This article was co-authored by Gina D'Amore. Gina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, several readers have written to tell us that this article was helpful to them, earning it our reader-approved status.

This article has been viewed 84,819 times.

Securities trading can be a financially and mentally rewarding experience, but only if you have the time and tools to properly research each trade. To make these trades, you'll have to work with a licensed stockbroker, either online or in person. Compared to personal brokers, online trading accounts offer smaller fees and more immediacy, making them better for traders looking for more independence. However, keep in mind that online accounts also come without professional guidance, making them a good place for beginners to lose money. Which of the online brokerages you choose will depend on your specific needs and goals.

Steps

Deciding to Start Trading Online

-

1Make sure you have enough risk capital to invest. Risk capital is money you are free to invest. This money isn't used in paying your living expenses, repaying your debts, or held in your retirement account. In other words, this is money you could stand to lose (but obviously don't want to). In addition to your retirement account, most financial professionals advise that you keep about six month's worth of wages in savings. This is a good financial cushion to cover unforeseeable life events, like losing your job or becoming ill.[1] Any money left over after this is your risk capital.

- Six month's worth salary is a minimum amount to keep in savings. For more security, consider saving a year's worth or more.

-

2Contribute to your 401(k) first. In addition to your emergency savings, you'll want to contribute to your 401(k) before committing money to risk capital. This is particularly true if your employer fully or partially matches your contributions. Max out the matched contributions to your retirement account each month before putting extra money into your trading account.[2]Advertisement

-

3Consider offline options. Before signing up for online trading, think about your goals and experience with trading. Would you rather have a professional handle your money? Are you more willing to trust someone you can meet in person? Offline brokers can offer you services and expertise that online broker cannot, so take these options into consideration before committing. Outside of online brokerages, you have two major options: money managers and full-service brokers.

- Money managers are the most hands-off of all of the broker options. They handle all of your trades, determine goals for your portfolio, and update you on its growth and progress. However, they also charge large management fees and require initial investments upwards of $100,000 or $250,000.[3]

- Full-service brokers offer, as the name implies, the most amount of services. They sit down with you to determine your financial goals based on your age, retirement plans, marital status, personality, and risk tolerance. They work with you to make investment strategies and also will make direct trades if you call and ask them to. They can offer advice on anything from taxes to estate planning. Accounts can be opened for as little as $1,000, but fees are generally higher than those for online brokerages.[4]

-

4Determine your investment style. If you're still planning to invest online, you'll need to determine what type of trades you'll be making. If you'll be doing more day trading, you'll need a platform that is responsive and has low per-trade fees. Alternately, if you plan to make long-term investments, you can afford a platform with higher trading fees that offers more services. Your decisions here will inform your choice of brokerage.

- Day trading is a stock trading strategy in which an investor buys and sells the same stock within the same day. Day traders typically hope to take advantage of small price fluctuations and make quick returns.[5]

Choosing a Trading Platform

-

1Locate several brokers. Select trading platforms that are reliable and well regarded. You'll want to be satisfied that the brokers are knowledgeable and responsive to your needs. Well-known platforms will be the most reliable. However, if you choose to go with a more obscure brokerage, make sure the platform is registered with the Securities and Exchange Commission (SEC) before committing your money.

- Some of the most reputable online brokers are: Fidelity, Scottrade, E*Trade, OptionsHouse, TD Ameritrade, Charles Schwab, TradeStation, and Interactive Brokers.[6]

-

2Make sure you meet minimum balance requirements. The first requirement you'll have to check is whether or not you meet the broker's minimum account balance. This is the smallest amount that you can deposit to start an account. For some of these brokerages, if you lose money and your account balance drops below this amount, you will still be charged additional fees for having too low a balance. Total up your risk capital and compare this to the required minimum balance at each brokerage.

- For reference, most online brokers require between $500 and $1000.[7] However, there are also discount brokers with a $0 minimum and higher-tier brokers with minimums of up to $25,000.

-

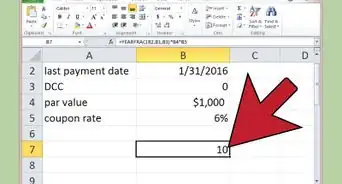

3Look at their fee structures. Online brokers vary widely in fees charged. Some charge monthly or annual service fees, some have high per-trade fees for securities, and some charge more or less on mutual fund purchases, among many other types and amounts of fees. Any broker will have this information readily available to potential account holders. Visit their website and jot down their different fees and how they might apply to you.

- Again, which fees are most relevant to you will depend on what type of trading you plan to do. High trade commissions are a non-issue if you plan to hold your securities for long periods of time. However, a day trader would prefer one of the brokers with $1 trade commissions.

- Day trading has been proven in academic studies to be less profitable that passive investing (buying and holding securities for longer periods of time). This is partially due to losses sustained on bad trades, but also to fees charged on each trade.[8]

-

4Determine the extent of services you need. Many larger, and more expensive, online brokers have advanced research and analytical tools for your use. If you plan to make quick, daily trades based on market information and analytics, you may get your money's worth out of these tools. However, if you plan to be a more passive investor, you may want to look for a more basic service that charges you lower fees.[9]

-

5Select the broker that best meets your needs. Narrow down your broker list first by choosing only those with low enough minimum balances. Next, look at the services offered and choose those which offer the services you need. Finally, look at the fee structures and determine which one will be cheapest for you to use. Select that broker.

Setting Up Your Account

-

1Register with your chosen broker. Go to "create a new account" or "register." This will likely be in a prominent position on the broker's main webpage. You'll likely have to enter your email address and create a username to get started.

-

2Provide documentation. During the application process, you will be asked to prove your identity and provide financial information. You may also be required to scan or fax in certain documents. For most brokers, you will need the following information and documents:

- Personal information, like your name, address, and work information

- Your Social Security number or card

- Your W-9 form

- Up to two other forms of identification

- Other information or documents as required by your broker.[10]

-

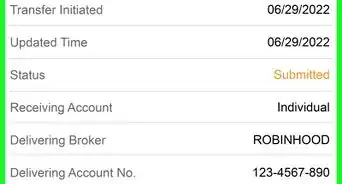

3Deposit money with the broker in order to start trading. Compile your risk capital into one account and deposit this money into your trading account. Many brokers offer electronic fund transfers for your first deposit, while other may require that you mail in an actual check.[11]

-

4Try out the tools and services offered by your broker. Take a tour of the platform and familiarize yourself with major tools and pages. Work out how to see your current positions in total and individually. Take advantage of every service you think you might use; after all, you're paying for them anyway.

-

5Do your research and make your first purchase. You may already have a purchase in mind, but you should still do your research first to make sure this is a sound investment. When you're ready, make your first order and wait for your broker to fill it. Make sure to not put all of your eggs in one basket here; diversification is key to building a successful portfolio.

- For more on diversification, see how to build a diversified portfolio.

Community Q&A

-

QuestionHow much does it cost to start an account?

DonaganTop AnswererWhatever your broker specifies as a minimum deposit, which you can then apply toward your first purchase. Your broker may insist that you keep that minimum amount of cash available in your account.

DonaganTop AnswererWhatever your broker specifies as a minimum deposit, which you can then apply toward your first purchase. Your broker may insist that you keep that minimum amount of cash available in your account. -

QuestionWhat do you mean about 'diversification is key to building a successful portfolio'?

DonaganTop AnswererIt means that the more securities you hold in your portfolio, the less likely it is that any one of them will hurt you badly by dropping in value, because each security represents only a very small portion of your portfolio.

DonaganTop AnswererIt means that the more securities you hold in your portfolio, the less likely it is that any one of them will hurt you badly by dropping in value, because each security represents only a very small portion of your portfolio. -

QuestionWhat is required to open an MMT account?

DonaganTop AnswererIf you're asking about a money-market account, choose a bank, mutual fund or other investment company, fill out an account registration form with them, and deposit at least the minimum amount required.

DonaganTop AnswererIf you're asking about a money-market account, choose a bank, mutual fund or other investment company, fill out an account registration form with them, and deposit at least the minimum amount required.

Warnings

- Stock trading can be risky, even for those who know what they're doing. Speculation and acting on rumors and emotional judgments are good ways to lose money in the markets.⧼thumbs_response⧽

- Stock trading can be addictive. Control yourself. Everything has it's limitations.⧼thumbs_response⧽

- Stock trading is a speculative activity not in compliance with religious morality.⧼thumbs_response⧽

Expert Interview

Thanks for reading our article! If you'd like to learn more about opening a trading account, check out our in-depth interview with Gina D'Amore.

References

- ↑ http://www.forbes.com/2011/01/25/how-to-open-your-first-online-brokerage-account-personal-finance.html

- ↑ http://www.forbes.com/2011/01/25/how-to-open-your-first-online-brokerage-account-personal-finance.html

- ↑ http://www.investopedia.com/ask/answers/05/042205.asp

- ↑ http://www.investopedia.com/ask/answers/05/042205.asp

- ↑ http://www.investopedia.com/articles/trading/06/daytradingretail.asp?performancelayout=true

- ↑ http://www.nasdaq.com/investing/online-brokers/

- ↑ https://www.thestreet.com/investing/getting-started-how-to-open-a-brokerage-account-10356979

- ↑ http://www.forbes.com/2011/01/25/how-to-open-your-first-online-brokerage-account-personal-finance.html

- ↑ https://www.thestreet.com/investing/getting-started-how-to-open-a-brokerage-account-10356979

- ↑ https://www.thestreet.com/investing/getting-started-how-to-open-a-brokerage-account-10356979

- ↑ https://www.thestreet.com/investing/getting-started-how-to-open-a-brokerage-account-10356979

- ↑ http://www.forbes.com/2011/01/25/how-to-open-your-first-online-brokerage-account-personal-finance.html

- ↑ https://www.thestreet.com/investing/getting-started-how-to-open-a-brokerage-account-10356979

About This Article

Before you open a trading account, go online to research reputable brokers that are registered with the Securities and Exchange Commission (SEC). Make sure you meet their minimum balance requirements, and they offer the services you need under a fee structure you can afford. Once you’ve chosen a broker, go to their webpage and create an account. Then, provide your personal information, and documentation of your identity and finances. Finally, mail in a check or initiate an electronic funds transfer to deposit money in your account. To learn how to trade offline through a money manager or a full-service broker, scroll down!