This article was written by Jennifer Mueller, JD. Jennifer Mueller is an in-house legal expert at wikiHow. Jennifer reviews, fact-checks, and evaluates wikiHow's legal content to ensure thoroughness and accuracy. She received her JD from Indiana University Maurer School of Law in 2006.

There are 8 references cited in this article, which can be found at the bottom of the page.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 97% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 58,092 times.

When you start a church in the US you typically register it with the state and federal governments. This registration isn't the same as getting a license to operate your church. In fact, there's no legal requirement that you register your church at all. However, if you want to incorporate your church, you must register it with your state's secretary of state. Incorporation is necessary if you want tax-exempt status from the federal government, which can save your church a lot of money and help you use donations more efficiently.[1]

Steps

Forming a Church

-

1Choose the officers for your church corporation. Apart from yourself, choose people who will operate your church and serve on its board of directors. These people will be making important business decisions on behalf of the church.[2]

- Although church officers should all be over 18 years old, there aren't any other legal requirements. Choose officers who believe in your church and will continue to support and uplift your church and its members.

- Officers who are also lawyers or accountants can help your church by offering their professional services free of charge.

-

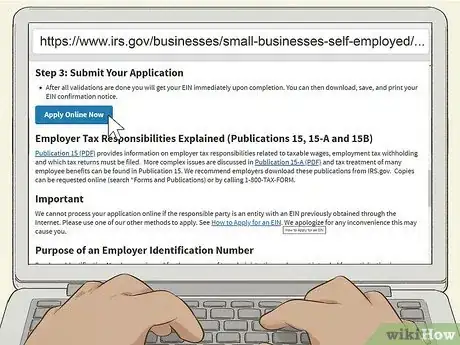

2Apply for an Employer Identification Number (EIN). Think of your church's EIN as its tax identification number. Your church needs one even if it isn't going to have any employees. Otherwise, you'll be stuck using your own Social Security number for church business. An EIN is also required if you're going to incorporate your church.[3]

- You can get an EIN online at https://www.irs.gov/businesses/small-businesses-self-employed/apply-for-an-employer-identification-number-ein-online. This service is only available Monday through Friday from 7:00 a.m. until 10:00 p.m. EST.

- If you want to get an EIN immediately and the online service isn't available, call 1-800-829-4933.

Advertisement -

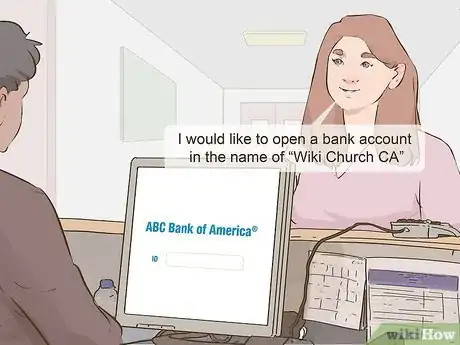

3Open a bank account for your church. Once you have an EIN for your church, you can open up bank accounts in the church's name. You'll need these bank accounts to accept donations, fund projects, and pay any church employees.[4]

- Many churches have special bank accounts available specifically for churches. These accounts typically don't charge any fees and may have other features that can help promote your church. Ask around at different banks to choose the best accounts for your church.

-

4Choose a location for your church. Choosing a location for your church may depend on what area you feel most called to minister to. You may have already identified a building you want to use or you may decide to build a new church building.[5]

- Building a new church building typically requires you to raise significant capital. You may want to use a temporary location while the building is being constructed.

- Talk to other pastors near you to get a feel for areas in your community that aren't being reached as well as others.

Tip: If you start in a temporary location and move the church later, make sure you update the IRS with the new address for your EIN.

-

5Write up the bylaws for your church corporation. The bylaws are the rules of operation for your church's board. You might think of the bylaws as your church's constitution. Typically, you don't have to submit this document to the state when you register your church corporation. However, you will likely need to submit them to the IRS as part of your application for tax-exempt status.[6]

- Your bylaws govern how the church's board operates, hires church employees, and makes decisions on behalf of the church. Bylaws also include information about how board members can step down and new board members can be added.

- Search online for sample bylaws for other churches. These will give you some idea of the types of information to include in your bylaws. You can also get help from an attorney who specializes in church or nonprofit corporation formation.

- In addition to bylaws, many churches also create documents such as a "Statement of Beliefs" or a "Statement of Faith." If you are starting a church of a particular domination, your church's counsel may already have these documents prepared. You would just need your board of directors to adopt them.

Registering Your Church Corporation

-

1Consult an attorney who specializes in church corporation formation. Incorporating a nonprofit organization can be more complicated than incorporating a for-profit business. An attorney will make sure your documents have all the language required by your state to form a nonprofit church corporation.[7]

- Some attorneys offer their services to churches for free. Your local bar association will be able to help you find attorneys that will work with your church's budget and needs.

- Religious legal associations may also be able to connect you with an attorney or give you legal advice.

-

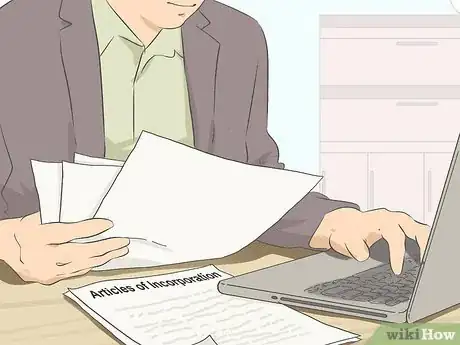

2Draft your church's articles of incorporation. The articles of incorporation is typically the only document you need to file with your state. It lists the name, EIN, and address of your church as well as the names and address of your board members.[8]

- If you've decided not to hire an attorney to draft your documents, look for forms or templates for your state. These are typically available from the office of your state's secretary of state and you may be able to download them from the secretary of state's website.[9]

- To find the website for your state's secretary of state, visit http://www.e-secretaryofstate.com/ and scroll the list until you find your state.

Tip: If you're drafting your own documents, make sure any forms or templates you use have any language required to form a nonprofit religious corporation.

-

3Register your church corporation with your state. When you've completed your articles of organization and any other documents required by your state, submit them to the appropriate state government agency along with the incorporation fee. While fees vary among states, they are typically no more than $100.[10]

- Your state may have a cover sheet or other application form that you need to fill out and file in addition to your articles of incorporation.

- Nonprofit organizations typically must register with their state to solicit donations from the general public. However, churches typically are not required to register and are not subject to the same reporting requirements as other nonprofit organizations.[11]

-

4Comply with your state's corporate recordkeeping requirements. To maintain your corporate status, certain financial and donation records must be kept and made available for inspection upon request. Some states may require regular audit reports to be submitted to the state.[12]

- An accountant who specializes in bookkeeping for churches and other nonprofit organizations can help ensure that your records are maintained according to your state's regulations.

Filing for Tax-Exempt Status

-

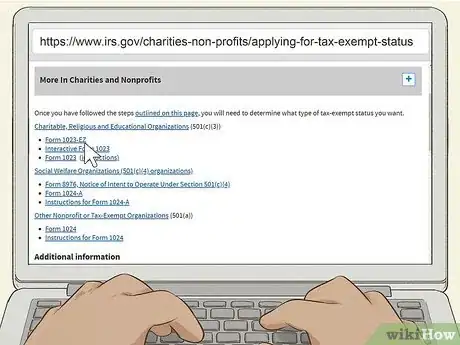

1Complete your application for recognition of tax-exempt status. Visit https://www.irs.gov/charities-non-profits/applying-for-tax-exempt-status to download the form you need. Make sure you also download and read the instructions carefully.[13]

- Filing for recognition of tax-exempt status can be complicated. If you've hired an attorney, they may be able to help you. An accountant or tax professional who specializes in working with nonprofit or religious organizations can also help.

- Some accountants and tax professionals offer their assistance to churches free of charge. Try posting an ad on your church's website or social media asking for help.

-

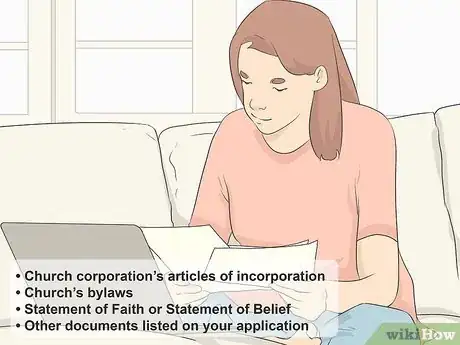

2Gather the required supporting documents for your church. When you apply for recognition of tax-exempt status, you must submit documents that support the information you provided in your application. Some of these documents include:[14]

- Your church corporation's articles of incorporation

- Your church's bylaws

- Your Statement of Faith or Statement of Belief

- Any other documents listed on your application

Tip: Copy or print each document you want to include with your application. At the top of each page, write or type the name of your church, your church's EIN, and the portion of the application the document applies to.

-

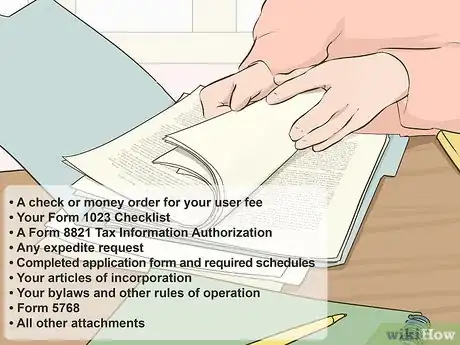

3Organize your application packet following IRS recommendations. The IRS has a specific order in which you should organize your application and documents before you submit it to the IRS. This enables the IRS to process your application more quickly. Generally, follow this order from top to bottom of the packet:[15]

- A check or money order for your user fee

- Your Form 1023 Checklist

- A Form 8821 Tax Information Authorization (if necessary)

- Any expedite request

- Your completed application form and required schedules

- Your articles of incorporation

- Your bylaws and other rules of operation

- Form 5768

- All other attachments

-

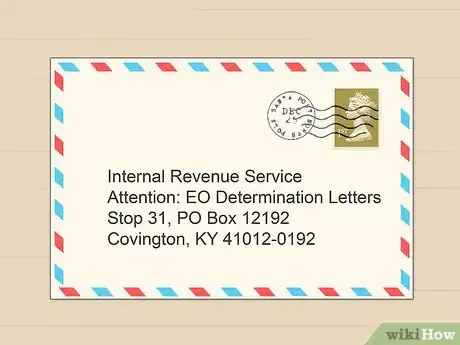

4Send your application packet to the IRS. Mail your packet to Internal Revenue Service, Attention: EO Determination Letters, Stop 31, PO Box 12192, Covington, KY 41012-0192. Include a check or money order for the user fee, which, as of 2019, is $600.[16]

- Use a private delivery service if you want proof of a mail and receipt date. You must use one of the approved delivery services included on the list at https://www.irs.gov/filing/private-delivery-services-pds. Applications submitted using a private delivery service must be mailed to Internal Revenue Service, Attention: EO Determination Letters, Stop 31, 201 West Rivercenter Blvd., Covington, KY 41011.

-

5Wait for a response from the IRS. It may take up to 12 months for the IRS to make a decision on your application. If the IRS has any questions or needs additional information to process your application, an IRS agent will call you.[17]

- If you submitted your application within 27 months of the date you started your church, your tax-exempt status will relate back to that date, regardless of how long it takes the IRS to process your application.

-

6Report your tax-exempt status to your state revenue agency. Even if the IRS recognizes your church as tax-exempt, you still have to register separately with your state. Tax-exempt status does not automatically transfer from federal to state and each state has its own tax-exempt requirements and regulations.[18]

- Go to https://www.irs.gov/charities-non-profits/state-links and click on the name of your state to find out more about your state's tax-exempt registration requirements.

- Once your church's tax-exempt status is recognized, maintain proper financial records according to federal and state requirements. You may want to choose an accountant who is experienced in bookkeeping for churches or other nonprofit organizations.

Tip: Even if the IRS fails to recognize your church as tax-exempt, your church may still be tax-exempt under your state's tax law.

Warnings

- This article describes how to register a church in the US. If you want to start a church in another country, the process will be different. Consult an attorney who specializes in the formation and registration of religious and nonprofit organizations.⧼thumbs_response⧽

References

- ↑ https://www.9marks.org/article/5-questions-on-church-incorporation/

- ↑ https://www.9marks.org/article/5-questions-on-church-incorporation/

- ↑ https://www.irs.gov/pub/irs-pdf/p557.pdf

- ↑ https://www.upcounsel.com/opening-a-church-bank-account

- ↑ https://www.portablechurch.com/2016/church-planting/choosing-church-venue/

- ↑ https://www.9marks.org/article/5-questions-on-church-incorporation/

- ↑ https://www.minnesotaumc.org/files/finance+%26+admin/incorporation+of+local+churches.pdf

- ↑ http://www.bergencountyclerk.org/Services/8

- ↑ https://www.9marks.org/article/5-questions-on-church-incorporation/

- ↑ http://www.bergencountyclerk.org/Services/8

- ↑ https://www.sos.ms.gov/BusinessServices/Pages/Non-Profit-Requirements.aspx

- ↑ https://www.sos.ms.gov/BusinessServices/Pages/Non-Profit-Requirements.aspx

- ↑ https://www.irs.gov/pub/irs-pdf/p557.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/i1023.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/i1023.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/i1023.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/i1023.pdf

- ↑ https://www.sos.ms.gov/BusinessServices/Pages/Non-Profit-Requirements.aspx

-Step-8-Version-3.webp)

-Step-10.webp)

-Step-8-Version-3.webp)

-Step-10.webp)