This article was co-authored by Carla Toebe. Carla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, 100% of readers who voted found the article helpful, earning it our reader-approved status.

This article has been viewed 457,586 times.

"Flipping" a house consists of buying a run-down property below market price, increasing its value, and rapidly re-selling it for a quick profit. This is different from development investing, in which the buyer purchases a property under development, then sells or rents the unit when it's ready for occupancy. If you play your cards right, you can make $50,000 or more per flip, and do it in under 90 days.

Steps

Making a Sensible Purchase

-

1Familiarize yourself with how to buy a home or condo. If you've already done that, then you already know the process. If you have never purchased a home, then consult with a Realtor and a financial adviser. There are a few steps involved when purchasing a home so you need to understand that process, such as: placing an offer, getting a mortgage, removing conditions and taking possession.

- Placing an offer: Since verbal offers don't constitute a legally enforceable sale, you need to draft a written offer and give it to the owners and/or Realtor. The offer stipulates price as well as the terms and conditions of the sale. If the offer is accepted, the offer becomes a legally-binding sales contract.

- Getting a mortgage: Unless you have heaps of cash handy, you'll need a mortgage. There are dozens of kinds of loans out there, so examine the ones that might work for you and talk to a mortgage broker if you have any questions. Some mortgages (ARMs) have special "teaser" interest rates that stay low in the beginning and increase significantly after a certain period of time. These might be attractive if you plan on selling the home quickly.

- Removing the conditions: This is usually what the buyer does once the seller has accepted their offer. It is a legal move that the buyer (usually) makes in order to communicate that any obligations entered into by both or either parties have been met.

-

2Understand the risks of flipping a home. Flipping a home can be risky. You're incurring a large amount of debt for a potential payoff in the future. Except sometimes, that payoff doesn't materialize, or it doesn't materialize as quickly as you might have liked. You could be sitting on a property for longer than expected, paying a mortgage, property taxes, and continual upkeep. Sometimes, you will need to sell a home for less than you bought it for. Often, you're at the mercy of a quivering housing market.

- The amount of physical effort required is also a potential risk. How fit are you and how willing are you to do a lot of the DIY work involved in flipping the house? If you've never done renovations or fixes before, it will be a steep learning curve and the less you know, the longer it'll take to flip the house.

Advertisement -

3Educate yourself about the real estate market in which you're investing. Read magazines such as Forbes, Entrepreneur, and Money; these often have articles about real estate. Begin to understand how the real estate market works, what constitutes a good and a bad deal, and how to anticipate future growth or contraction in the future.

- The housing market is like the stock market. It has both bull cycles (meaning optimism, growth, and high demand) and bear cycles (meaning pessimism, contraction, and low demand). The difference is that the housing market can take many more years than the stock market to switch from one cycle to another.

- After talking to at least three Realtors and doing some investigation, if you find that the market is in low demand and everyone and their dog seems to be trying to liquidate homes, housing prices are going to fall and profit margins will fall with them. These kinds of market conditions would make it more challenging to flip a home.

- Try to wait for a bull market. Wait to buy until the real estate market has turned back around and more people are trying to buy than sell. This will create better conditions for you to start flipping.

-

4Look for a home that can be substantially improved with the least amount of time and resources. You're not trying to live in this house; you're trying to buy it, improve it, and sell it. Try not to get attached to the home. Instead, view it purely as a profit-making exercise.

- A home with room for improvement might have a run-down yard, an old carpet, a good spot for a carport, or other things that can be fixed with a little money and some hard labor. These types of fixes often provide an excellent return on investment (ROI) when flipping a home.

- Some people look for distressed properties. Those are ones that the seller is "desperate to sell" for reasons such as: divorce, bankruptcy, death, poor condition of the property, late on payments or other. These give the buyer an inherent advantage over the seller.

- Look for homes that sell in the middle to upper range. What that means is the amount where the average family would be able to afford it. Generally that means between about $200,000, and $500,000 depending on your area. You want that price range because these tend to sell the fastest — you have the largest population density looking for these mid-range homes. It could be much less or much more but that's about the average. These homes generally have 3 or more bedrooms and at least 2 full bathrooms.

- Find out what is preferred by residents in the area you're looking to buy into. Simple things like easy access, off-street parking, no-through roads and a quiet neighborhood can make or break the attractiveness of a property.

-

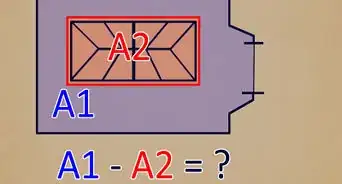

5Obtain a loan for at least several thousand dollars more than the price of the property you wish to flip. You'll need this money for repairs and improvements. Negotiate a purchase of the property and buy. In the offer, be sure to have multiple ways out of the contract. The most common method is to simply put "subject to financing by [such and such] date." If you can't make the financing by then, ask for an extension before the financing contingency period expires.

- Keep in mind that there are 2 different financing dates: 1 for making an application to get the loan and 1 to gain the funds to close the deal. To protect the buyer, the contingency should extend through the close of the contract. Generally, a financing contingency has a deadline of 30 days, so extend the deadline unless you know you can get the financing within that time period.

-

6Give yourself a timeline that outlines your ideal selling scenario. Time is money, and your object is to get your house renovated and flipped as soon as possible. To that end, create a timeline that lists realistic times for contracting, showing, and selling. You don't have to meet all the goals along the way, but you want to be in the ballpark. A timeline will help you accomplish this.

- Note when you expect major renovations to be completed by. Include regular progress reviews to help you stay alert to problems as they arise.

- Mark down blocks of time when you're available to work on the house, such as long weekends, vacation time, etc. that you expect to accelerate the work being done.

Fixing the House

-

1Decide what kind of work you'll put into the home. Will you do the work yourself on the cheap or do you need a General Contractor or "GC" to do the work? If the repairs are minor, then it may be best to go it alone to quickly and cheaply improve the property. For larger projects that require building permits, it's best to hire a GC. As already noted, the key is to make improvements, often merely cosmetic ones, that make the house look much better but won't cost you too much.

-

2Do the important fixes first. That way, if your plan changes (and it very well could), you've done all the important fixes and you only have minor fixes to maneuver around. Also, if your budget becomes bloated, you won't be missing essential fixes like kitchen spruce-ups or basic yard work, and you can push to sell quickly.

- Major fixes are things like rewiring the house so that it doesn't fault and cause a fire or electrocution; fixing broken fixtures such as bathtubs, showers and sinks; re-flooring tired carpets or bumpy linoleum; patching up wall/ceiling/door holes; replacing hinges/brackets/fittings, etc. that are loose or broken; repainting peeling or poorly done paintwork; replacing broken tiles/pavers/steps, etc.; renovating anything that is dirty and broken––tired things are less of a concern than dirty things, so prioritize what needs doing most.

- Seek out the cheapest labor you can find (college kids, or even yourself) and have the property immaculately cleaned up and repaired. If there's any money left over after this, put it into a high-interest liquid savings account; do not use it to pay off part of the loan yet.

- Remodeling kitchens and bathrooms typically do not raise the value of the home enough because owners tend to pay too much for the remodel.

-

3Work on minor fixes last. More minor fixes include changing paint colors on already decent paintwork; changing working fittings to more modern ones; fitting better storage inside cupboards, etc. All nice to have but not essential if you're squeezed for time and money.

- Read books written about what buyers look for in a home. A lot is about presentation––if you can use a few shortcut tricks to enhance the house's look, then you'll save time and money. Of course, you also need to pass the builder's inspection, so this needs to be taken into account for any structural issues that need addressing.

- Typically, cleaning, painting, and adding plants are the cheapest way to boost the value of a home. A deck also raises the value more than the price of the deck. Replacing electrical and plumbing fixtures and fixing anything broken is also a cheap way to get a good boost in home value.

- Things you can probably do yourself: Repaint. Tear out old carpet to find hard wood floors or re-carpet. Touch up old fixtures. Paint minor areas. Change fittings. Repave patio and entrance areas. Change the color of the front door. Add new handles.

Selling the Property

-

1Stage the house. Staged houses can sell substantially quicker than unstaged houses, sometimes up to 50% faster. Of course, make sure your house is cleaned, de-cluttered, and organized. Try to make the first impression give a lasting impression.

- Staged homes often benefit from very neutral colors and features––features that appeal to a wide range of people while not offending very many people. That means a lot of neutral colors (browns, creams, etc.) and not too much flashy furniture. You can rent furniture from a staging company if you wish, or you can be in control of staging the home yourself.

- Remove all personal effects from the home. Remember, you want people who view the staging to believe that this home could be their new home eventually. Personal effects such as trophies, children's paintings, holiday souvenirs, and family photos, should all be removed.

- Make the home appeal to the senses.

- Sight: clean, declutter, organize, leave space for open room, open the drapes, etc.

- Smell: put air fresheners in the bathrooms, leave flowers out in the foyer, put out a fresh pot of coffee, etc.

- Touch: appeal to your guests to sit in the softest couch; make sure that no dust is left around.

- Sound: turn off all noisy generators, TVs, and computer, and instead put on some easy listening music such as jazz.

-

2Show the property to potential buyers. Discuss it with them. If a particular problem is repeatedly mentioned, see if you can use some of the money you saved to repair/improve it. Otherwise, modify your selling strategy to distract attention from it. This step should take less than a month, at the very most.

- Use the power of the web and your personal network if you're having trouble selling the home. Don't just rely on the broker to make the sale. Put ads up on websites (Craigslist, Zillow, or Trulia are a good starting point) and tap into your social networks to see if anyone might be interested in biting.

-

3Sell the home for a significantly higher price than the one at which you purchased the property. Any annoyances or expenses with the property are now the buyer's problem, not yours. Pay off the loan, deposit your profit, and take a vacation.

- Be willing to lower the price if no one is biting. Researching home prices in the area is a must, especially if the price of your home is bloated and you don't even know it. Adjusting the price to a more manageable sum can mean a sale in no time. Paying a mortgage and taxes on an overpriced home because your ego is in the way of lowering the price is not a good way to make money.

-

4Remember to report your profit to the IRS. An unreported $100,000 can lead to a painful audit down the road. It's a hassle, but it's a necessary hassle.

Expert Q&A

-

QuestionIs it better to have a LLC for construction while flipping houses?

Carla ToebeCarla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

Carla ToebeCarla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

Real Estate Broker It is best to consult with an attorney for advisement on the structure of the business, but with an LLC the losses will be limited to the LLC. With a sole proprietor, the losses can be attached to personal property if liens are placed.

It is best to consult with an attorney for advisement on the structure of the business, but with an LLC the losses will be limited to the LLC. With a sole proprietor, the losses can be attached to personal property if liens are placed. -

QuestionDo you recommend buying short sale homes?

Carla ToebeCarla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

Carla ToebeCarla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

Real Estate Broker It is okay to purchase these homes if you want to wait out the time it will take to get bank approval. You should use a short sale addendum that will allow you to leave at any time should you not want to wait any longer and get any earnest money back. Typically though, short sale homes are occupied so if your intention is to flip it, you will have to have the tenants vacate, or the homeowner to vacate. You are better off purchasing a home that is already vacant that can close quickly so you are not wasting time.

It is okay to purchase these homes if you want to wait out the time it will take to get bank approval. You should use a short sale addendum that will allow you to leave at any time should you not want to wait any longer and get any earnest money back. Typically though, short sale homes are occupied so if your intention is to flip it, you will have to have the tenants vacate, or the homeowner to vacate. You are better off purchasing a home that is already vacant that can close quickly so you are not wasting time. -

QuestionI have a house that I want to sell. I do have an existing mortgage, can I carry a mortgage for a potential buyer?

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

Ryan BarilRyan Baril is the Vice President of CAPITALPlus Mortgage, a boutique mortgage origination and underwriting company founded in 2001. Ryan has been educating consumers about the mortgage process and general finance for almost 20 years. He graduated from the University of Central Florida in 2012 with a B.S.B.A. in Marketing.

VP, CAPITALPlus Mortgage No, you cannot carry the mortgage for the buyer. If the buyer cannot get a mortgage on their own, you would have to rent the home to them or find a different buyer.

No, you cannot carry the mortgage for the buyer. If the buyer cannot get a mortgage on their own, you would have to rent the home to them or find a different buyer.

Warnings

- Flipping a house is exceedingly risky, and you could end up losing hundreds of thousands of dollars, on which you'll then owe interest to the bank. Only attempt it if you're sure you know exactly what you're doing.⧼thumbs_response⧽

- The idea behind flipping is that you can make a sale before interest begins to accrue on your loan. If you find yourself sitting on a "black hole," cash out as best you can; a loss of a few thousand dollars is nowhere near as bad as a decaying property and a mountain of lifelong debt.⧼thumbs_response⧽