This article was co-authored by Gina D'Amore and by wikiHow staff writer, Jennifer Mueller, JD. Gina D'Amore is a Financial Accountant and the Founder of Love's Accounting. With 12 years of experience, Gina specializes in working with smaller companies in every area of accounting, including economics and human resources. She holds a Bachelor's Degree in Economics from Manhattanville College and a Bookkeeping Certificate from MiraCosta College.

This article has been viewed 29,009 times.

If you've been investing for awhile, you may want to take the leap into trading options. When you buy put options, you're buying the right to sell a stock for a set price at a specific date in the future. You don't actually have to own the underlying stock to trade options. You can use put options to hedge your investments if you think stock prices are going to dive. Options are more complex than stock trading and can be risky, so be sure you're working with a strong and experienced broker.[1]

Steps

Opening an Account

-

1Choose an options broker. Options typically are traded over an online platform. Look for the platform that you find easiest to understand and navigate. You also want a broker who has significant educational resources available to traders, especially if you're just starting out in options trading.[2]

- Find out what analysis tools and real-time data are available on the platform for free, and which require you to pay an extra fee.

- Determine when customer service is available and what kinds of service are provided. If you're new to trading options, look for a broker that has a dedicated trading desk.

- Evaluate the fees and commissions that you'll pay to your broker. Some charge a flat fee per purchase. This may be a better deal for you if you anticipate high-volume trading. Others charge a per-contract fee plus a commission.

-

2Gather information to provide your potential broker. Before the broker approves you to trade options, they must have specific information from you about your trading goals and strategies, your trading experience, and your personal finances.[3]

- You may want to look at the broker's options agreement in advance so you have a better idea of the type of information you'll need to provide.

Advertisement -

3Fill out your options agreement. Before you can start trading options, you must complete an options agreement in writing. On your options agreement, you'll provide information to the broker about the options you want to buy and the resources you have available for trading.[4]

- Depending on the broker, you may be required to submit documents to back up information you included in the agreement, such as account statements. If you already had an investment account with the broker, they may not need additional documentation to process your agreement.

-

4Find out what trading level you've been assigned. When the broker receives your options agreement, they will analyze it and assign you to a trading level. The levels vary among brokers, but generally there are 5 levels that represent varying degrees of risk.[5]

- Typically, level 1 would indicate the lowest level of risk, while level 5 would indicate the highest level. Keep in mind that any level of options trading carries an inherent degree of risk.

- Brokers generally assign trading levels based on the resources you have available and your experience as a trader. Your broker will explain what level you've been assigned, and the types of trades you can make at that level.

-

5Read and consider the required disclosures carefully. The US Securities and Exchange Commission (SEC) requires brokers to provide publications to new options traders that describe how options work and the risks associated with them.[6]

- Before you start trading, make sure you understand the process and the risks involved. The SEC has an introductory bulletin available at http://www.sec.gov/oiea/investor-alerts-bulletins/ib_introductionoptions.html. You can also take advantage of training and educational resources offered by your broker.

Trading Put Options

-

1Analyze stock movement. Before you buy put options, you need to know enough about the patterns of various stock to be able to predict whether it will go up or down. If you're buying put options, you are making a prediction that the stock will go down over time.[7]

- In addition to looking at the stock market itself, you also have to be able to analyze trends in various industries. Understand which sectors will tend to go up and which will tend to go down in response to various economic factors.

- If you don't have a lot of experience trading, you may want to watch the market for awhile before you start buying options. Take advantage of any educational resources and training offered by your broker to learn more about how options work.

-

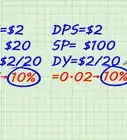

2Choose your strike price. The strike price of your option is the price at which you agree to purchase the stock on the expiration date of the options. With put options you have the right to buy the stock at that price, but no obligation to do so.[8]

- To make money on put options, you want to set the strike price lower than the price for which the stock currently sells. For example, if a stock is currently selling at $100, but you believe it will decline to below $80, you might buy a put option to sell shares at $85. If the stock price drops below $85, you could sell those shares at a profit.

- Strike prices are standardized based on the price of the stock, and sold in option chains that have a range of strike prices at varying expiration dates.

-

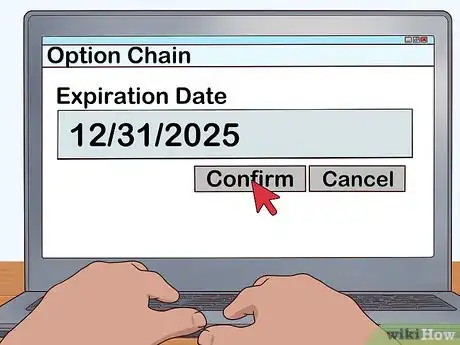

3Select an option chain with the expiration date you want. Options chains have a variety of short-term and long-term options available. Generally, the shorter the time period, the riskier the investment.[9]

- Longer time periods give you more options if the stock doesn't move the way you've predicted it would. If you're just starting out, you'll probably want to go with monthly or yearly expiration dates.

- You may be restricted to longer-term options depending on your trading level, especially if you're a new trader.

-

4Decide how many contracts you want to buy. Each contract represents 100 shares of stock. You'll have to pay a premium for each contract to the seller of the contract. Depending on how your broker fees and commissions are structured, you may also have to pay a per-contract fee to your broker.[10]

- The number of contracts you buy depends on how much money you have available and how much you're willing to risk on the prediction you've made about the movement of that stock.

-

5Pay your premium and fees to buy your options contracts. You'll use your broker's trading platform to buy the options contracts you've decided you want. Call your broker's trading desk if you have any questions or need guidance.[11]

- If your broker has a tutorial available, you may want to go through that first to make sure you're doing everything correctly.

Exercising Put Options

-

1Keep your eye on the stock. Once you've purchased your options contracts, you're essentially playing a waiting game. Watch the stock to see if it moves in the direction you predicted it would when you bought your options.[12]

- Most brokers allow you to set alerts that will send you a notification when a stock falls below a certain level. You can use these alerts to more easily manage your options.

-

2Put the stock to the seller if the stock declines. You can exercise your option at any time before the expiration date. When you buy a put option, the seller of that option is obligated to buy the stock at the strike price any time (before the expiration date) you present that option to them.[13]

- If the stock declines below your strike price, you are "in the money" if you have a put option. You can put your options to the seller and the seller will have to buy the stock at your strike price, even though it's currently trading for less.

- For example, suppose you have 5 contracts (representing 500 shares of stock) with a strike price of $100. The underlying stock of those contracts drops to $80. When you put those options to the seller, the seller is obligated to pay you $50,000. Since the underlying stock is only worth $40,000, you've realized a $10,000 profit.

-

3Sell the contracts themselves if the stock declines before expiration. Options have both intrinsic value and time value. You may want to sell the options if the stock has declined as you predicted, but is trending back upward.[14]

- For example, suppose you have 5 contracts (representing 500 shares of stock) with a strike price of $100. The stock dropped to $80, then rebounded to $85 and is trending upward. If you sell the contracts at the strike price, you will make $7,500.

- When you sell an option, you then become obligated to purchase the stock at the strike price. To continue the example, suppose the stock continues to rise to $125. If obligated to buy the stock, you would make an additional profit because, after buying the stock for $100, you could turn around and sell it for $125.

-

4Let the option expire if the stock doesn't decline. If your prediction didn't pan out and the stock increased in value or stayed the same, you're "out the money." Since there's no obligation to exercise an option as the buyer, you can simply let it expire.[15]

- When you let an option expire, you'll be out the premiums and fees you paid for the option, but that would be all you would lose.

Community Q&A

-

QuestionIf I have a put option strike 45.00 by September and the price is 45.00, do I hold or sell?

Community AnswerIt depends on your initial goal. If it was a hedge against the security you actually bought to make your put then 45 is neutral you hold till September. If it was the standalone purchase of the option then it's your call to hold or sell - a small economic sense of both. You sell it when the price of the underlying asset is significantly below 45, then your option is "in the money".

Community AnswerIt depends on your initial goal. If it was a hedge against the security you actually bought to make your put then 45 is neutral you hold till September. If it was the standalone purchase of the option then it's your call to hold or sell - a small economic sense of both. You sell it when the price of the underlying asset is significantly below 45, then your option is "in the money". -

QuestionIf the price of the contract changes, that is the premium paid, to a favorable level where you could cover your fees and still make a profit, could you sell the contract itself?

Community AnswerIf the contract is a subject of trading on any stock exchange, then why not?

Community AnswerIf the contract is a subject of trading on any stock exchange, then why not?

Expert Interview

Thanks for reading our article! If you'd like to learn more about put options, check out our in-depth interview with Gina D'Amore.

References

- ↑ https://www.nerdwallet.com/blog/investing/how-to-trade-options/

- ↑ https://www.nerdwallet.com/blog/investing/choose-options-broker/

- ↑ https://www.sec.gov/oiea/investor-alerts-bulletins/ib_openingoptionsaccount.html

- ↑ https://www.sec.gov/oiea/investor-alerts-bulletins/ib_openingoptionsaccount.html

- ↑ https://www.sec.gov/oiea/investor-alerts-bulletins/ib_openingoptionsaccount.html

- ↑ https://www.sec.gov/oiea/investor-alerts-bulletins/ib_openingoptionsaccount.html

- ↑ https://www.nerdwallet.com/blog/investing/how-to-trade-options/

- ↑ https://www.nerdwallet.com/blog/investing/how-to-trade-options/

- ↑ https://www.nerdwallet.com/blog/investing/how-to-trade-options/

- ↑ https://www.nerdwallet.com/blog/investing/how-to-trade-options/

- ↑ https://www.nerdwallet.com/blog/investing/put-options/

- ↑ https://www.nerdwallet.com/blog/investing/put-options/

- ↑ https://www.optionseducation.org/tools/faq/options_exercise.html

- ↑ https://www.nerdwallet.com/blog/investing/put-options/

- ↑ https://www.optionseducation.org/tools/faq/options_exercise.html/