud, the DWP Fraud Investigation Service will look into the matter. Unfortunately, DWP will not be able to update you on the status of the investigation.[14] However, if the office needs more information from you, you should provide it promptly.

Reporting Social Security Fraud in the U.S.

-

1Understand Social Security benefits. The Social Security Administration (SSA) administers several benefits programs. They include retirement benefits (which are commonly called “Social Security”), disability benefits, and the Supplemental Security Income program.[15] [16]

- In many situations, SSA also provides survivor’s benefits to children and widows/widowers of beneficiaries.

- SSA also contracts or provides grants with many different businesses.

-

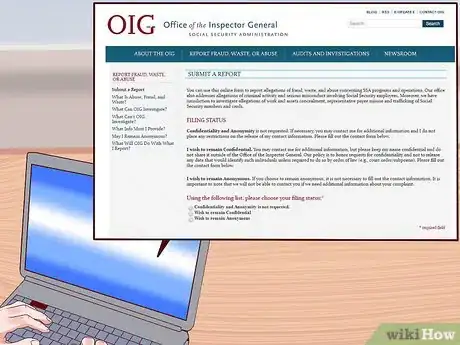

2Report online. You can submit a report at https://www.socialsecurity.gov/fraudreport/oig/public_fraud_reporting/form.htm. You should provide as much of the following information as possible:[17]

- If you are reporting as an individual or as a representative for a business.

- Your personal contact information (name, address, home and work phone numbers, as well as your Social Security number).

- Whether you were the victim of the violation/fraud that you are reporting.

- Whether the person who committed the fraud is a private individual or a business.

- The alleged perpetrator’s contact information, date of birth, sex, race, and state of birth. If the perpetrator is a business, then provide the business’s contact information and Employer Identification Number.

- The primary victim’s name, contact information, Social Security number, date of birth, sex, and race.

- Your summary description of the fraud. In 4,000 characters, provide the “who, what, where, when, how, and why” of the fraud. You should also identify anyone else who has information about the fraud.

-

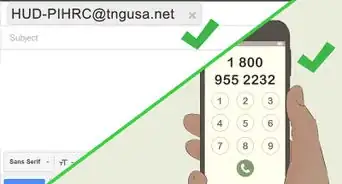

3Report by phone. If you do not want to submit a report to SSA online, then you can report by telephone. You can call toll free 1-800-269-0271 from 10:00 am to 4:00 pm Eastern Standard Time. If you are deaf or hard of hearing, then call 1-866-501-2101.

- If you cannot reach anyone at the above number, then call 1-800-772-1213 from 7:00 am to 7:00 pm. You may also report fraud to any Social Security office. The information will then be forwarded on.

-

4Report by mail. If you choose not to call or report online, you may report fraud by mailing a letter that contains the necessary information. Send it to Social Security Fraud Hotline, PO Box 17785, Baltimore, MD 21235.

- You can also fax the letter to 410-597-0118.

Reporting Food Stamps Fraud in the U.S.

-

1Understand food stamps. The Supplemental Nutrition Assistance Program (SNAP) is a benefit program aimed at low-income individuals and families.[18] To be eligible, people must have income and assets below a certain threshold.[19] They must also spend benefits on only certain foods, such as breads, fruits and vegetables, dairy products, and meat.

- Benefits cannot be spent on alcoholic beverages, pet supplies, hot foods, or foods that can be eaten in a store.[20]

-

2Report by phone. To report SNAP fraud by telephone, you can call 1-800-424-9131 or 202-690-1622. For the deaf or hard of hearing, call 202-690-1202.[21]

-

3Report by mail. You can write a letter with all supporting details and mail it to United States Department of Agriculture, Office of Inspector General, PO Box 23399, Washington, DC 20026-3399.[22]

-

4Email your letter. If you don’t want to call or mail a letter, you can email details to the USDA. Send an email to usda_hotline@oig.usda.gov.[23]

-

5Report fraud to your state. As a final option, you can report SNAP fraud to your state instead of to the federal government. You should report to your state if you think someone lied about income or assets in order to qualify, or if you think the person has misused their benefits.[24]

- To find your state office, check the list of fraud hotlines maintained by USDA and available at https://www.fns.usda.gov/report-nutrition-assistance-fraud-state.

References

- ↑ https://www.gov.uk/benefit-fraud

- ↑ https://secure.dwp.gov.uk/benefitfraud/

- ↑ http://oig.ssa.gov/making-false-statements-claims

- ↑ https://www.gov.uk/report-benefit-fraud

- ↑ https://www.gov.uk/report-benefit-fraud

- ↑ http://oig.ssa.gov/report-fraud-waste-or-abuse/may-i-remain-anonymous

- ↑ https://secure.dwp.gov.uk/benefitfraud/

- ↑ http://oig.ssa.gov/report-fraud-waste-or-abuse/may-i-remain-anonymous

- ↑ https://www.gov.uk/benefit-fraud

- ↑ https://www.gov.uk/benefit-fraud

- ↑ https://secure.dwp.gov.uk/benefitfraud/

- ↑ https://www.gov.uk/report-benefit-fraud#other-ways-to-apply

- ↑ https://www.gov.uk/report-benefit-fraud#other-ways-to-apply

- ↑ https://www.gov.uk/report-benefit-fraud#other-ways-to-apply

- ↑ http://www.ssa.gov/disability/

- ↑ http://www.ssa.gov/disabilityssi/ssi.html

- ↑ https://www.socialsecurity.gov/fraudreport/oig/public_fraud_reporting/form.htm

- ↑ http://www.fns.usda.gov/snap/supplemental-nutrition-assistance-program-snap

- ↑ http://www.fns.usda.gov/snap/eligibility

- ↑ http://www.fns.usda.gov/snap/eligible-food-items

- ↑ http://www.fns.usda.gov/fraud/how-can-i-report-snap-fraud

- ↑ http://www.fns.usda.gov/fraud/how-can-i-report-snap-fraud

- ↑ http://www.fns.usda.gov/fraud/how-can-i-report-snap-fraud

- ↑ http://www.fns.usda.gov/fraud/how-can-i-report-snap-fraud