This article was co-authored by Andrew Lokenauth and by wikiHow staff writer, Jennifer Mueller, JD. Andrew Lokenauth is a Finance Executive who has over 15 years of experience working on Wall St. and in Tech & Start-ups. Andrew helps management teams translate their financials into actionable business decisions. He has held positions at Goldman Sachs, Citi, and JPMorgan Asset Management. He is the founder of Fluent in Finance, a firm that provides resources to help others learn to build wealth, understand the importance of investing, create a healthy budget, strategize debt pay-off, develop a retirement roadmap, and create a personalized investing plan. His insights have been quoted in Forbes, TIME, Business Insider, Nasdaq, Yahoo Finance, BankRate, and U.S. News. Andrew has a Bachelor of Business Administration Degree (BBA), Accounting and Finance from Pace University.

This article has been viewed 43,445 times.

If you've recently gotten married, congratulations! Once you get settled into married life, one of the first things you should do is update your W-4 with your employer. This form determines how much money will be withheld from your taxes. Generally, married taxpayers are entitled to more allowances than single taxpayers. However, things can get a little more complicated if both you and your spouse work, or if either of you has more than one job.[1]

Steps

Entering Personal Information

-

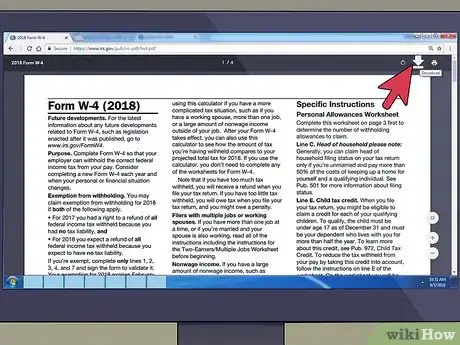

1Download a current copy of the W-4 with instructions. Your employer typically will give you a blank copy of the W-4 if you ask for one. You can also download a copy from the IRS website at https://www.irs.gov/forms-pubs/about-form-w4. Make sure the form you fill out is valid for the current year.[2]

- Get the full form with the instructions and worksheets. You'll need the worksheets to calculate your allowances so you won't have too much money withheld from your paycheck.

-

2Write or type your name and address on Line 1. If you plan to change your surname after getting married, fill out the form with the name you plan to use. Even if you haven't completed the necessary steps to legally change your name, go ahead and use it on your W-4.[3]

- If the last name you entered is different from the last name on your Social Security card, check the box on Line 4. Your employer will continue to withhold taxes under your old name until you show them your new Social Security card.[4]

Advertisement -

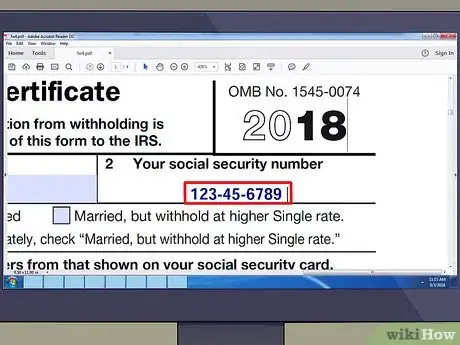

3Provide your Social Security number on Line 2. Your employer must get your Social Security number to withhold taxes from your wages, even if you are a resident or nonresident alien. If you've changed your name on your Social Security card, bring your updated Social Security card to your employer so they can photocopy it for their records.[5]

- If you don't have a Social Security number yet, apply for one using the form available at https://www.ssa.gov/forms/ss-5.pdf. You may want to make a copy of this form for your employer once you complete it, so they have it for their records.

-

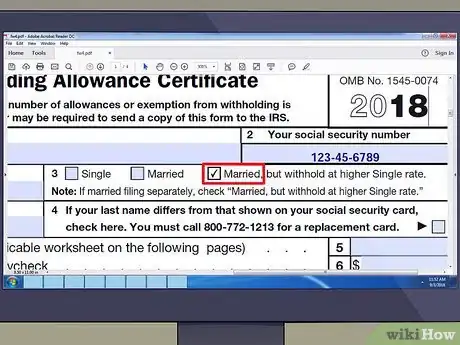

4Check the "Married" box on Line 3. This box indicates that you are married and plan to file a federal tax return jointly with your spouse. Filing jointly as a married couple typically entitles you to greater allowances than single taxpayers.[6]

- If you're concerned that you won't have enough tax withheld, you can check the "Married, but withhold at higher Single rate" box. You might want to do this if, for example, you and your spouse plan to file separate tax returns.

Claiming Allowances

-

1Discuss head of household and child allowances with your spouse. Before you start filling out your W-4, it may help to sit down with your spouse and coordinate how you are going to fill out your W-4s and what allowances you are each going to claim. This is potentially more important if either of you already had dependents when you got married.[7]

- You may be eligible for additional credits or allowances, depending on your annual income as a couple. It can help to look at your tax returns from the previous year to figure out how much you're going to make.

- If you and your spouse each have dependents and your income is relatively substantial, work with an accountant to make sure you both fill out your W-4s appropriately. Having too much withheld is like giving a free loan to the government, while having to little withheld could result in a big bill at tax time.

-

2Claim personal and married allowances. No matter what, you get an allowance for yourself. Even if you end up claiming no other allowances, you always want to claim at least this one. If you plan to file your tax return jointly with your spouse, enter a "1" on Line B as well.[8]

- Typically you can only claim the allowances on Lines C and D if your spouse does not work and you only have one job.

-

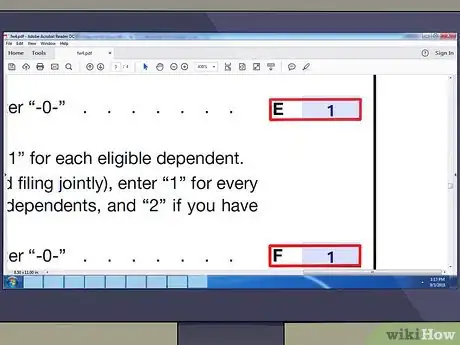

3Enter allowances for the child tax credit, if applicable. If neither you nor your spouse have any children, you can skip Line E of the personal allowances worksheet. If you do have children, review the criteria listed to determine what allowances to claim.[9]

- If you're not sure whether you're eligible for the child tax credit, read the publication at https://www.irs.gov/forms-pubs/about-publication-972.

- If you're not eligible for the child tax credit, you may still be able to claim allowances for any children on Line F.[10]

-

4Include any other credits you claim on Line G. If you want your withholding to reflect other credits you plan on claiming on your tax return, such as a mortgage interest credit or an earned income credit, fill out the worksheet that accompanies IRS Publication 505.[11]

- You can download Publication 505 from the IRS website at https://www.irs.gov/pub/irs-pdf/p505.pdf. Make sure the copy you download is valid for the current year.

- Review the information in the publication, then fill out Worksheet 1-6. It will tell you what number you should put on Line G.

-

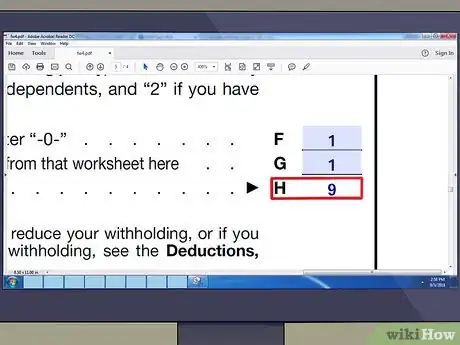

5Add Lines A through G and enter that number on Line 5 of your W-4. Lines A through G are the total allowances that you're claiming. Each allowance reduces the amount of money that will be withheld from your paycheck.[12]

- If you and your spouse both work, and your combined income exceeds $52,000, you may want to make additional adjustments to make sure enough tax is withheld from your paychecks. Otherwise you could end up with a big bill at tax time.

- Instead of making adjustments, you also have the option of tinkering with your allowances. For example, you may choose not to claim allowances for dependents, even though you have children. More tax would be withheld from your paychecks, but you likely wouldn't have to worry about paying too little.[13]

Making Adjustments

-

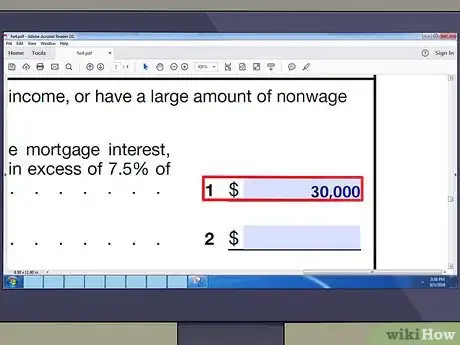

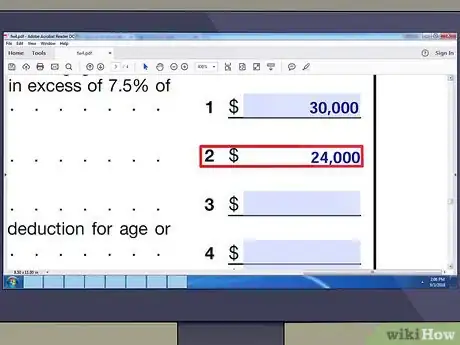

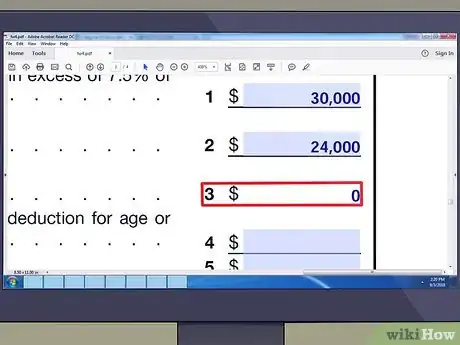

1Estimate your deductions if you plan to itemize. You may choose to itemize deductions rather than take the standard deduction. Taxpayers most commonly choose to itemize if they own a house, to take advantage of the home mortgage tax deduction.[14]

- You should be able to make a reliable estimate of your total joint deductions by looking at the tax returns you and your spouse filed last year. Work with an accountant if you're not sure how being married would impact any deductions you took while single.

-

2Complete the worksheet for deductions and adjustments. The worksheet directly below the personal allowances worksheet allows you to calculate your allowances if you plan to itemize your deductions, or if you have substantial non-wage income (such as dividends or interest on investments).[15]

- Before you fill out this worksheet, you may want to have documents handy that you can use to estimate your income and your spouse's income from all jobs.

-

3Enter your total allowances on Line 1 of the two-earners worksheet. If both you and your spouse work, or if either of you have more than one job, this worksheet allows you to adjust your allowances to ensure enough taxes are withheld from your paychecks. Start by entering the same number you came up with on Line H of the personal allowances worksheet.[16]

- You don't have to include all allowances for which you're eligible to use the worksheet. If you decided not to claim an allowances for the purposes of withholding, you can leave it off here as well.

-

4Use Table 1 to find the appropriate number to put on Line 2. Use the first half of the table if you are married filing jointly. Otherwise, use the ranges and numbers on the second half of Table 1. Find the range that corresponds to the income you earn each year from your lowest paying job.[17]

- You can use the income from your previous year's tax return to help you, but make sure you're estimating wages for the current year. If your pay has recently increased, take that into account.

- If the total allowances you claimed from the personal allowances is less than the number that corresponds to your lowest paying job in Table 1, claim "-0-" allowances on your W-4.

- For example, suppose you claimed 2 personal allowances. Your lowest paying job pays $35,000 a year, which corresponds to the number "4" on the table. Since 2 is smaller than 4, enter "-0-" on your W-4. Then continue the worksheet to calculate any additional withholding.

-

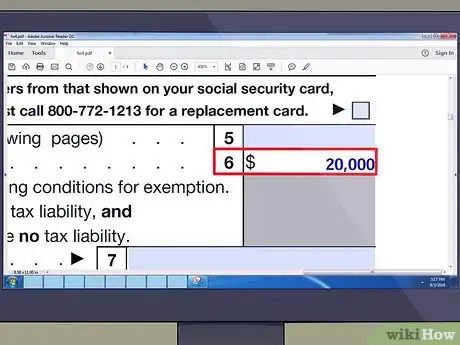

5Use Table 2 to calculate additional withholding. If the number you calculate for Line 3 is 1 or more, find the range in Table 2 that corresponds to your wages from your highest paying job. Enter the dollar figure next to the range on Line 7 of the worksheet.[18]

- For example, if your wages from your highest paying job are $75,000 and you plan to file jointly with your spouse, you would enter $500 on Line 7.

- As with Table 1, this table is divided with figures for taxpayers who are married filing jointly and for all other taxpayers. While the dollar amounts are the same, the pay ranges are different – so make sure you're using the right one.

-

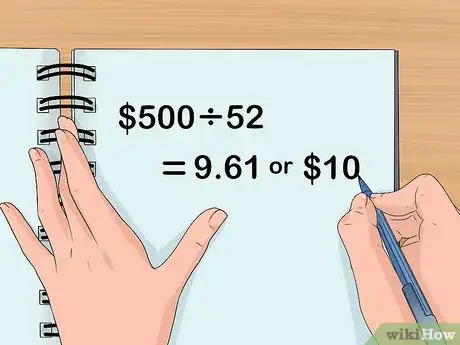

6Divide your annual withholding by the number of pay periods. The amount you entered on Line 7 is the additional amount that should be withheld from your pay each year. When you divide that amount, you get the dollar amount that should be withheld from each paycheck.[19]

- For example, suppose you entered $500 on Line 7. You get paid every week, so you would divide $500 by 52. Round the result to the nearest whole dollar to get $10. Enter that amount on Line 9 of the worksheet.

-

7Copy the amount on Line 9 to Line 6 your W-4. The amount you wrote on Line 9 of the worksheet corresponds to the additional amount of money that should be withheld from each of your paychecks for taxes. go back to your W-4 and enter that amount in the box on Line 6 after the phrase "Additional amount, if any, you want withheld from each paycheck."[20]

- This additional withholding should mean that you don't owe any additional taxes when you file your return. If you do owe taxes, or if you are due a sizable refund, you may want to revisit your W-4s and tweak your withholding.

References

- ↑ https://www.blog.rapidtax.com/how-to-fill-out-a-w-4-correctly/

- ↑ https://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/p15.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ https://www.nerdwallet.com/blog/taxes/how-to-fill-out-w4/

- ↑ https://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ https://www.irs.gov/publications/p505

- ↑ https://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ https://www.nerdwallet.com/blog/taxes/how-to-fill-out-w4/

- ↑ https://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ https://www.irs.gov/pub/irs-pdf/fw4.pdf

- ↑ https://www.irs.gov/newsroom/seven-tax-tips-for-recently-married-taxpayers