This article was co-authored by Gina D'Amore. Gina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

This article has been viewed 115,972 times.

An International Bank Account Number (IBAN) makes it possible to transfer money across national borders.[1] If you want to wire money, then you will need the IBAN of the person you are wiring money to. Currently, the U.S. does not participate in IBAN, so you will need different information when transferring to a U.S.-based account.

Steps

Finding an IBAN Number

-

1Ask the recipient to contact their bank. If you’re sending money to someone, have the recipient call their bank and request their IBAN. This might be the easiest way to find the IBAN number.

-

2Contact your bank if you're receiving money. You'll need to give your IBAN to the person sending the wire. Your bank should be able to give it to you. Call and speak to a representative, and provide them with your name and account number.

- There may also be a link on the website you can use to look up your IBAN number.

Advertisement -

3Look on your statement. Some banks, such as Barclays, publish your IBAN on your bank statement. Find your paper copy or log into your account and find the IBAN. Look in the top right corner of your paper statement, as many banks provide the IBAN number in that spot.[2]

-

4Use an online calculator. There are many calculators online which will convert a bank account to an IBAN. Input the Bank’s code and the account number. An IBAN is a code that begins with two letters followed by 14-30 numbers. You can see sample IBANs by country at https://www.iban.com/structure.html.

- For example, an IBAN for Finland could read FI1410093000123458.

- Find these calculators online by searching for “IBAN calculator.”

-

5Double check an IBAN. If someone gives you their IBAN, you can verify that it is accurate. Some online calculators will validate an IBAN. You can find them by searching for “IBAN validation calculator.” [3]

- You can also call the bank that will be receiving money and give them the recipient’s name. Ask that they validate the IBAN.

Transferring Money to the US

-

1Find the bank’s Swift Code/BIC. The U.S. does not participate in IBAN. Nevertheless, you can still transfer money to a U.S. bank account by using the bank’s Bank Identifier Code (BIC), also called the SWIFT Code. This code is eight or eleven digits, and you can find it on the bank’s website.[4]

- Some smaller banks might not provide this information online, so call and ask for their Swift Code.

- Large banks in the U.S. often have multiple Swift Codes. Find the Swift Code for the region where the bank is located.

-

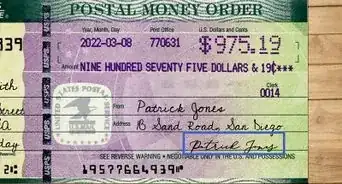

2Get the recipient’s account number. The recipient can find their account number on a check or by looking at their bank statement. The recipient’s account number is usually 10-12 digits and will appear right beside the nine-digit routing number on the check.[5]

-

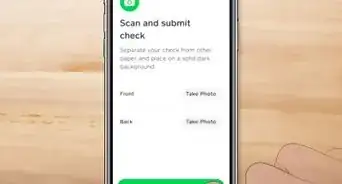

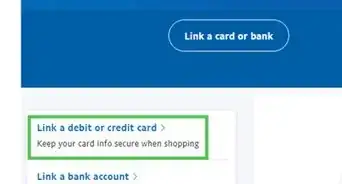

3Wire money online. Your bank might allow you to wire money from an online account. Log into your account and look for the wire transfer option near the top of the page. You will need the following information:[6]

- Full name and address of the recipient’s bank.

- The recipient bank’s Swift Code.

- The recipient’s name, address, account number, and account name (e.g., savings or checking).

-

4Ask a teller to wire the money. If you don’t want to wire money online, you can stop into your bank in person and request that the teller wire the money. Share the same information that you would need if you did the transfer yourself online.

- Some inexperienced tellers might not know the U.S.-based banks don’t use IBAN. In this situation, ask to speak to a manager who can explain the situation to the teller.

Expert Interview

Thanks for reading our article! If you'd like to learn more about IBAN number, check out our in-depth interview with Gina D'Amore.

References

- ↑ https://www.swift.com/standards/data-standards/iban

- ↑ http://www.barclays.co.uk/help/international/payments/making-and-receiving-international-payments/generate-iban/

- ↑ https://bank.codes/iban/validate/

- ↑ https://www.theswiftcodes.com/united-states/

- ↑ https://www.usbank.com/bank-accounts/checking-accounts/checking-customer-resources/aba-routing-number.html

- ↑ https://www.commbank.com.au/support/faqs/681.html

About This Article

If you want to transfer money across national borders, you’ll need an International Bank Account Number, or an IBAN. When sending money to someone, have them call their bank to request their IBAN number. In cases when someone is sending you money, you’ll need to ask your bank for your IBAN number. You’ll either need to talk to a representative or there may be a link on their website to look it up. Some banks also publish your IBAN on the top right corner of your paper bank statements, so you can look there as well. Another way to find your IBAN is to use an online calculator that will convert your bank account to an IBAN. All you’ll need is your Bank’s code and the account number, and the calculator will do the rest. To learn how to verify that you have the correct IBAN number, keep reading!