This article was co-authored by Darron Kendrick, CPA, MA. Darron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

This article has been viewed 20,830 times.

A money market fund is a type of mutual fund that is required by the government to invest in only low-risk investment vehicles, such as certificates of deposit (CDs), government securities, and other highly liquid, low-risk securities. Because of the low-risk strategy associated with money market funds, they are considered to be one of the safest investment forms available, comparable to high-yield savings accounts. Their relatively low rate of return is a direct reflection of their low-risk status. There are many money market funds available, offered by a number of different investment firms. Follow these steps to choose the right money market fund for your investment needs.

Steps

Deciding to Invest in a Money Market Fund

-

1Decide if money market funds are right for you. Before investing in a money market mutual fund (MMF), you'll have to make sure that doing so is the right move for you. At a basic level, money market funds operate similarly to savings accounts. They are low-risk accounts that earn a relatively steady interest rate over time and can be withdrawn from. However, the actual withdrawal process is not as simple as visiting your bank and asking for a withdrawal. Instead, you'll have to either write a large check or electronically transfer the funds out if you need them, which makes MMFs a bad choice if you might need the money quickly.

- In addition, MMFs are not FDIC-insured. This means that the government does not insure your funds in case of the default of the investment firm that provides your MMF. However, in reality there is very little risk of your losing money this way.

- Most MMFs also have a minimum investment of at least $2,500.

-

2Use the fund to manage cash. One potential use of an MMF is to manage any unused money you have with an investment firm. If this is the case, the firm will often recommend putting the money in a money market account as a comparable, slightly higher-yielding, alternative to a savings account.[1]Advertisement

-

3Replace a savings account. Money market funds are a good bet if you need a safe, easy-to-access investment to put your money into while you make a more long-term investment decision or save for a large purchase. In this way, the money market serves as a savings account, but with a higher yield. When you are ready to invest, it is easy to transfer the money out to purchase mutual fund or securities shares.[2]

- However, you should only use a MMF as a savings account if you don't need to take money out before you close the account. This is because there may be large fees for writing checks from or withdrawing money from the account.[3]

-

4Transfer money to and from other investments. If you want to sell a higher-yield investment fund in order to cash in on its maturity before deciding on which fund you next want to purchase, you can use a money market fund to hold your balance in the interim. Placing the money in a money market fund held by the company you plan on investing with is a good idea, as you can easily transfer funds from the money market account into a new fund, once you make a decision.[4]

Finding Different Money Market Funds

-

1Know where to look for money market funds. Money market funds are typically available through investment management companies, like Fidelity, Vanguard, Charles Schwab and T Rowe Price. Visit the websites for these companies to learn more about their money market fund offerings.

- It may also be a good idea to check with your current broker to see what money market funds they have available.[5]

- Each of these companies will offer a variety of money market funds that offer different levels of risk and returns.

-

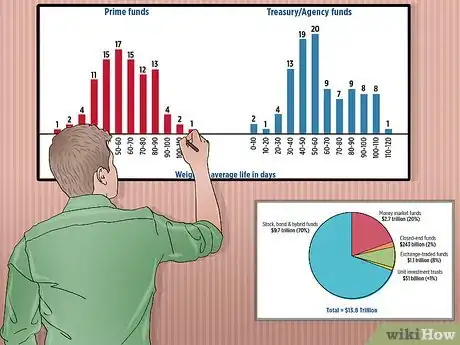

2Consider US Treasuries Securities funds. These funds limit their investing strictly to U.S. treasuries securities, or Treasury bills (T-bills), and are generally considered the safest type of money market funds. However, they also yield the lowest returns.[6]

-

3Investigate Government Sponsored Enterprises (GSEs) funds. Government entities like Fannie Mae and Freddie Mac are the primary investment for these money market funds, which yield a higher return than T-bill funds, but are also slightly riskier. These funds also don't qualify for tax-free status on state income tax.[7]

-

4Analyze different money market securities funds. The final type of MMF invests mostly in short-term corporate securities. These provide the highest returns. However, they are not exempt from any taxation and also carry the highest amount of risk.[8]

Comparing Money Market Funds

-

1Obtain fund information. You can obtain fund information from the investment company that provides it by requesting fund documents and information. The primary document, the prospectus, outlines how the fund is organized and exactly where it invests its money. The company also produces monthly and annual reports that showcase the performance of the fund. In addition, there may also be Key Investor Information Documents (KIIDs) that can provide you with more fund structure and performance information.

- For more popular or well-known MMFs, there may also be information available online at sites like MarketWatch and Yahoo! Finance.

-

2Compare funds with tax-exempt and non tax-exempt status. Taxable funds invest in securities that are federally taxable, like Treasury bills and commercial papers. Tax-exempt funds invest only in state and local government-issued securities that are not subject to federal taxation. Search for MMFs specific to your state to find one that is tax free on both of the state and federal level. Many investment companies offer this type of state-specific fund.

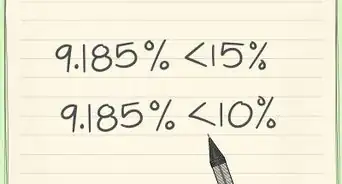

- The stated yields on tax-free MMFs may be lower than their taxable counterparts. However, in many cases the after-tax yield is higher. This is especially true for those investors in a higher tax bracket.[9]

- Generally, those in the 28 percent tax bracket or above should seek to invest in tax-free MMFs. Otherwise, their funds will be taxed too heavily to offer positive after-tax returns.

-

3Analyze expenses. Take all expenses associated with a money market fund into account before committing. Because of the relatively low returns earned by MMFs, it is generally more important to avoid paying fees. Most funds charge management fees and fund expenses, but some also charge an annual fee and/or withdrawal fees. Redemption fees, which may be charged when you take money out of your account, can also eat in your yields but are capped at 2 percent of your investment value.

- Prospectuses are required to state fees charged, but the prospectus presented may be out of date and fees are liable to change daily.

- Prospectuses also show an "expense ratio" that calculates average fees as a percentage of your investment. Look for the lowest expense ratio when choosing your MMF.

- Some funds will also waive fees if the fees charged would create a negative return for investors.[10]

-

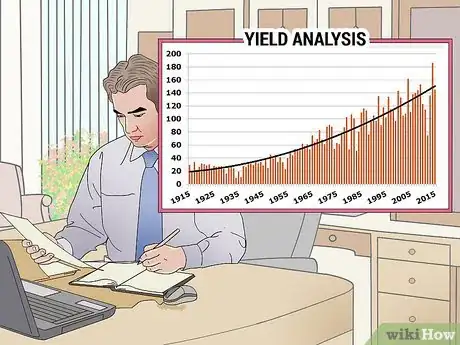

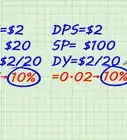

4Look for the best yield. The yield is similar to an interest rate: the higher the yield, the higher the money market fund payout to you. Yields may fluctuate on a daily basis, so consider a fund's current yield and yield history. Remember to compare the yield to the expense ratio to assess how much you can actually expect to make on the investment.

-

5Check the credit ratings of money market fund holdings. The risk inherent to a money market fund will depend on the underlying securities it is invested in. Always investigate the fund's prospectus to figure out where your money will be going. For example, the safest MMFs are invested in US Government Treasury securities. These funds are also cheap as far as fees go because these securities require little to no research on the part of the fund managers. However, some other MMFs may be invested in relatively risky short-term municipal or corporate securities.[11]

- Look at the credit ratings of individual securities held by the MMF to assess the credit risk of the MMF.

References

- ↑ http://www.investopedia.com/articles/mutualfund/04/081104.asp

- ↑ http://www.investopedia.com/articles/mutualfund/04/081104.asp

- ↑ http://www.bankrate.com/finance/savings/money-market-fund-shoppers-1.aspx

- ↑ http://www.investopedia.com/articles/mutualfund/04/081104.asp

- ↑ http://www.fool.com/personal-finance/saving/2007/05/09/the-best-money-market-funds.aspx

- ↑ http://www.fool.com/personal-finance/saving/2007/05/09/the-best-money-market-funds.aspx

- ↑ http://www.fool.com/personal-finance/saving/2007/05/09/the-best-money-market-funds.aspx

- ↑ http://www.fool.com/personal-finance/saving/2007/05/09/the-best-money-market-funds.aspx

- ↑ http://www.fool.com/personal-finance/saving/2007/05/09/the-best-money-market-funds.aspx