This article was co-authored by Clinton M. Sandvick, JD, PhD. Clinton M. Sandvick worked as a civil litigator in California for over 7 years. He received his JD from the University of Wisconsin-Madison in 1998 and his PhD in American History from the University of Oregon in 2013.

This article has been viewed 37,200 times.

If you write a will, a court will supervise the transfer of your assets to your heirs after you die. This process, called probate, can takes months. A living trust allows you to avoid probate and transfer your assets to your heirs quickly and smoothly. If the trust includes appreciating assets, including securities or a house owned by you and your spouse as joint tenants, you should consider changing them to community property assets. Doing so can save you quite a bit of money on your taxes.

Steps

Understanding Community Property

-

1Understand community property. In a state like California, money earned during a marriage and property purchased with those earnings belong to both spouses equally.[1] There are many exclusions, such as property owned separately before marriage, any property inherited individually while married, and any property purchased while the couple was separated.[2]

-

2Meet with an attorney. You should meet with an attorney to discuss why you want to change property in a trust from joint tenancy to community property. Typically, you would make the switch from joint tenancy to community property to save on taxes.

- In joint tenancy, when one spouse dies, the other owns the entire asset. However, he or she must pay capital gains taxes on the value that appreciated to the asset. The tax will be calculated based on the difference between the original purchase price of the asset and its eventual sale price. Accordingly, if a house were purchased for $50,000 but then sold for $300,000, then the appreciation of the asset is $250,000. Because the surviving spouse takes the other spouse’s half of the property, he or she would owe capital gains taxes on half of the appreciated value. In our hypothetical, it would be $125,000.[3]

- With community property, one spouse will also own the entire asset upon the death of the other spouse. However, because the property is held as community property, the entire property will be “stepped up” to current market value, thus wiping out capital gains taxes.

Advertisement -

3Find your trust document. If you want to go ahead and retitle property from joint tenancy to community property with right of survivorship, then find your trust document and see what assets are in the trust.

- Hold onto your copy of the trust document. You will need to change it to reflect the fact that the property is now being held in community property with right of survivorship.

-

4Identify appreciating assets. Look at your trust document and identify any assets that might appreciate in value. These assets will be taxed differently depending on whether they are held in joint tenancy or as community property.

- Almost any asset can appreciate in value, but the most common are securities (stocks) and real estate. To save on taxes, you should work on making appreciating assets community property with right of survivorship.

- By contrast, some property depreciates in value, such as automobiles. You probably will not worry about retitling property that depreciates.

Retitling Stocks

-

1Find the name of the transfer agent. You will need to retitle securities so that they will be held as community property. First, you need to find the name and address of the transfer agent.[4]

- The transfer agent may be printed on the back of the certificate. However, if the certificate is old, then you should no longer assume that the name listed is the current transfer agent.

- Instead, contact the company and ask who the agent is.

-

2Complete the notification of assignment. You should find the notification on the back of the security certificate, or you will need to get a stock power form.[5]

- Stock power forms are available online or from a bank.

- You must fill out the form, listing the name of the trust, the name of the trustees (you and your spouse), and the date of the agreement.[6] You should also write that the property is held as “community property with right of survivorship.”

- If you fill out the stock power form, then you will need specific information such as the name and number of shares, as well as the certificate number.[7] You should have this information already from when you initially placed the stock in the trust.

-

3Get a signature guarantee recognized by your transfer agent. Your bank should be able to provide you with a guarantee.

- Getting a guarantee is like getting a document notarized.[8] You must provide proof of your identity (typically a valid driver’s license or passport will suffice).

-

4Sign the stock over to the trust. You should also make copies for your records.

-

5Send to your transfer agent. Send the notification of assignment, trust document, and the signature guaranteed security certificate to the transfer agent by an insured carrier. The transfer agent will send a retitled security back to you.

Changing the Deed on Your House

-

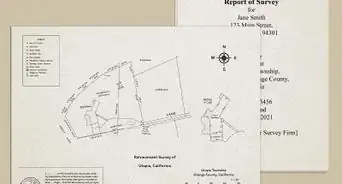

1Record a new deed. You need to record a community property with right of survivorship deed with the county assessor. This is a deed in which you and your spouse transfer the property to yourselves as community property with right of survivorship.

- Consider hiring an attorney. You can have a lawyer draft a deed for you, or you could do it yourself. You might want to use a lawyer if you are worried about making a mistake.

- Deed kits are available online or at an office supply store. You can also download a blank form from the website of the county assessor or through estate attorney websites.

-

2Complete a Preliminary Change of Ownership Report (PCOR) and check the box showing that this is a transfer between spouses. You can request this from the county assessor or download it from the assessor's website or the website of the California courts. You must file it with the deed.

- Fill in the deed form. You and your spouse must sign it in the presence of a notary public.

- Include a legal description of the property, which your current deed will have. The legal description should be listed under the heading “Description” or “Legal Description.”

-

3File with the assessor. Hand-carry or mail the notarized deed, legal description of the property, and the PCOR to the assessor's office.

- Keep a copy of the deed with your living trust.

-

4Change the wording of your living trust. The trust should indicate that the house is held as “community property with right of survivorship.” These are the words required by California statutes.[9]

- Be careful of how you revise the trust document. If you are careless and write that “all” property is now held as community property, then any separate property held in the trust will be converted to community property.

- You should have an attorney review the new trust document to make sure you have done the revisions properly.

Warnings

- Retitling securities yourself can be a long, tedious process. Name changes, stocks splits and other changes can make tracking down the transfer agent difficult. It also means that you will lose control of your security while you wait for the retitled certificate to arrive. You will not be able to sell the security during this time.⧼thumbs_response⧽

- The legal issues regarding inheritance for same-sex couples in California are complex because different laws were in effect depending on when they married or registered their domestic partnership. Same-sex couples should consult with an attorney before creating living trusts or retitling assets.⧼thumbs_response⧽

References

- ↑ http://www.nolo.com/legal-encyclopedia/marriage-property-ownership-who-owns-what-29841.html

- ↑ http://homeguides.sfgate.com/community-property-law-california-6860.html

- ↑ http://heritagelivingtrust.com/blog/2013/3/30/joint-tenancy-and-capital-gains.html

- ↑ http://www.nolo.com/legal-encyclopedia/free-books/avoid-probate-book/chapter6-5.html

- ↑ http://finance.zacks.com/move-stock-revocable-trust-1037.html

- ↑ http://finance.zacks.com/move-stock-revocable-trust-1037.html

- ↑ http://finance.zacks.com/move-stock-revocable-trust-1037.html

- ↑ http://finance.zacks.com/move-stock-revocable-trust-1037.html

- ↑ http://www.nolo.com/legal-encyclopedia/free-books/avoid-probate-book/chapter6-5.html