This article was written by Jennifer Mueller, JD. Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow's legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.

There are 10 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 35,041 times.

When you execute a will, you have no way of predicting how your life might change before you die and the will takes effect. In the meantime, you may divorce and get remarried, have a new child, become estranged from a family member, or lose someone close to you. All of these events and many others may mean you no longer want to leave your assets to someone named in your original will. Generally, to remove a beneficiary from your will, you'll have to complete a process similar to the one you went through when you executed your original will. [1]

Steps

Executing a New Will

-

1Identify the clauses you need to change. If you want to revoke your old will and create a new one, read through your original will carefully. Note the places in which the person's name appears as a beneficiary.[2]

- Creating a new will is one of the most straightforward ways to make any changes to your old one.

- If you're making a new will, you also have the ability to change anything else that seems outdated or no longer appropriate.

- Since you probably will be copying most of the language from your original will into your new one (unless you have substantial changes planned), take care to highlight the portions you need to change.

- Keep in mind that you may not be allowed to disinherit certain people, such as your spouse or your children, under the laws of some states. Contact an estate planning attorney if you think this might be an issue.

-

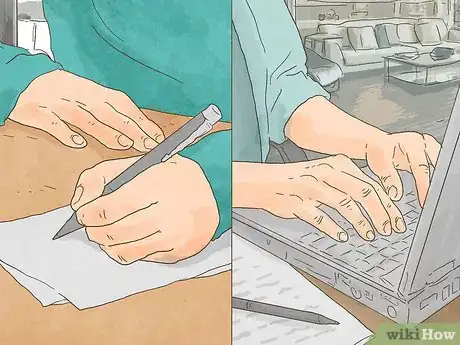

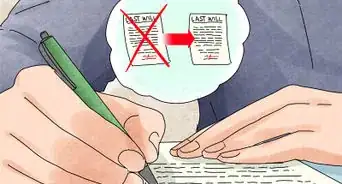

2Copy the format of your existing will. Since you already have a will, you generally can draft a new one on your own – even if you had an attorney draft the original. However, if you do plan to draft a new will, you may want to contact the attorney who drafted the original and let them know what you're planning to do.

- You don't necessarily have to get that attorney to draft your new will. However, they may have copies of your old will, and you want to make sure those are destroyed.

- If you're creating your will using a word processing application on your computer, simply copy the font, paragraph styles, and margins that were used in your original will.

- There's no need to change the title of your will, or to otherwise acknowledge the previous will. Rather, simply include a sentence in the first paragraph that says "With this will, I revoke any and all wills or codicils I previously executed."

Advertisement -

3Keep the language you don't want to change. If the only thing you're doing is removing a beneficiary, you should be able to copy everything else in your will verbatim. Be careful changing any language you don't need to change, as you may unwittingly alter the effect of the will. [3]

- Remember that a will is first and foremost a legal document. Even if you don't understand some of the language and think it's unimportant, include it anyway.

- One factor of legalese many people don't understand is how redundant it seems. However, in the context of wills, these seemingly redundant phrases often are necessary to pass down your assets exactly the way you want.

- This is particularly true if you had an attorney draw up your original will. Changing their language may result in unintended consequences.

-

4Remove and add beneficiaries where appropriate. Ideally, you should be able to simply remove the name of the person you want to remove as a beneficiary, and put another name in their place. [4]

- If you don't want to replace the person, but want to give those assets to another beneficiary already listed, you might want to talk to an attorney about how to rework the language so your new will has that effect.

- You may have given everything in your estate that wasn't specifically given to someone else to one beneficiary.

- If that's the case, and if you no longer wish the specific bequest to go to a particular individual, you can simply remove the clause giving that asset to the beneficiary you want to remove.

-

5Sign your new will. Once you've finished drafting your new will, look over it carefully to make sure you don't have any typos or other errors. You may want to have an estate planning attorney look over it as well.[5]

- When you're satisfied with your draft, print it up for signing. You must follow the same formalities you did when you signed your original will.

- If you don't remember what you did when you signed your original will, look at the document itself. Note the number of witness signatures and whether there's a notary seal.

- The entire proceeding of executing a will typically must be all at once. If you're required to have two witnesses, you may want to call the same people who witnessed your original will.

- Once you've signed your new will, do everything you can to destroy any existing copies of your old will, so there isn't any confusion.

Making a Codicil

-

1Note the provisions you want to change. If you don't want to draft an entirely new will, you also can remove a beneficiary from your will through a codicil, which is essentially an amendment of your original will.[6] [7]

- Before you can draft your codicil, read your will carefully and mark the provisions where the person you want to remove as a beneficiary is listed.

- The easiest way to do this is to make a copy of your will that you can mark up – don't mark on your original.

- On your copy, highlight the provisions you want to change. You also may want to make a note in the margins to indicate how you want to change that provision.

- If there's anything else you see that you want to update or change, make note of that as well.

-

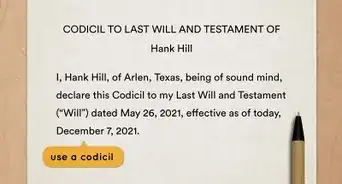

2Copy the formatting of your will. Although a codicil is a much shorter document than the full will, copying the same formatting that was used in your will creates a continuity between the two documents and makes them look as though they belong together.[8] [9]

- Just as you titled your will, you'll also want to title your codicil. Identify which codicil it is so there's no question, in the event you make another one later.

- Assuming this is your first one, you can simply title it "First Codicil to the Last Will and Testament of [your name]."

-

3Write out the changes you want to make. Below your title, you'll want to copy the same introductory paragraphs that were in your will into your codicil – identifying the document as a codicil, rather than a will, where appropriate.[10] [11]

- Following your introduction, list the changes or additions you want to make to your original will. Use the same order as you did in the original will, so the two documents track each other.

- You don't have to copy the entire provision you intend to change verbatim. However, this is something to consider if you worry your changes will be misinterpreted.

- Keep your changes and additions separate. For example, suppose you've acquired property since you executed your will and you want to use the codicil to pass it on as well. That addition would follow the changes you made in removing a beneficiary from your will.

-

4Reaffirm the rest of your will. End your codicil with a paragraph that states that other than the changes you've explicitly made in that codicil, the rest of your assets should pass according to the terms of your original will.[12] [13]

- You can find template codicils online if you're drafting the codicil yourself and want to make sure you have the right language for this paragraph.

- There aren't really any magic words required here, however. You can simply say "Apart from the changes made in this codicil, I reaffirm my Last Will and Testament, dated [date your will was executed]."

- The purpose of including this language is to make it clear that what you're making is a codicil, and not a new will. Without it, you could open the door for dissatisfied family members to challenge your will.

-

5Sign your codicil. You must execute your codicil using the exact same formalities that were used when you signed your original will. Otherwise, it will not achieve its desired effect of amending your original will.[14] [15]

- In most states, this means you must have two witnesses. You also may have to sign in the presence of a notary public.

- An easy way to discern what procedures are required is to look back at your original will. If it had signatures from two witnesses, then you need two witnesses for your codicil. If it includes a notary's seal, those signatures must be made in the presence of a notary.

- Once your codicil is signed, make a copy of it to keep with every copy of your will that you have. This means if you've put copies of your will in different places, you'll need to make a codicil to go with each of them.

Replacing Your Will with a Trust

-

1Evaluate the benefits of a trust. Trusts have many benefits over wills, not the least of which is that they tend to be easier to change than wills are. If you anticipate having to change your will many times over your lifetime, a trust might be better suited to your purposes.[16] [17]

- Another benefit of a trust is that your loved ones will not have to go through probate when you die.

- Since all your assets are already being held by the trust, your successor trustee simply transfers those assets to the beneficiaries you've named.

- You also have the benefit of privacy. While a will must be entered into the probate court, where it becomes a public record, a trust doesn't have to be recorded with the probate court or any government agency.

-

2Consult an estate planning attorney. If you have a will but have decided you'd rather replace it with a trust, you may want to consider talking the matter over with an estate planning attorney before you go forward.[18]

- Particularly if you had an attorney draw up your original will, they probably will be willing to offer you some advice on whether a trust would work for you.

- If you didn't use an attorney to draw up your original will, look for a reputable estate planning attorney in your area. You may be able to get a recommendation from a friend or family member.

- You also can find estate planning attorneys by searching the directory on the website of your state or local bar association's website.

- If you find attorneys who provide free initial consultations, you may want to talk to two or three different attorneys so you can get several opinions. This will allow you to appropriately consider all the estate planning options available to you. #Decide what type of trust you want. Generally, you can create a revocable trust or an irrevocable trust. Ask an estate planning attorney to explain which would be best for your particular estate.[19] [20]

- Revocable trusts can be changed, or ended, at any point during your life. If you make an irrevocable trust, however, you won't be able to end the trust entirely – at least not without going to a lot of trouble.

- If you're married, you also should consider whether you want an individual or joint trust. A joint or shared trust is probably a better idea if you and your spouse own a lot of property together.

- Keep in mind that a joint trust can dispose of both shared and individual assets.

-

3Make a list of your assets. Since you've already executed a will, you can use that as a guide when you list the assets you want to include in your trust. Then you can use this list to help you decide how you want to distribute those assets.[21] [22]

- Typically, anything that would go through probate is something you want to include in your trust – particularly if one of the main reasons you're creating a trust is to avoid probate.

- However, you don't necessarily want to have all of your property in your trust. For example, if you have retirement or investment accounts that already allow you to designate a beneficiary, including those in your trust can cause potential confusion by adding unnecessary complication.

- Go ahead and gather paperwork, such as account statements, deeds, and titles for the assets you want to include in your trust. Once you've signed your declaration of trust you'll need to transfer those assets from yourself into the name of the trust.

-

4Find a form or template. Although you may have consulted an attorney earlier, you typically won't need an attorney to draft your declaration of trust for you. This is particularly true if you have a relatively simple estate with few assets.[23] [24]

- You can find forms or templates online that you can use to draft your declaration of trust yourself. Just make sure the form you choose has been approved for use in your state.

- If you want an attorney to prepare these documents for you, expect to pay at least $1,000. However, if you feel comfortable doing them yourself you typically won't spend more than $100.

- You also may be able to get an attorney to look over the document once you've finished drafting it to check for errors. This shouldn't cost you more than a couple hundred dollars.

-

5Draft your declaration of trust. The declaration of trust is the trust document that is roughly equivalent to the will you've decided to replace. The language may seem similar, but there are some aspects of a trust that aren't present in a will.[25]

- For example, with a living trust, you're going to list yourself both as the grantor – the person creating the trust – and as the trustee. You'll remain trustee as long as you're alive.

- You'll have to name a successor trustee to take over after you die. Most people name their spouse or an adult child. You may want to use the same person you'd named as executor of your will.

- The declaration also establishes the responsibilities of the trustee and successor trustee. If you're using a form, this language will already be included. Just give it a careful read-through and make sure you understand what it's saying.

- After this, you'll list the beneficiaries of the trust, and the property included in your trust. You may want to create a separate document called a "schedule of property" so you can add or remove assets from the trust at any time without drafting a new declaration.

-

6Sign your declaration of trust. Once you've completed your documents, look over them carefully to make sure everything is correct, all names are spelled correctly, and there aren't any typos or other errors.[26]

- The signing procedures for a trust generally aren't as formal as those for a will, but they do vary from state to state.

- You may be able to tell whether witnesses or a notary is required by looking at the form you used that was approved for use in your state. Otherwise, you may want to ask an attorney.

- In most states, you must sign your declaration of trust in the presence of a notary. You don't typically need other witnesses like you would if you were executing a will.

- After signing your declaration, make several copies of it. Then gather the documents you had for the assets in the trust and begin the processing of switching those assets over into the name of the trust.

Warnings

- This article deals with American law. If you live outside the United States, other rules or requirements may apply. Contact an estate planning attorney in your area to find out how you can remove a beneficiary from your will.⧼thumbs_response⧽

References

- ↑ http://www.nolo.com/legal-encyclopedia/when-change-will-29985.html

- ↑ http://www.nolo.com/legal-encyclopedia/when-change-will-29985.html

- ↑ http://www.nolo.com/legal-encyclopedia/when-change-will-29985.html

- ↑ http://www.nolo.com/legal-encyclopedia/when-change-will-29985.html

- ↑ http://www.nolo.com/legal-encyclopedia/when-change-will-29985.html

- ↑ https://www.rocketlawyer.com/document/codicil-to-will.rl

- ↑ http://estate.findlaw.com/wills/changing-a-will.html

- ↑ https://www.rocketlawyer.com/document/codicil-to-will.rl

- ↑ http://estate.findlaw.com/wills/changing-a-will.html

- ↑ https://www.rocketlawyer.com/document/codicil-to-will.rl

- ↑ http://estate.findlaw.com/wills/changing-a-will.html

- ↑ https://www.rocketlawyer.com/document/codicil-to-will.rl

- ↑ http://estate.findlaw.com/wills/changing-a-will.html

- ↑ https://www.rocketlawyer.com/document/codicil-to-will.rl

- ↑ http://estate.findlaw.com/wills/changing-a-will.html

- ↑ http://www.nolo.com/legal-encyclopedia/living-trust-v-will.html

- ↑ https://www.legalzoom.com/articles/will-vs-living-trust-whats-best-for-you

- ↑ http://www.nolo.com/legal-encyclopedia/making-living-trust-yourself-29736.html

- ↑ http://www.nolo.com/legal-encyclopedia/make-living-trust-quick-checklist-29476.html

- ↑ https://www.legalzoom.com/articles/top-5-must-dos-before-you-write-a-living-trust

- ↑ http://www.nolo.com/legal-encyclopedia/make-living-trust-quick-checklist-29476.html

- ↑ https://www.legalzoom.com/articles/top-5-must-dos-before-you-write-a-living-trust

- ↑ http://www.nolo.com/legal-encyclopedia/sample-individual-living-trust.html

- ↑ https://www.rocketlawyer.com/form/living-trust.rl

- ↑ http://www.nolo.com/legal-encyclopedia/sample-individual-living-trust.html

- ↑ http://www.nolo.com/legal-encyclopedia/sample-individual-living-trust.html