This article was co-authored by Michael R. Lewis. Michael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

This article has been viewed 70,920 times.

Among many choices of investments, you may be looking at investing in money market fund. These funds are a type of mutual fund that focuses on short-term bonds and other liquid, low-risk securities. These relatively safe investments complement an overall portfolio and can be a good way to realize long-term financial goals.

Steps

Gathering Information About Money Market Funds

-

1Learn about money market funds. Money market funds invest in short-term securities such as U.S. Treasury bills and commercial paper.There are many kinds of money market funds, including those that invest primarily in government securities, tax-exempt municipal securities, or general purpose securities.[1] Online articles at Investopedia and BankRate and publications from banks and mutual fund companies such as Fidelity, Vanguard or TIAA-CREF can provide additional information.[2]

- Banks often offer customers money market accounts, where the money that they put in will earn a bit more interest than it would in a conventional savings account. Banks' money market accounts are typically insured by the Federal Deposit Insurance Corporation. By contrast, money market funds through brokers or mutual fund companies are not FDIC-insured and are thus considered slightly riskier than bank-offered money market accounts. Losing money in any money market fund or account, however, is virtually unheard of.

-

2Understand the goal of money market funds. These funds seek to maintain a very stable value of its shares while also seeking to increase shareholders' wealth through accumulation of interest and dividends. In practice, today's money market funds and accounts produce rather limited growth of wealth in an environment of very limited risk.[3]

- Money market funds are considered among the safest and most conservative of investments, by virtue of the fact that they hold their money in U.S. government securities, as well as higher-rated corporate "paper" and certificates of deposit. While no investment is completely risk-free, money market funds and accounts come as close as you can get.

Advertisement -

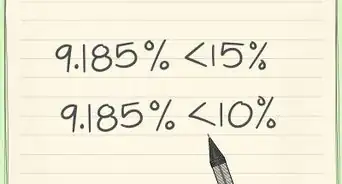

3Learn the disadvantages of money market funds. Some mutual fund companies charge an expense ratio, or the fees paid to the fund company to manage a particular money market fund. The ratio includes investment advisory fees, administrative costs, other operating expenses and a fee charged as a distribution expense. The expense ratio will be listed in the fund's prospectus, which you should read carefully before investing.[4]

- Some mutual fund companies are waiving the expense ratio in view of the low rate of return in the current market.

Investing in Money Market Funds

-

1Understand the different types of money market funds. The most common are government securities, tax-exempt municipal securities, or general purpose securities known as prime funds. All have different types of investments that will affect your yield:[5]

- Government securities - These consist of U.S. Treasury securities and securities issued by U.S. government agencies such as Freddie Mac, Fannie Mae and the Federal Home Loan Banks.

- Tax exempt securities - These are securities issued by national, state and local governments and non-profit organizations. They are usually exempt from federal income taxes and may also be exempt from state income taxes depending on the state.

- General purpose (prime) securities - These include commercial paper, corporate notes, certificates of deposit, and other private instruments.

-

2Understand the purposes of money market funds. Money market funds are useful when you need an investment that is liquid, meaning you can withdraw the money at any time to use as an emergency fund. Other purposes include investing in them as a percent of your total portfolio that provides more safety than stocks or bonds, and as a holding place for cash while waiting for other investment opportunities.[6]

-

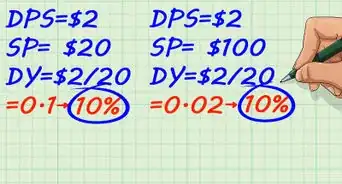

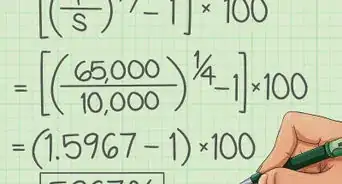

3Compare past yields. Before choosing a money market fund, check historical yields over the past year. This information can be found online at Bankrate or Investopedia. Then compare these yields to IBC's Money Fund Report Average that gives the average yield of all triple-A rated money market funds. Choose a fund that shows the highest yields that are over the IBC's report averages over the longest period of time.[7]

- The IBC report is compiled and distributed by iMoneyNet.

Buying and Tracking Money Market Funds

-

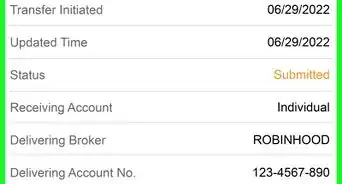

1Buy into a money market fund. Your online brokerage or other services (such as mutual fund companies) will help you invest a specific amount of money into money market funds by writing a check or making an online transfer. Money market funds are a good place to hold the money you expect to need in the foreseeable future. They are not a good place to hold money you want to grow over a long period of time.[8]

- Think of money market funds and accounts as savings (or even checking) accounts. Some funds do offer check-writing privileges.

-

2Track the investment. Like other funds, money market funds should have tracking information available from the brokerage or institution that offer the funds. Use these tools to understand how much gain your funds are accruing and to actively manage your investments over the long term. Your money in a money market fund is easily accessible when you want to invest it differently or devote it to some other purpose.[9]

-

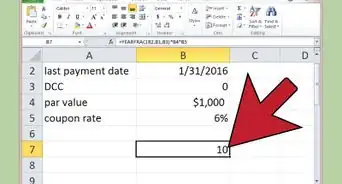

3Use records for tax filing. When it comes time to pay taxes, an investment in money market funds might trigger additional income taxes. The money market investor will need to report interest and dividend payments received.

References

- ↑ https://www.sec.gov/spotlight/money-market.shtml

- ↑ http://www.bankrate.com/finance/savings/money-market-fund-shoppers-1.aspx

- ↑ http://www.investopedia.com/terms/m/money-marketfund.asp

- ↑ http://www.bankrate.com/finance/savings/money-market-fund-shoppers-1.aspx

- ↑ https://www.fidelity.com/learning-center/investment-products/mutual-funds/what-are-money-market-funds

- ↑ https://www.fidelity.com/learning-center/investment-products/mutual-funds/what-are-money-market-funds

- ↑ http://www.investorwords.com/8277/IBCs_money_fund_report_average.html

- ↑ http://www.bankrate.com/finance/savings/money-market-fund-shoppers-1.aspx

- ↑ http://www.investopedia.com/terms/m/money-marketfund.asp

About This Article

Before investing in a money market fund, do some research and decide if this type of account, with it’s low-risk and easy liquidity, is a good fit for your needs. If it is, determine which specific investments you want your fund to focus on and compare the past performance of various funds. When you’re ready, open a money market account through either your bank or a brokerage service, and use tracking information to keep tabs on your investment. For more information from our Financial reviewer on types of money market funds available and what their tax implications are, keep reading.