This article was co-authored by Carla Toebe. Carla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

There are 9 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 468,520 times.

Probably the easiest way to calculate the re-sale value of a mobile home is to look up its book value. However, if you are selling your mobile home along with land it sits on, then you need to account for the land’s value. Perform some research instead. You can compare your home to other mobile homes that have sold in your area recently. You may also hire an appraiser.

Steps

Finding the Book Value

-

1Locate the blue book. In the United States, the NADA Manufactured Housing Appraisal Guide is the “blue book” used to determine the value of mobile homes. Go to your local library and see if there is a copy.

- Look in the book for your type of manufactured home, and then follow the step-by-step guide for calculating the retail book value. Your calculation will depend in part on the condition of the mobile home.[1]

-

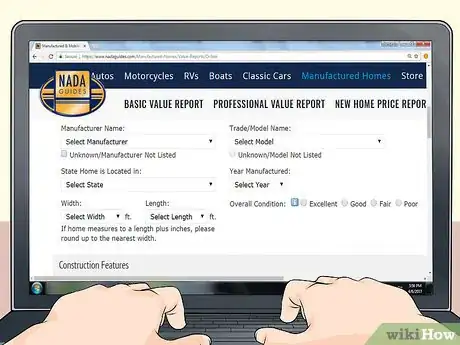

2Visit the NADA website. Alternately, you can submit an online request for a value report at the NADA website. Go here: http://www.nadaguides.com/FAQ/manufactured-home-value-reports#q21. However, you must pay in order to get a report.

- A Basic Used Home Value Report will cost $26. You can use this report if there are no unique features to your mobile home.

- A Professional Used Home Value Report will cost $50. This report will give you a more in-depth analysis and accurate estimate of the home’s value.[2]

- A New Home Price Report will cost $35.

Advertisement -

3Provide the requested information. The NADA guide will estimate the value of your home based on the following factors:[3]

- year the home was manufactured

- manufacturer

- size of the home (width and length)

- where you are located (state and region)

- condition of the home

- other features, such as granite countertops, hardwood floors, garages, etc.

-

4Receive your report. After submitting your online request, you will instantly receive your report. Click on the “View Your Report” button, which is located on your payment confirmation page.[4]

- You can print off your report or save it.

-

5Understand the limitations of the book value. The book value does not take into account the value of your land, which is often more valuable than your mobile home.[5] For this reason, you should also do your own research if your mobile home is fixed to a piece of property.

Performing Your Own Research

-

1Research comparable sales in your neighborhood. Each local real estate market is different, and the book value cannot account for whether your local market is hot or not. Make sure to look at how much comparable mobile homes have sold in your area. You can find the sale price at your county recorder’s office or by looking at websites such as Zillow.

- The mobile homes need to be comparable in terms of size, age, general condition, and the amount of land.

- You are unlikely to find an exact match, but you don’t need an exact match. Find mobile homes around the same age as yours and about the same size.

- Sales also need to be recent. The market was different four years ago than it is today.

- Your comparison properties should be located within half a mile of your property if you live in the city, a mile of your property if you live in the suburbs, or 5 miles of your property if you live in a rural location.

-

2Assess the condition of the home's interior. The overall condition of the mobile home will impact its value. Visit the mobile home and try to inspect the inside. The more repairs you need to make, the less value the home has. Pay attention to the following factors:

- Roof. Look for signs of a leaky roof inside the mobile home. In particular, water damage should show on the ceiling or walls.

- Walls. Check the stability of the walls and whether there is any mold.

- Flooring. Look for holes or soft spots on floors. Also check whether the floor is uneven.

- Plumbing. Some water leaks may be caused by leaks in the plumbing. Also check the water pressure.

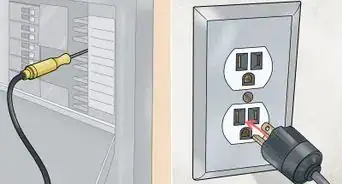

- Electricity. Check outlets and turn on light switches to see if the electricity works.

-

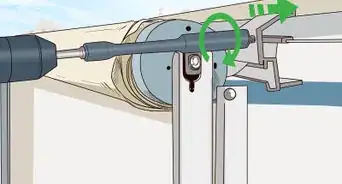

3Inspect the outside of the home. Repairs often have to be made to the outside of the mobile home. Walk around and assess the following:

- Roof. Don't rely solely on the absence of water marks inside. Instead, check the exterior of the roof by walking on it and looking for soft spots, holes, or missing shingles.

- Siding. Check whether siding is damaged, rotting, or dented. Also assess the overall aesthetic quality. Ugly siding can reduce the value of the home.

- Underside. Definitely check the underside to see how stable it is. If necessary, remove some pieces of skirting and use a flashlight. Check for insulation hanging down or junk and debris strewn all over the place. Also check whether animals are living under the home.

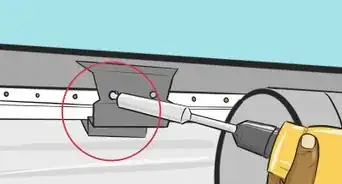

- Make sure the home has tie downs that connect the home to the ground. These will be necessary to get loan funding to pay for the property.

-

4Identify features that add value. Some features might increase the value of your mobile home. You should identify anything that would make your home desirable, including the following:

- Quality of the neighborhood. For example, you might be in a well-maintained neighborhood that isn’t overcrowded. If so, your home’s value should increase.

- Proximity to services. Your home’s value will also increase if you are near hospitals, schools, or a transportation hub.[6]

- Granite countertops or new appliances. Buyers might value these features and pay more for them.

-

5Ask a real estate agent for an analysis. A real estate agent might be willing to provide you with a comparative market analysis (CMA) for free. Find agents in your phone book or ask someone you know for a referral.

-

6Look at your property tax statement. You are assessed property taxes based on the value of your home. Find your property tax statement and find out how much the appraiser has valued the mobile home.[7]

- Property tax records are also public, so you can find out this information about another home in your area. Visit the tax assessor’s office.

- Keep in mind that homes usually sell for more on the open market than the price that is listed on the tax assessment forms.

Hiring an Appraiser

-

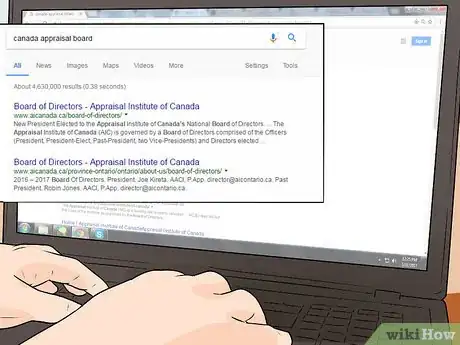

1Find an appraiser. Look for someone who is certified or has a state license.[8] These are signs of sufficient training and skill. You can find an appraiser in the following places:

- Obtain a referral from a state appraisal board. Type “your state” and “appraisal board” into your favorite search engine. Check to see if your state board has a directory you can search.

- Search the directory of an accreditation society, such as the American Society of Appraisers.

- Contact a real estate agent for a referral to someone who is qualified.

-

2Ask about the appraiser’s knowledge of mobile homes. Mobile homes can present many challenges to appraisers who do not have sufficient experience. Ask appraisers whether they have a certification to appraise mobile homes or whether they have ever taken a course on manufactured home appraisals.[9]

- Keep researching appraisers until you find one sufficiently knowledgeable about mobile homes.

-

3Meet with the appraiser. You should meet the appraiser at the mobile home. They may have questions about the neighborhood or the property.[10] Answer them as completely and honestly as you can.

- The appraiser also needs space to perform the appraisal, so don’t hover. Give them enough space to do their job properly.

- A typical appraisal takes a few hours and costs around $500.[11]

- Most of the appraisal will be done away from the property. Expect the meeting at the property to take about 10 minutes. The appraiser will measure the home, take inside and outside photos, ensure systems are working, and recommend any needed repairs.

-

4Analyze the appraisal report. When you receive the report, you should study it closely. You’ll want to make sure that the appraiser used appropriate homes for comparison purposes.

- Also check whether the appraiser properly valued features that can add value to your mobile home, such as location to public transportation or proximity to a good school district.[12]

- If you disagree with something in the appraisal report, bring it to the appraiser’s attention. Write a letter laying out what you think the appraiser overlooked.

Expert Q&A

-

QuestionHow much is a 1976 Fleetwood mobile home with 2 bedrooms and 2 bathrooms worth?

Carla ToebeCarla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

Carla ToebeCarla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

Real Estate Broker Lenders will not lend on a mobile home built prior to 1978 so you will only be able to sell it to a cash buyer. You will have to look at similarly aged mobile homes that have sold. Be sure to search within one mile if suburban, 5 miles if rural and .5 mile if urban for any other mobile homes that are similar in age. You can adjust for the difference in square footage, lot size or land value, amenities to the property, condition and any other relevant factor that may affect the value. Search for similar properties that have sold within the past year. In the MLS, for these type of properties, it is generally advertised as land only, the mobile home has no value if the mobile home is built prior to 1978, cash buyers only. The main value of this property will be in the land if attached to the land. If it is not attached to a lot then the value will be based on what other properties have sold for that are not attached to the land. So when valuing the property you need to determine first whether it is attached to the land or not and then compare it to properties that are similar to yours that are attached if yours is attached or not attached to the land if yours is not attached to the land. It is not appropriate to use properties that are not similar in that factor. It would basically be classified as owned lot or rented lot and those two types must be valued separately within its own respective categories.

Lenders will not lend on a mobile home built prior to 1978 so you will only be able to sell it to a cash buyer. You will have to look at similarly aged mobile homes that have sold. Be sure to search within one mile if suburban, 5 miles if rural and .5 mile if urban for any other mobile homes that are similar in age. You can adjust for the difference in square footage, lot size or land value, amenities to the property, condition and any other relevant factor that may affect the value. Search for similar properties that have sold within the past year. In the MLS, for these type of properties, it is generally advertised as land only, the mobile home has no value if the mobile home is built prior to 1978, cash buyers only. The main value of this property will be in the land if attached to the land. If it is not attached to a lot then the value will be based on what other properties have sold for that are not attached to the land. So when valuing the property you need to determine first whether it is attached to the land or not and then compare it to properties that are similar to yours that are attached if yours is attached or not attached to the land if yours is not attached to the land. It is not appropriate to use properties that are not similar in that factor. It would basically be classified as owned lot or rented lot and those two types must be valued separately within its own respective categories. -

QuestionHow do I find the value of my mobile home?

Carla ToebeCarla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

Carla ToebeCarla Toebe is a licensed Real Estate Broker in Richland, Washington. She has been an active real estate broker since 2005, and founded the real estate agency CT Realty LLC in 2013. She graduated from Washington State University with a BA in Business Administration and Management Information Systems.

Real Estate Broker Remember the NADA Guide is an excellent resource to use for determining the value of your mobile home. You should also use the other tips provided above.

Remember the NADA Guide is an excellent resource to use for determining the value of your mobile home. You should also use the other tips provided above.

References

- ↑ https://www.fanniemae.com/content/guide/selling/b4/1.4/01.html

- ↑ http://www.nadaguides.com/Manufactured-Homes

- ↑ http://www.nadaguides.com/Manufactured-Homes/images/forms/MHOnlineBasicValueReportSample.pdf

- ↑ http://www.nadaguides.com/FAQ/manufactured-home-value-reports#q75

- ↑ http://mobilehomeliving.org/how-much-is-your-manufactured-home-worth/

- ↑ http://mobilehomeliving.org/how-much-is-your-manufactured-home-worth/

- ↑ http://mobilehomeliving.org/how-much-is-your-manufactured-home-worth/

- ↑ http://mobilehomeliving.org/how-much-is-your-manufactured-home-worth/

- ↑ http://mobilehomeliving.org/how-much-is-your-manufactured-home-worth/

About This Article

To calculate the approximate value of a mobile home, visit your library to see if they have a copy of the the NADA Manufactured Housing Appraisal Guide or use Zillow's website to compare prices on similar homes. For a more precise appraisal, visit the NADA website and fill out an appraisal form, but expect to pay around $26. For an exact appraisal of your home in its current condition, hire a local appraiser or real estate agent. For information from our Real Estate reviewer about getting an appraisal, read on!