This article was co-authored by Darron Kendrick, CPA, MA. Darron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

There are 13 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 148,114 times.

Debt service is the total amount paid in interest and principal on debt during a specific time frame, usually a year. Businesses may be required to disclose their total debt service to lenders when applying for a loan. Lenders use this information, along with the company’s net income, to calculate the debt service coverage ratio. This measures the percentage of net income used to pay for debt.

Steps

Calculating Debt Service Payments

-

1Learn the meaning of debt service. Debt service is the amount of cash needed to pay interest and principal owed on a debt for a specific period of time. It is usually calculated on an annual basis. Businesses or individuals may need to know their total debt service when applying for a loan.[1]

- An individual’s debt service might include a mortgage and student loans.

- Debt service for companies includes the principal and the interest on outstanding loans.

- An individual or company that cannot afford to make the payments is said to be “unable to service the debt.”

-

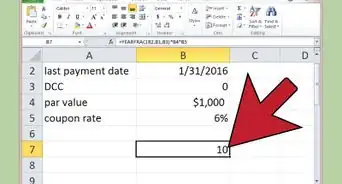

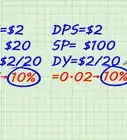

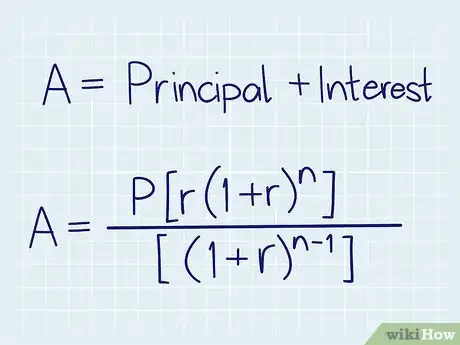

2Calculate monthly payments on debt. In most cases, your lender calculates your monthly payments when you are approved for a loan. However, you can calculate the monthly payments yourself. You can search online for a payment calculator or do the equation by hand. To calculate monthly payments on a debt, first calculate the rate per month by dividing the annual interest rate by 12. Then, calculate the monthly payment on each loan using the following formula: .

- In this formula, A = amount per month, P = principal (loan amount), r = interest rate per period and n = total number of payments.[2]

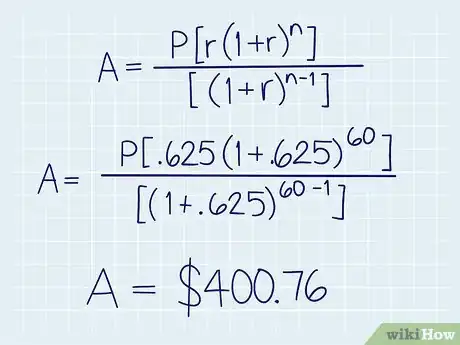

- For example, suppose you purchased a $21,000 car and you put down a $1,000 down payment. You need to borrow $20,000, so you take out a 60-month loan at an annual interest rate of 7.5 percent.

- Calculate the interest rate per period (month) by dividing 7.5/12 = 0.625 percent per month.

- Plug in the values to the formula: .

- In this example, the total monthly payment would be $400.76.

Advertisement -

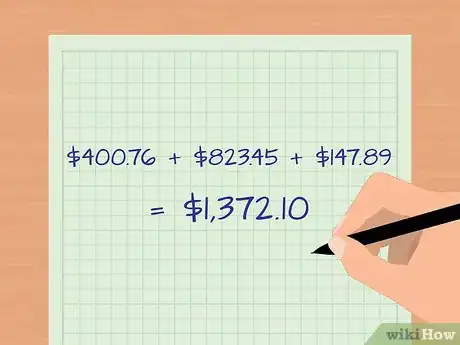

3Calculate total monthly debt service payments. Begin by calculating the monthly payment for each of your loans. Total the monthly payments for all of your loans by adding all of the monthly payments together. Once you know your total debt service payments, you can calculate the debt service ratio.

- For example, suppose in addition to the car loan for $400.76 per month, you have a mortgage payment for $823.45 per month and a student loan payment of $147.89 per month.

- Your total debt service payments would be $400.76 + $823.45 + $147.89 = $1,372.10.

Gathering the Information to Determine Total Debt Service

-

1Determine the debt service. The debt service is the total of all principal and interest paid on debts over the course of a year. For an individual, this includes all debts that are payable in the current year. For a business, it includes interest, any debts maturing within one year, and any principal payments on long-term debts.[3]

- Short-term debt is any debt that is due in less than one year.[4]

- The current portion of long-term debt is the total amount of long-term debt that must be paid in the current year.[5]

- Businesses do not report debt service on financial statements. It may be reported in the notes on a financial statement.[6]

-

2Include all portions of debt that are due in the current year. This includes all interest and principal payments that are due in the current year. Businesses must factor in sinking fund payments, which are repayments of funds that were borrowed from a bond issue.[7] Also, add in lease payments that are due in the current year.[8]

-

3Include current maturities of long-term debts in debt service. Current maturities means the portion of long-term debt that will be due in the next 12 months.[9] You would use maturities from the previous 12 months to determine ability to cover debt service this year. You would use maturities due in the next 12 months to project ability to cover debt service on a new loan .[10]

-

4Decide how to handle lines of credit and revolving debt when calculating debt service. A company may plan to pay down a line of credit during the year. Or, they may "term out" a line of credit that is fully extended.[11]

-

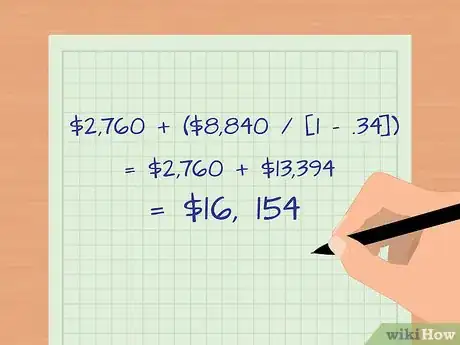

5Adjust interest and principal expenses to reflect income tax expenses. Interest payments are tax deductible, so you will not have to pay income taxes on those. Principal payments are not tax deductible.[14] You will have to adjust the total amount of principal due to account for the income taxes that will be paid on it. Otherwise, you are understating your debt service, which in turn overstates your ability to service your debt.[15]

- Make this adjustment by using this formula: interest + (principal / [1 – tax rate]).

- For example, suppose a business pays income taxes at a rate of 34 percent, and has a 5-year loan for $50,000 with 6.0 percent interest. This year, the company will pay $8,840 towards the principal and $2,760 in interest.

- Calculate the debt service with the above formula, using the equation $2,760 + ($8,840 / [1 - .34]) = $2,760 + $13,394 = $16, 154.

-

6Verify net income. Net operating income is the amount of revenue left over after operating expenses have been paid.[16] It does not include taxes or interest. Net operating income is considered equivalent to earnings before interest and tax (EBIT). It can be found on the company’s income statement.[17]

- Operating expenses are those expenditures businesses incur as a result of running the business. They include employee wages and funds dedicated to research and development.[18]

Calculating Debt Service Coverage Ratio

-

1Learn about the debt service coverage ratio. Knowing your total debt payments per month is important. But creditors like to look at the ratio of your total debt service to your total income in order to evaluate your creditworthiness. This is called the debt service coverage ratio (DSCR). The debt service coverage ratio (DSCR) measures the percentage of net income used for debt service coverage. It is calculated by dividing the total net income by the total debt service, using the equation DSCR = total net income / total debt service. Creditors look at this information to assess a debtor’s ability to pay current or new loans. They want to be sure that the borrower has enough operating income to cover current debt plus enough left over to service new loans. [19] The higher the ratio, the more capable the company is of paying its debt obligations on time.[20]

-

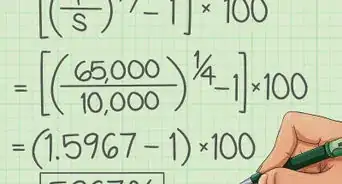

2Calculate the debt service coverage ratio (DSCR). Use this formula: net income / total debt service. For example, suppose a rental company generates a net income of $500,000 and has a debt service of $440,000. The debt service represents the total annual mortgage payments on the properties the company owns.[21]

- The DSCR is calculated with the equation $500,000 / $440,000 = 1.14.

- The rental company generates 14 percent more income than they need to service their debts.

-

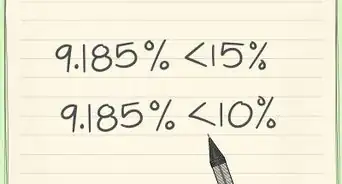

3Analyze the DSCR. The minimum DSCR a lender may demand varies depending on the performance of the economy. Lenders may overlook lower DSCRs when the economy is growing. However, such lack of scrutiny leaves lenders at risk for large numbers of borrowers defaulting on loans for which they shouldn’t have qualified.[22]

- If the DSCR is greater than 1, then the company or individual has enough cash to service the debt.

- If the DSCR is less than 1, then there is not sufficient cash to service the debt. For example, a DSCR of .87 means that the individual or business only has enough cash to pay 87 percent of the interest and principal on debt for that year. The borrower would have to draw from savings or borrow more to service the debt.

- Some creditors may require debtors to keep their DSCR above a minimum threshold while the loan is outstanding.

- Most creditors will require a ratio of 2 or more before granting any new debt.

Expert Q&A

Did you know you can get expert answers for this article?

Unlock expert answers by supporting wikiHow

-

QuestionHow DSCR is calculated?

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Financial Advisor

-

QuestionWhat is the debt service?

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Financial Advisor

-

QuestionWhat is a debt service account?

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Darron Kendrick, CPA, MADarron Kendrick is an Adjunct Professor of Accounting and Law at the University of North Georgia. He received his Masters degree in tax law from the Thomas Jefferson School of Law in 2012, and his CPA from the Alabama State Board of Public Accountancy in 1984.

Financial Advisor

References

- ↑ http://www.investopedia.com/terms/d/debtservice.asp

- ↑ http://www.vertex42.com/ExcelArticles/amortization-calculation.html

- ↑ http://www.investopedia.com/terms/d/dscr.asp

- ↑ http://www.investopedia.com/terms/s/shorttermdebt.asp

- ↑ http://www.investopedia.com/terms/c/currentportionlongtermdebt.asp

- ↑ http://www.myaccountingcourse.com/financial-ratios/debt-service-coverage-ratio

- ↑ http://www.investopedia.com/terms/s/sinkingfund.asp

- ↑ http://www.investopedia.com/terms/d/dscr.asp

- ↑ https://money-zine.com/definitions/investing-dictionary/current-maturities-of-long-term-debt/

- ↑ http://www.rbgcpa.com/

- ↑ http://www.rbgcpa.com/

- ↑ http://www.investopedia.com/terms/t/termout.asp

- ↑ http://www.vertex42.com/ExcelArticles/amortization-calculation.html

- ↑ http://www.investopedia.com/terms/d/dscr.asp

- ↑ http://www.rbgcpa.com/

- ↑ http://www.myaccountingcourse.com/financial-ratios/debt-service-coverage-ratio

- ↑ http://www.investopedia.com/terms/d/dscr.asp

- ↑ http://www.investopedia.com/terms/o/operating_expense.asp

- ↑ http://www.investopedia.com/terms/d/dscr.asp

- ↑ http://www.myaccountingcourse.com/financial-ratios/debt-service-coverage-ratio

- ↑ http://www.accountingtools.com/debt-service-coverage-ratio-ds

- ↑ http://www.investopedia.com/terms/d/dscr.asp

![{\displaystyle A=P{[r(1+r)^{n}]/[(1+r)^{n-1}]}}](./images/1705910138-60139ecc7d337e540c3973e53a941e85ca3a4af5.webp)

![{\displaystyle A={[.625(1+.625)^{60}]/[1+.625)^{60-1}]}}](./images/1677139699-1d7cf25032d13d4c87097869062cbf2e72b59915.webp)