This article was co-authored by Samantha Gorelick, CFP®. Samantha Gorelick is a Lead Financial Planner at Brunch & Budget, a financial planning and coaching organization. Samantha has over 6 years of experience in the financial services industry, and has held the Certified Financial Planner™ designation since 2017. Samantha specializes in personal finance, working with clients to understand their money personality while teaching them how to build their credit, manage cash flow, and accomplish their goals.

There are 12 references cited in this article, which can be found at the bottom of the page.

This article has been viewed 127,840 times.

If you’re running out of money each month or struggling to save enough for emergencies, it might be time for a budget. Whether you have a part-time job or just get an allowance from your parents, you can learn easy ways to track your expenses, spend less, and save more.

Steps

Tracking Your Income and Expenses

-

1Use budgeting software or apps to help with calculations. All of your budgeting can be done using a pen, a piece of paper, and a calculator. But you can also use software like Excel or apps like Mint or iAllowance to create a detailed budget with charts or graphs to go with it.[1] These also have the added benefit of doing all the math for you.[2]

-

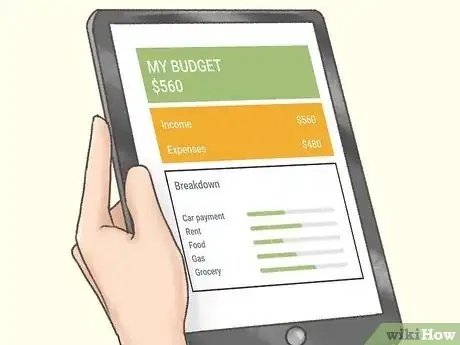

2Add up how much money you earn.[3] Make a list of the things you do each month that bring in money. Do you get an allowance? Do you babysit? Do you mow lawns in your neighborhood? Include anything that you do regularly. Then add up the amounts of money you receive for these things.[4]

- For example, if each month you earn about $200 working at a cafe, $100 babysitting, and $50 walking dogs, then your monthly income is $350.

- If these amounts vary from month to month, add up your income from the last six months, and then divide by six to get an average.[5]

Advertisement -

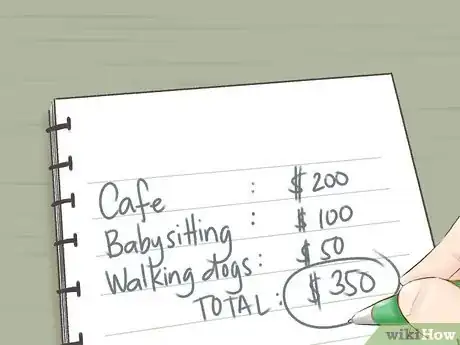

3Add up costs you’re responsible for.[6] Do your parents make you buy your own clothes or pay for your own food when you go out with friends? If you drive, do you have to make a monthly car payment, or pay for gas? List everything you regularly spend money on, then add up about how much you’re spending each month.[7]

- For example, if your parents make you pay for new clothes, think of all the pants, tops, and shoes you bought last month. Estimate how much you spent on all of it. If you only buy new clothes every three months, divide that number by three to get a more accurate monthly total.

-

4Look at your monthly statements. If you have a debit or credit card, you probably receive a statement in the mail or through an online portal. Look at these statements from the past few months to see exactly where your money has been going.

- It's also a good idea to review your statement and look for any fraudulent charges so you can report them right away.

-

5Subtract what you spend from what you earn.[8] If you earned $350 last month, and you spent about $300, then you have a balance of $50, which is great! You can spend or save that money however you see fit. But if the numbers are reversed – you earned $300 and spent $350 – then you have a negative balance. You’re spending $50 more than you should be, and you’ll need to make some cuts.[9]

-

6List necessary expenses. To figure out where you can cut costs, look at your list of expenses again.[10] Circle everything you don’t have a choice about spending money on. For instance, a car payment is a necessary expense if you drive to school or work. But new clothes are not a necessary expense, since you could continue wearing your current wardrobe.[11]

- Other necessary expenses might be gas or insurance for your car, school supplies, toiletries, or a cell phone.

- Other expenses that aren’t necessary are eating out, going to movies, buying video games, or buying extra pairs of shoes.

-

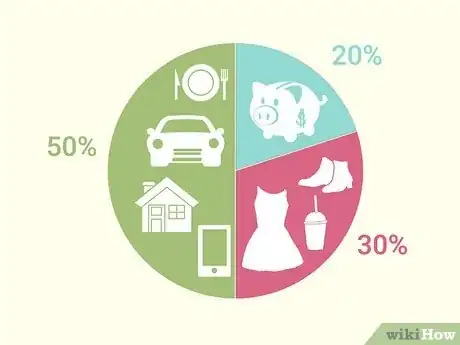

7Aim for a 50/30/20 budget. This budget breaks down into three parts: 50% necessities, 30% wants, and 20% savings. So if you’re making $350 a month, then $175 can go toward the necessary expenses you circled, $105 can go toward the unnecessary expenses, and $70 would go into savings.[12]

- If you find that your necessary expenses are more than 50% of what you’re earning each month, you’ll need to adjust the proportions of your budget. For example, if necessities are costing 70% of your income, adjust your wants down to 20% and your savings to 10%.

Spending Less

-

1Find free things to do with friends. It’s easy to get carried away when you go out with friends and spend money on food, movies, and shopping. Instead, plan activities that keep you away from restaurants and malls. Suggest a picnic at the park or the beach, then pack sandwiches and soda for everyone, or ask each person to bring something and do it potluck-style.[13]

- For daytime activities, consider hiking at a nearby state park, going for a bike ride, playing a board game, or going to a museum on a day that’s free for community members.

- For nighttime activities, schedule a movie night at your house, or invite everyone over for s’mores and stargazing in your backyard.

-

2Leave the credit card at home. Figure out how much money you’re comfortable spending when you go out, and then take that much in cash. A credit card will allow you to go way beyond that number without even thinking about it.[14]

- If you’re worried about possible emergencies, keep a credit card in the glove box of your car (or in any other safe, hidden location). It’ll still be accessible, but it won’t be with you inside stores or restaurants.

-

3Eat before you go out. If you’re heading out for a movie or shopping, eat before you leave your house. You’ll be less likely to get hungry while you’re out, and you won’t be tempted to buy a slice of pizza or some popcorn.[15]

- If everyone’s going out to dinner together, you don’t have to stay home. Eat a snack before you leave and then order an inexpensive appetizer or a small salad as your main course. And always choose water as your beverage, rather than paying for a soda.

-

4Wait for sales. If you love shopping and can’t cut it out of your life, adjust the way you shop. Wait until the middle or end of the season to buy that season’s clothing. Stores will likely be starting to discount stuff to make room for next season’s clothes. If you find something you like online, check back in every week or so to keep an eye on the price.[16]

- Check out thrift stores and consignment stores to find items that are both discounted and unique.

-

5Join community exchange groups. Search Facebook for local groups in which members swap clothes or other items. Or check out sites like Freecycle, where people post things they no longer need or want for free.[17]

- If you can’t find one in your area, start one! Create a Facebook group and invite your friends to join and post items they want to get rid of or trade.

-

6Pay off your credit card in full. If you have a credit card, you may be tempted to just pay the minimum every month. But you’ll be charged hefty fees for doing this, and then you’ll end up spending far more money in the long run. Only spend money you know you have at home or in the bank, and then it won’t be a problem to pay off your balance.[18]

Earning and Saving More

-

1Get a part-time job. If you have time, consider finding a part-time job you can do after school or on the weekends. Browse online job boards for your community, or ask your friends if they know of anyone who's hiring.

- Go into local stores and ask if they're hiring cashiers. Or visit a movie theater or swimming pool and see if they need help running the concession stand.

-

2Pick up odd jobs. If you don't have a ton of time, but you want to earn some money, spread the word that you’re looking for work. Have your parents tell their friends you’re free for babysitting. Let the neighbors know you’re available to mow their lawn, rake their leaves, or shovel snow off their driveways.[19]

- Create a flyer with your name, phone number, and the type of work you’re looking for, and post it around the neighborhood.

- Other jobs you could do include dog walking, house sitting, gutter cleaning, weeding, painting, or tutoring a younger student.

- If your customers are mostly local, consider getting a credit card reader. People love paying with their credit cards. You can connect a card reader to your phone through companies like Square. These card readers can take care of all your calculations, including how much revenue you made and how much you will owe in taxes.[20]

-

3Set up a savings account. If you don’t already have a savings account, ask your parents to set one up for you. Not only will the money in your account earn a little bit of interest, but you’ll be less likely to spend it if it’s a little more difficult to get to.[21]

-

4Make saving a habit. Stick to your budget. If you determined you’re going to save 20% of your income, don’t wait until the end of the month to do it. You might be running out of money by then, and you’ll make excuses not to save. Instead, every time you get a paycheck or get handed some cash, immediately divide it up into your 50/30/20 budget plan.[22]

- If you don’t have a bank account yet, create a system with envelopes or jars. Get three jars and label each jar “Needs,” “Wants,” and “Savings.” Then distribute cash accordingly every time you earn some.

References

- ↑ Samantha Gorelick, CFP®. Financial Planner. Expert Interview. 6 May 2020.

- ↑ http://www.moneycrashers.com/how-to-make-a-budget/

- ↑ Samantha Gorelick, CFP®. Financial Planner. Expert Interview. 6 May 2020.

- ↑ https://bettermoneyhabits.bankofamerica.com/en/personal-banking/teaching-children-how-to-budget

- ↑ http://www.moneycrashers.com/how-to-make-a-budget/

- ↑ Samantha Gorelick, CFP®. Financial Planner. Expert Interview. 6 May 2020.

- ↑ https://bettermoneyhabits.bankofamerica.com/en/personal-banking/teaching-children-how-to-budget

- ↑ Samantha Gorelick, CFP®. Financial Planner. Expert Interview. 6 May 2020.

- ↑ https://bettermoneyhabits.bankofamerica.com/en/personal-banking/teaching-children-how-to-budget

- ↑ Samantha Gorelick, CFP®. Financial Planner. Expert Interview. 6 May 2020.

- ↑ https://www.nerdwallet.com/blog/finance/how-to-build-a-budget/

- ↑ https://www.nerdwallet.com/blog/finance/how-to-build-a-budget/

- ↑ http://www.thesimpledollar.com/little-steps-100-great-tips-for-saving-money-for-those-just-getting-started/

- ↑ http://www.thesimpledollar.com/little-steps-100-great-tips-for-saving-money-for-those-just-getting-started/

- ↑ http://www.onegoodthingbyjillee.com/2016/01/29-creative-ways-to-spend-less-and-save-more.html

- ↑ http://www.today.com/style/teens-are-spending-less-shopping-thrifty-their-parrents-t41196

- ↑ http://recyclingnearyou.com.au/pass-it-on/

- ↑ http://www.businessinsider.com/35-things-you-can-do-right-away-to-start-spending-less-money-2014-2

- ↑ https://www.thepennyhoarder.com/jobs-making-money/100-summer-jobs-for-teens/

- ↑ Ylva Bosemark. Teenage Entrepreneur. Expert Interview. 5 February 2019.

- ↑ http://www.themint.org/teens/about-savings-accounts.html

- ↑ https://www.nerdwallet.com/blog/finance/how-to-build-a-budget/

-Step-22-Version-2.webp)