This article was co-authored by Hovanes Margarian. Hovanes Margarian is the Founder and the Lead Attorney at The Margarian Law Firm, a boutique automotive litigation law firm in Los Angeles, California. Hovanes specializes in automobile dealer fraud, automobile defects (aka Lemon Law), and consumer class action cases. He holds a BS in Biology from the University of Southern California (USC). Hovanes obtained his Juris Doctor degree from the USC Gould School of Law, where he concentrated his studies in business and corporate law, real estate law, property law, and California civil procedure. Concurrently with attending law school, Hovanes founded a nationwide automobile sales and leasing brokerage which gave him insights into the automotive industry. Hovanes Margarian legal achievements include successful recoveries against almost all automobile manufacturers, major dealerships, and other corporate giants.

This article has been viewed 56,537 times.

An adjusted lease balance on a lease, such as a car lease, refers to the portion of the adjusted capitalized cost of your car lease that currently remains on your lease. In layman's terms, this is how much is actually owed on your lease at the moment. The balance on the lease decreases as payments are made and this balance is calculated using a standard industry-wide method. If the car lease is terminated before the end of the lease term (such as at year 3 on a 5-year lease term), the balance is usually the main part of the payoff amount. Therefore, it is a good idea for you to be able to calculate this amount in advance so that you are aware of what your payoff will be for turning a leased car back to the dealer earlier than expected.

Steps

Gathering Lease Information

-

1Request information from your dealer or lease provider. To calculate your lease balance, you will first need to calculate your lease value and monthly payments. To do, you will need some information. Contact your lender or dealer and ask for the following:

- The manufacturer's suggested retail price (MSRP) for the vehicle.

- The sale price of your vehicle.

- Any rebates or incentives provided on your lease.

- The residual value of the vehicle.

- The lease duration and the number of months remaining.

- The money factor on your lease. This figure is the equivalent of interest rate in a lease structure, but it is expressed differently.[1] [2]

-

2Double-check the criteria for early termination that is included in your lease agreement. Read the agreement to protect yourself against calculations errors on the funder's part or purposeful fraud. Compare each figure stated in your agreement to the information you just received from your dealer or lender. Look for early termination fees, administrative charges, and taxes, along with any resale charges or expenses. Your agreement will also specify a residual value for the vehicle, so make sure that this matches the value given to you by the lender or dealer.

- An early termination charge may be assessed by the dealer in the event of lease termination. This charge may be in the form of several months' worth of lease payments and may depend on how many months of payments remain on the lease.[3]

Advertisement -

3Check for past-due payments. Any unpaid or late lease payments will also be added into the cost of ending your lease. Check for these payments by checking over your lease payment history.[4]

-

4Find your monthly lease payment. Your monthly lease payment is the payment you have been paying throughout the life of your lease. You can find this amount on your lease bills. If you have not yet gotten the lease, you can calculate your monthly lease payment by adding the vehicle's monthly depreciation plus the monthly finance charge.

- Calculate the monthly depreciation by subtracting the residual value from the capitalized cost of the vehicle. The capitalized cost of the vehicle is what the lender borrowed for the lease, which is the sale price of the vehicle minus incentives and rebates.

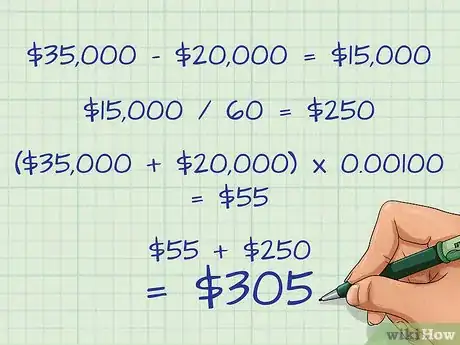

- For example, a $40,000 car might have sold for $37,000, and then been further reduced by a $2,000 rebate to $35,000. The capitalized cost is the $35,000.

- The residual value is stated in your lease agreement. Imagine for the $35,000 vehicle that the stated residual value is $20,000. The total depreciation over the life of the lease would be $35,000 (the capitalized cot) - $20,000 (residual value), or $15,000.

- The monthly depreciation, assuming a 5-year lease, would then be $15,000/60 (for 60 months), or $250.

- The finance charge is calculated by adding together the capitalized cost and depreciation charge and then dividing by the money factor. For example, imagine that the lease described above has a money factor of 0.00100. The monthly finance charge would then be ($35,000+$20,000)*0.00100, which is $55.

- Finally, add the monthly finance charge to your monthly depreciation to get the monthly payment. In this case, this would be $55 + $250, or $305.[5]

- Calculate the monthly depreciation by subtracting the residual value from the capitalized cost of the vehicle. The capitalized cost of the vehicle is what the lender borrowed for the lease, which is the sale price of the vehicle minus incentives and rebates.

Calculating Adjusted Lease Balance

-

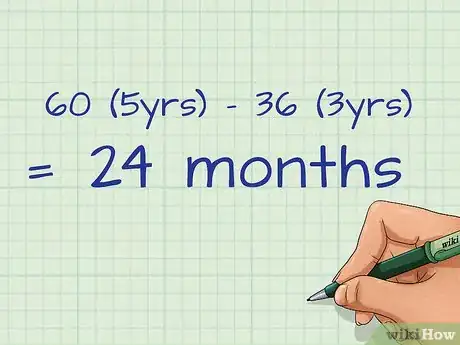

1Figure out how many months are left on the lease. You can work out the number of months left on your lease in several ways. First, try just asking your lender or dealer how many months of payments remain on the lease. Alternately, you can subtract the number of months you have paid from the total lease duration in months. So, if you've paid 3 years (36 months) of a 5-year (60 month) lease, you have 60-36, or 24 months remaining.[6]

-

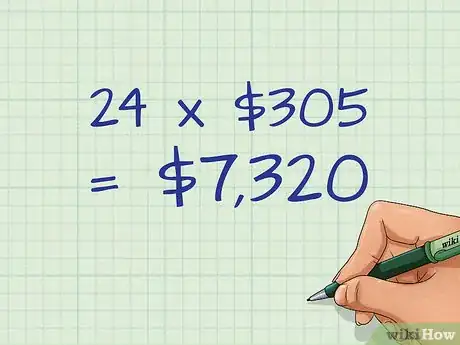

2Multiply the number of months by the monthly payment. Once you know how many payments you still owe, multiply that number by your monthly payment amount to get your adjusted lease balance. For example, using the example of 24 months remaining on the five-year lease with a $305 monthly payment, you would have a lease balance of 24*$305, or $7,320.[7]

-

3Confirm your lease balance with your lender. Despite the simple calculation above, your actual adjusted lease balance may be different due to rent charges in your lease. These may differ from your calculations due to different calculations made as part of the actuarial method by the lender or dealer. To know your adjusted lease balance for sure, call your lender or dealer and ask for this balance.[8]

Calculate Your Early Termination Costs

-

1Check your lease agreement for the vehicle's residual value. The residual value is defined in the lease agreement. It is the lender or dealer's estimated value for the vehicle at the end of the lease term.[9] This may be somewhat higher or lower than the actual value of the vehicle in the current market when you end your lease, but is still used in determining your termination costs.

-

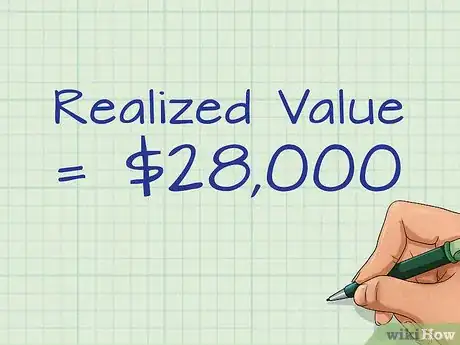

2Figure out the vehicle's realized value. The realized value is another way to measure the value of the vehicle at the time of your lease's termination. It can be defined in the lease agreement, or may be calculated through other means, including:

- You or the dealer may obtain an appraisal of the fair market value of the vehicle upon lease termination.

- The highest bid for the vehicle at a wholesale or retail auction.

- The insurance payout for a total loss in the event that the vehicle is severely damaged in a collision.[10]

-

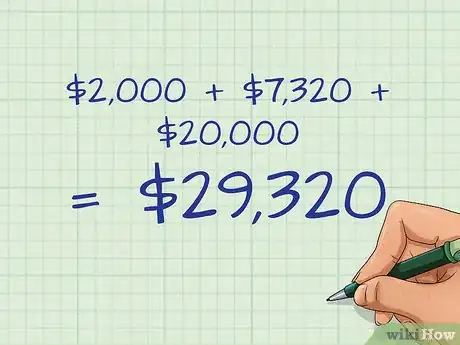

3Add together expenses, fees, and your lease balance. Add up termination fees, charges, taxes, unpaid amounts, and resale expenses to arrive at a fee total for the lease termination. Then, add in your lease balance as calculated by you or provided by your lender. Next, add this figure to the residual value specified in your loan agreement. This number represents the money that you owe your lender before turning over the vehicle.[11]

- For example, imagine you owe $2,000 in various fees and expenses, along with the loan balance of $7,320 calculated in the previous example and a residual value of $20,000. Your total at this stage would be $2,000 + $7,320 + $20,000, or $29,320.

-

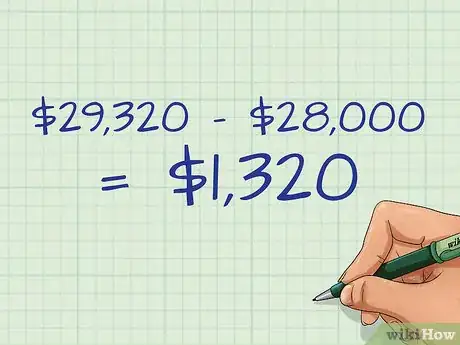

4Subtract realized value. Your realized value is now subtracted from the previous total to arrive at your early termination cost. Keep in mind that your realized value may be lower or higher than the residual value in the lease agreement and depends on the market value of the vehicle.[12]

- For example, imagine that the realized value for the car in the previous example is $28,000 at the time of lease termination.

-

5Arrive at an early termination cost. Your early termination cost will be what you owe the lender or dealer for ending your lease early. In the above example, this would come to $29,320 - $28,000, or $1,320.

- This fee can be avoided by transferring the lease to someone else rather than terminating it.[13]

References

- ↑ http://leasehackr.com/blog/2016/4/17/how-to-calculate-lease-payments-by-hand

- ↑ Hovanes Margarian. Attorney. Expert Interview. 15 September 2020.

- ↑ https://www.usbank.com/dealer-services/auto-leasing/returning-a-leased-vehicle-early.aspx

- ↑ https://www.usbank.com/dealer-services/auto-leasing/returning-a-leased-vehicle-early.aspx

- ↑ http://leasehackr.com/blog/2016/4/17/how-to-calculate-lease-payments-by-hand

- ↑ https://www.usbank.com/dealer-services/auto-leasing/returning-a-leased-vehicle-early.aspx

- ↑ https://www.usbank.com/dealer-services/auto-leasing/returning-a-leased-vehicle-early.aspx

- ↑ https://www.usbank.com/dealer-services/auto-leasing/returning-a-leased-vehicle-early.aspx

- ↑ Hovanes Margarian. Attorney. Expert Interview. 15 September 2020.

- ↑ https://www.usbank.com/dealer-services/auto-leasing/returning-a-leased-vehicle-early.aspx

- ↑ https://www.usbank.com/dealer-services/auto-leasing/returning-a-leased-vehicle-early.aspx

- ↑ https://www.usbank.com/dealer-services/auto-leasing/returning-a-leased-vehicle-early.aspx

- ↑ http://www.investopedia.com/terms/l/lease-balance.asp