This article was co-authored by Gina D'Amore and by wikiHow staff writer, Jennifer Mueller, JD. Gina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

This article has been viewed 12,802 times.

Capital expenditures, or CapEx, is the money you invest back into your company so that it can grow and continue operating. Typically, these expenses take the form of purchases of real estate, buildings, equipment, or technology that your company will use for several years. To plan for capital expenditures, create a budget separate from the day-to-day expenses of running your business that takes into account company growth and the overall health of the economy.[1]

Steps

Budgeting for Capital Expenditures

-

1Separate capital expenditures from operating expenditures. Operating expenditures are the day-to-day expenses required to keep your business running, such as office supplies and utilities. Capital expenditures, on the other hand, are expenses for equipment, tools, property, and other assets that your company will use for several years.[2]

- Keeping your CapEx budget separate from your operating budget makes deducting taxes easier. This is because deductions for capital expenses are made over a number of years as depreciation, while operating expenses are deducted in full in the year you incur them.[3]

- CapEx budgets often span longer than a year, which is another good reason to keep them separate from your operating expenses.[4] For example, you might anticipate building a new factory or warehouse, which could take several years to construct and put into operation.

- You never want the same bank account connected to your merchant account as everything else, because the merchant can theoretically file a chargeback and take all the money. It's very responsible for a business owner to have multiple business accounts.

-

2Total your company's need for capital expenditures. Assess your current equipment, buildings, technology, and other capital assets. Determine when each will need upgrades or maintenance and how much those things will cost. This will give you a rough idea of how much your company needs to budget for capital expenditures.[5]

- Many of these needs are fairly predictable. For example, if your company relies on desktop computers, you might estimate that those computers need to be replaced every 3 years. Adding up the replacement cost for each computer gives you an idea of how much your company will need to spend on computers every 3 years.

- Your needs might also be based on your company's growth. For example, you might need to upgrade equipment when your production doubles.

- If you have a larger company, work with your department heads to determine your CapEx needs. Because they work with the equipment and technology on a regular basis, they'll have a better idea of what upgrades and maintenance are needed.

Advertisement -

3Create a maximum spending limit based on your needs. The specific costs for necessary upgrades, maintenance, and eventual replacement of your capital assets give you a base amount for your capital expenditures. However, you'll need to budget more than that to account for any changes that might occur or unforeseen circumstances that might arise.[6]

- Taking company income into account, set the top end of your spending range at 1.5 to 2 times the expenses you've already found.

- When setting your maximum spending limit, consider the position of your company and your projections for the future. If you're optimistic about growth and your sales are trending upward, you might set a higher spending limit than you would if your company was in the midst of a slump in performance.

-

4Time expenditures based on company income and growth. Some expenses may not be necessary at all for several years. Careful planning allows your company to save for those expenses in advance so the money's there when you need it.[7]

- For example, suppose you know you'll need to spend $10,000 on new computers in 5 years. If you budget $2,000 a year towards those computers, you'll have the money when you need to purchase them.

- Other expenses might be triggered by a specific event. For example, if you know you'll need to upgrade your production equipment when your sales double, look at the amount of money you'll need to complete the necessary upgrades and determine when your company will have that money available. This helps you plan your growth strategy and sales goals so that your company doesn't grow beyond its means.

-

5Adjust your CapEx budget based on the economy. National and global economic trends may affect your CapEx budget. Since it's difficult (if not impossible) to predict the state of the economy 5 to 10 years down the road, adjustments are necessary in the event of a downturn.[8]

- For example, if the economy is currently booming and your sector is doing well, you might optimistically plan to invest more of the company's income on capital expenses. However, if a recession is looming 2 years later, you'd want to go back and adjust your CapEx budget accordingly so you could keep your business ahead of the curve.

Calculating Net Capital Expenditures

-

1Find the value for depreciation on the income statement. Your business's most current income statement has a line with a value for depreciation and amortization of capital assets. Use this value to infer net capital expenditures indirectly.[9]

- Make sure you have full financial reports for the same period, since you'll need entries from other reports to calculate net capital expenditures.

-

2Check the balance sheet for PP&E. Look in the assets section of your company's balance sheet for a line that provides the value of your company's property, plant, and equipment (often abbreviated PP&E). You'll see the value for the current accounting period in the second column. The first column gives you the value for the previous period.[10]

- The value of assets decreases over time through depreciation, so don't be surprised if the amount for the current period is lower than the value for the previous period.

-

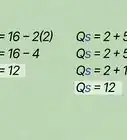

3Subtract the prior period's PP&E from the current PP&E. Subtracting the prior period's PP&E from the current period's PP&E gives you the net increase in PP&E for the period. If your current PP&E is lower than the prior period's PP&E, you'll end up with a negative number, which means the value of your PP&E assets is decreasing.[11]

- For example, suppose your company's PP&E is $25,000 for the current period and $27,000 for the previous period. You would have a net increase in PP&E of -$2,000, which you could also express as a net decrease in PP&E of $2,000.

-

4Add depreciation to infer the net capital expenditures for the period. Use the depreciation figure you found on your company's income statement. Adding this expense to the net increase in PP&E tells you your net capital expenditures for the period. If your net increase in PP&E was negative, add the depreciation to the negative number.[12]

- For example, if your company has a net increase in PP&E of -$2,000 and depreciation expenses of $4,000, you would have net capital expenditures of $2,000 (-2,000 + 4,000 = 2,000).

- Once you've calculated your net capital expenditures, compare them to your budget. If your net capital expenditures exceed the maximum spending limit you budgeted, go back and rework your budget accordingly.

- If your company's net capital expenditures are greater than the depreciation, this means your company's assets are growing over time. Conversely, net capital expenditures that are less than the depreciation indicate shrinking assets.

Warnings

- Avoid borrowing too much to finance capital expenditures. In the event of an economic slump, you may have difficulty making the debt payments. You also run the risk that the expenditure might not result in the gain you originally predicted.[14]⧼thumbs_response⧽

Expert Interview

Thanks for reading our article! If you'd like to learn more about capital expenditures, check out our in-depth interview with Gina D'Amore.

References

- ↑ https://www.investopedia.com/ask/answers/122214/how-should-company-budget-capital-expenditures.asp

- ↑ https://www.investopedia.com/ask/answers/020915/what-difference-between-capex-and-opex.asp

- ↑ https://www.investopedia.com/ask/answers/122214/how-should-company-budget-capital-expenditures.asp

- ↑ https://www.accountingtools.com/articles/capital-expenditure-budget.html

- ↑ https://www.investopedia.com/ask/answers/122214/how-should-company-budget-capital-expenditures.asp

- ↑ https://www.investopedia.com/ask/answers/122214/how-should-company-budget-capital-expenditures.asp

- ↑ https://www.accountingtools.com/articles/capital-expenditure-budget.html

- ↑ https://www.finra.org/investors/insights/how-companies-use-their-cash-capital-expenditures

- ↑ https://corporatefinanceinstitute.com/resources/knowledge/modeling/how-to-calculate-capex-formula/

- ↑ https://corporatefinanceinstitute.com/resources/knowledge/accounting/capital-expenditure-capex/

- ↑ https://corporatefinanceinstitute.com/resources/knowledge/modeling/how-to-calculate-capex-formula/

- ↑ https://www.finra.org/investors/insights/how-companies-use-their-cash-capital-expenditures

- ↑ https://corporatefinanceinstitute.com/resources/knowledge/modeling/how-to-calculate-capex-formula/

- ↑ https://www.finra.org/investors/insights/how-companies-use-their-cash-capital-expenditures

-Step-1.webp)

-Step-2.webp)

-Step-3.webp)

-Step-4.webp)

-Step-5.webp)

-Step-6.webp)

-Step-7.webp)

-Step-8.webp)

-Step-9.webp)