This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

There are 10 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 249,766 times.

Learn more...

A check or cash isn't always a sufficient method for paying a bill or submitting payment for a purchase. However, money orders are widely accepted when cash or checks are not. If you don't have a checking account, a money order also can substitute as a check when paying bills or creditors. Here are some recommendations about how to pay for a money order.

Steps

Choosing a Payment Method

-

1Use cash. Cash is the most widely accepted form of payment for a money order. You can go to any money order provider and purchase a money order with cash. You simply pay for the amount of the money order plus a fee.

- Companies that issue money orders want the most secure form of payment possible because once they issue the money order, their money is as good as gone.

- You can also pay with a debit card linked to your bank account.

- You cannot pay for a money order with a personal check. Checks can take a few days to process. If you don’t have sufficient funds, the money order issuer loses the money.

-

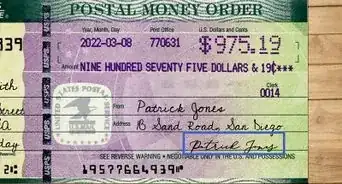

2Buy a money order with traveler’s checks. The only place you can purchase a money order with a traveler’s check is at the United States Post Office (USPS). You will have to pay for the amount of the money order plus a fee based on the money order amount. When you pay, sign the traveler’s check in front of the postal service worker who is preparing the money order for you.[1]

- USPS is willing to accept traveler’s checks because they recognize them as a form of cash.[2]

Advertisement -

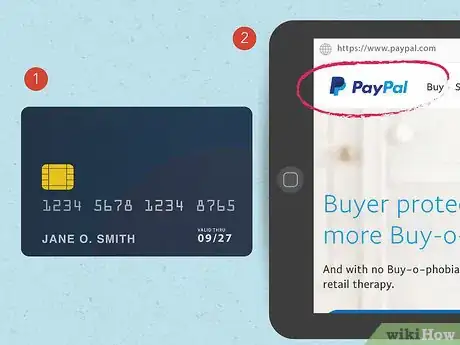

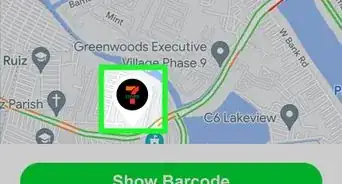

3Purchase a money order with a credit card. Some money order issuers allow you to use a credit card, but not all. You can use a credit card to purchase a money order at Western Union and 7-Eleven. It is expensive to buy a money order with a credit card. Your card issuer will likely view it like a cash advance. This means they will charge you the higher interest rates and fees associated with cash advances. Also, you don’t earn any points or rewards on cash advances, so you won’t earn them for purchasing a money order either.

-

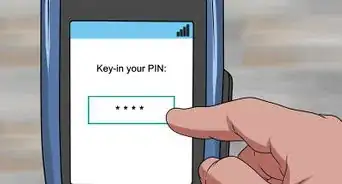

4Pay with a PIN-enabled Visa or MasterCard gift card. You can pay with one of these cards at Western Union, Walmart, the post office and 7-Eleven. However, doing so is often linked with suspicious activity. For example, some people purchase these pre-paid cards and then immediately liquidate them in order to take advantage of any available rewards the cards offer. Then they deposit the money orders into their bank accounts and use the money to pay their bills. But depositing lots of money orders into your bank account looks like money laundering, and your bank can close your account for doing so.[3] [4]

-

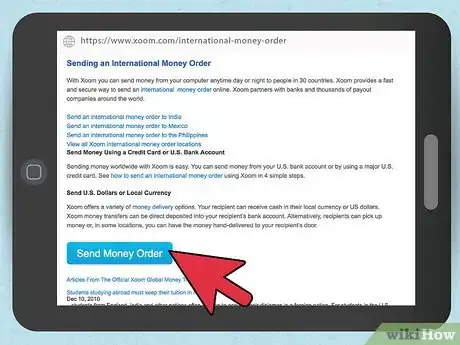

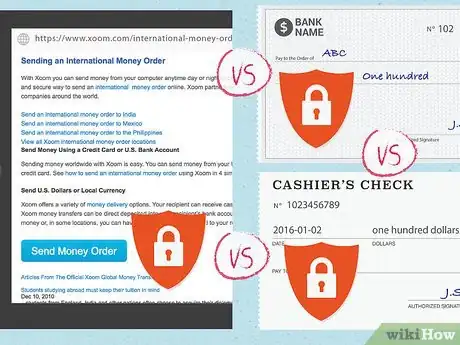

5Purchase a money order remotely. Some companies now allow you to purchase and send a money order online. For example, you can purchase a money order online with Payko and pay with your PayPal account, which is linked to a credit card or bank account. However, you can only purchase a single, $200 money order per day. This method is not as fast as other online bank transfers. Instead of an instantaneous transfer of funds from one account to another, a physical money order is printed out and mailed to the recipient. This can take several days.[5]

- Sending money over the phone is possible, but this is not the same thing as a money order. You can contact a remittance service like Western Union and request an electronic transfer of funds over the phone. You can pay with a credit or debit card. However, a physical money order is not printed out in this case. Rather, the funds are transferred from your bank account to the recipient’s account electronically.[6]

Paying Fees

-

1Purchase a money order from the bank. In general, banks charge the highest fees for money orders. Every bank charges a different amount. Some banks may charge you as low as $1.25 for money orders up to $1,000. Others may charge you as much as $5.00. If your bank charges more than $1.25 for money orders, try to go someplace else to purchase one.

-

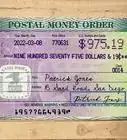

2Go to the post office. The post office charges $1.25 for money orders up to $500 and $1.65 for money orders up to $1,000. This is not the least expensive fee for money orders. However, people will be less likely to question the legitimacy of a money order from the U.S. Post Office. It is a widely-recognized, well-respected issuer of money orders. Also, if you need to pay with traveler’s checks, the post office is the only place where you can do that. Finally, it is convenient if you need to send the money order to someone, because you can purchase the money order and mail it all in one transaction.[7]

-

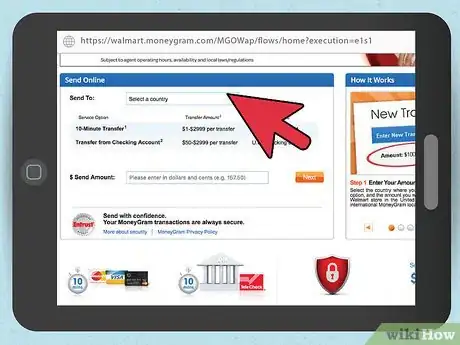

3Use a remittance service provider. Remittance service providers are places where you can electronically transfer money. Examples include Western Union, MoneyGram and Walmart. Walmart charges 70 cents for money orders up to $1,000. At Western Union and MoneyGram, the fees for money orders vary from branch to branch. Expect to pay at least $1 for a money order of up to $1,000.

-

4Pay for online money orders. Payko is a company that allows you to purchase money orders online. However, their fees are considerably higher than purchasing a money order in person. Expect to pay a flat fee that ranges from $3.49 to $4.99. On top of that, you will have to pay a fee of 5.49 percent of the value of the money order. Finally, you have to pay for postage to send the money order to the recipient. If you want to send it via express mail, expect to pay approximately $15.[8]

-

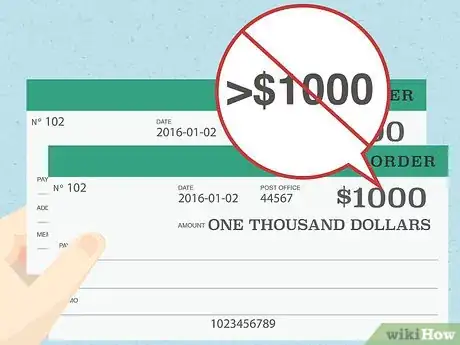

5Purchase multiple money orders if you need more than $1,000. Money orders are generally capped at $1,000. So if you need more money than that, you must purchase multiple money orders. This means that you also pay multiple fees.

- For example, if you need $2,200 in money orders and you go to the USPS, you will need to purchase two $1,000 money orders for $1.65 each, and one $200 money order for $1.25. This adds up to $4.55.

Considering Your Options

-

1Evaluate alternatives to money orders. Money orders are inexpensive and expedient. But, they attract scammers, and some places do not accept them as a form of payment. Also, since you have to go in person to purchase a money orders, they may not be as convenient as other forms of payment.

- If you don’t mind the recipient seeing your bank account information, consider paying for your purchase with a personal check.

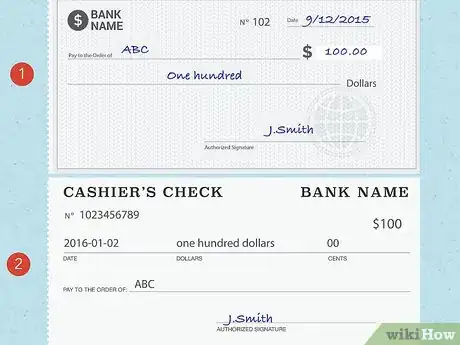

- Cashier’s checks are more secure than money orders since they are drawn on the issuing bank’s funds and signed by a bank representative. Also, there is no cap on the amount of the cashier’s check.

- Wire transfers allow you to send money to a recipient very quickly.

- If you don’t have a bank account or good credit, you can use pre-paid debit cards. They give you the convenience of a credit card without the risk of running up a huge debt.

-

2Compare the fees for a money order with other forms of payment. Money orders are inexpensive. However, sometimes people choose to pay higher fees for other forms of payment. This can be for security reasons or for convenience.

- If you want to be able to write personal checks from your checking account, you will probably have to pay monthly account fees.

- Cashier’s checks are more expensive than money orders. They can cost as much as $10 each.[9]

- Wire transfers can be very pricey, especially if you want to send the money quickly. Expect to pay at least $25 to $30 to wire money to someone overnight.

-

3Compare the security features. Money orders are sometimes seen as a disreputable form of payment. Someone can steal a money order and put their own name as the recipient. Also, many scammers try to use counterfeit money orders.

- Personal checks are more secure because they are linked to the security of your bank.

- Cashier’s checks are secure because they are guaranteed by the issuing bank and are signed by a bank representative.[10]

- Wire transfers are considered secure because the identity of both parties is confirmed before the transfer takes place.[11]

Community Q&A

-

QuestionCan I transfer money without a physical credit card if I know the information?

DonaganTop AnswererYes.

DonaganTop AnswererYes. -

QuestionCan I buy a money order with an American Express?

Andrew SerranoTop AnswererThis would depend on who you are purchasing from. If you are buying it in person, changes are they will request cash, however American Express does have different allowances with some of their vendors. They may only allow a traveler's check, however many places will no longer accept them because of fraud potential.

Andrew SerranoTop AnswererThis would depend on who you are purchasing from. If you are buying it in person, changes are they will request cash, however American Express does have different allowances with some of their vendors. They may only allow a traveler's check, however many places will no longer accept them because of fraud potential. -

QuestionCan I use a credit card to purchase a cashiers check?

Andrew SerranoTop AnswererIn a roundabout way, yes. You would have to go to your bank and request a cash advance from your credit card. This cash would be deposited in your account, and the bank would issue a cashiers check. However, be forewarned: a cash advance from a credit card will cause the highest potential interest rate to begin accruing the same day as you take the cash, and there are usually a cash advance fee of a percentage of what you advance. Only do this in an emergency situation, and pay the balance off immediately.

Andrew SerranoTop AnswererIn a roundabout way, yes. You would have to go to your bank and request a cash advance from your credit card. This cash would be deposited in your account, and the bank would issue a cashiers check. However, be forewarned: a cash advance from a credit card will cause the highest potential interest rate to begin accruing the same day as you take the cash, and there are usually a cash advance fee of a percentage of what you advance. Only do this in an emergency situation, and pay the balance off immediately.

References

- ↑ https://www.usps.com/shop/money-orders.htm

- ↑ http://www.investopedia.com/terms/t/travelerscheck.asp

- ↑ http://milestomemories.boardingarea.com/visa-gift-card-prepaid-mastercard/

- ↑ http://www.dansdeals.com/archives/35174

- ↑ http://money.howstuffworks.com/personal-finance/online-banking/money-order-online1.htm

- ↑ http://westernunion.com/us/how-to/how-to-send-money-by-phone.page

- ↑ https://www.usps.com/shop/money-orders.htm

- ↑ http://money.howstuffworks.com/personal-finance/online-banking/money-order-online1.htm

- ↑ https://www.wellsfargo.com/online-banking/service-fees/

About This Article

A money order is like a pre-paid check you can buy from a bank, post office, or online. You can pay for a money order with cash or a debit card. If you’re buying your money order from the United States Post Office, you can also use traveler’s checks. Keep in mind that you can’t use personal checks, since these take too long to clear. Some money order issuers, like Western Union and 7-Eleven, will let you use a credit card, but these will be expensive, since your card issuer will charge you fees and interest rates. You can also use a PayPal account linked to your bank or credit card through some websites like Payko. However, this will only work for a single, 200-dollar money order per day and you’ll have to wait for it to come in the mail. For more tips, including how to use alternatives to money orders, read on!