This article was co-authored by wikiHow Staff. Our trained team of editors and researchers validate articles for accuracy and comprehensiveness. wikiHow's Content Management Team carefully monitors the work from our editorial staff to ensure that each article is backed by trusted research and meets our high quality standards.

This article has been viewed 89,298 times.

Learn more...

Wiring money is a fast and easy way to pay someone. As a Wells Fargo customer, you can send money online or in person, and you can also receive wire transfers. You’ll need to gather required information so that the wire can go through smoothly. Also confirm what fees you will pay, because you can’t send or receive money for free.

Steps

Sending Money Online

-

1Check if this is an option for you. You can wire money online if you have been a Wells Fargo Online customer for at least 180 days. You also need a valid Wells Fargo savings, checking, or Command Asset Program account.[1]

- If you haven’t been a Wells Fargo Online customer for enough time, you should register. This will allow you to send wires online in the future.

-

2Add recipients. Once you log in, you should select “Transfer and Pay” and then choose “Wire Money.”[2] You should add recipient details, such as the following:

- The recipient’s name and address.

- The name, address, and country of the recipient’s bank.

- The bank’s routing number.

- The bank’s Swift Code/BIC. This is an 8 or 11-digit code.

Advertisement -

3Send money. You should include the amount you want to send and the recipient’s account number. If you are sending money internationally, you will need the International Bank Account Number (IBAN).

- If you want the money to arrive on the same day, you should send before 4:30 Central Time (CT). This is the deadline for sending outgoing domestic and international wire transfers. If you live in the Eastern Time zone, then 5:30 is the deadline. Talk to a banking representative if you have questions.

-

4Pay fees. Online wire fees start at $30. Review your consumer account fee and information schedule or call 1-800-869-3557 for more information.[3]

Wiring Money in Person

-

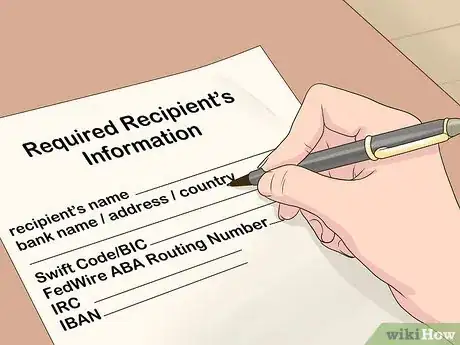

1Gather information from the recipient. You need the following information to make sure that your wire goes through:

- The recipient’s name and address.

- The recipient bank name, address, and country.

- Swift Code/BIC of the recipient’s bank. The recipient should give you this information.

- The FedWire ABA Routing Number (domestic wires). This is a nine-digit number.

- International Routing Code (international wires).

- The recipient’s bank account number or International Bank Account Number (IBAN).

-

2Meet the deadline. If you want your wire to go through on the same day, then you must send it before the deadline. If you miss the deadline, the wire goes through on the next business day. Consider the following deadlines:[4]

- 12:00 pm (noon) Central Time. Same-day wires to Mexico in Pesos and wires to Canada in Canadian dollars. If you are in the Eastern Time zone, add one hour (1:00 pm). Subtract one hour in the Mountain Time zone (11:00 am) and two hours in the Pacific Time zone (10:00 am).

- 3:00 pm CT. Tax payments and outgoing international wire transfers from a consumer account.

- 4:30 pm CT. Outgoing domestic and international wire transfers and outgoing drawdowns.

- 7:00 pm CT. Same-day wire transfers between two Wells Fargo accounts.

-

3Stop into your bank. Visit any Wells Fargo location. Find the nearest at https://www.wellsfargo.com/locator/. Unfortunately, you must stop by in person because Wells Fargo cannot accept wire instructions by email or through fax.

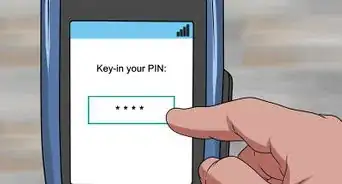

- If you want to wire money using the phone in the future, you should complete a Wire Agreement at the branch. You will also order your personal identification number (PIN), which will take 10-14 business days to arrive.

-

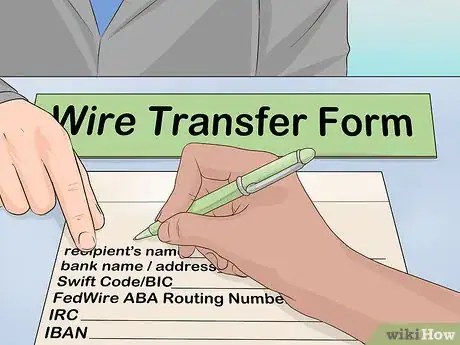

4Complete a form. Tell the bank representative that you want to wire money to someone. There should be a form for you to fill out. Sign in front of the bank representative. Also ask about fees before going through with the wire transfer.

Receiving a Wire Transfer

-

1Provide the sender with your account information. You want the wire to go through smoothly, so make sure the person sending you money has the necessary information. Send them the following:[5]

- Wire Routing Transfer Number: 121000248.

- Bank Name: Wells Fargo Bank, N.A.

- Location: 420 Montgomery, San Francisco, California (use this regardless of where your account is located).

- Swift Code: WFBIUS6S (for international transfers).

- Title of your account: as it appears on your statement.

- Your full account number.

-

2Receive your money. To receive money on the same day, incoming wires must be received by 5:30 pm Central Time. If the wire comes in later, you won’t receive the money until the next business day.[6]

- The deadline is 6:30 pm in the Eastern Time zone, 4:30 pm in the Mountain Time zone, and 3:30 pm in the Pacific Time zone.

-

3Pay the fee. You need to pay a $15 fee to receive a wire transfer. Other fees may also apply. Call 1-800-869-3557 for more information about fees or talk to a banking representative.

References

- ↑ https://www.wellsfargo.com/online-banking/wires/

- ↑ https://www.wellsfargo.com/online-banking/wires/

- ↑ https://www.wellsfargo.com/online-banking/wires/

- ↑ https://www08.wellsfargomedia.com/assets/pdf/personal/help/wire-transfer-quick-reference.pdf

- ↑ https://www08.wellsfargomedia.com/assets/pdf/personal/help/wire-transfer-quick-reference.pdf

- ↑ https://www08.wellsfargomedia.com/assets/pdf/personal/help/wire-transfer-quick-reference.pdf

Community Q&A

-

QuestionHow do I transfer money into a Wells Fargo account from outside of the USA?

EricTop AnswererIf you have a foreign bank account, you can request the foreign bank send a wire transfer to your Wells Fargo account. Be sure to check with Wells Fargo for the applicable incoming wire instructions that you can provide to the foreign bank to ensure there are no delays in processing and receiving the wire.

EricTop AnswererIf you have a foreign bank account, you can request the foreign bank send a wire transfer to your Wells Fargo account. Be sure to check with Wells Fargo for the applicable incoming wire instructions that you can provide to the foreign bank to ensure there are no delays in processing and receiving the wire. -

QuestionHow much money can I wire through Wells Fargo when doing a wire transfer?

EricTop AnswererThere is no limit to the amount of funds that can be sent through a wire transfer (aside from your account balance). If you are a business customer submitting a wire transfer online, you may have limits set that are specific to your business. If you request the wire transfer over the phone, there may also be reduced limits. For the most security, request a wire transfer in a Wells Fargo branch location.

EricTop AnswererThere is no limit to the amount of funds that can be sent through a wire transfer (aside from your account balance). If you are a business customer submitting a wire transfer online, you may have limits set that are specific to your business. If you request the wire transfer over the phone, there may also be reduced limits. For the most security, request a wire transfer in a Wells Fargo branch location.

About This Article

To send a Wells Fargo wire transfer online, you’ll need to have held a savings, checking, or Command Asset Program account with them for at least 180 days. You’ll also need your recipient’s name, address, bank details, and Swift code. A swift code is an international bank code that identifies a particular bank. If you want your money to arrive on the same day, send it before 4:30 Central Time. Online wire fees start at 30 dollars. To send a wire transfer in person, you’ll need to fill in a form with your recipient’s details at the branch. For a same day transfer, file your form before noon Central Time. To receive your transfer, you’ll need to pay a basic fee of 15 dollars. For more tips, including how to contact Wells Fargo for more information, read on!