This article was co-authored by Darron Kendrick, CPA, MA. Darron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

wikiHow marks an article as reader-approved once it receives enough positive feedback. In this case, several readers have written to tell us that this article was helpful to them, earning it our reader-approved status.

This article has been viewed 411,272 times.

Goodwill is a type of intangible asset — that is to say, an asset that is non-physical, and is often difficult to value. Along with goodwill, these types of assets can include intellectual property, brand names, location and a host of other factors. Goodwill refers to a premium over the fair market value of a company that a purchaser pays, and this premium can often be attributed to intangible items like reputation, future growth, brand recognition, or human capital. It is the portion of a business's value that cannot be attributed to other business assets. The methods of calculating goodwill can all be used to justify the market value of a business that is greater than the accounting value on a company's books. While there are many different ways to calculate goodwill, income-based methods are the most common. Keep in mind that goodwill exists only when a buyer pays more for an asset than the asset is worth, not before.

Steps

Calculating Goodwill Using Average Profits

-

1Understand how the average profits method is applied. Under this method, Goodwill is equal to the average profits for a set time period, multiplied by the number of years. This is the simplest and the most common method to calculate goodwill.

- To summarize the formula: Goodwill = Average Profits X Number of Years.

- For example, if you used the average annual profits of the years 2010-14, you would multiply the average by 5.

-

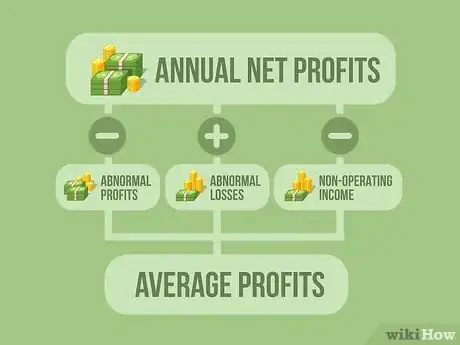

2Adjust the numbers before you make the calculations. Make sure that you make the following adjustments before computing average profits:[1]

- Any abnormal profits should be deducted from the net profits in the year that they were earned.

- Any abnormal losses should be added back to the net profits in the year they were incurred.

- Non-operating incomes (e.g., income from investments) should be deducted from the net profits of the year that they were earned.

Advertisement -

3Do the math. Start by determining the average profits for the years under consideration. To find average profits, you add together the profits of all the years and divide by 4 (the number of years).

-

4Let's say there was a company that had these profits (in the associated years): 2010: $200,000; 2011: $220,000; 2012: $190,000; 2013: $210,000. You would first add these numbers together to get $820,000.

- Divide the sum ($820,000) by the number of years, which in this case is four. The result is the average. In this case, the average profits equals $205,000.

- As Goodwill is equal to the average profit over a given span of years multiplied by the number of years, Goodwill would equal $820,000. In this case, Goodwill was really just the aggregated total of profits from the given years. In the real world, abnormal costs and profits would have altered the result.

-

5Add the Goodwill to the fair market value of the business. If making a purchase offer for a business, this Goodwill amount could be added to the fair market value of the business, or its assets minus its liabilities. In this case, Goodwill is a premium over the fair market value of the business that reflects the average profits the business earns over several years.

Calculating Goodwill Using Super Profits

-

1Establish your average profits. For this method, you will need to understand what your average profits from previous years are. Add together the profits of previous years, and divide by the total number of years.

- For example, you may have earned $200,000 in 2010, $220,000 in 2011, $190,000 in 2012, and $210,000 in 2013. Add these all up to get $820,000 and divide by four years. You will get $205,000, which is the average profit.

-

2Subtract your average profits from your actual profits. Super profits are the profits earned above the average profits. To learn what your super profits are, take this year's actual profits and subtract your average profits from them. For example, let's say the average profit for your business is $200,000. In one year you earned a net profit of $230,000. The excess of profits earned over the average profits — the super profit — is $30,000.

-

3Learn the super profits formula for goodwill. For calculating goodwill, the total super profits of a given number of years are multiplied by the agreed number of years of purchase. Put another way — Goodwill = Super Profits X Number of Years.”[2]

-

4See how the model is applied. An example is provided to demonstrate how the super profits formula is applied.

- Let's say average profits had been $200,000, but the actual actual profits in a four year span were: 2010: $210,000; 2011: $230,000; 2012: $210,000; 2013: $200,000.

- The super profits for each year are calculated by subtracting the average profit from the actual profit. For 2010, the super profit is 10,000; for 2011 it is 30,000, etc.

- The yearly super profits are then added together. For this example, you end up with $10,000 + $30,000 + $10,000 + 0 = $50,000.

- Finally, the total super profit is multiplied by the number of years. In this case, Goodwill = $50,000 X 4 or $200,000.

-

5Add the Goodwill to the fair market value of the business. In this case, Goodwill would be reflective of a company/s ability to earn more than its average profits. By adding the super profits to the fair market value of the business, your purchase price reflects a company's earnings power.

Calculating Goodwill Using Capitalization of Profits

-

1Understand the capitalization method. This method starts with the results of one of the other two methods. Beginning with average or super profits, the capitalization method determines how much capital is needed to produce those average or super profits, assuming the business earns a normal rate of return for the particular industry. This amount of capital is known as the capitalized value of profits, and the excess of this figure over the total capital employed can be considered goodwill.

-

2Calculate total capital employed. To find the capital employed, simply subtract the liabilities from the assets. It can also be represented as: Capital Employed = Assets - Liabilities.

-

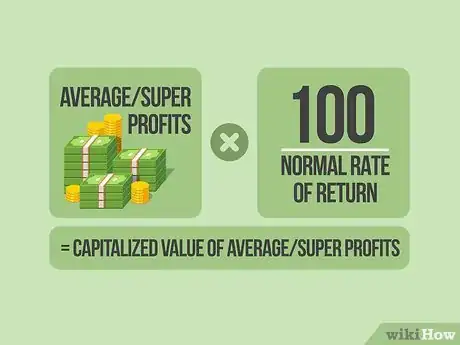

3Learn how to calculate capitalized value of profits. In order to use the the capitalization method, you must know how to calculate the capitalized value of profits.

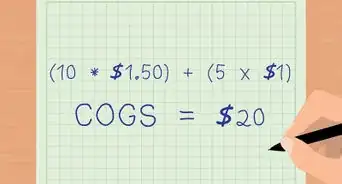

- In order to find the capitalized value of profits, you must first multiply the average or super profit by 100 (either one works). The total must then be divided by the normal rate of return. The formula can also be represented as: Capitalized Value of Average/Super Profits = Average/Super Profits X (100 / Normal Rate of Return). This formula calculates how much capital is required to earn the average or super profits of the business, assuming it made a normal rate of return.

-

4Calculate goodwill. Simply subtract capital employed from step 2, from capitalized value of average or super profits. The formula looks like this: Goodwill = Capitalized Value of Average/Super Profits - Capital Employed.

- Consider an example. Let's say that firm has average profits of $40,000, in an industry where the normal rate of return is 10%. The firm also has $1,000,000 in assets and $500,000 in liabilities. The total capitalized value of the firm is $40,000 × 100/10, which is equal to $400,000. The capital employed = $1,000,000 − $700,000, which leaves $300,000. Finally, goodwill is equal to capitalized value of profits minus the capital employed, or $400,000 − $300,000. The goodwill is $100,000.

- With this method, goodwill is reflective of the difference between the rate of return of the business in question, and the normal rate of return. For example, in this scenario, the business would earn a 13% return on capital employed ($40,000/$300,000). The normal return, however, is 10%. This method simply takes that 3% premium, and "capitalizes" it, or determines how much capital employed would be required to produce that $40,000 return based on a 10% normal return. In this case, it would require $400,000, or $100,000 more than the actual fair value of the businesses assets. This $100,000 could be added to the fair value of the business when selling or purchasing it, as a reflection of the company's strong returns.

Expert Q&A

Did you know you can get expert answers for this article?

Unlock expert answers by supporting wikiHow

-

QuestionFor a new small business, with a loss for the first year, would there be a value for the goodwill then, and how is this calculated?

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Financial Advisor

-

QuestionHow then does a startup calculate goodwill as a way of knowing the value of the startup?

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Michael R. LewisMichael R. Lewis is a retired corporate executive, entrepreneur, and investment advisor in Texas. He has over 40 years of experience in business and finance, including as a Vice President for Blue Cross Blue Shield of Texas. He has a BBA in Industrial Management from the University of Texas at Austin.

Business Advisor

-

QuestionIf the accounts of the firm are not real, than what has to done to arrive at Goodwill?

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Financial Advisor

References

- ↑ https://books.google.com/books?id=d6IvogayVI0C&pg=SA6-PA4&lpg=SA6-PA4&dq=goodwill+%22average+profit+method%22+abnormal&source=bl&ots=UYqed9BjSD&sig=ulb3dHO-9kT-RJ_6f8o5lqQUm48&hl=en&sa=X&ei=7tgmVcSTDra1sQS7yIHoCA&ved=0CEEQ6AEwBw#v=onepage&q=goodwill%20%22average%20profit%20method%22%20abnormal&f=false

- ↑ http://www.readyratios.com/reference/accounting/goodwill.html

About This Article

The simplest and most common way to calculate Goodwill is to use the formula Goodwill = Average Profits × Number of Years. Before you do the calculation, be sure to make any necessary adjustments, like adding abnormal losses back to or deducting abnormal profits from net profits in the relevant years. When you’ve made your adjustments, get Average Profits by adding together the profits from all the years and dividing by the number of years. You can then just multiply that result by the Number of Years to get your value for Goodwill. For information from our Accountant reviewer on calculating Goodwill by using the capitalization of profits, read on!